Want to maximize your yield as a liquidity provider?

Look no further than 1inch DEX! With our innovative platform, you can earn the highest possible returns on your investments. We offer a seamless and secure way to swap tokens and provide liquidity on decentralized exchanges.

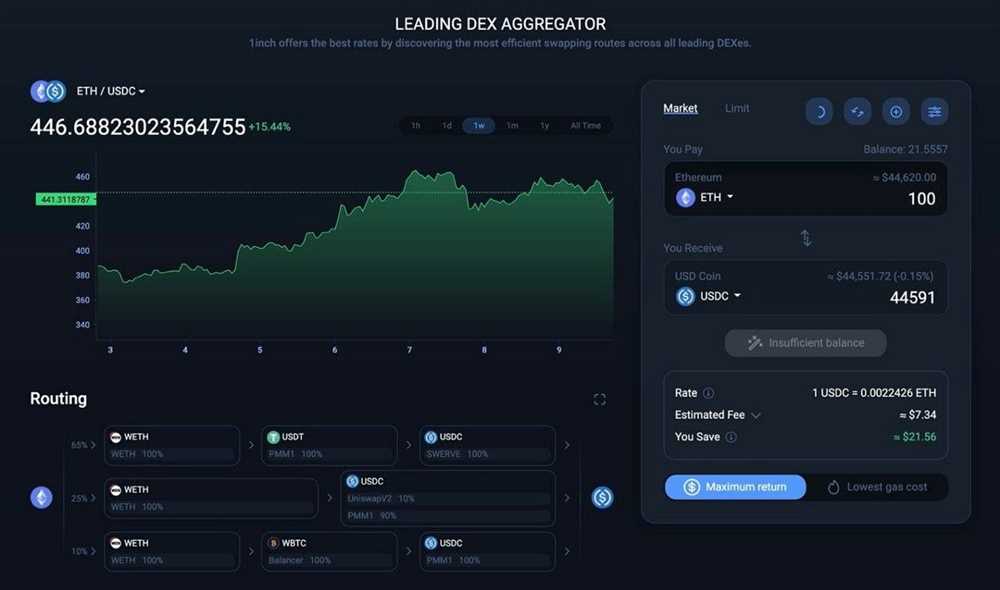

How does 1inch DEX work? It’s simple!

Our smart contract technology sources the best prices across multiple decentralized exchanges, ensuring you get the most out of your liquidity provision. Our algorithm automatically splits your liquidity across different pools, optimizing your yield and minimizing risk.

But that’s not all!

1inch DEX is also fully transparent and secure.

Our open-source protocol allows you to verify every step of the process, giving you peace of mind. Plus, your funds remain in your control at all times, as we never have access to your private keys.

Ready to start maximizing your yield?

Join 1inch DEX today and take advantage of our cutting-edge technology. It’s time to earn more from your investments.

Maximizing Yield for Liquidity Providers

As a liquidity provider on the 1inch DEX, you have the opportunity to maximize your yield like never before. By providing liquidity to the platform, you are able to earn fees and rewards while helping to ensure a seamless trading experience for all users.

Here are some strategies to help you maximize your yield as a liquidity provider:

Diversify Your Portfolio

One way to maximize your yield is to diversify your portfolio across multiple liquidity pools. By spreading your investments across different assets, you can reduce the risk of volatility and increase your potential returns.

Keep an Eye on Market Dynamics

Market dynamics can heavily impact your yield as a liquidity provider. Stay informed about the latest market trends and adjust your liquidity accordingly. By staying ahead of the curve, you can take advantage of opportunities and mitigate risks.

Optimize Your Fees

When providing liquidity, pay attention to the fees charged by the platform. Different liquidity pools may have varying fee structures, so it’s important to choose pools that align with your investment objectives. By optimizing your fees, you can maximize your overall yield.

Stay Informed and Adapt

The decentralized finance (DeFi) space is constantly evolving. Stay updated on the latest developments, new liquidity pools, and emerging opportunities. Being proactive and adaptable will help you stay ahead of the curve and maximize your yield.

By following these strategies and staying actively engaged as a liquidity provider on 1inch DEX, you can maximize your yield and take full advantage of the benefits offered by the platform.

Benefits of 1inch DEX

1inch DEX offers a range of benefits for liquidity providers, making it a highly attractive option for maximizing yield. Here are some of the key advantages:

1. Best Price Execution: 1inch DEX leverages a sophisticated algorithm that aggregates liquidity from various decentralized exchanges, ensuring that trades are executed at the best available prices. This means that liquidity providers can enjoy optimal returns on their assets.

2. Low Slippage: By accessing multiple liquidity sources, 1inch DEX minimizes slippage and provides traders with improved price stability. This makes it an ideal platform for liquidity providers, as they can avoid significant price impacts on their trades.

3. Gas Optimization: 1inch DEX optimizes gas costs by splitting transactions across multiple DEXs, reducing fees for liquidity providers. This not only saves money but also enhances the overall profit potential for liquidity providers.

4. Secure and Transparent: 1inch DEX operates on a decentralized infrastructure, ensuring that the platform is highly secure and resistant to hacking or manipulation. Additionally, all transactions are stored on the blockchain, providing complete transparency and accountability.

5. User-Friendly Interface: 1inch DEX is designed with a user-friendly interface, making it easy for liquidity providers to navigate and participate in the ecosystem. The platform also offers advanced analytics and tools to help liquidity providers make informed decisions.

6. High Liquidity Pools: 1inch DEX benefits from its extensive network of liquidity sources, providing liquidity providers with access to deep pools of liquidity. This ensures that trades can be executed quickly and efficiently, without impacting asset prices.

By utilizing 1inch DEX, liquidity providers can take advantage of these benefits and maximize their yield potential while enjoying a secure and user-friendly trading experience.

How to Maximize Yield with 1inch DEX

When it comes to maximizing your yield as a liquidity provider, 1inch DEX is the platform you need. With its innovative features and user-friendly interface, 1inch DEX allows you to earn the highest returns on your cryptocurrency assets.

Here are a few steps to help you maximize your yield with 1inch DEX:

1. Choose the right pools: With 1inch DEX, you have access to a wide range of liquidity pools. It’s important to choose the pools with the highest APY (Annual Percentage Yield) to ensure maximum returns on your investment. Take your time to research and analyze the different pools available.

2. Optimize your trading: 1inch DEX provides you with advanced trading features like smart contract execution, which helps you find the best prices across multiple decentralized exchanges. By optimizing your trading strategy, you can minimize slippage and maximize your yields.

3. Utilize yield farming: Yield farming is a popular strategy that involves lending your assets to liquidity pools to earn additional rewards. 1inch DEX offers various yield farming opportunities, allowing you to put your assets to work and earn even more.

4. Stay informed: Keeping up with the latest news and updates in the cryptocurrency space is crucial for maximizing your yield. 1inch DEX provides a comprehensive news section where you can stay informed about the latest trends and opportunities.

Remember, maximizing your yield requires careful planning and research. With 1inch DEX, you have all the tools and resources you need to make informed decisions and earn the highest returns on your cryptocurrency investments.

Start maximizing your yield today with 1inch DEX and take your liquidity provision to the next level!

Question-answer:

What is 1inch DEX?

1inch DEX is a decentralized exchange that allows users to trade cryptocurrencies and maximize their yield as liquidity providers.

How does 1inch DEX work?

1inch DEX aggregates liquidity from multiple decentralized exchanges to find the best possible trade routes and prices for users. This allows users to trade at the most favorable rates and maximize their profit.

What is the benefit of being a liquidity provider on 1inch DEX?

Becoming a liquidity provider on 1inch DEX allows users to earn passive income by providing liquidity to the platform. They can earn trading fees and additional rewards from various liquidity mining programs.