Are you looking to diversify your investment portfolio?

Introducing 1inch Coin – the revolutionary cryptocurrency that’s taking the industry by storm.

With the cryptocurrency market rapidly evolving, it’s more important than ever to have a diverse range of assets in your portfolio. 1inch Coin offers a unique opportunity for investors to capitalize on the potential of decentralized finance (DeFi).

What makes 1inch Coin stand out?

1inch Coin is built on the Ethereum blockchain, utilizing smart contract technology to provide users with the most efficient and cost-effective way to trade on decentralized exchanges (DEXs).

By leveraging the power of automated market makers (AMMs) and an advanced routing algorithm, 1inch Coin ensures that users always get the best prices and lowest slippage for their trades.

Why should you consider adding 1inch Coin to your portfolio?

1. Diversification: With 1inch Coin, you can diversify your portfolio by adding exposure to the booming DeFi sector.

2. Liquidity: 1inch Coin provides access to liquidity across multiple DEXs, ensuring that your trades are executed quickly and efficiently.

3. Transparency: As a decentralized protocol, 1inch Coin offers full transparency and security, with no intermediaries involved.

Don’t miss out on this opportunity to diversify your portfolio and take advantage of the potential growth in the DeFi sector. Invest in 1inch Coin today and stay ahead of the curve!

What is 1inch Coin?

1inch Coin is a decentralized cryptocurrency that is built on the Ethereum blockchain. It is the native token of the 1inch Network, a popular decentralized exchange (DEX) aggregator. The 1inch Network aims to help users find the best prices for their trades across various decentralized exchanges.

The 1inch Coin can be used within the 1inch Network ecosystem for a variety of purposes. Holders of the coin can stake it to earn rewards, participate in governance by voting on proposals, and enjoy fee discounts when trading on the platform. The coin also plays a crucial role in the network’s liquidity protocol, enabling users to contribute liquidity and earn passive income.

Key Features of 1inch Coin

1. Decentralized Exchange Aggregator: The 1inch Network combines liquidity from various decentralized exchanges, allowing users to find the best possible prices for their trades.

2. Governance and Voting: Holders of 1inch Coin can participate in the governance of the 1inch Network by voting on proposals and shaping the future of the platform.

3. Liquidity Protocol: The 1inch Coin is used to provide liquidity to the network, enabling users to contribute their assets and earn passive income through fees.

How to Get 1inch Coin

1inch Coin can be acquired through various means. One way is to purchase it on a cryptocurrency exchange that supports the token. Another option is to provide liquidity to the 1inch Network, which involves depositing tokens into the network’s liquidity pools and earning 1inch Coin as a reward. Additionally, users can also participate in the network’s governance and earn tokens through voting.

| Token Name | Symbol | Blockchain |

|---|---|---|

| 1inch Coin | 1INCH | Ethereum |

Overall, 1inch Coin offers users the opportunity to diversify their portfolio by investing in a decentralized cryptocurrency that powers a popular decentralized exchange aggregator. With its various use cases and features, 1inch Coin is an attractive option for those looking to explore the world of decentralized finance.

Why Diversify?

Diversification is an essential strategy for any investor looking to maximize their returns and minimize risk. By spreading your investments across different asset classes, you can reduce the impact of any one investment on your overall portfolio.

One of the key benefits of diversification is that it helps to protect against market volatility. Different asset classes, such as stocks, bonds, and real estate, tend to perform differently under various market conditions. By diversifying, you can potentially offset losses in one area with gains in another, helping to stabilize your overall portfolio.

Additionally, diversification can help to protect against specific risks associated with individual companies or sectors. By investing in a wide range of assets, you are less vulnerable to the performance of any single company or industry. This can be particularly important in times of economic uncertainty or when a specific sector is experiencing challenges.

Diversification also provides opportunities for growth. By investing in different asset classes, you can take advantage of various market trends and capitalize on different opportunities as they arise. This can help to enhance your portfolio’s overall performance and increase your potential for long-term wealth creation.

Finally, diversifying your portfolio with 1inch Coin can offer unique benefits in the cryptocurrency market. As a decentralized exchange aggregator, 1inch Coin allows you to access multiple liquidity sources, increasing the efficiency and potential returns of your cryptocurrency investments. By adding 1inch Coin to your portfolio, you can diversify your exposure to cryptocurrencies and take advantage of the growing popularity and potential of decentralized finance.

In conclusion, diversifying your portfolio is crucial for managing risk, maximizing returns, and taking advantage of various investment opportunities. By spreading your investments across different asset classes, including 1inch Coin, you can build a well-rounded portfolio that is positioned for long-term success.

Benefits of Portfolio Diversification

Diversifying your investment portfolio by adding 1inch Coin can provide various benefits:

1. Risk reduction:

By spreading your investments across different assets, you can reduce the risk associated with having all your eggs in one basket. The volatility of the cryptocurrency market can be mitigated by including a diverse range of assets in your portfolio.

2. Increased potential for returns:

When you diversify your portfolio, you increase the chances of earning higher returns. By investing in different assets that have low correlation to each other, you can capture potential gains from different market movements.

For example, if one asset class experiences a downturn, another asset class may perform well, offsetting the losses and potentially even generating a profit.

3. Preservation of capital:

Diversification can help protect your capital by avoiding concentration in a single asset. If one investment performs poorly, the impact on your overall portfolio is minimized when you have other investments that can offset the losses.

4. Opportunity for growth:

By including 1inch Coin in your investment portfolio, you can take advantage of the growth potential in the decentralized finance (DeFi) sector. 1inch is a leading decentralized exchange aggregator that provides efficient and low-cost trading. As the adoption of DeFi increases, 1inch Coin has the potential to appreciate in value, contributing to the growth of your portfolio.

Overall, portfolio diversification with 1inch Coin can help mitigate risk, increase potential returns, preserve capital, and provide opportunities for growth in the dynamic cryptocurrency market.

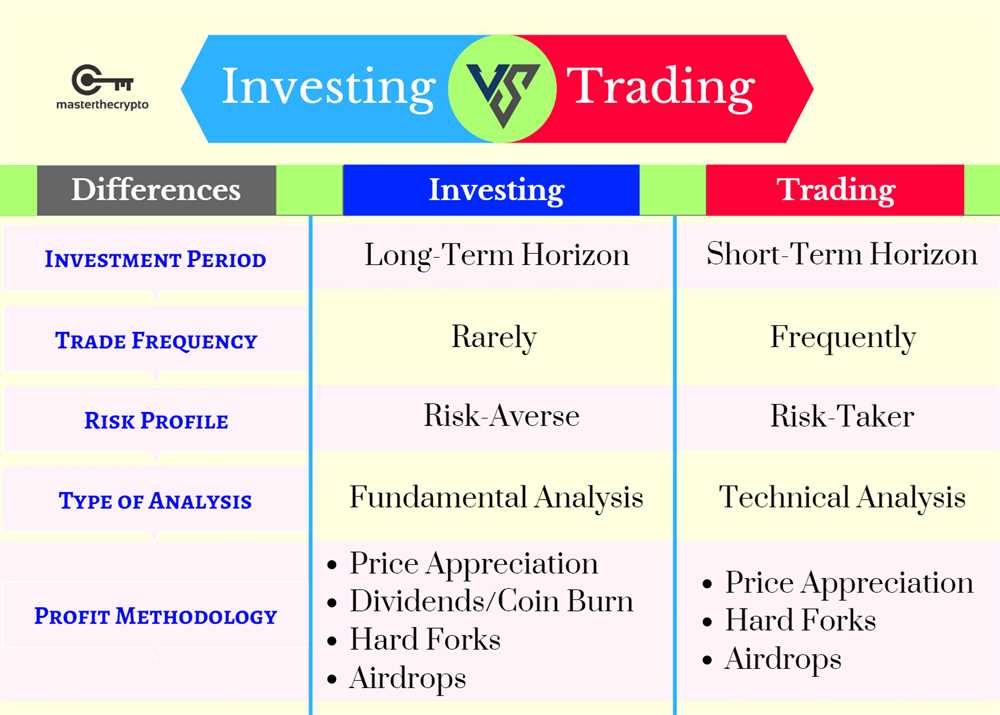

How to Diversify

Diversification is a key strategy when it comes to investing in the cryptocurrency market. By spreading your investments across different assets, you can reduce the potential risks and increase the chances of earning stable returns. Here are some tips on how to diversify your portfolio:

1. Research and Select Different Cryptocurrencies

Start by researching and selecting a variety of cryptocurrencies to include in your portfolio. Look for projects that have strong fundamentals, a solid development team, and a clear roadmap. By investing in different cryptocurrencies, you can benefit from the growth of multiple projects and reduce the impact of a single coin’s price volatility.

2. Explore Different Sectors and Use Cases

Another way to diversify your portfolio is to invest in cryptocurrencies that belong to different sectors and have different use cases. For example, you can consider investing in cryptocurrencies that are focused on decentralized finance (DeFi), non-fungible tokens (NFTs), or blockchain interoperability. This way, you can capitalize on the growth potential of different sectors and reduce the risk of being heavily dependent on a single sector.

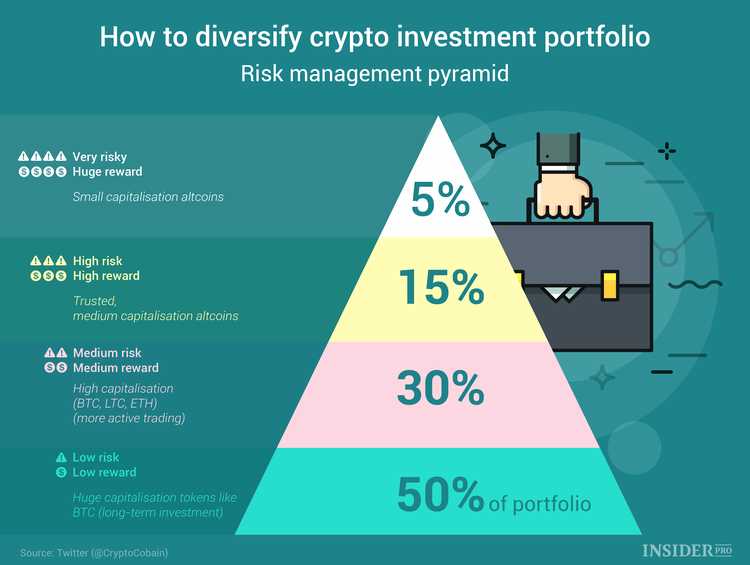

3. Allocate Investments Across Different Market Caps

Diversify your portfolio by allocating your investments across cryptocurrencies with different market capitalizations. Market capitalization refers to the total value of a cryptocurrency. Investing in a mix of large-cap, mid-cap, and small-cap cryptocurrencies can help you diversify and balance the risk-reward ratio. Large-cap cryptocurrencies tend to be more stable, while small-cap cryptocurrencies have the potential for high returns but come with higher risks.

4. Consider Including Stablecoins and Bitcoin

To further diversify your portfolio, consider including stablecoins and Bitcoin. Stablecoins are cryptocurrencies that are pegged to a stable asset, such as the US dollar. They offer stability and can act as a hedge during volatile market conditions. Bitcoin, on the other hand, is the largest and most established cryptocurrency, and it can serve as a store of value in your portfolio.

Remember, diversification is not about randomly investing in different cryptocurrencies, but about carefully selecting a mix of assets that align with your investment goals and risk tolerance. Regularly review and rebalance your portfolio to ensure that it stays diversified and aligned with your long-term investment strategy.

Using 1inch Coin for Diversification

When it comes to diversifying your investment portfolio, it’s essential to consider a variety of assets and strategies. One option that you may want to explore is incorporating 1inch Coin into your investment mix.

What is 1inch Coin?

1inch Coin is a decentralized exchange aggregator that allows users to access liquidity from various decentralized exchanges (DEXs) in a single platform. It is built on the Ethereum blockchain and aims to provide users with the best possible trading rates and low slippage.

Through its smart contract technology, 1inch Coin automatically splits the user’s trade across multiple DEXs to ensure the best possible price. This feature not only helps traders find the best rates but also minimizes the impact of price fluctuations.

The Benefits of Diversification with 1inch Coin

Integrating 1inch Coin into your investment strategy can have several benefits:

1. Access to Liquidity:

By utilizing 1inch Coin, you can tap into the liquidity of multiple decentralized exchanges, giving you access to a wide range of trading pairs and assets. This increased liquidity can help you execute trades quickly without significant slippage.

2. Lower Transaction Costs:

As an aggregator, 1inch Coin automatically splits your trades across multiple DEXs to provide the best rates. This splitting also helps to reduce transaction costs associated with large trades, as the platform can find the most cost-effective route for your trade.

3. Minimize Risk:

With 1inch Coin, you can spread your risk across different DEXs, mitigating the impact of price fluctuations and potential security vulnerabilities associated with a single exchange. By diversifying your trades, you can reduce your exposure to a single point of failure.

Incorporating 1inch Coin into your portfolio diversification strategy can help you optimize your trading experience and minimize risk while accessing liquidity from multiple decentralized exchanges. Whether you are a seasoned investor or just starting, it’s worth considering the benefits that 1inch Coin brings to the table.

Question-answer:

What is 1inch Coin?

1inch Coin is the native digital asset of the 1inch Network, which is a decentralized exchange aggregator. It allows users to trade cryptocurrencies across various decentralized exchanges to get the best possible price.

How can I diversify my portfolio with 1inch Coin?

You can diversify your portfolio with 1inch Coin by allocating a portion of your investment to this cryptocurrency. By adding 1inch Coin to your portfolio, you can participate in the potential growth of the 1inch Network and the popularity of decentralized exchanges.

What are the benefits of diversifying my portfolio with 1inch Coin?

Diversifying your portfolio with 1inch Coin can provide several benefits. Firstly, it allows you to gain exposure to the decentralized finance (DeFi) sector, which has been gaining traction in recent years. Secondly, 1inch Coin has the potential for price appreciation if the 1inch Network continues to grow in popularity. Lastly, by diversifying your portfolio, you can reduce the risk associated with having all your investments in a single asset or asset class.