In the world of decentralized finance (DeFi), one of the biggest challenges that traders face is navigating the complexity of accessing multiple liquidity sources while trying to minimize slippage and maximize returns. That’s where the 1inch Network comes in.

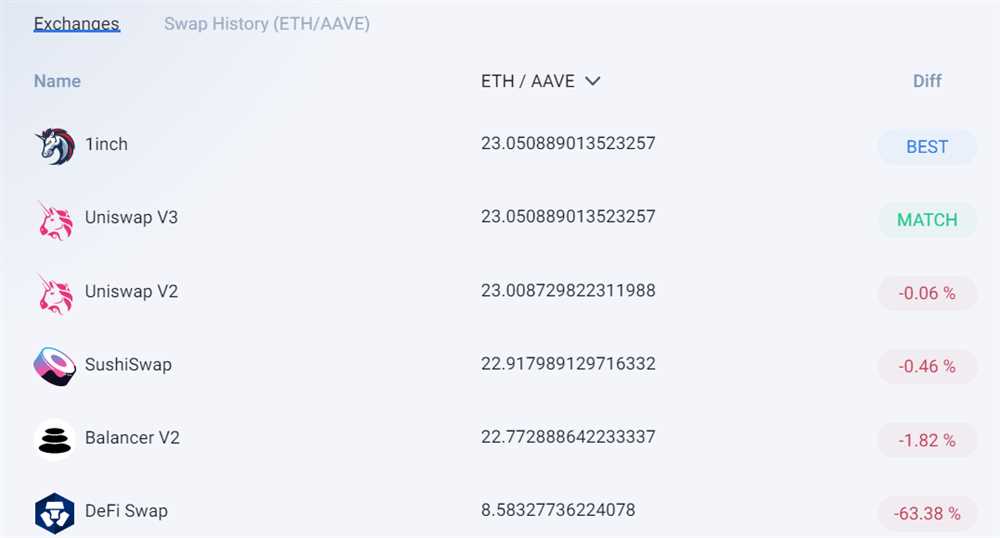

1inch Network is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible trading rates. By leveraging arbitrage opportunities across different DEXs, 1inch Network reduces slippage and improves the overall trading experience for users.

Not only does 1inch Network help traders achieve better rates, but it also maximizes returns through its unique algorithm. The network’s smart contract splits users’ trades across multiple DEXs to secure the best possible prices, ensuring optimal returns on every transaction.

With 1inch Network, traders can enjoy the benefits of DeFi without the hassle of manually searching for the best rates across different platforms. The platform leverages its innovative technology to provide users with a seamless trading experience, reducing slippage and maximizing returns.

Don’t let slippage eat into your profits. Choose 1inch Network and take advantage of the best trading rates in the DeFi space.

The Role of 1inch Network

The 1inch Network plays a crucial role in reducing slippage and maximizing returns for cryptocurrency traders. As a decentralized exchange aggregator, 1inch uses innovative technology to find the most efficient routes for trading across different liquidity pools, allowing users to get the best possible prices for their trades.

One of the main challenges in decentralized trading is dealing with slippage, which occurs when the price of a token changes during the execution of a trade. This can result in traders receiving less tokens or paying more than expected. 1inch addresses this issue by splitting orders and routing them through various liquidity sources, reducing slippage and optimizing trade execution.

1inch also plays a vital role in maximizing returns for traders by leveraging the power of its liquidity sources. By providing access to multiple decentralized exchanges and liquidity pools, 1inch ensures that traders can take advantage of the best available prices and liquidity. This allows them to maximize their profits and reduce the risks associated with trading on a single exchange or liquidity pool.

Additionally, the 1inch Network is powered by the 1INCH token, which serves as a utility token for the platform. Token holders can stake their 1INCH tokens to participate in the network’s governance and earn rewards. This decentralized governance model ensures that the network is governed by its community, fostering transparency and decentralization.

With its innovative technology, focus on reducing slippage, and maximizing returns, the 1inch Network is revolutionizing the decentralized trading landscape. Whether you are a beginner or an experienced trader, utilizing the 1inch Network can significantly improve your trading experience and enable you to achieve the best possible outcomes for your trades.

Reducing Slippage

Slippage is a common problem in decentralized finance (DeFi) trading, occurring when the execution price of a trade differs from the expected price. This can lead to traders losing a significant portion of their intended returns.

The 1inch Network aims to address this issue by leveraging its smart contract technology and aggregation protocols. The platform analyzes various decentralized exchanges (DEXs) to find the best possible prices for users’ trades, thus reducing the risk of slippage.

| Benefits of 1inch Network in Reducing Slippage: |

|---|

| 1. Aggregation of Liquidity: 1inch Network aggregates liquidity from multiple DEXs, ensuring that users have access to the largest pool of liquidity possible. By accessing a larger pool of liquidity, the chances of slippage are significantly reduced. |

| 2. Optimization Algorithms: The 1inch Network utilizes advanced algorithms to optimize trades and find the best possible prices across different DEXs. This helps to minimize slippage and maximize returns for traders. |

| 3. Gas Fee Optimization: By analyzing gas fees and transaction costs across various DEXs, the 1inch Network helps users select the most cost-effective trading routes. This ensures that users can execute trades with minimal fees, further reducing the impact of slippage on their returns. |

| 4. Intelligent Routing: The 1inch Network intelligently routes trades across different DEXs to achieve the best possible prices. This routing strategy minimizes the chances of encountering high slippage rates and ensures that users can maximize their returns. |

Overall, the 1inch Network is dedicated to reducing slippage and maximizing returns for traders in the DeFi space. Through its advanced technology and optimization protocols, the platform offers users a more efficient and cost-effective way to trade across multiple DEXs.

Maximizing Returns

When it comes to maximizing returns, the 1inch Network is your go-to solution. With its advanced algorithm and innovative technology, it ensures that you get the best possible returns on your trades.

Reducing Slippage

One of the main factors that can negatively impact your returns is slippage. Slippage occurs when the price of an asset changes between the time you place an order and the time it is executed. This can result in you getting a different price than what you expected, leading to lower returns.

The 1inch Network tackles this issue by aggregating liquidity from various decentralized exchanges (DEXs) and routing your trades through the most efficient path. By doing so, it minimizes slippage and ensures that you get the best possible price for your trades.

Maximizing Liquidity

In addition to reducing slippage, the 1inch Network also maximizes liquidity. Liquidity refers to the volume of assets available for trading. Higher liquidity means that there are more buyers and sellers in the market, which leads to tighter spreads and better prices.

The 1inch Network achieves this by tapping into a wide range of DEXs and aggregating their liquidity. This allows it to offer you a higher level of liquidity compared to trading on a single exchange. As a result, you can make larger trades without significantly impacting the market price, maximizing your returns.

Optimizing Gas Fees

Gas fees, which are the transaction fees on the Ethereum network, can eat into your returns. The 1inch Network understands this challenge and optimizes gas fees to ensure that you get the most out of your trades.

By utilizing its advanced routing algorithm, the 1inch Network finds the most cost-effective path for your trades, minimizing gas fees in the process. This means that you can maximize your returns by reducing the amount you spend on transaction fees.

Overall, the 1inch Network is your key to maximizing returns on your trades. With its ability to reduce slippage, maximize liquidity, and optimize gas fees, you can be confident that you are getting the best possible outcomes for your investments.

Question-answer:

What is the role of 1inch Network?

The role of 1inch Network is to reduce slippage and maximize returns for users in decentralized finance (DeFi) trading.

How does 1inch Network reduce slippage?

1inch Network reduces slippage by splitting the order across multiple liquidity sources. It aggregates liquidity from various decentralized exchanges (DEXs) to find the most efficient trading route with the lowest slippage.

What does maximizing returns mean in the context of 1inch Network?

Maximizing returns means that 1inch Network helps users get the best possible price for their trades. By finding the most efficient trading route, it ensures that users get the most value for their tokens.

Can 1inch Network be used for any cryptocurrency?

Yes, 1inch Network supports various cryptocurrencies. Users can trade a wide range of tokens on the platform, including popular ones like Ethereum, Bitcoin, and stablecoins like USDT and DAI.

Is 1inch Network safe to use?

Yes, 1inch Network is designed to prioritize security. The platform employs various measures to ensure the safety of user funds, including smart contract audits and partnerships with reputable security providers.