Comparing the Performance of 1inch Tokens to Other Cryptocurrencies: An In-depth Analysis

In the ever-evolving world of cryptocurrencies, one token has been steadily gaining attention and popularity – 1inch. As more investors flock to this decentralized exchange (DEX) aggregator, it becomes crucial to analyze and understand the performance of 1inch tokens in comparison to other cryptocurrencies.

1inch is a utility token that powers the 1inch Network, a platform that enables users to find the most efficient trading routes across various decentralized exchanges. The token plays a vital role in the ecosystem, offering a range of benefits to holders such as reduced trading fees and governance rights.

When comparing the performance of 1inch tokens to other cryptocurrencies, several factors come into play. One significant aspect is the token’s market capitalization, which reflects the total value of all circulating tokens. Additionally, analyzing the token’s price movements over different periods provides insights into its volatility and potential for growth.

Furthermore, it is essential to examine the trading volume of 1inch tokens, which indicates the level of activity and liquidity within the market. Higher trading volumes generally contribute to increased price stability and can attract more investors to the token.

Understanding how 1inch tokens perform in comparison to other cryptocurrencies is crucial for both existing and potential investors. By analyzing factors such as market capitalization, price movements, and trading volume, one can gain valuable insights into the token’s potential for growth and its position within the broader cryptocurrency market.

Comparing 1inch Tokens to Major Cryptocurrencies

When analyzing the performance of 1inch tokens compared to other cryptocurrencies, it is important to take into consideration various factors such as market capitalization, trading volume, and historical price data.

One of the major cryptocurrencies that can be compared to 1inch tokens is Bitcoin (BTC). As the first and most well-known cryptocurrency, Bitcoin has a massive market capitalization and trading volume. Its price is also highly volatile, which can present both opportunities and risks for investors.

Ethereum (ETH) is another prominent cryptocurrency that can be compared to 1inch tokens. Ethereum is known for its smart contract functionality and has a wide range of decentralized applications built on its blockchain. The price of Ethereum has also shown significant growth, making it an attractive investment option for many crypto enthusiasts.

Ripple (XRP) is a cryptocurrency that focuses on facilitating fast and low-cost international money transfers. Although its market capitalization is not as high as Bitcoin or Ethereum, XRP has gained popularity for its practical use case in the remittance industry.

Other major cryptocurrencies that can be compared to 1inch tokens include Litecoin (LTC), Bitcoin Cash (BCH), and Cardano (ADA). These cryptocurrencies have their own unique features and use cases, which can impact their performance and appeal to investors.

Overall, comparing 1inch tokens to major cryptocurrencies can provide valuable insights into the performance and potential of these tokens. Investors should consider factors such as market trends, technological advancements, and regulatory developments when making investment decisions in the cryptocurrency market.

Key Factors Influencing the Performance of 1inch Tokens

When analyzing the performance of 1inch tokens compared to other cryptocurrencies, it is important to consider a number of key factors. These factors can significantly impact the price and value of 1inch tokens in the market.

1. Liquidity

One of the primary factors influencing the performance of 1inch tokens is liquidity. The level of liquidity in the market can affect the ease with which traders can buy or sell 1inch tokens. Higher liquidity generally corresponds to a higher level of market activity and can lead to increased demand and trading volume, which can positively impact the price of 1inch tokens.

2. Adoption and Utility

The adoption and utility of 1inch tokens are also important factors to consider. If more users and platforms start to adopt and use 1inch tokens for their transactions or as a means of accessing certain services, this can increase the demand for the tokens and potentially drive up their value. Conversely, if adoption and utility are low, it may negatively impact the performance of 1inch tokens.

3. Market Sentiment and External Factors

Market sentiment and external factors, such as overall market conditions and regulatory changes, can have a significant impact on the performance of 1inch tokens. If the overall sentiment in the crypto market is positive and there is increased interest in decentralized finance (DeFi) projects like 1inch, it can drive up the price of 1inch tokens. On the other hand, negative market sentiment or adverse regulatory actions can have a negative impact on the price and performance of 1inch tokens.

4. Competition

Competition within the decentralized exchanges (DEX) space can also influence the performance of 1inch tokens. If other DEX platforms gain popularity and start to attract more users and liquidity, it may impact the demand for 1inch tokens. It is important to consider the competitive landscape and how 1inch stands out or differentiates itself from other DEX platforms.

5. Technology and Development Updates

The technology behind 1inch and any development updates can also play a role in the performance of its tokens. Improvements in technology, new features, and partnerships can increase the confidence and interest in 1inch, which can lead to increased demand for its tokens. Conversely, any issues or delays in development can negatively impact the performance of 1inch tokens.

Overall, analyzing the performance of 1inch tokens requires considering multiple factors. Liquidity, adoption and utility, market sentiment, competition, and technology and development updates are all important factors that can influence the performance of these tokens compared to other cryptocurrencies. By considering these factors, investors can make more informed decisions regarding the potential value and future performance of 1inch tokens.

Question-answer:

How has the performance of 1inch tokens compared to other cryptocurrencies?

The performance of 1inch tokens has been quite impressive compared to other cryptocurrencies. In recent months, the price of 1inch tokens has seen significant growth, outperforming many other cryptocurrencies in terms of returns.

Why have 1inch tokens performed so well compared to other cryptocurrencies?

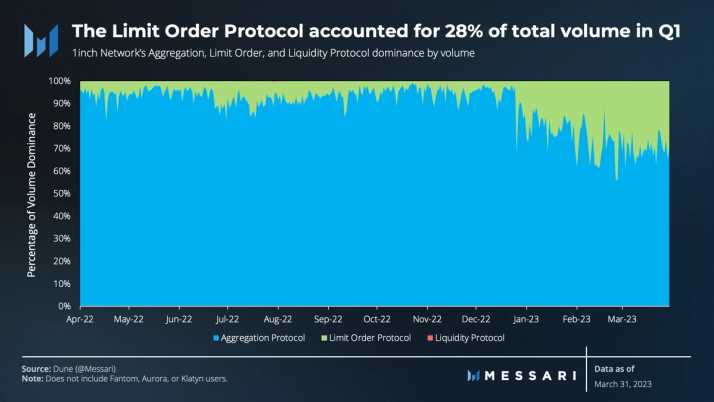

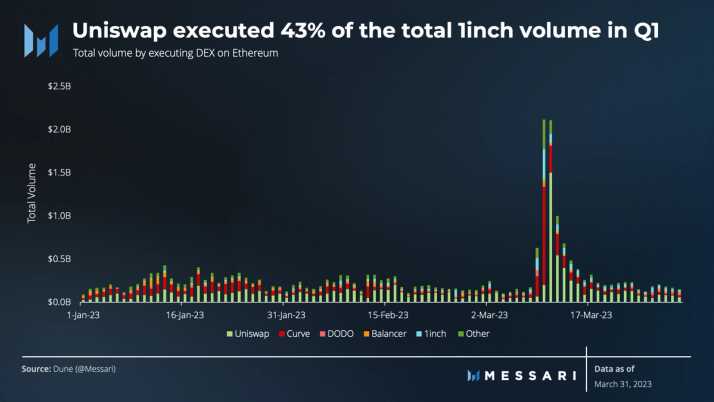

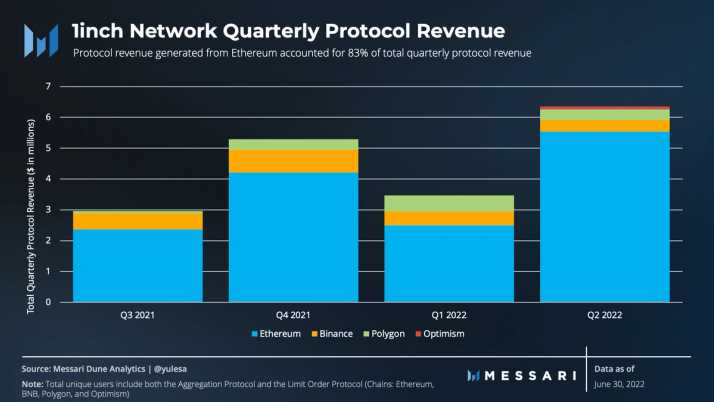

There are a few factors that have contributed to the strong performance of 1inch tokens compared to other cryptocurrencies. Firstly, the 1inch exchange has gained a lot of traction in the decentralized finance (DeFi) space, attracting a large number of users and generating a significant amount of trading volume. This increased usage has increased demand for 1inch tokens, driving up their price. Additionally, the team behind 1inch has been actively working on improving their platform and expanding their ecosystem, which has also boosted investor confidence.

Will the performance of 1inch tokens continue to outperform other cryptocurrencies?

While it is difficult to predict the future performance of any cryptocurrency, considering the current momentum and the growth of the decentralized finance (DeFi) space, there is a possibility that 1inch tokens will continue to outperform other cryptocurrencies. However, it is important to note that the cryptocurrency market is highly volatile and subject to various factors, so it is always recommended to conduct thorough research and consult with a financial advisor before making any investment decisions.