The Increasing Popularity of Automated Market Makers on the 1inch Crypto Platform

Automated Market Makers (AMMs) have revolutionized the way decentralized exchanges operate in the crypto industry. Among the many AMM platforms that have emerged, 1inch has quickly become one of the most popular and widely used.

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges and provides users with the best possible trading rates. It achieves this by leveraging AMM algorithms that automatically split and route trades across multiple liquidity pools, ensuring that users get the most competitive prices.

One of the key advantages of using AMMs is their ability to eliminate the need for traditional order books, which can be complex and prone to market manipulation. Instead, AMMs rely on liquidity pools, where users can deposit their funds and become liquidity providers. These liquidity pools are powered by smart contracts, which use mathematical formulas to determine the price of assets based on the available supply.

With the rise of automated market makers like 1inch, decentralized exchanges have become more accessible and user-friendly. They provide traders with greater control over their funds and reduce reliance on centralized platforms. As the crypto industry continues to evolve, AMMs are likely to play a central role in shaping its future.

The Rise of Automated Market Makers

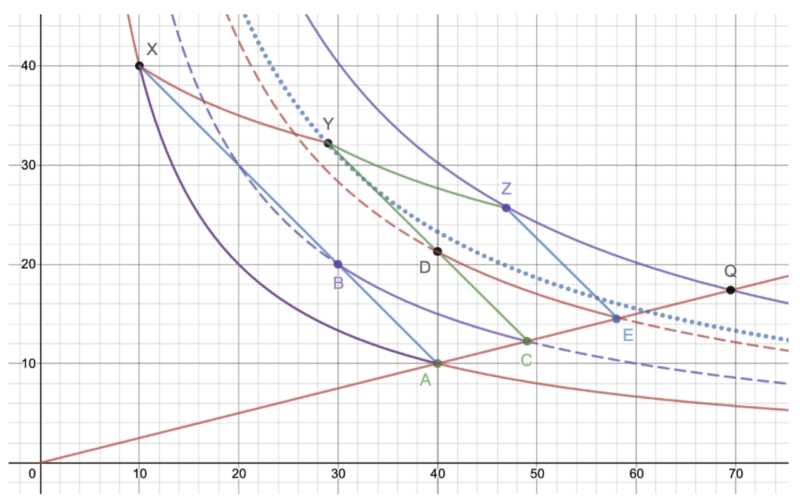

Automated Market Makers (AMMs) have emerged as a groundbreaking innovation in the world of decentralized finance (DeFi). AMMs are algorithms that provide liquidity and enable seamless trading in decentralized exchanges (DEXs). Unlike traditional market makers who use order books, AMMs use smart contracts to set token prices based on predefined mathematical formulas.

The rise of AMMs has been fueled by their ability to address key challenges faced by traditional market makers. AMMs offer greater liquidity, transparency, and accessibility, allowing for efficient and trustless trading. They eliminate the need for intermediaries, reduce transaction costs, and enable users to trade directly from their wallets.

One of the most popular AMMs is 1inch, a decentralized exchange aggregator that sources liquidity from various DEXs. 1inch leverages the power of AMMs to provide users with the best possible trading rates and minimal slippage. By splitting trades across different liquidity pools, 1inch ensures that users get the highest returns on their trades.

The Benefits of Automated Market Makers

AMMs offer several benefits that make them attractive to traders and investors. Firstly, AMMs provide liquidity to DEXs, allowing users to trade even in low-volume markets. This makes it easier for users to buy or sell tokens without affecting the market prices significantly.

Secondly, AMMs enable users to earn passive income through liquidity provision. Users can contribute their tokens to liquidity pools and earn fees for each trade that occurs in those pools. This incentivizes users to provide liquidity and ensures a constant supply of liquidity in the market.

Lastly, AMMs provide users with more control over their trading strategies. Users have the flexibility to set their own prices and execute trades without relying on centralized intermediaries. This empowers users and reduces the risk of manipulation or unfair trading practices.

The Future of Automated Market Makers

The rise of AMMs has revolutionized the world of decentralized finance and is expected to continue in the future. As more users recognize the benefits of AMMs, the liquidity and trading volume in decentralized exchanges are likely to increase significantly.

Furthermore, AMMs are constantly evolving and improving. New innovations such as impermanent loss protection and multi-chain compatibility are being introduced to address the limitations of AMMs. These advancements will further enhance the user experience and attract more users to decentralized exchanges.

In conclusion, the rise of automated market makers has ushered in a new era of decentralized finance. AMMs offer greater liquidity, transparency, and accessibility, revolutionizing the way we trade cryptocurrencies. As the DeFi ecosystem continues to grow, AMMs will play a crucial role in enabling efficient and decentralized trading.

1inch Crypto:

The rise of automated market makers (AMMs) on the 1inch Crypto platform has revolutionized the way users trade and access liquidity in the decentralized finance (DeFi) space. 1inch Crypto, a decentralized exchange aggregator, leverages AMMs to provide users with the best possible prices and low slippage when executing trades.

What are Automated Market Makers?

Automated market makers are smart contracts that facilitate decentralized trading without the need for traditional order books. Instead of relying on buyers and sellers to create liquidity, AMMs utilize algorithms and liquidity pools to automatically provide liquidity for any given trading pair. This algorithmic approach allows for continuous liquidity and more efficient price discovery in the market.

How does 1inch Crypto Utilize AMMs?

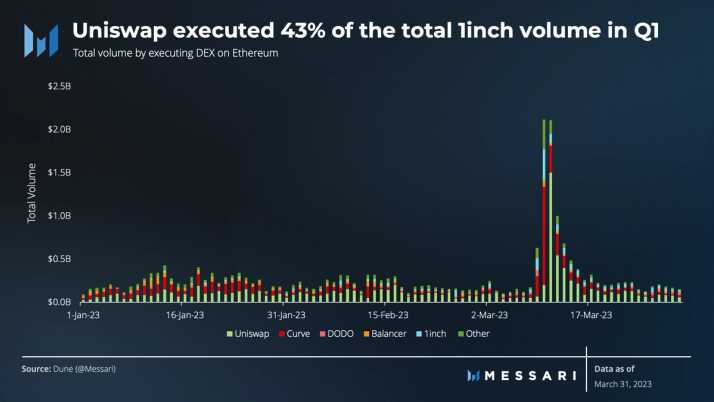

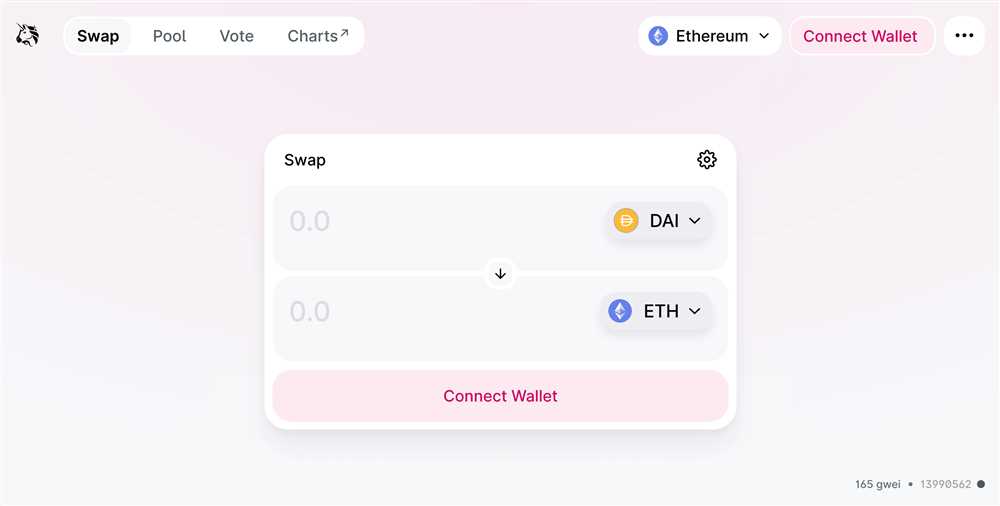

1inch Crypto integrates with various liquidity protocols, such as Uniswap, SushiSwap, and Balancer, to access liquidity pools and optimize trades. When a user initiates a trade on 1inch Crypto, the platform’s smart contracts analyze the available liquidity across these protocols and determine the best route to execute the trade at the lowest possible cost.

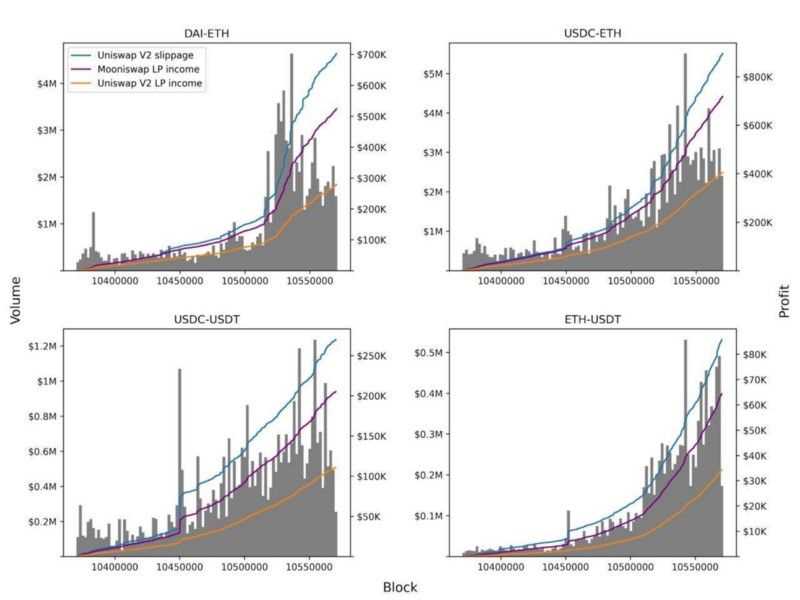

1inch Crypto’s AMM algorithm splits the user’s trade across multiple liquidity pools, reducing slippage and maximizing trading efficiency. This allows users to access the most competitive prices and ensures that large trades do not significantly impact the market price.

The Benefits of 1inch Crypto’s AMM Approach

1inch Crypto’s use of AMMs offers several advantages for traders and liquidity providers:

- Improved liquidity: By tapping into multiple liquidity pools, 1inch Crypto offers users access to a larger pool of liquidity, increasing the chances of obtaining favorable prices for trades.

- Reduced slippage: The AMM algorithm employed by 1inch Crypto mitigates slippage, resulting in better execution prices for traders.

- Cost efficiency: The optimization of trades across different liquidity protocols allows 1inch Crypto to find the most cost-effective routes for users, saving on gas fees and other transaction costs.

- Market impact reduction: By splitting large trades across multiple pools, 1inch Crypto minimizes the impact on the overall market price and provides a more stable trading experience.

The integration of AMMs on 1inch Crypto has been crucial in democratizing access to decentralized finance and improving trading efficiency. Traders can benefit from increased liquidity, reduced slippage, and optimal trade execution, all made possible by automated market makers on the 1inch Crypto platform.

Advantages and Benefits of Automated Market Makers

Automated Market Makers (AMMs) have revolutionized the world of decentralized finance by providing liquidity and allowing for seamless trading without the need for intermediaries. Here are some of the key advantages and benefits of using AMMs:

- Liquidity: AMMs ensure that there is always liquidity available for traders, allowing them to execute their transactions quickly and efficiently. This helps to reduce slippage and improve the overall trading experience.

- No middleman: With AMMs, there is no need for a traditional intermediary such as a broker or exchange. This eliminates the need for trust in a third party and reduces the risk of counterparty manipulation or malpractice.

- Decentralization: AMMs operate on decentralized protocols, which means they are not controlled by any single entity or authority. This enhances the security and trustlessness of the trading process.

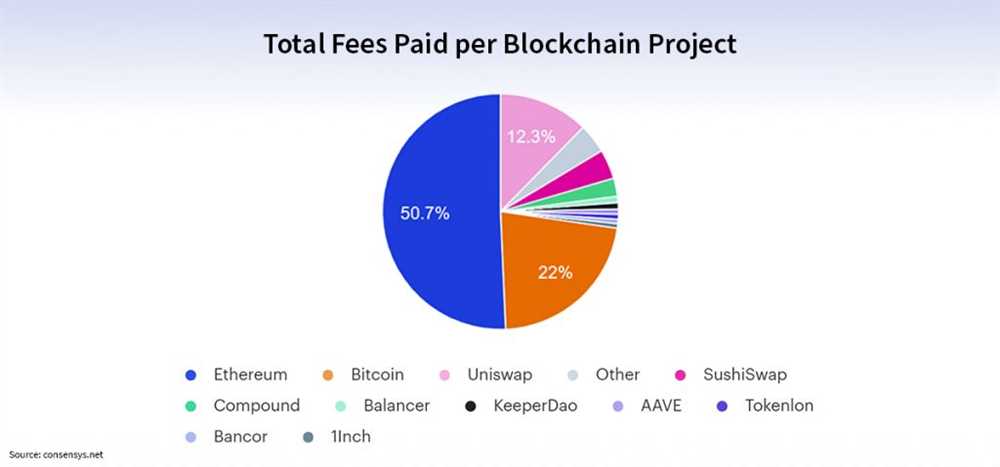

- Lower fees: AMMs typically have lower fees compared to traditional centralized exchanges. This is because there are no intermediaries involved, and trading fees are typically distributed among liquidity providers.

- Accessibility: AMMs are open and accessible to anyone with an internet connection. This allows users from all over the world to participate in the decentralized finance ecosystem and access a wide range of trading opportunities.

- Flexibility: AMMs support a wide range of assets and trading pairs, providing traders with a high level of flexibility. This allows users to easily diversify their portfolio and explore new trading opportunities.

- Transparency: The transparent nature of blockchain technology ensures that all transactions on AMMs can be publicly verified. This enhances trust and accountability within the ecosystem.

Overall, the rise of AMMs has democratized the world of trading by providing a decentralized and accessible platform for users to trade assets efficiently and securely. As the adoption of decentralized finance continues to grow, AMMs are expected to play a crucial role in shaping the future of financial markets.

How Automated Market Makers Are Transforming the Crypto Industry

The rise of automated market makers (AMMs) has been a game-changer for the crypto industry. AMMs have revolutionized the way trading is conducted by eliminating the need for traditional order books and relying on algorithms to determine prices.

Efficiency and Liquidity

One of the main benefits of AMMs is their ability to provide efficient and liquid trading. This is achieved through the use of smart contracts that automatically execute trades based on predefined rules. As a result, transactions can be settled quickly and without the need for intermediaries.

Additionally, AMMs help to increase liquidity in the market. By allowing users to provide liquidity and earn fees in return, AMMs encourage a diverse range of traders to participate. This, in turn, leads to a more vibrant and active market.

Accessibility and Decentralization

Another key advantage of AMMs is their accessibility. Traditional trading platforms often have high barriers to entry, such as minimum deposit amounts or complex registration processes. AMMs, on the other hand, are typically open to anyone with an internet connection and a compatible wallet.

Furthermore, AMMs promote decentralization in the crypto industry. Since AMMs are built on blockchain technology, they are inherently decentralized and not controlled by any single entity. This helps to foster a more inclusive and democratic financial system.

Overall, the rise of automated market makers has had a transformative impact on the crypto industry. Through increased efficiency, liquidity, accessibility, and decentralization, AMMs are changing the way trading is conducted and paving the way for a more inclusive and innovative future.

Future Implications and Opportunities for 1inch Crypto

The rise of automated market makers (AMMs) on 1inch Crypto has significant implications for the future of decentralized finance (DeFi) and opens up numerous opportunities for users and investors.

One of the key implications of AMMs on 1inch Crypto is the increased accessibility and efficiency of decentralized trading. By automating the process of matching buy and sell orders, AMMs eliminate the need for traditional order books and centralized intermediaries. This allows users to trade directly with each other, reducing fees and increasing liquidity. As a result, more users can participate in DeFi trading without relying on traditional financial institutions.

Another implication is the potential for increased transparency and security in the crypto market. As AMMs are typically built on blockchain technology, all transactions are recorded on a public ledger. This provides a level of transparency that is lacking in traditional financial markets. Additionally, since AMMs do not rely on centralized intermediaries, they are less susceptible to hacking and other security breaches.

Furthermore, the rise of AMMs on 1inch Crypto presents exciting opportunities for investors. By providing liquidity to AMMs, users can earn fees and participate in the success of the platform. Additionally, as more users adopt AMMs, the liquidity and trading volume on 1inch Crypto are likely to increase, which can lead to higher rewards for liquidity providers. This creates an incentive for investors to contribute to the growth of the platform and earn passive income.

In conclusion, the rise of AMMs on 1inch Crypto has the potential to revolutionize decentralized finance and provide new opportunities for users and investors. By increasing accessibility, transparency, and efficiency, AMMs can democratize trading and make DeFi more accessible to a wider range of participants. Additionally, the potential for increased liquidity and earning opportunities incentivizes investors to contribute to the growth and success of the platform. As 1inch Crypto continues to evolve and innovate, it will be interesting to see how these implications and opportunities unfold in the future.

Question-answer:

What is an automated market maker?

An automated market maker is a decentralized protocol that uses algorithms to facilitate trading in decentralized exchanges. It provides liquidity to a decentralized marketplace by automatically executing trades.

How do automated market makers work?

Automated market makers work by using smart contracts to create pools of tokens. These pools hold certain amounts of different cryptocurrencies, allowing traders to swap one cryptocurrency for another. Algorithms ensure that these trades are executed at fair prices based on the available liquidity in the pool.

Why are automated market makers becoming popular?

Automated market makers are becoming popular because they offer several advantages over traditional market makers. They are decentralized, meaning that anyone can participate in providing liquidity and earning rewards. They also offer lower costs and faster transactions compared to traditional exchanges.

What is the significance of the rise of automated market makers?

The rise of automated market makers has democratized access to liquidity in decentralized exchanges. It has allowed smaller traders and investors to participate in the market and earn rewards by providing liquidity. This has increased the overall efficiency and liquidity of decentralized exchanges.