Discover the future of decentralized finance (DeFi) with 1inch, the leading decentralized exchange (DEX) platform.

Are you tired of the limitations and inefficiencies of traditional centralized exchanges? Looking for a more secure and transparent way to trade your digital assets? Look no further – 1inch is here to revolutionize your DeFi experience.

With its innovative technology and user-friendly interface, 1inch stands out from other DEXs in the market. Our unique algorithm aggregates liquidity from various protocols, ensuring the best possible prices for your trades.

Unlike other DEXs, 1inch offers lightning-fast transactions and significantly lower fees. Our platform is powered by smart contracts, providing you with unmatched security and eliminating the need for intermediaries.

Whether you’re a seasoned DeFi enthusiast or just getting started, 1inch is the ideal platform to explore the exciting world of decentralized finance. Experience the power of decentralized trading and take full control of your assets with 1inch today!

Description and Importance of DeFi Platforms

Decentralized Finance (DeFi) platforms have emerged as a revolutionary solution that aims to redefine the traditional financial system. These platforms utilize blockchain technology to provide users with a decentralized and permissionless environment for conducting various financial activities.

What is DeFi?

DeFi refers to a set of financial applications and protocols built on blockchain networks like Ethereum. Unlike traditional finance, DeFi platforms operate without the need for intermediaries such as banks or other financial institutions. Instead, they rely on smart contracts to automate transactions and eliminate the need for middlemen.

DeFi platforms offer a wide range of financial services, including decentralized exchanges (DEXs), lending and borrowing protocols, stablecoins, yield farming, and more. These services provide users with the opportunity to earn passive income, access liquidity, and gain exposure to a variety of investment opportunities.

The Importance of DeFi Platforms

DeFi platforms play a crucial role in enabling financial inclusion and empowering individuals by giving them control over their funds and financial decisions. These platforms are accessible to anyone with an internet connection, allowing people from all around the world to participate in the global financial ecosystem.

One of the key advantages of DeFi platforms is their transparency. All transactions and operations are recorded on the blockchain, making them publicly verifiable. This transparency ensures trust and reduces the risk of fraud and manipulation.

Another important aspect of DeFi platforms is their openness and interoperability. Developers can build new applications and integrate them into existing DeFi protocols, creating a vibrant ecosystem of interconnected financial services. This fosters innovation and allows for the rapid development of new solutions and products.

Furthermore, DeFi platforms provide users with greater control over their assets. Users hold their private keys and have full ownership and custody of their funds. This eliminates the risk of funds being frozen or seized by a third party.

Overall, DeFi platforms are reshaping the financial landscape and offering a more inclusive and transparent alternative to traditional finance. With the potential to revolutionize various industries, DeFi is gaining momentum and attracting both individual and institutional investors.

1inch vs Other DEXs

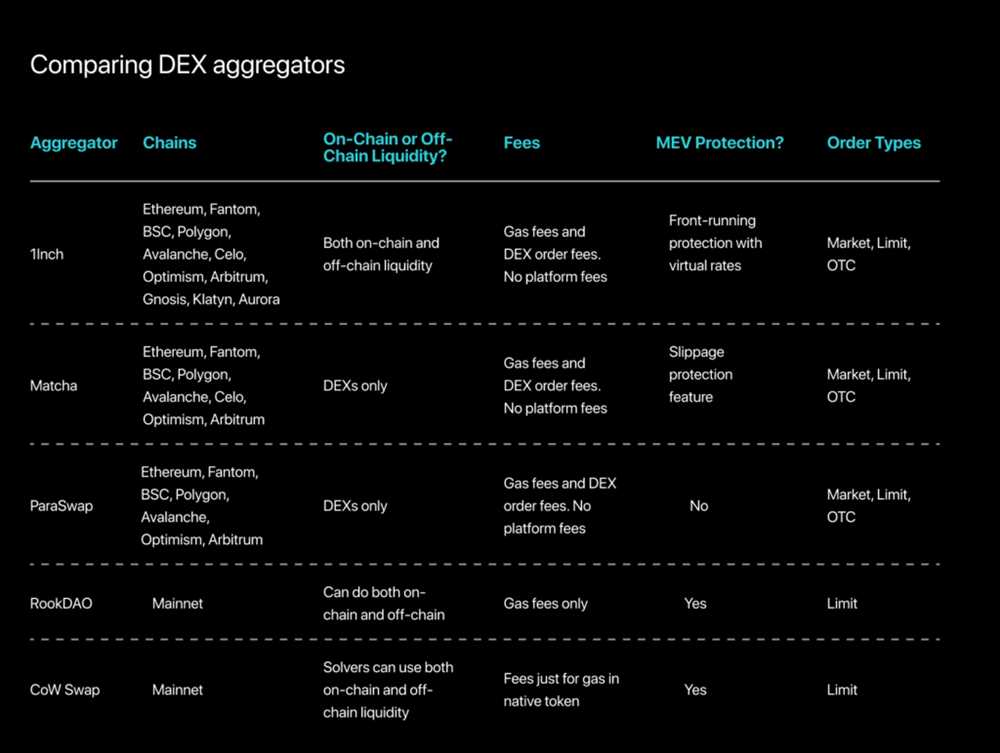

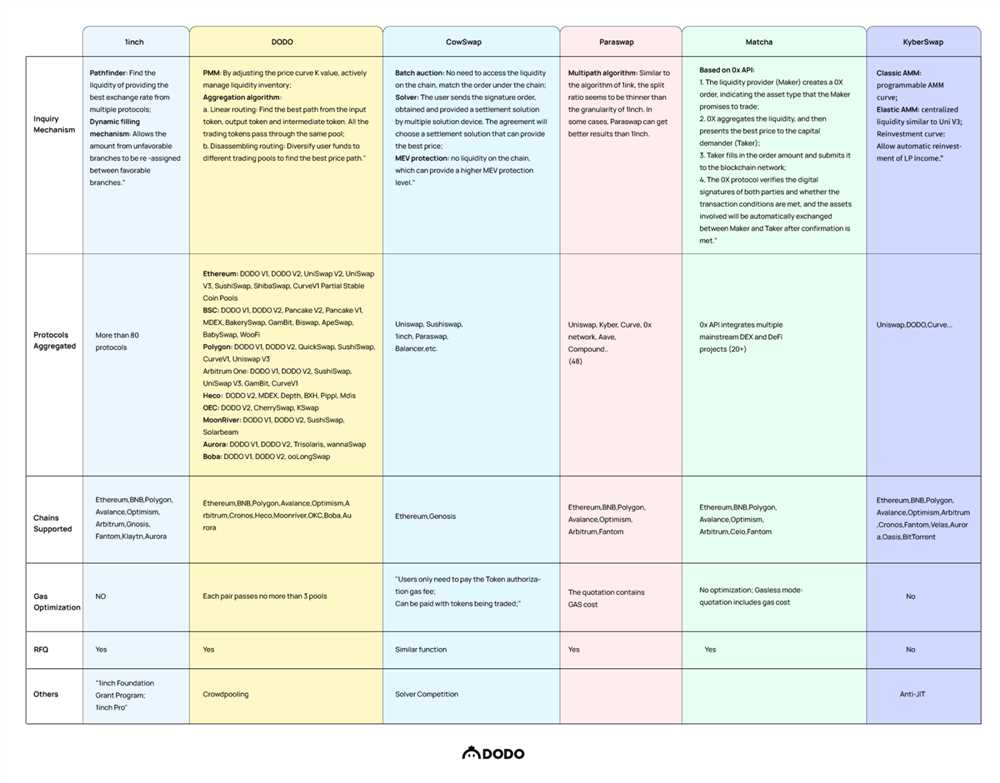

When it comes to decentralized exchanges (DEXs), 1inch stands out from the crowd. Its unique features and innovative design make it a popular choice among DeFi traders. Let’s compare 1inch with other DEXs to see why it’s the preferred platform for many.

1. Aggregation Protocol

One of the key advantages of 1inch is its aggregation protocol. Unlike traditional DEXs, 1inch sources liquidity from multiple platforms, ensuring the best possible trading rates for users. This means that traders can get the most favorable prices and minimal slippage when making transactions.

2. User-Friendly Interface

1inch offers a user-friendly interface that is easy to navigate, even for beginners. The platform provides clear and concise information on trading pairs, liquidity pools, and transaction fees. Users can execute trades with just a few clicks, making the trading process efficient and effortless.

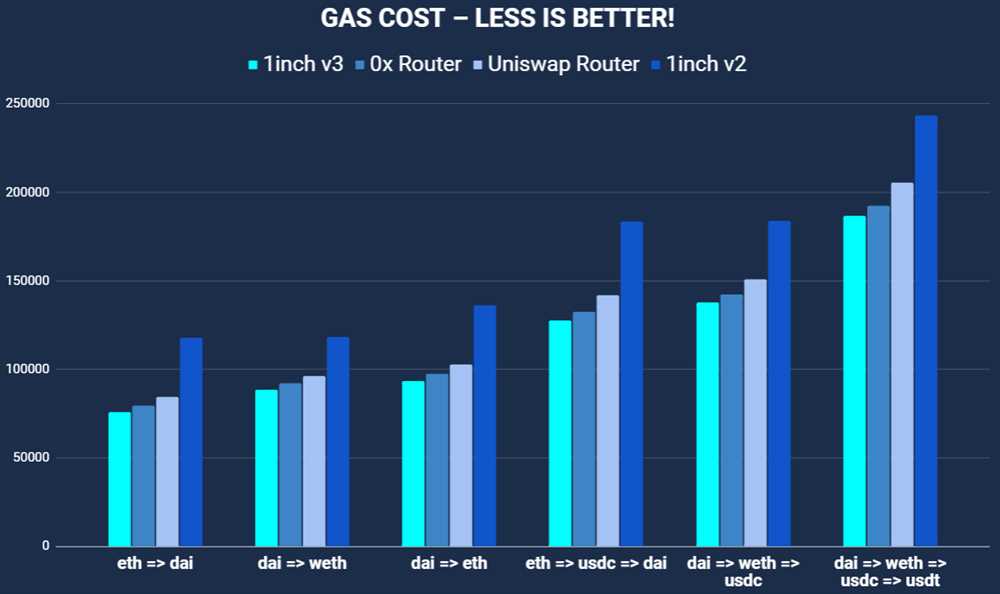

3. Efficient Gas Optimization

Gas fees on the Ethereum network can often be costly, especially during peak times. However, 1inch utilizes sophisticated algorithms to find the most cost-effective routes for transactions. This optimization helps users save on gas fees and reduces the overall cost of trading on the platform.

4. Advanced Security Measures

1inch places a strong emphasis on security, implementing stringent measures to protect user funds. The platform utilizes smart contract audits and integration with leading security providers to minimize the risk of hacking or unauthorized access. Users can trade on 1inch with confidence, knowing that their assets are safe.

5. Wide Range of Supported Tokens

1inch supports a wide range of tokens, including popular cryptocurrencies and ERC-20 tokens. This allows users to trade and swap between different assets seamlessly. The platform also integrates with other DeFi protocols, opening up even more possibilities for users to diversify their portfolios.

Overall, 1inch offers a comprehensive and superior trading experience compared to other DEXs. Its innovative features, user-friendly interface, efficient gas optimization, advanced security measures, and wide range of supported tokens make it the go-to platform for DeFi traders.

Overview and Comparison of Features

In this section, we will provide an overview and comparison of the features offered by 1inch and other decentralized exchanges (DEXs). By understanding the unique capabilities of each platform, users can make informed decisions on which DEX suits their trading needs best.

1inch DEX

1inch is a decentralized exchange aggregator that sources liquidity from various DEXs, offering users the best possible token swap rates across different platforms. Its key features include:

| Feature | Description |

| Multi-DEX integration | 1inch integrates with multiple DEXs, allowing users to access a wide range of liquidity pools. |

| Optimal execution paths | 1inch employs advanced algorithms to find the most cost-effective routes for token swaps, ensuring users get the best rates. |

| Custom slippage tolerance | Users can set their desired slippage tolerance, enabling them to execute trades with flexibility and control. |

| Gas fee optimization | 1inch automatically optimizes gas fees to save users money when executing transactions. |

Other DEXs

While 1inch offers unique features, other DEXs in the DeFi space also provide their own set of capabilities. Here are some notable features offered by other DEXs:

| DEX | Notable Features |

| Uniswap | Uniswap is one of the most popular DEXs with a simple and user-friendly interface, providing easy access to liquidity pools. |

| SushiSwap | SushiSwap offers yield farming and staking opportunities, allowing users to earn rewards by providing liquidity to the platform. |

| PancakeSwap | PancakeSwap is a DEX built on the Binance Smart Chain, offering lower transaction fees and faster confirmation times compared to Ethereum-based DEXs. |

| Balancer | Balancer enables users to create and manage liquidity pools with multiple tokens, allowing for more customizable and flexible trading options. |

By considering the features offered by 1inch and other DEXs, traders can evaluate their options and choose the platform that aligns with their specific requirements and preferences.

Advantages of 1inch

1inch, as a decentralized exchange aggregator, offers several advantages that set it apart from other DEXs:

1. Efficient and Optimized Trades

Unlike traditional DEXs, 1inch utilizes intelligent routing algorithms to find the most efficient paths for trades. This ensures that users get the best possible prices and minimal slippage, ultimately maximizing their gains.

2. Wide Range of Liquidity Sources

1inch connects to multiple liquidity sources, including popular DEXs and various liquidity protocols. By aggregating liquidity from different platforms, 1inch provides users with access to a vast pool of liquidity, increasing the chances of finding optimal trading opportunities.

3. Low Transaction Costs

1inch is designed to minimize transaction costs by splitting trades across different DEXs and protocols. By distributing orders intelligently, 1inch reduces gas fees and ensures that users enjoy cost-effective transactions.

Furthermore, 1inch’s Gas Token (Chi) significantly reduces gas costs by optimizing the use of Ethereum’s block space.

4. User-friendly Interface

1inch offers a user-friendly interface that makes it easy for both experienced and beginner traders to navigate the platform. The intuitive design allows users to quickly execute trades and access various advanced features without any hassle.

5. Strong Security Measures

1inch prioritizes the security of user funds and employs various security measures to protect against potential risks. These measures include audits of smart contracts, integration with reputable wallets, and thorough screening of supported liquidity sources.

With these advantages, 1inch stands out as a reliable and efficient decentralized exchange aggregator, providing users with an enhanced trading experience in the rapidly evolving world of DeFi.

Comparative Analysis of DeFi Platforms

Decentralized finance (DeFi) platforms have gained immense popularity in recent years, offering users the ability to trade, lend, borrow, and earn interest on cryptocurrencies without relying on intermediaries. With numerous DeFi platforms available in the market, it is essential to compare the features, benefits, and drawbacks of each platform to make an informed decision. In this comparative analysis, we will be comparing 1inch with other leading DeFi platforms.

1. User Experience

When it comes to user experience, 1inch stands out from the competition. The platform provides a user-friendly interface that offers easy navigation and a seamless trading experience. The intuitive design and clear instructions make it suitable for both beginner and experienced traders. On the other hand, some other DeFi platforms lack user-friendly interfaces, which can be a barrier to entry for newcomers.

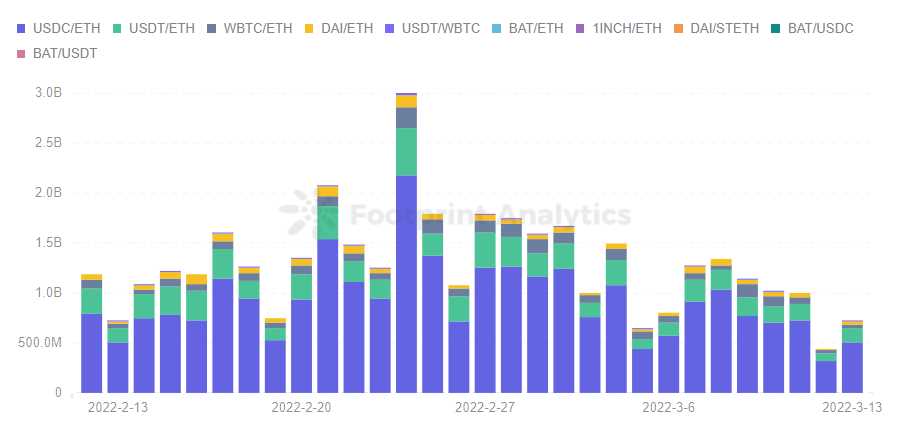

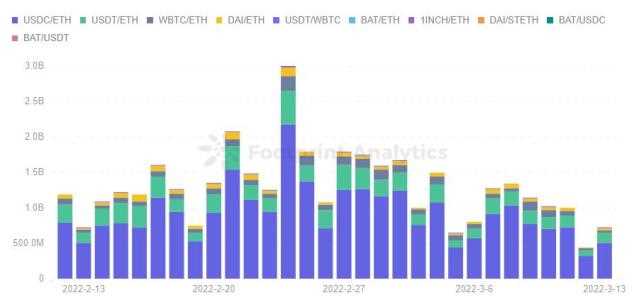

2. Liquidity and Trading Options

1inch leverages a decentralized aggregator that pools liquidity from various decentralized exchanges (DEXs), resulting in a higher liquidity pool compared to other platforms. This allows users to access better trading options, including competitive prices and lower slippage. In contrast, some other DeFi platforms have limited liquidity, which can lead to higher slippage and lower trading options.

Overall, while there are several notable DeFi platforms available, 1inch stands out for its user experience and superior liquidity and trading options. However, it is essential to research and understand the specific requirements and goals before choosing a platform to ensure it aligns with your needs.

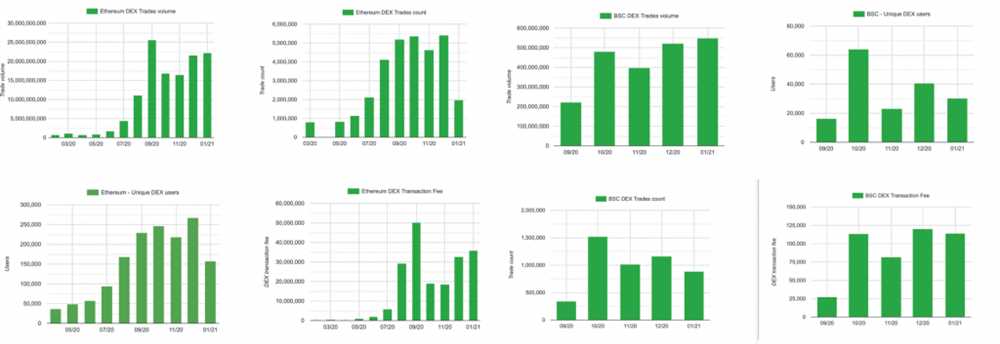

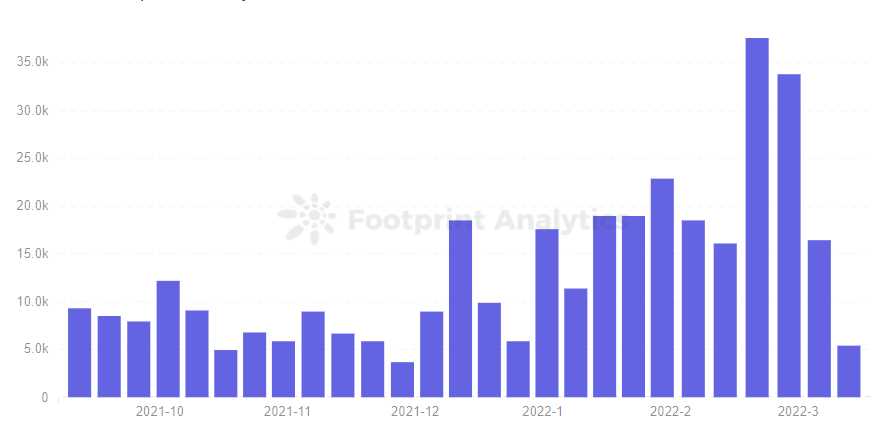

Market Share and User Base

When it comes to market share and user base, 1inch has established itself as a prominent player in the decentralized finance (DeFi) space. The platform boasts a significant market share and a growing user base, making it a preferred choice for many DeFi enthusiasts.

One of the key factors contributing to 1inch’s market share is its unique aggregation algorithm, which combines multiple liquidity sources to provide users with the best possible rates. This has attracted a wide range of users, including both retail and institutional investors, who are drawn to the platform’s ability to optimize trades and maximize returns.

Furthermore, 1inch has actively focused on expanding its user base by partnering with various DeFi projects and platforms. This collaborative approach has allowed the platform to tap into new markets and attract users from different segments of the DeFi ecosystem.

The strong market share and user base of 1inch have also enabled the platform to foster a vibrant and active community. This community not only provides valuable feedback and support but also contributes to the platform’s overall growth and development.

As the DeFi landscape continues to evolve, 1inch’s market share and user base are expected to expand further. With its innovative features, user-friendly interface, and commitment to continuous improvement, 1inch is well-positioned to solidify its position as a leading DeFi platform.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that provides users with the best prices across various DEXs. It also offers a variety of advanced features and tools to improve the trading experience.

How does 1inch compare to other DEX platforms?

1inch excels in comparison to other DEX platforms in several ways. It offers better prices by splitting orders across multiple liquidity sources, resulting in lower slippage. Additionally, it provides advanced features like limit orders, gas optimization, and token swapping with options for both simplicity and complex trading strategies.

What are the benefits of using 1inch over other DEXs?

There are several benefits to using 1inch over other DEXs. First, 1inch offers the best prices by aggregating liquidity from multiple DEXs, ensuring you get the most value for your trades. Second, it provides advanced trading features like limit orders, which many other DEXs lack. Lastly, 1inch has a user-friendly interface and a highly optimized trading experience, making it easier and more efficient to use compared to other platforms.