The decentralized finance (DeFi) space has witnessed a rapid surge in popularity and innovation in recent years. One of the major players making significant waves in this landscape is 1inch.exchange. With its revolutionary approach to decentralized exchanges, 1inch.exchange has emerged as a game-changer in the world of DeFi.

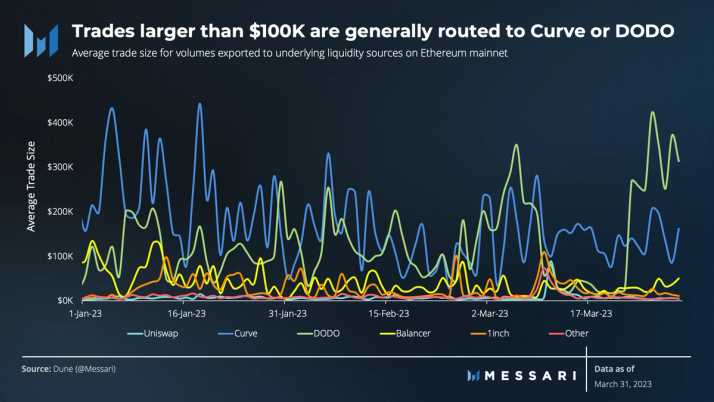

1inch.exchange is a decentralized aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible swap rates. By utilizing smart contract technology, 1inch.exchange ensures that users get the most advantageous prices for their crypto trades.

What sets 1inch.exchange apart from other DEXs is its unique algorithm, known as Pathfinder, which routes trades across multiple liquidity sources, including both on-chain and off-chain DEXs. This innovative routing mechanism optimizes trades and minimizes slippage, resulting in significantly better rates for users.

Moreover, 1inch.exchange offers a range of advanced features, such as limit orders, gas optimization, and yield farming. These features empower users to maximize their profits and optimize their trading strategies in the ever-changing DeFi landscape.

In conclusion, 1inch.exchange has brought a game-changing influence to the DeFi landscape. Its revolutionary approach to sourcing liquidity and optimizing trades has enabled users to get the best possible rates and maximize their profits. With its advanced features and commitment to user experience, 1inch.exchange continues to shape and redefine the future of decentralized finance.

The Revolutionized Impact of 1inch.exchange on DeFi Ecosystem

Since its launch, 1inch.exchange has had a profound impact on the DeFi landscape, revolutionizing how users interact with decentralized finance protocols. With its advanced algorithm and user-friendly interface, 1inch.exchange has become a game-changer in the world of decentralized finance.

1inch.exchange is a decentralized exchange aggregator that allows users to find the best prices and make trades across multiple decentralized exchanges. It searches across various liquidity sources to provide users with the most favorable rates, saving them time and money.

One of the key features that sets 1inch.exchange apart is its smart contract-based routing algorithm. This algorithm, known as Pathfinder, is able to split an order across multiple exchanges to optimize trade execution and minimize slippage. By finding the most efficient path for the trade, users can achieve better prices and higher returns.

Another revolutionary aspect of 1inch.exchange is its intuitive user interface. The platform is designed to be user-friendly, making it easy for both experienced traders and newcomers to navigate and trade with confidence. The interface provides real-time data on gas fees, estimated slippage, and other essential information to help users make informed decisions.

1inch.exchange has also made significant contributions to the DeFi ecosystem through its liquidity protocol. By incentivizing users to provide liquidity to the platform, 1inch.exchange has helped to increase liquidity across various decentralized exchanges. This increased liquidity benefits all DeFi users by improving trade execution and reducing slippage.

The impact of 1inch.exchange on the DeFi ecosystem cannot be overstated. Its advanced algorithm, user-friendly interface, and liquidity protocol have revolutionized how users interact with decentralized finance protocols. By providing better prices, reducing slippage, and increasing liquidity, 1inch.exchange has become an essential tool for traders and investors in the rapidly evolving world of DeFi.

The Competitive Edge of 1inch.exchange in DeFi Efficiency

In the rapidly evolving world of decentralized finance (DeFi), 1inch.exchange has emerged as a game-changer with its innovative approach to optimizing trades across multiple decentralized exchanges. One of the key factors that sets 1inch.exchange apart from its competitors is its unmatched efficiency.

By leveraging artificial intelligence algorithms and decentralized smart contracts, 1inch.exchange is able to provide users with the best possible swap rates and minimal slippage. This is achieved through its automated routing system, which scours various decentralized exchanges to find the most efficient trading paths for each transaction.

Swift Execution

1inch.exchange’s advanced technology enables it to execute trades with lightning speed. By aggregating liquidity from multiple exchanges, it minimizes the time it takes for a trade to be completed. This is a crucial advantage for traders looking to take advantage of volatile market conditions, as delays can result in missed opportunities and loss of potential profits.

Cost-Effective Trades

Efficiency also extends to cost-effectiveness. When executing a trade on 1inch.exchange, users can benefit from lower gas fees compared to other decentralized exchanges. By optimizing and consolidating trades, 1inch.exchange minimizes network congestion and reduces the overall cost of transactions.

| Features | Benefits |

|---|---|

| Automated routing system | Finds the best trading path for each transaction, resulting in optimal swap rates and minimal slippage. |

| Lightning-fast execution | Allows users to take advantage of market conditions quickly and efficiently. |

| Reduced gas fees | Saves users money by minimizing network congestion. |

In conclusion, 1inch.exchange has gained a competitive edge in DeFi efficiency by providing users with swift execution and cost-effective trades. With its automated routing system and advanced technology, it has revolutionized the way trades are conducted across decentralized exchanges. As the DeFi landscape continues to evolve, 1inch.exchange remains at the forefront, constantly pushing the boundaries of efficiency in the industry.

Driving DeFi Adoption with Unique Features of 1inch.exchange

1inch.exchange, a decentralized exchange (DEX) aggregator, has emerged as a game-changer in the DeFi landscape due to its unique features and innovative approach. These features have significantly contributed to the rapid adoption of 1inch.exchange in the DeFi community.

One of the key features that sets 1inch.exchange apart from other DEX aggregators is its smart contract routing algorithm. This algorithm enables 1inch.exchange to split a single transaction across multiple liquidity sources, optimizing for the best possible trade execution and ensuring users get the most competitive rates. By integrating with a wide range of decentralized exchanges, including Uniswap, Kyber Network, and more, 1inch.exchange offers users access to the deepest pools of liquidity, ensuring minimal slippage and maximizing trading opportunities.

Another standout feature of 1inch.exchange is its implementation of Mooniswap, an automated market maker (AMM) that reduces impermanent loss. Impermanent loss is a common concern for liquidity providers in DeFi. However, through its innovative smart contract design, Mooniswap minimizes this loss by introducing a virtual balance system. As a result, liquidity providers can now earn attractive yields without the worry of substantial impermanent losses.

Furthermore, 1inch.exchange has integrated gas token technology. Gas tokens are a type of Ethereum token that can be used to pay for transaction fees on the Ethereum network. By utilizing gas token technology, 1inch.exchange reduces transaction costs for users, making DeFi more accessible and affordable for a wider range of participants. This feature has been particularly beneficial during periods of high network congestion, enabling users to save significantly on gas fees.

Additionally, 1inch.exchange boasts a user-friendly and intuitive interface, making it easy for both experienced traders and newcomers to navigate and execute trades. The platform provides real-time price updates, comprehensive trade analysis, and various trading options, including limit orders and stop orders. These features empower users to make informed trading decisions and navigate the volatile DeFi market with greater confidence.

Collectively, these unique features of 1inch.exchange drive DeFi adoption by addressing key pain points and providing solutions that enhance the trading experience for users. As the DeFi landscape continues to evolve, 1inch.exchange remains at the forefront, continually innovating and introducing new features to meet the needs of the growing DeFi community.

The Future of DeFi: How 1inch.exchange Shapes the Landscape

1inch.exchange has emerged as a game-changer in the decentralized finance (DeFi) landscape, revolutionizing the way users interact with decentralized exchanges (DEXs) and reshaping the future of DeFi as a whole.

With its innovative aggregation protocol, 1inch.exchange enables users to find the best possible trading routes across multiple DEXs, allowing for better price discovery and improved liquidity. This not only saves users time and effort but also ensures that they can capitalize on the most favorable trading opportunities.

What sets 1inch.exchange apart is its unique algorithm that splits orders across various DEXs, taking into account factors such as slippage and gas costs. By doing so, 1inch.exchange minimizes the impact of trading fees and ensures that users get the best possible prices for their trades.

Furthermore, 1inch.exchange also incorporates decentralized finance protocols beyond DEXs, such as lending and yield farming platforms. This integration provides users with a seamless experience, allowing them to access multiple DeFi services from a single platform.

The impact of 1inch.exchange on the DeFi landscape has been monumental. Not only has it improved the efficiency and accessibility of decentralized trading, but it has also paved the way for other projects to follow suit and build on its success.

As the DeFi space continues to grow and evolve, it is expected that 1inch.exchange will continue to shape the landscape by introducing new features and partnerships. Its commitment to innovation and user-centric design makes it a powerful force in the DeFi ecosystem, ensuring that users have access to the best possible tools and services.

In conclusion, 1inch.exchange has emerged as a game-changing platform in the DeFi landscape, revolutionizing decentralized trading and setting the stage for the future of DeFi. With its innovative aggregation protocol, seamless integration of various DeFi protocols, and commitment to user-centric design, 1inch.exchange is shaping the landscape and paving the way for the next wave of DeFi innovation.

Question-answer:

What is 1inch.exchange?

1inch.exchange is a decentralized exchange aggregator that sources liquidity from different decentralized exchanges (DEXs). It allows users to find the best trading route across different DEXs to achieve optimal trade execution and reduce slippage. It also offers other features such as limit orders, gas optimization, and yield farming opportunities.

How does 1inch.exchange benefit users in the DeFi landscape?

1inch.exchange benefits users in the DeFi landscape by providing them with better access to liquidity and improved trade execution. By aggregating liquidity from multiple DEXs, users are able to find the best prices and minimize slippage on their trades. Additionally, the platform offers advanced features such as limit orders and gas optimization, which further enhance the trading experience for users.

Can you explain how 1inch.exchange uses algorithms to optimize trades?

1inch.exchange uses various algorithms to optimize trades for its users. The platform considers factors such as liquidity, fees, and slippage across different DEXs to find the most efficient trading route. The algorithms analyze multiple options and split orders across different exchanges to achieve the best possible execution. This ensures that users get the best prices and minimize any negative impact on their trades.