Optimize your DeFi trading strategies with 1inch on Arbitrum: Expert tips to boost your trading experience.

DeFi trading has gained significant popularity in recent years, allowing users to participate in decentralized finance and earn lucrative returns. One of the leading platforms in the DeFi space is 1inch, which offers users the ability to execute trades across multiple decentralized exchanges (DEXs) with minimal slippage and maximum efficiency. With the recent launch of Arbitrum, a layer 2 scaling solution for Ethereum, there are even more opportunities to optimize your DeFi trading strategies.

Optimizing your DeFi trading strategies on 1inch with Arbitrum can be achieved through a variety of tips and techniques. Firstly, it’s important to understand the benefits of using Arbitrum for your trades. As a layer 2 scaling solution, Arbitrum enables faster and cheaper transactions compared to the Ethereum mainnet. This means that you can execute trades on 1inch with lower gas fees and reduced network congestion, leading to improved overall trading performance.

Another tip for optimizing your DeFi trading strategies with 1inch on Arbitrum is to take advantage of the advanced features offered by the platform. 1inch provides users with a wide range of tools and options, such as smart contract routing and conditional orders, which can help you achieve the best possible trade execution. By utilizing these features effectively, you can minimize slippage, maximize liquidity, and enhance your trading outcomes.

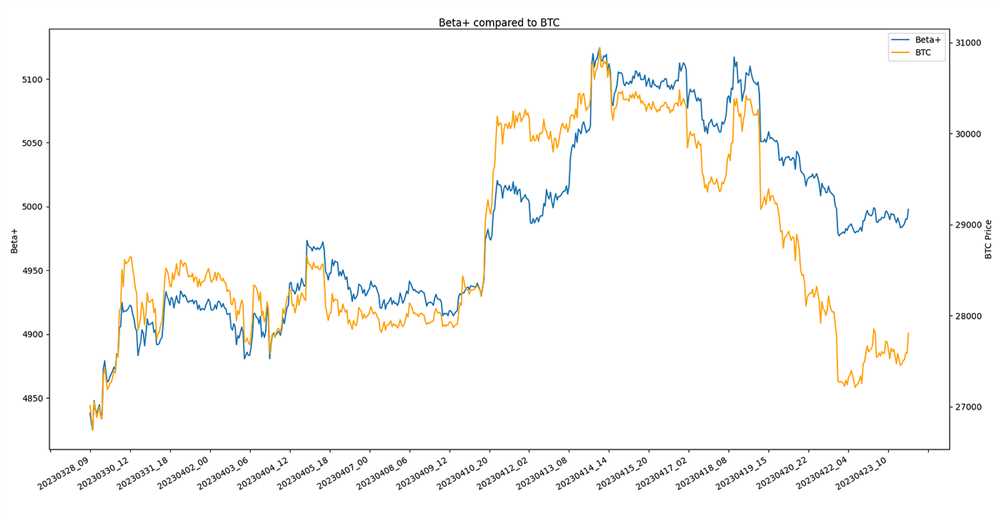

Furthermore, keeping an eye on the market and staying informed about the latest trends and developments is crucial for optimizing your DeFi trading strategies. The cryptocurrency market is highly volatile and constantly evolving, so it’s important to stay up-to-date with the latest news and analyze market data to make informed trading decisions. Additionally, following influential traders and joining relevant communities can provide valuable insights and strategies that can enhance your trading performance on 1inch.

In conclusion, optimizing your DeFi trading strategies with 1inch on Arbitrum requires a combination of technical knowledge, market awareness, and utilizing the advanced features provided by the platform. By following these top tips, you can maximize your trading efficiency, minimize costs, and increase your overall profits in the exciting world of decentralized finance.

Top Tips for Optimizing DeFi Trading Strategies with 1inch on Arbitrum

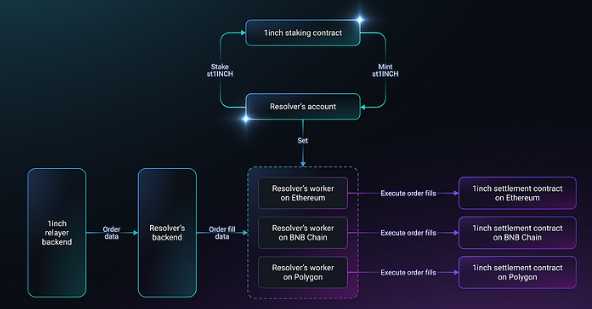

Decentralized Finance (DeFi) trading has gained immense popularity in recent years, and with the introduction of 1inch on Arbitrum, traders have a powerful tool at their disposal. 1inch is a decentralized exchange (DEX) aggregator that sources liquidity from various DEXes to provide users with the most optimal trading routes and exchange rates.

1. Understand Arbitrum and its Benefits

Before diving into DeFi trading strategies on Arbitrum with 1inch, it’s important to understand what Arbitrum is and its benefits. Arbitrum is a Layer 2 scaling solution built on Ethereum that aims to improve scalability and reduce fees. By leveraging Arbitrum, traders can enjoy faster transaction confirmations and lower gas fees, resulting in a more efficient trading experience.

2. Leverage the Power of 1inch

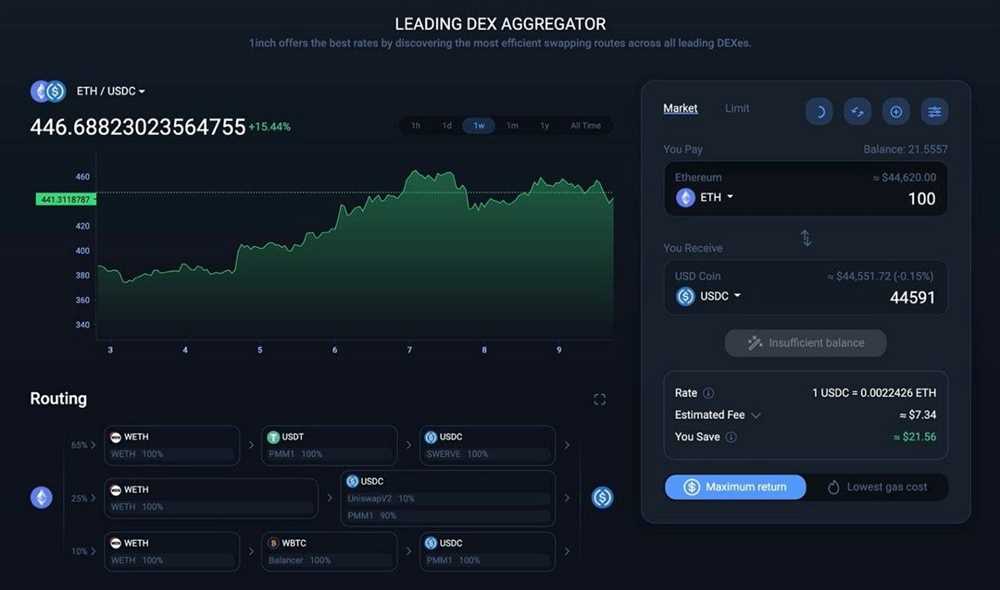

1inch is a powerful DEX aggregator that combines liquidity from multiple DEXes to provide users with the best possible trading routes. When trading on Arbitrum, make sure to use the 1inch platform to maximize your trading gains. Through its algorithm, 1inch can split your trade across different exchanges to secure the best possible price, resulting in improved trading outcomes.

3. Utilize Advanced Trading Features

1inch offers a range of advanced trading features that can help optimize your trading strategies. One such feature is the “Slippage Protection” option, which sets a maximum allowable slippage for your trade. By setting an appropriate slippage percentage, you can prevent excessive price impact and ensure you get the desired execution price.

Additionally, 1inch offers “Dex Aggregation” and “Partial Fill” options, enabling you to further customize your trading strategy. Dex Aggregation allows you to choose specific DEXes to route your trade through, while Partial Fill enables you to execute a trade with only a portion of the available liquidity, which can be useful for large volume trades or when testing new strategies.

4. Stay Informed with Analytics

1inch provides users with access to detailed analytics that can help inform your trading decisions. By analyzing historical exchange rates, liquidity depth, and trading volumes, you can gain valuable insights into market trends and optimize your trading strategies accordingly. Regularly monitoring these analytics can help you stay ahead of the curve and make informed trading decisions.

5. Consider Risk Management

As with any trading activity, it’s important to consider risk management when trading on Arbitrum with 1inch. Diversify your portfolio, set stop-loss orders, and only invest what you can afford to lose. Additionally, stay updated with the latest security practices and be cautious of potential scams or rug pulls in the DeFi space.

| Summary |

|---|

| Optimizing DeFi trading strategies with 1inch on Arbitrum involves understanding the benefits of Arbitrum, leveraging the power of 1inch as a DEX aggregator, utilizing advanced trading features, staying informed with analytics, and practicing risk management. By following these top tips, traders can enhance their trading experiences and maximize their gains in the DeFi space. |

Understanding the Basics of DeFi Trading

Decentralized Finance (DeFi) has emerged as a revolutionary concept in the world of finance, offering individuals the opportunity to participate in financial activities without relying on traditional intermediaries such as banks or brokers. One of the key components of DeFi is the ability to trade digital assets in a decentralized manner.

DeFi trading enables users to buy, sell, and exchange cryptocurrencies and other digital assets directly with each other on various DeFi platforms. This form of trading eliminates the need for intermediaries, reducing costs and increasing accessibility for participants.

One popular DeFi trading platform is 1inch, which utilizes smart contract technology to aggregate liquidity from multiple decentralized exchanges (DEXs). This aggregation allows users to find the best trading opportunities with the most favorable rates and minimal slippage.

When trading on 1inch, it is essential to have a basic understanding of some key concepts. First, liquidity refers to the availability of assets on a particular DEX. Higher liquidity generally results in better trading conditions. Additionally, slippage refers to the difference between the expected price of a trade and the actual executed price, which can occur when trading large volumes or in illiquid markets.

Another crucial aspect to consider is gas fees, which are transaction fees paid to network validators to execute transactions on the Ethereum blockchain. Gas fees can vary depending on network congestion and the complexity of the transaction being executed. These fees can significantly impact the profitability of your trades, so it’s important to keep them in mind.

To optimize your DeFi trading strategies, it is essential to take advantage of the features offered by 1inch, such as the Pathfinder algorithm, which finds the most efficient trading routes by considering available liquidity and gas costs.

Furthermore, using 1inch on the Arbitrum network can help reduce transaction costs and speed up the execution of trades. Arbitrum is a Layer 2 scaling solution for Ethereum, which helps alleviate network congestion and reduce gas fees.

In conclusion, understanding the basics of DeFi trading is paramount for anyone looking to participate in this innovative financial ecosystem. By grasping concepts such as liquidity, slippage, and gas fees, as well as leveraging platforms like 1inch and the Arbitrum network, traders can optimize their strategies and enhance their overall trading experience.

Leveraging the Benefits of 1inch

1inch is a powerful DeFi aggregator that offers a range of benefits to users. Here are some key advantages of using 1inch for your DeFi trading strategies on Arbitrum:

- Efficiency: 1inch uses advanced algorithms to find the best trading routes across multiple liquidity sources, ensuring you get the most competitive rates and save on gas fees.

- Optimization: With 1inch, you can optimize your trading strategies by setting specific parameters, such as slippage tolerance and gas price limits. This allows for a more tailored and efficient trading experience.

- Accessibility: 1inch is accessible to both beginner and advanced traders, offering a user-friendly interface and a wide range of supported tokens and liquidity pools. Whether you’re new to DeFi or an experienced trader, 1inch makes it easy to navigate and execute trades.

- Security: 1inch utilizes various security measures to protect user funds, such as smart contract audits and integration with reputable wallets. Your assets are kept safe throughout the trading process.

- Integration: 1inch can be seamlessly integrated with various DeFi platforms, including Arbitrum. This allows you to take advantage of the benefits offered by both 1inch and Arbitrum, further enhancing your trading strategies.

By leveraging the benefits of 1inch on Arbitrum, you can optimize your DeFi trading strategies and maximize your profits in a secure and efficient manner. Start exploring the power of 1inch today!

Exploring Arbitrum for Enhanced Performance

Arbitrum is a layer 2 scaling solution for Ethereum, designed to reduce gas fees and improve transaction speed. By leveraging Arbitrum, DeFi traders can greatly enhance their trading strategies and optimize their overall performance. In this article, we will explore some key features of Arbitrum that can help traders achieve better results.

One of the main advantages of Arbitrum is its ability to significantly reduce transaction costs. As an Ethereum layer 2 solution, Arbitrum operates off-chain, allowing users to benefit from lower gas fees compared to trading directly on the Ethereum mainnet. This cost reduction can make a significant difference for traders, especially those engaged in high-frequency trading or executing large transactions.

In addition to cost savings, Arbitrum offers faster transaction speeds. By processing transactions off-chain, Arbitrum can achieve near-instant settlement times, eliminating the delays often associated with trading on the Ethereum mainnet. This increased speed opens up opportunities for traders to take advantage of market fluctuations and execute trades more efficiently.

Arbitrum also provides improved scalability for DeFi applications. With the Ethereum network facing congestion and high gas fees, many traders are looking for alternative solutions to ensure faster and more efficient trades. By leveraging Arbitrum, traders can avoid these scalability issues and enjoy a smoother trading experience.

Another benefit of Arbitrum is its compatibility with various DeFi protocols. Traders can easily connect their existing wallets and access a wide range of decentralized exchanges, liquidity pools, and lending platforms supported by Arbitrum. This interoperability enables traders to diversify their trading strategies and take advantage of the various opportunities available in the DeFi ecosystem.

Overall, exploring Arbitrum for enhanced performance in DeFi trading is a smart move for traders looking to optimize their strategies. With its cost savings, faster transaction speeds, improved scalability, and compatibility with popular DeFi protocols, Arbitrum presents an exciting opportunity for traders to achieve better results and navigate the evolving landscape of decentralized finance.

Implementing Effective Strategies for Success

When it comes to trading on DeFi platforms like 1inch on Arbitrum, having a solid strategy in place is crucial for achieving success. Here are some top tips for implementing effective trading strategies:

1. Set clear goals: Before you start trading, it’s important to define your goals. Are you looking to make short-term profits or do you have a long-term investment strategy in mind? Having clear goals will help you make better decisions and stay focused on your objectives.

2. Research the market: Take the time to research and understand the market trends and dynamics. Stay updated with the latest news and developments in the DeFi space. This will allow you to identify potential opportunities and avoid unnecessary risks.

3. Diversify your portfolio: It’s important to diversify your portfolio to spread your risk and maximize your returns. Consider investing in different assets and DeFi protocols to reduce the impact of any single investment.

4. Use risk management tools: DeFi trading involves certain risks, so it’s crucial to use risk management tools to protect your investments. Set stop-loss orders to limit potential losses and use tools like leverage and insurance to enhance your trading strategies.

5. Stay updated with gas fees: Gas fees can significantly impact your trading profitability. Keep an eye on the gas fees in the Arbitrum network and plan your trades accordingly. Consider using tools like gas price trackers to optimize your trading costs.

6. Take advantage of automation: Automated trading tools can help you execute trades more efficiently and take advantage of market opportunities in real-time. Consider using bots or automated trading platforms to streamline your trading process.

7. Learn from your mistakes: Trading is a learning process, and it’s important to learn from your mistakes. Analyze your trading decisions and outcomes, and make adjustments to your strategy accordingly. Continuously improving your strategy will lead to better trading performance in the long run.

By implementing these strategies and staying disciplined, you can increase your chances of success in DeFi trading on platforms like 1inch on Arbitrum. Remember to always do your own research and make informed decisions based on your risk appetite and investment goals.

Question-answer:

How do I start optimizing my DeFi trading strategies with 1inch on Arbitrum?

To start optimizing your DeFi trading strategies with 1inch on Arbitrum, you need to connect your wallet to the Arbitrum network. Then, visit the 1inch app on Arbitrum and select the trading pair you want to optimize. From there, you can explore different trading strategies and adjust various parameters to optimize your trades.

What are some factors to consider when optimizing DeFi trading strategies on Arbitrum?

When optimizing DeFi trading strategies on Arbitrum, you should consider factors like slippage tolerance, gas costs, and potential price impact. It’s also important to analyze the liquidity available on the platform and consider the time of your trade to ensure optimal execution.

Can I use 1inch on Arbitrum to trade any ERC-20 tokens?

Yes, you can use 1inch on Arbitrum to trade a wide variety of ERC-20 tokens. The platform supports a large number of tokens, including popular ones like Ethereum, DAI, USDC, and many others. You can easily find and trade your desired token pairs on the 1inch app on Arbitrum.

How can I minimize slippage when trading on 1inch with Arbitrum?

To minimize slippage when trading on 1inch with Arbitrum, you can adjust the slippage tolerance parameter. Setting a lower slippage tolerance will lead to fewer trades being executed, but it will also reduce your risk of slippage. Additionally, you can choose to trade with more liquid tokens or at a time when the market is less volatile.

What are some advantages of using 1inch on Arbitrum for DeFi trading?

There are several advantages to using 1inch on Arbitrum for DeFi trading. Firstly, Arbitrum offers significantly lower gas fees compared to the Ethereum mainnet, allowing for cost-effective trading. Additionally, 1inch provides access to liquidity across multiple decentralized exchanges, ensuring the best possible rates for your trades. The platform also offers advanced features like limit orders and gas token payments, further enhancing your trading experience.