Welcome to the exciting world of decentralized finance, or DeFi! If you’re new to the space, you may be overwhelmed by the vast array of platforms and protocols available. One popular DeFi platform that has gained significant attention is 1inch. In this beginner’s guide, we will walk you through the basics of using 1inch and help you navigate the DeFi landscape.

1inch is a decentralized exchange aggregator that allows users to find the best possible prices for their cryptocurrency trades across multiple decentralized exchanges. In simple terms, it acts as a search engine for decentralized exchanges, helping users to save money and optimize their trading strategies.

Using 1inch is incredibly simple. All you need to do is connect your cryptocurrency wallet to the platform and choose the tokens you want to trade. 1inch will then search various decentralized exchanges, such as Uniswap, SushiSwap, and others, to find the best rates for your trade. This means you can get better prices and save on transaction fees compared to using just one exchange. It’s like having a financial advisor that always finds you the best deal!

But 1inch is not just for beginners. Advanced users can take advantage of features like “slippage tolerance” and “gas optimization” to fine-tune their trades. Slippage tolerance allows users to set a maximum amount of price impact they are willing to accept for their trades, while gas optimization helps to reduce transaction costs. These features give users full control over their trades and help them maximize their profits in the volatile DeFi market.

So, whether you’re a beginner or an experienced trader, 1inch is a powerful tool that can enhance your DeFi experience. It’s user-friendly, cost-effective, and offers advanced features for those who want to take their trading to the next level. Join the millions of users who have already discovered the benefits of using 1inch and start exploring the exciting world of decentralized finance today!

Understanding Decentralized Finance (DeFi)

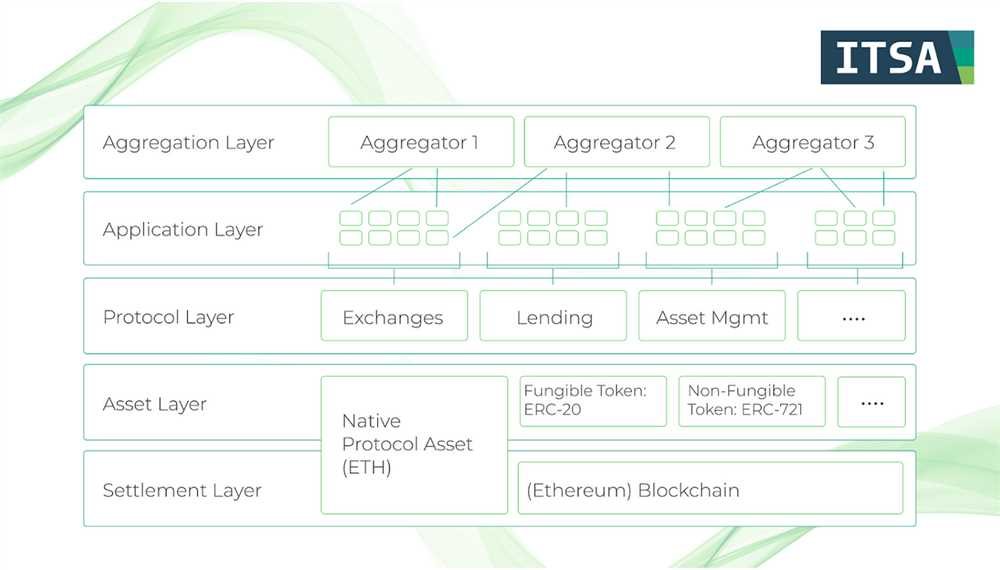

Decentralized Finance, also known as DeFi, is a term used to describe the use of blockchain technology and cryptographic assets to recreate traditional financial services in a decentralized manner. DeFi aims to replace centralized intermediaries, such as banks and other financial institutions, with smart contracts running on a blockchain.

DeFi offers various financial solutions, such as lending, borrowing, trading, and yield farming, all powered by smart contracts. By eliminating the need for intermediaries, DeFi aims to provide a more transparent, inclusive, and accessible financial system.

One of the core concepts of DeFi is the use of decentralized exchanges (DEXs) which allow users to trade assets directly with each other, without relying on a central authority. This enables users to have full control over their assets and removes the risk of counterparty failure.

Another important aspect of DeFi is the concept of liquidity pools, where users can contribute their assets to a pool and earn a share of the trading fees generated by the pool. This creates a decentralized network of liquidity providers and enables continuous liquidity for various trading pairs.

DeFi applications are typically built on public blockchains, such as Ethereum, and leverage the programmability of smart contracts to automate the execution of financial transactions. This automation reduces the need for manual intervention and enables faster, more efficient, and more secure transactions.

However, it is important to note that DeFi is a relatively new and rapidly evolving field. While it offers promising opportunities, it also comes with certain risks, such as smart contract vulnerabilities, regulatory concerns, and potential market manipulation.

| Pros of DeFi | Cons of DeFi |

|---|---|

| – Greater financial inclusion – More transparency – Lower fees – Non-custodial control of assets |

– Smart contract risks – Regulatory uncertainties – Limited scalability – Market volatility |

In conclusion, DeFi is revolutionizing the traditional financial system by providing decentralized alternatives to traditional financial services. While it has the potential to offer numerous benefits, it is important for users to exercise caution and do thorough research before participating in DeFi protocols.

How to Use 1inch for DeFi Trading

1inch is a decentralized exchange (DEX) aggregator that aims to provide users with the best possible prices for trading decentralized finance (DeFi) assets. Here’s a step-by-step guide on how to use 1inch for DeFi trading:

Step 1: Connect your Wallet

The first step is to connect your Ethereum wallet to 1inch. You can choose from various wallet options, such as MetaMask, WalletConnect, or Ledger. Simply click on the “Connect Wallet” button and follow the prompts to connect your wallet.

Step 2: Choose the Tokens

Once your wallet is connected, you can select the tokens you want to trade. 1inch supports a wide range of tokens, including popular ones like Ethereum (ETH) and stablecoins like Tether (USDT).

Step 3: Select the Trading Pair

After choosing the tokens, you need to select the trading pair. For example, if you want to trade ETH for USDT, you would select the ETH/USDT trading pair. 1inch will automatically display the best available prices from various decentralized exchanges.

Step 4: Review the Trading Options

Once you’ve selected the trading pair, 1inch will provide you with a list of trading options. These options may include different decentralized exchanges and liquidity pools. You can compare the prices and liquidity of each option to choose the most suitable one for your trade.

Step 5: Choose the Slippage and Gas Fees

Before confirming the trade, you can adjust the slippage tolerance and gas fees. Slippage tolerance determines the maximum price difference allowed between the time you initiate the trade and when it is executed. Gas fees are the transaction fees paid to the Ethereum network. You can choose faster or cheaper options depending on your preferences.

Step 6: Confirm and Execute the Trade

Once you’ve reviewed and adjusted the trading options, you can click on the “Swap” button to confirm and execute the trade. Your wallet will prompt you to approve the transaction and sign it with your private key. Confirm the transaction and wait for it to be processed on the Ethereum network.

Step 7: Check the Transaction Status

After the trade is executed, you can check the status of your transaction on the Ethereum blockchain. You can find the transaction hash in your wallet or use blockchain explorers like Etherscan to track the transaction’s progress.

Using 1inch for DeFi trading offers users access to a wide range of decentralized exchanges and liquidity pools, ensuring the best possible prices for their trades. By following these steps, you can navigate the 1inch platform and enjoy seamless DeFi trading.

| Pros | Cons |

|---|---|

| Access to best prices from multiple decentralized exchanges | May have higher gas fees compared to directly trading on a single exchange |

| Wide range of supported tokens | Additional steps compared to trading on a single exchange |

| Easy-to-use interface | Dependency on Ethereum network congestion |

| Ability to adjust slippage tolerance and gas fees |

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges and provides users with the best possible trading rates. It connects to various decentralized exchanges such as Uniswap, Kyber Network, and more to find the most optimal prices for trades.

How does 1inch help with trading on decentralized exchanges?

1inch tackles the issue of fragmented liquidity on decentralized exchanges by aggregating liquidity across multiple platforms. It helps users find the best prices by splitting the trades across multiple exchanges, reducing slippage and optimizing trading rates.

How can I start using 1inch?

To start using 1inch, you first need to have a compatible cryptocurrency wallet like MetaMask. Then, you simply need to visit the 1inch website, connect your wallet, and you can begin trading on various decentralized exchanges through the 1inch interface.

Is 1inch safe to use?

1inch takes security seriously and has implemented measures to ensure the safety of users’ funds. It does not have custody over users’ assets and only connects to external wallets like MetaMask. Additionally, the 1inch aggregator smart contract has been thoroughly audited by industry-leading security firms.