Are you looking to maximize your profits in the world of decentralized finance (DeFi)? Look no further – we have the ultimate guide for you! Introducing 1inch, the leading decentralized exchange aggregator, and the Arbitrum network, a cutting-edge Layer 2 scaling solution.

1inch allows you to find the best prices for your crypto assets across various decentralized exchanges. With its complex algorithm and smart routing, it ensures that you get the most out of your trades. And now, with the integration of 1inch on the Arbitrum network, you can access lightning-fast and low-cost transactions.

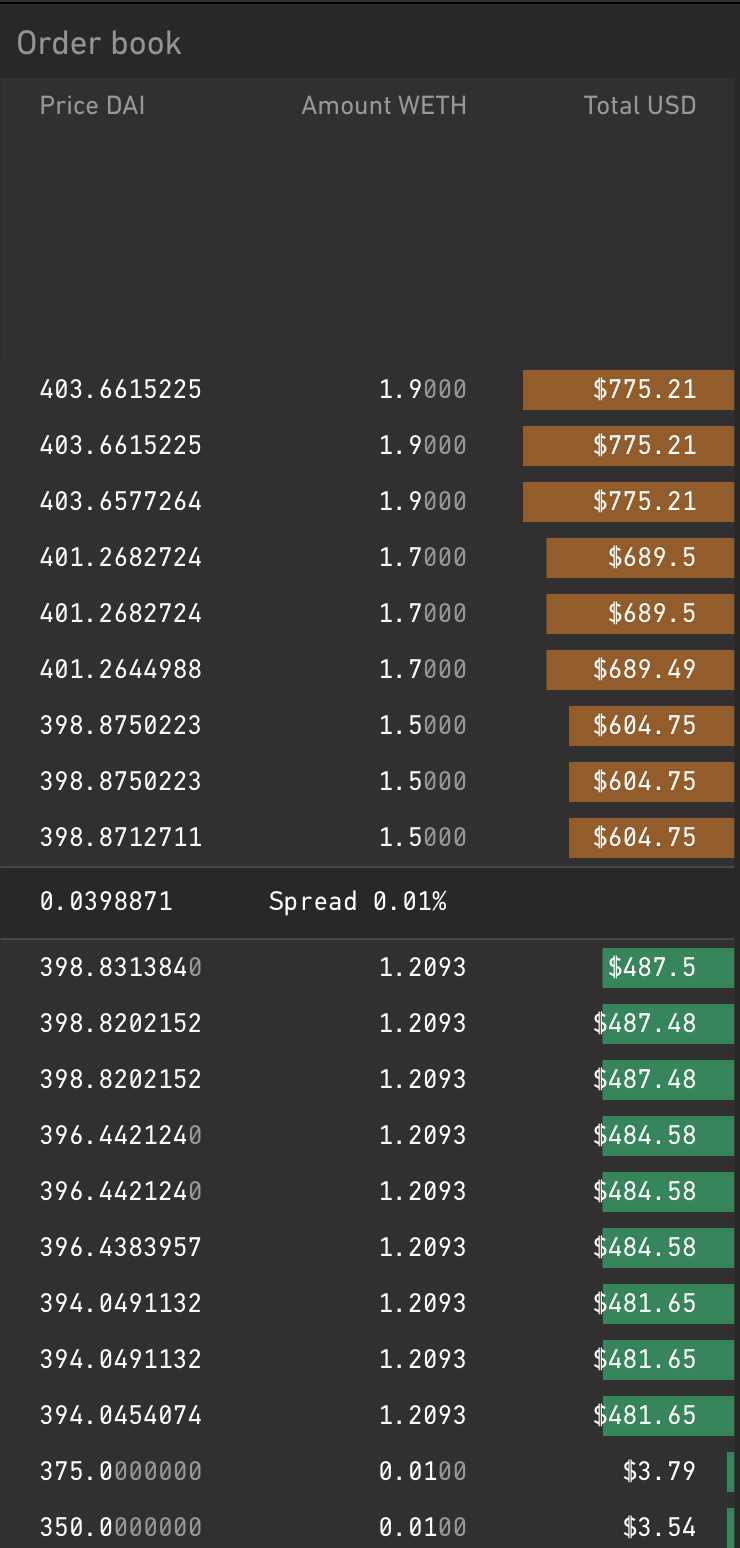

But how does DeFi arbitrage work exactly? It’s simple – when there are discrepancies in the prices of a specific token across different exchanges, you can take advantage of these price differences by buying low and selling high. This is where 1inch and Arbitrum come into play.

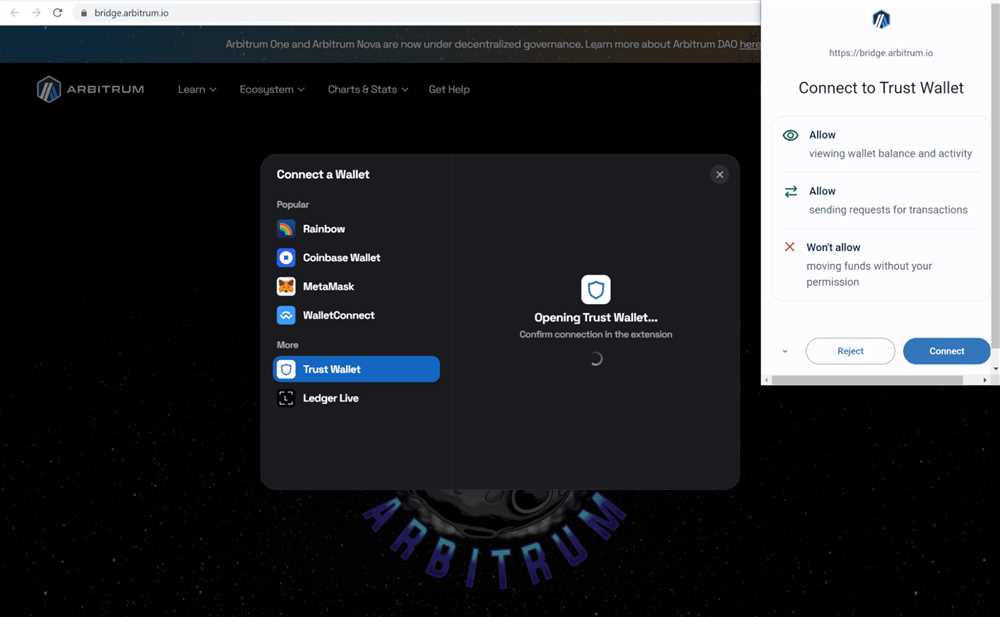

Step 1: Connect your wallet to the Arbitrum network and ensure that you have some funds in your account.

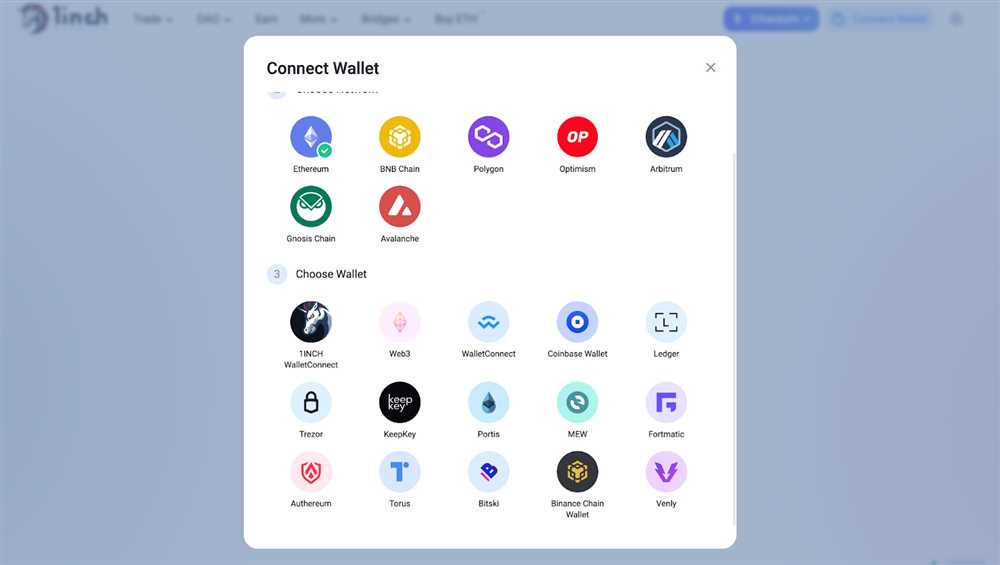

Step 2: Open the 1inch platform and select the token you want to trade.

Step 3: Let 1inch do the magic! It will analyze all the liquidity pools across different exchanges on the Arbitrum network and find you the best possible trade.

Step 4: Review the trade details and confirm the transaction. Congratulations, you have successfully performed DeFi arbitrage!

With 1inch and Arbitrum, you can minimize your slippage and maximize your profits in an efficient and secure manner. Don’t miss out on this lucrative opportunity – join the world of DeFi arbitrage using 1inch on the Arbitrum network today!

What is DeFi arbitrage?

DeFi arbitrage, short for decentralized finance arbitrage, refers to the practice of exploiting price differences between different decentralized finance protocols to generate profits. DeFi protocols are blockchain-based platforms that provide various financial services such as lending, borrowing, and trading, without the need for intermediaries like banks.

Arbitrage, on the other hand, is the act of taking advantage of price discrepancies in different markets to make a profit. In traditional finance, arbitrageurs buy an asset in one market and simultaneously sell it in another market where the price is higher, thereby pocketing the price difference.

In the context of DeFi, arbitrageurs employ similar strategies by leveraging the decentralized nature of the ecosystem. They identify opportunities where the price of an asset or token is mispriced across different protocols and execute trades to capitalize on the price difference.

DeFi arbitrage can be a lucrative strategy for traders who are well-versed in the intricacies of decentralized finance and have the necessary technical expertise to navigate different protocols and execute trades quickly. However, it also comes with risks, including impermanent loss and smart contract vulnerabilities.

By using 1inch on the Arbitrum network, traders can access a comprehensive guide and toolkit for executing DeFi arbitrage strategies. 1inch is a decentralized exchange aggregator that sources liquidity from various platforms, allowing traders to find the best prices for their trades. The Arbitrum network is a layer 2 scaling solution for Ethereum, offering lower transaction fees and faster execution times.

Overall, DeFi arbitrage presents an opportunity for traders to capitalize on inefficiencies in the decentralized finance ecosystem. However, it requires a deep understanding of the underlying protocols, market dynamics, and risk management strategies to be successful.

How does 1inch work?

1inch is a popular decentralized exchange (DEX) aggregator that allows users to trade on multiple liquidity protocols with just one transaction. The platform sources the best prices and lowest slippage across various DEXs, providing users with the most optimal trading experience.

At its core, 1inch uses a combination of smart contract technology and an algorithmic routing protocol to find the most efficient trading routes. When a user wants to make a trade, 1inch scans multiple DEXs to determine the best possible rate. It then splits the trade across these DEXs to minimize slippage and maximize the user’s returns.

The algorithm behind 1inch takes several factors into consideration when determining the best trading route. These factors include liquidity, available reserves, and gas fees. By analyzing these variables, 1inch ensures that users get the best possible price and avoid excessive gas fees.

1inch also offers various features to enhance the trading experience. One such feature is called Pathfinder, which is an intelligent algorithm that explores multiple routes to find the most cost-effective path for a trade. Another feature is called Chi GasToken, which allows users to save on gas fees by optimizing gas usage.

Overall, 1inch simplifies the process of trading on decentralized exchanges by providing users with the most optimal routes and prices. With its advanced algorithm and user-friendly interface, 1inch has become a go-to platform for DeFi traders looking for efficient and cost-effective trading solutions on the Arbitrum network.

Understanding the 1inch protocol

The 1inch protocol is a decentralized exchange aggregator that connects multiple liquidity sources to provide the best possible trading rates for users. It operates by splitting a trade across multiple decentralized exchanges, enabling users to find the most optimal route for their trades. This ensures that users get the highest possible returns on their investments.

How does the 1inch protocol work?

When a user initiates a trade on the 1inch platform, the protocol searches for the best liquidity among various decentralized exchanges. It uses an algorithm to determine the most efficient route and splits the trade into smaller parts to get the best possible prices. This process is known as ‘gas optimization’ and helps users save on transaction fees.

The 1inch protocol aggregates liquidity from various decentralized exchanges such as Uniswap, SushiSwap, and Kyber Network. By connecting to multiple sources, the protocol ensures that users have access to a larger pool of liquidity, providing them with better trading opportunities.

Benefits of using the 1inch protocol

- Improved trade execution: By splitting trades and utilizing various liquidity sources, the 1inch protocol ensures users get the best execution prices.

- Lower transaction fees: The gas optimization feature of the protocol helps users save on transaction fees, making trading more cost-effective.

- Access to better liquidity: By aggregating liquidity from multiple decentralized exchanges, the 1inch protocol provides users with access to a larger pool of liquidity, improving trading opportunities.

- Transparent and secure: The 1inch protocol is built on the Ethereum blockchain, providing users with a secure and transparent trading environment.

Overall, the 1inch protocol offers users a reliable and efficient way to trade on decentralized exchanges. Its ability to find the best trading rates and optimize gas costs makes it a popular choice among decentralized finance (DeFi) enthusiasts.

Arbitrum network and its benefits

The Arbitrum network is a layer 2 scaling solution for Ethereum, designed to address the scalability and high transaction fees issues on the Ethereum blockchain. It aims to provide a more efficient and cost-effective platform for various decentralized applications (dApps), including decentralized finance (DeFi) protocols.

One of the key benefits of the Arbitrum network is its ability to significantly increase the transaction throughput, allowing for faster and more seamless execution of transactions. This is achieved by utilizing the concept of Ethereum Virtual Machine (EVM) rollups, which batch multiple transactions together and settle them on the Ethereum mainnet. As a result, users can experience reduced confirmation times and lower fees compared to directly interacting with the Ethereum network.

| Benefits of the Arbitrum network: |

| 1. Scalability: The use of rollups enables the Arbitrum network to handle a significantly higher number of transactions per second, effectively alleviating congestion on the Ethereum blockchain. |

| 2. Lower transaction fees: By operating on layer 2, the Arbitrum network can offer users reduced transaction fees compared to conducting transactions directly on the Ethereum mainnet. |

| 3. Improved user experience: The faster transaction confirmation times and lower fees provide a more seamless and efficient user experience, making it easier to participate in various DeFi activities. |

| 4. Compatibility with existing Ethereum ecosystem: The Arbitrum network is designed to be fully compatible with existing Ethereum smart contracts and protocols, making it easy for developers to migrate their dApps to the Arbitrum network. |

In summary, the Arbitrum network offers a scalable and cost-effective solution for decentralized applications, including DeFi protocols. It allows for faster transaction processing, lower fees, and an improved user experience, all while maintaining compatibility with the existing Ethereum ecosystem.

Exploring the Arbitrum network

The Arbitrum network is a layer 2 scaling solution for Ethereum that aims to enhance the performance and scalability of decentralized applications (dApps). By utilizing Arbitrum, users can enjoy faster transaction speeds and lower fees compared to the Ethereum mainnet.

Benefits of the Arbitrum network:

- Improved scalability: Arbitrum employs a technology known as Optimistic Rollups to aggregate multiple transactions into a single batch, significantly increasing the throughput of the Ethereum network.

- Lower transaction fees: With Arbitrum, users can execute transactions at a fraction of the cost incurred on the Ethereum mainnet, making it more affordable to use decentralized finance (DeFi) protocols and participate in arbitrage opportunities.

- Seamless interoperability: The Arbitrum network is designed to be compatible with existing Ethereum smart contracts, allowing developers to deploy their dApps on Arbitrum with minimal modifications. This ensures a seamless transition for users and enhances the overall user experience.

How Arbitrum works:

Arbitrum utilizes a mechanism called optimistic rollups to achieve scalability. In this mechanism, most transactions are processed off-chain and are only submitted to the Ethereum mainnet when there is a dispute or disagreement between participants.

When a transaction is submitted to Arbitrum, it is validated by a network of validators who ensure its correctness and consistency. Once validated, the transaction is encapsulated into a rollup block, which is then published to the Ethereum mainnet. This allows for faster transaction speeds and reduces the burden on the Ethereum network.

Use cases for the Arbitrum network:

The Arbitrum network opens up numerous possibilities for developers and users alike. Some potential use cases include:

- DeFi marketplaces: With its scalability and low fees, Arbitrum can facilitate the creation of decentralized finance platforms that offer enhanced trading experiences and efficient liquidity provisioning.

- Token transfers: Sending and receiving tokens can be done more efficiently and cost-effectively on Arbitrum, making it an ideal solution for token transfers and remittances.

- Arbitrage opportunities: Traders can take advantage of the improved transaction speeds and lower fees on Arbitrum to execute profitable arbitrage strategies across different decentralized exchanges and liquidity pools.

In conclusion, the Arbitrum network presents an exciting opportunity for users to experience a more scalable and affordable decentralized ecosystem. Its compatibility with existing Ethereum smart contracts and seamless interoperability make it a promising solution for developers and businesses looking to enhance their decentralized applications.

A guide to DeFi arbitrage using 1inch on Arbitrum

Welcome to our comprehensive guide on how to engage in profitable DeFi arbitrage using the renowned decentralized exchange aggregator, 1inch, on the Arbitrum network. With the explosive growth of decentralized finance (DeFi) and the increasing number of opportunities for traders, knowing how to navigate the market can be the key to maximizing your profits.

DeFi arbitrage refers to the practice of exploiting price differences for the same asset on different platforms. By taking advantage of these price inefficiencies, traders can earn a profit by buying low on one platform and selling high on another. With 1inch, you can take advantage of these opportunities using the fast and secure Arbitrum network.

1inch is a popular DEX aggregator that scans multiple decentralized exchanges to find the best possible prices for a given trade. By leveraging the power of their smart contract technology, you can access the pools of liquidity from various exchanges, increasing the chance of finding profitable arbitrage opportunities.

Arbitrum is a layer 2 scaling solution for Ethereum, designed to alleviate network congestion and reduce gas fees. By utilizing Arbitrum, you can enjoy faster transaction times and lower fees, making it an ideal choice for conducting arbitrage trades. 1inch on Arbitrum provides you with an efficient and cost-effective platform to execute your trades.

To get started with DeFi arbitrage using 1inch on Arbitrum, you’ll need to follow these steps:

- Connect your wallet to the 1inch platform on the Arbitrum network.

- Explore the available trading pairs and identify potential arbitrage opportunities.

- Analyze and compare the prices on different exchanges to determine the most profitable trades.

- Execute your arbitrage trades by routing the transactions through 1inch to take advantage of the best possible prices.

- Monitor your trades and ensure that you have successfully executed the buy and sell orders.

Remember, successful DeFi arbitrage requires careful analysis, quick execution, and a good understanding of the market dynamics. Be sure to stay updated with the latest trends and developments in the DeFi space to identify potential opportunities before they disappear.

By following this guide and using 1inch on Arbitrum, you can start exploring the exciting world of DeFi arbitrage and potentially generate significant profits. Happy trading!

Question-answer:

What is DeFi arbitrage?

DeFi arbitrage is a trading strategy used in decentralized finance (DeFi) that takes advantage of the price differences between different platforms or exchanges. It involves buying an asset at a lower price on one platform and selling it at a higher price on another platform, thereby profiting from the price discrepancy.

What is 1inch?

1inch is a decentralized exchange (DEX) aggregator that sources liquidity from various decentralized exchanges to provide users with the best possible trading rates. It is designed to minimize slippage and maximize profit for its users.

How does the Arbitrum network work?

The Arbitrum network is a Layer 2 scaling solution for Ethereum that aims to increase scalability and reduce transaction fees. It works by creating a sidechain that runs parallel to the Ethereum mainnet, allowing for faster and cheaper transactions. Users can interact with the Arbitrum network using compatible wallets and dApps.