How the 1inch aggregator ensures optimal pricing by considering slippage and gas fees

When it comes to trading cryptocurrencies, getting the best price is crucial. That’s where 1inch, the decentralized exchange aggregator, comes into play. 1inch is designed to find the most optimal trading route for your transactions, ensuring that you get the best possible price for your trades. But how does 1inch achieve this?

One of the key factors that 1inch takes into account is slippage. Slippage refers to the difference between the expected price of a trade and the actual price at which the trade is executed. High slippage can significantly impact your trading profits. To address this issue, 1inch uses algorithms to split your trades across multiple liquidity sources, minimizing slippage and maximizing your potential gains.

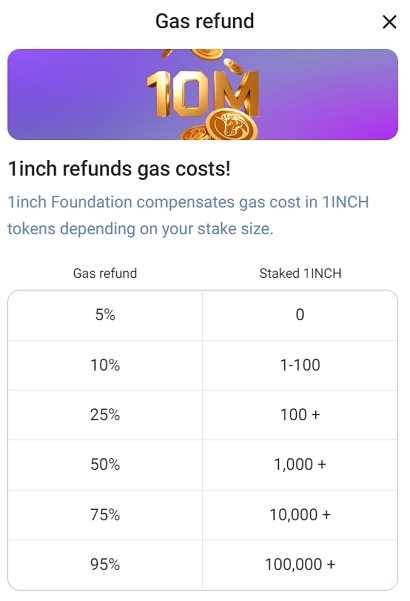

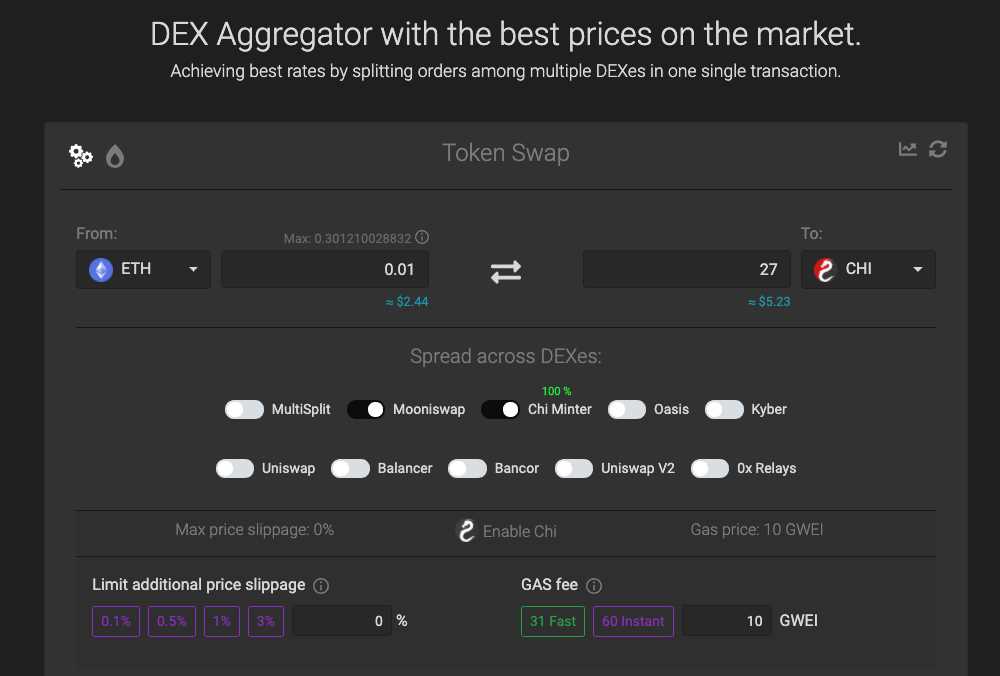

In addition to slippage, 1inch also considers gas fees when determining the optimal trading route. Gas fees are the fees paid to miners for processing and validating transactions on the Ethereum network. These fees can vary greatly depending on network congestion and other factors. 1inch takes into account the current gas fees and transaction costs to ensure that you are getting the best price while keeping your transaction costs as low as possible.

1inch’s ability to consider both slippage and gas fees sets it apart from other decentralized exchanges. By optimizing these factors, 1inch provides users with the best possible trading experience, maximizing their potential profits and minimizing transaction costs. Whether you are a seasoned trader or just starting out, 1inch offers a powerful solution for achieving optimal pricing in the world of decentralized finance.

What is 1inch?

1inch is a decentralized exchange aggregator that combines various decentralized exchanges (DEXs) to offer users the best possible rates and lowest fees when trading cryptocurrencies. It was founded in 2020 by Sergej Kunz and Anton Bukov and has quickly gained popularity among traders and DeFi enthusiasts.

Unlike traditional centralized exchanges, 1inch operates on the Ethereum blockchain, utilizing smart contracts to automate the trading process. By integrating multiple DEXs, 1inch allows users to take advantage of the liquidity pools and trading pairs available on each platform, ensuring that they always get the most optimal pricing.

One of the key features of 1inch is its ability to consider factors like slippage and gas fees when executing trades. Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. By taking slippage into account, 1inch ensures that users are not affected by sudden price movements that can negatively impact their trades.

Gas fees, on the other hand, are the fees required to execute transactions on the Ethereum network. These fees can vary depending on network congestion and the complexity of the transaction. 1inch analyzes the gas fees on different DEXs and routes trades through the platform with the lowest fees, saving users money on transaction costs.

Overall, 1inch provides users with a seamless trading experience by offering competitive rates, lower fees, and efficient execution. Its innovative technology and commitment to optimizing pricing make it a popular choice among cryptocurrency traders looking to maximize their profits.

Understanding the decentralized exchange aggregator

Decentralized exchange aggregators, like 1inch, play a crucial role in the world of decentralized finance (DeFi). These platforms have gained popularity due to their ability to provide users with the best prices and optimal liquidity across multiple decentralized exchanges.

At its core, a decentralized exchange aggregator works by splitting trades across various liquidity sources to ensure that users get the most favorable rates. This involves sourcing liquidity from different decentralized exchanges, such as Uniswap, Sushiswap, and Balancer, to find the best possible rates for a specific trade.

How does it work?

When a user wants to make a trade using a decentralized exchange aggregator, the platform automatically splits the trade into multiple smaller trades across different exchanges. By doing so, it ensures that trades are executed at the most favorable prices, taking into account slippage and gas fees.

The decentralized exchange aggregator factors in potential price impact and examines the liquidity available on different exchanges to determine the optimal route for executing trades. This process allows users to achieve better rates compared to manually executing trades on a single exchange.

Benefits of using a decentralized exchange aggregator

There are several benefits to using a decentralized exchange aggregator like 1inch:

- Best prices: By splitting trades across multiple exchanges, users can access the best prices and liquidity available in the DeFi market.

- Optimal execution: The aggregator automatically finds the most efficient route for executing trades, considering factors such as slippage and gas fees.

- Time-saving: Users can save time and effort by executing trades across different exchanges in a single transaction, without the need for manual interaction.

- Reduced risk: By diversifying trades across multiple exchanges, users can mitigate the risk of encountering low liquidity or price manipulation on a single exchange.

In conclusion, decentralized exchange aggregators like 1inch provide users with a convenient and efficient way to access the best prices and liquidity in the DeFi market. By leveraging technology and smart contract protocols, these platforms ensure optimal pricing while minimizing risks and saving users’ time.

Importance of Optimal Pricing

When it comes to decentralized finance (DeFi) platforms like 1inch, optimal pricing is crucial for both users and liquidity providers. Optimal pricing ensures that users get the best possible exchange rate for their trades, allowing them to maximize their returns and minimize slippage.

Slippage refers to the difference between the expected price of a trade and the executed price. In highly volatile markets, slippage can be significant, resulting in users losing money on their trades. By considering slippage, 1inch ensures that users get the most favorable prices and helps them avoid unnecessary losses.

Gas fees are another important factor to consider when it comes to optimal pricing. Gas fees are the fees paid to miners to process transactions on the Ethereum network. Higher gas fees can significantly impact the cost of trades, especially for smaller transactions.

1inch takes into account both slippage and gas fees to optimize the pricing for its users. By analyzing the order books of various decentralized exchanges and aggregating liquidity from multiple sources, 1inch can provide users with the best possible prices while also factoring in gas fees to ensure cost-effectiveness.

Overall, optimal pricing is vital for users as it allows them to achieve better returns on their trades and avoid unnecessary losses. By considering slippage and gas fees, 1inch helps users navigate the ever-changing landscape of the decentralized finance market and provides them with a seamless and efficient trading experience.

Critical factors influencing pricing in decentralized exchanges

When it comes to decentralized exchanges (DEXs), there are several critical factors that can influence the pricing of assets. These factors play a crucial role in determining the optimal price for traders and ensuring a fair and efficient trading environment. Here, we will discuss some of the most important factors that affect pricing in decentralized exchanges.

1. Liquidity: Liquidity refers to the ability to buy or sell an asset without causing substantial changes in its price. In decentralized exchanges, liquidity is essential for achieving optimal pricing. DEXs with higher liquidity tend to have tighter bid-ask spreads, reducing the impact of trading on the market price.

2. Market depth: Market depth represents the total volume of buy and sell orders at different price levels. Higher market depth leads to better pricing accuracy, as it indicates a greater number of participants willing to trade at various price points. DEXs with deeper markets can handle larger orders with lower slippage.

3. Slippage: Slippage refers to the difference between the expected price of an asset and the price at which the trade is executed. In decentralized exchanges, slippage can occur due to the imbalance between buy and sell orders. DEXs that consider slippage in their pricing algorithms can provide traders with more accurate prices and reduce the impact of large orders on the market.

4. Gas fees: Gas fees are transaction costs paid on the Ethereum network for executing smart contracts. In decentralized exchanges, gas fees can significantly impact pricing, especially for smaller trades. DEXs that factor in gas fees when determining prices can help traders optimize their trades and minimize costs.

5. Order book depth: The order book depth represents the number of open buy and sell orders at different price levels. DEXs with a deep order book can offer better pricing as they have a larger pool of potential trades to match orders with, leading to more competitive prices.

6. Asset availability: The availability of assets on a DEX can have a significant impact on their pricing. If an asset has limited liquidity or is difficult to acquire, it can result in higher prices. DEXs that provide a wide range of assets and ensure sufficient availability can offer traders better pricing options.

In conclusion, pricing in decentralized exchanges is influenced by several critical factors such as liquidity, market depth, slippage, gas fees, order book depth, and asset availability. These factors are crucial for ensuring fair and efficient trading and enabling traders to achieve optimal prices for their transactions.

How 1inch Considers Slippage

One of the key factors that 1inch takes into consideration when executing trades is slippage. Slippage refers to the difference between the expected price of a trade and the actual price at which the trade is executed.

By analyzing the liquidity of different trading pairs on various decentralized exchanges (DEXs), 1inch can estimate the potential slippage that may occur during a trade. This estimation helps users to make informed decisions by providing them with a preview of the expected execution price and the potential price impact.

1inch ensures that users are able to achieve optimal pricing by factoring in slippage and suggesting the best routes for executing a trade. This is done by taking into account the liquidity and the potential slippage of each trading pair.

How 1inch Calculates Slippage

To calculate the slippage, 1inch compares the current available liquidity on different DEXs for a specific trading pair with the desired trade size. This allows 1inch to determine the potential impact on the execution price based on the available liquidity.

1inch also takes into consideration the volatility of the market and the recent trading activity of the selected trading pair. By analyzing these factors, 1inch can estimate the potential slippage that may occur during a trade.

Slippage Tolerance

1inch allows users to set their desired slippage tolerance, which indicates the maximum acceptable difference between the expected execution price and the actual execution price. Users can customize this setting based on their risk appetite and trading preferences.

Based on the selected slippage tolerance, 1inch suggests the best routing options for executing the trade. By considering the available liquidity and the potential slippage of each trading pair, 1inch ensures that users can achieve optimal pricing while minimizing the potential price impact.

| Benefits of Considering Slippage |

|---|

| 1. Minimize price impact: By factoring in slippage, 1inch helps users to minimize the impact of their trades on the market price. |

| 2. Optimize trade execution: By suggesting the best routing options, 1inch ensures that users can execute their trades at the most optimal prices. |

| 3. Informed decision-making: By providing users with a preview of the expected execution price and the potential slippage, 1inch empowers them to make informed decisions. |

Minimizing price impact with advanced algorithms

1inch aims to provide users with the most optimal pricing by considering factors such as slippage and gas fees. The platform utilizes advanced algorithms to minimize the price impact when executing trades.

When a user places a trade on 1inch, the platform takes into account the liquidity available on various decentralized exchanges (DEXs) and evaluates the potential impact on the price. By considering the depth of liquidity and the trading volumes on each DEX, 1inch is able to provide the best possible pricing for the user.

The algorithms used by 1inch calculate the optimal route for the trade, taking into consideration not only the price impact but also the gas fees associated with the transaction. By considering both factors, 1inch ensures that users are able to trade with minimal cost and maximum efficiency.

Slippage

Slippage refers to the difference between the expected price of a trade and the executed price. It can occur when there is a lack of liquidity on a particular DEX, causing the price to move unfavorably for the user. 1inch takes into account the slippage rate for each DEX and adjusts the trade accordingly to minimize the price impact.

Gas fees

Gas fees are the costs associated with executing transactions on the Ethereum network. These fees can vary depending on the network congestion and the complexity of the transaction. 1inch considers the gas fees when calculating the optimal trade route, ensuring that users are able to minimize their transaction costs.

By leveraging advanced algorithms and considering factors such as slippage and gas fees, 1inch is able to provide users with the best possible pricing and minimize the price impact when executing trades.

Question-answer:

What is slippage and how does it affect pricing?

Slippage refers to the difference between the expected price of a trade and the actual executed price. In the context of 1inch, slippage refers to the price impact that occurs when executing a trade with significant order size. It can lead to unfavorable prices for traders. 1inch takes slippage into consideration to ensure optimal pricing for its users.

How does 1inch consider gas fees when ensuring optimal pricing?

Gas fees are the fees paid to miners to validate and process transactions on the Ethereum network. 1inch takes gas fees into consideration by calculating the gas cost for each trade and factoring it into the overall pricing analysis. This ensures that users get the best possible price after accounting for gas fees.

Can you explain how 1inch ensures optimal pricing?

1inch ensures optimal pricing by considering both slippage and gas fees. It analyzes the order book and liquidity of various decentralized exchanges to find the most favorable prices for users. It also takes into account the expected slippage for each trade and calculates the gas fees involved. By factoring in both slippage and gas fees, 1inch is able to provide users with the best possible pricing for their trades.