Are you tired of waiting in long lines at the bank? Do you want instant access to your funds without any hassle? Look no further than 1inch, the revolutionary platform that is changing the landscape of traditional banking services in America.

1inch is a decentralized exchange aggregator that allows users to find the best prices across multiple exchanges. With just a few clicks, you can swap your assets and take advantage of the most competitive rates on the market. No longer do you have to rely on traditional banking services that charge exorbitant fees and subject you to lengthy processing times.

By utilizing advanced smart contracts and cutting-edge technology, 1inch ensures that your transactions are fast, secure, and transparent. Say goodbye to hidden fees and hello to a new era of financial freedom.

But that’s not all. With 1inch, you can also earn passive income by providing liquidity to the platform. Simply deposit your assets into the liquidity pool and start earning rewards. It’s that easy.

Join the 1inch revolution and experience the future of banking services in America. Sign up today and discover the power of decentralized finance.

The Disruption of 1inch

1inch has revolutionized the way people exchange and access liquidity in the decentralized finance (DeFi) space. With its innovative decentralized exchange (DEX) aggregator, 1inch has disrupted the traditional banking services in America.

Traditionally, banking services have been centralized and heavily regulated by financial institutions. This centralized approach often limits access to financial services and puts the power in the hands of a few intermediaries. However, 1inch has introduced a decentralized and user-centric model that empowers individuals to take control of their finances.

By leveraging blockchain technology and smart contracts, 1inch eliminates the need for intermediaries and enables peer-to-peer transactions. This not only reduces the costs associated with traditional banking services but also eliminates the risk of censorship and interference from centralized authorities.

Furthermore, 1inch offers users the ability to access multiple liquidity sources from various decentralized exchanges. This allows for the aggregation of liquidity, resulting in better prices and improved execution for users. With 1inch, users can tap into a global network of liquidity providers and seamlessly swap between different tokens without the need for multiple transactions.

Additionally, 1inch’s intelligent routing algorithm ensures that users always get the best possible prices by splitting orders across multiple liquidity sources. This eliminates the need for users to manually search for the most favorable rates and ensures optimal execution for all transactions.

Moreover, 1inch provides users with access to advanced trading features such as limit orders and automated market-making. These features enhance the trading experience and provide users with more control over their investments.

| Benefits of 1inch’s Disruption | Traditional Banking Services |

|---|---|

| Decentralized and user-centric | Centralized and institution-centric |

| Lower costs and fees | High costs and fees |

| Global access to liquidity | Limited access to liquidity |

| Optimal execution and best prices | Limited execution and unfavorable rates |

| Advanced trading features | Basic trading features |

In conclusion, 1inch’s disruption of traditional banking services in America has brought forth a new era of decentralized finance. With its user-centric approach, lower costs, global liquidity access, advanced trading features, and optimal execution, 1inch is leading the way in reshaping the financial landscape.

Traditional Banking in America

In America, traditional banking has long been the dominant form of financial services. Banks have played a fundamental role in the country’s economic growth and development, providing individuals and businesses with a wide range of financial products and services.

The Role of Banks

Banks in America have traditionally served as intermediaries between depositors and borrowers. They accept deposits from individuals and businesses and use these funds to make loans. This system has allowed banks to effectively channel funds from those with surplus funds to those in need of capital.

In addition to providing loans, banks offer a variety of financial services. They facilitate payments, provide credit cards and debit cards, offer checking and savings accounts, and advise customers on investments and financial planning.

Advantages of Traditional Banking

Traditional banking offers several advantages in America. One of the key advantages is the sense of stability and security that comes with using a well-established institution. Banks are subject to government regulations and oversight, ensuring that customer funds are protected.

Another advantage is the convenience of having access to a wide network of branches and ATMs. This allows customers to easily deposit and withdraw funds, make payments, and access various financial services.

Traditional banks also offer a wide range of financial products and services tailored to the needs of individuals and businesses. They provide loans for various purposes, including mortgages, auto loans, and business loans. They also offer competitive interest rates on savings accounts and provide investment opportunities.

Challenges and Change in the Banking Industry

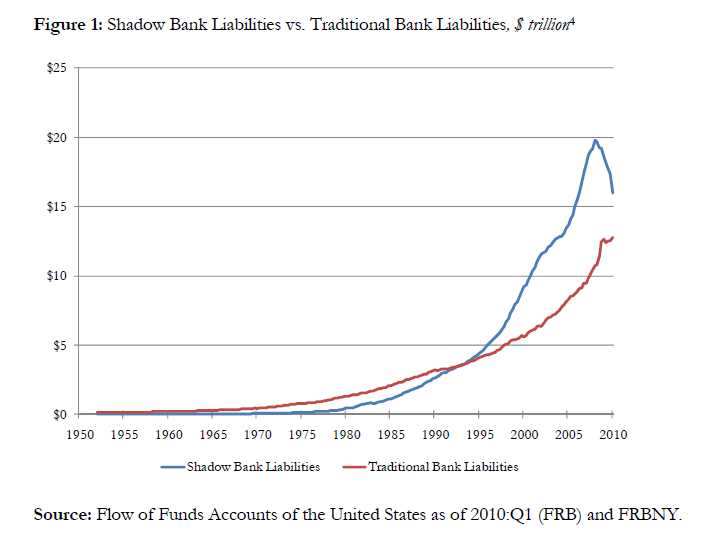

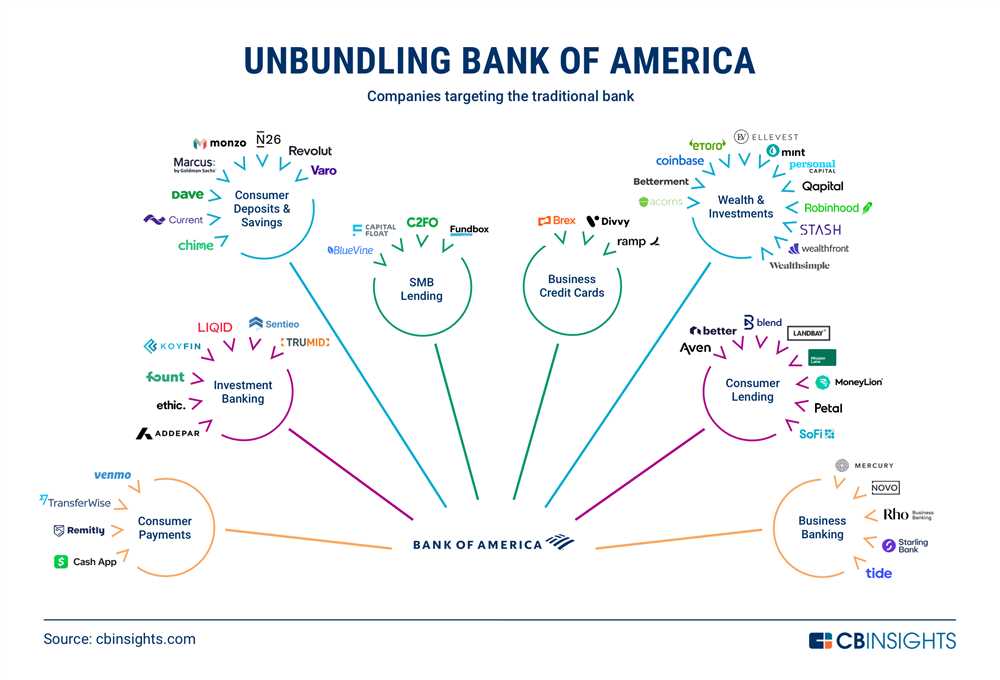

Despite their advantages, traditional banks in America are facing challenges due to technological advancements and changing consumer preferences. The rise of digital banking and fintech companies, such as 1inch, has disrupted the traditional banking landscape.

These new players offer innovative and convenient financial services, often with lower fees and faster processing times. They have leveraged technology to provide seamless online and mobile banking experiences, attracting younger generations who prefer a more digital approach to banking.

To adapt to these changes, traditional banks have started embracing digital transformation. They are investing in online and mobile banking platforms, enhancing their services and customer experiences, and exploring partnerships with fintech companies.

The Impact of 1inch on Traditional Banking Services

As 1inch continues to grow and disrupt the banking industry, traditional banks in America must evolve to stay competitive. They need to focus on leveraging technology to enhance their services, streamline processes, and provide a seamless customer experience.

The emergence of 1inch and other fintech companies is a wake-up call for traditional banks to embrace digital innovation and adapt to changing customer demands. By doing so, they can continue to play a vital role in the American financial system and provide value to their customers.

The Rise of 1inch

Since its launch, 1inch has quickly risen to prominence in the world of decentralized finance (DeFi). With its innovative approach to liquidity pools, automated market making, and decentralized exchanges, 1inch has disrupted the traditional banking services in America, offering users a more efficient and transparent financial ecosystem.

Innovation in Decentralized Finance

1inch has pioneered several groundbreaking features in the DeFi space. One of its key contributions is the implementation of a multi-chain infrastructure, which allows users to access liquidity across multiple blockchain networks, including Ethereum, Binance Smart Chain, and Polygon. This interoperability has significantly expanded the reach and accessibility of decentralized finance for users in America.

In addition, 1inch has introduced the concept of “aggregation” in the decentralized exchange space. By aggregating liquidity from various sources, such as different decentralized exchanges and liquidity pools, 1inch is able to offer users the best possible prices and reduce slippage. This innovative approach has revolutionized the way users trade and swap tokens, providing them with improved efficiency and cost savings.

Empowering the Community

1inch is not just a platform, but a community-driven ecosystem. Through its governance token, 1INCH, users can actively participate in the decision-making process and shape the future of the platform. This decentralized governance model ensures that the interests of the community are represented and allows for a more inclusive and democratic financial system.

Furthermore, 1inch has a strong focus on user education and engagement. The platform provides extensive resources and tutorials to help users navigate the DeFi space and make informed decisions. By empowering users with knowledge and tools, 1inch is driving the adoption of decentralized finance in America and enabling individuals to take control of their financial future.

Overall, the rise of 1inch has brought about a paradigm shift in the traditional banking services in America. With its innovative features and community-driven approach, 1inch has paved the way for a more open, inclusive, and efficient financial system, benefiting individuals and businesses alike.

Impact on Traditional Banking

With the rise of 1inch in America, traditional banking services are facing a significant impact. The innovative technology behind 1inch is revolutionizing the financial industry and changing the way people store, transfer, and invest their money.

One of the key impacts of 1inch on traditional banking services is its ability to provide decentralized finance (DeFi) solutions. Unlike traditional banks, 1inch operates on blockchain technology, allowing users to have complete control over their funds without relying on centralized intermediaries. This eliminates the need for traditional banks to facilitate transactions and manage customer accounts, making them less relevant in the financial landscape.

Furthermore, 1inch offers a range of financial services that directly compete with traditional banking offerings. Users can earn interest on their holdings through decentralized lending protocols, borrow funds without the need for extensive credit checks, and participate in yield farming to maximize their returns. These services not only provide users with more control over their finances but also offer better interest rates and higher potential returns compared to traditional bank accounts.

In addition, the transparency and security provided by 1inch are reshaping customer expectations for banking services. The blockchain technology used by 1inch ensures that all transactions and account balances are publicly viewable, providing users with a higher level of trust and confidence in their financial activities. This level of transparency is difficult for traditional banks to match, as their opaque systems often leave customers in the dark about how their money is being managed and invested.

Overall, the impact of 1inch on traditional banking services in America is undeniable. As more individuals embrace decentralized finance and experience the benefits of using platforms like 1inch, traditional banks will need to adapt or risk becoming obsolete. The financial landscape is evolving, and 1inch is at the forefront of this transformation.

| Traditional Banking | 1inch |

|---|---|

| Relies on centralized intermediaries | Operates on blockchain technology |

| Limited control over funds | Complete control over funds |

| Lower interest rates | Better interest rates and higher potential returns |

| Opaque systems | Transparent and publicly viewable transactions |

The Future of Banking

The impact of 1inch on traditional banking services in America is just the beginning of a larger trend that will shape the future of the banking industry. As technology continues to advance at a rapid pace, traditional banks will need to adapt and innovate in order to stay relevant in an increasingly digital world.

Digital Transformation

One of the key drivers of change in the banking industry is the ongoing digital transformation. As more and more people rely on smartphones and other digital devices for their everyday tasks, including banking, traditional banks will need to invest in digital infrastructure and user-friendly interfaces to meet the changing needs of their customers.

With the rise of blockchain technology and decentralized finance (DeFi), there is an increasing demand for more efficient and transparent financial services. Traditional banks will need to explore opportunities to integrate these technologies into their existing systems, or risk losing their customers to more innovative competitors like 1inch.

Personalized Banking Experience

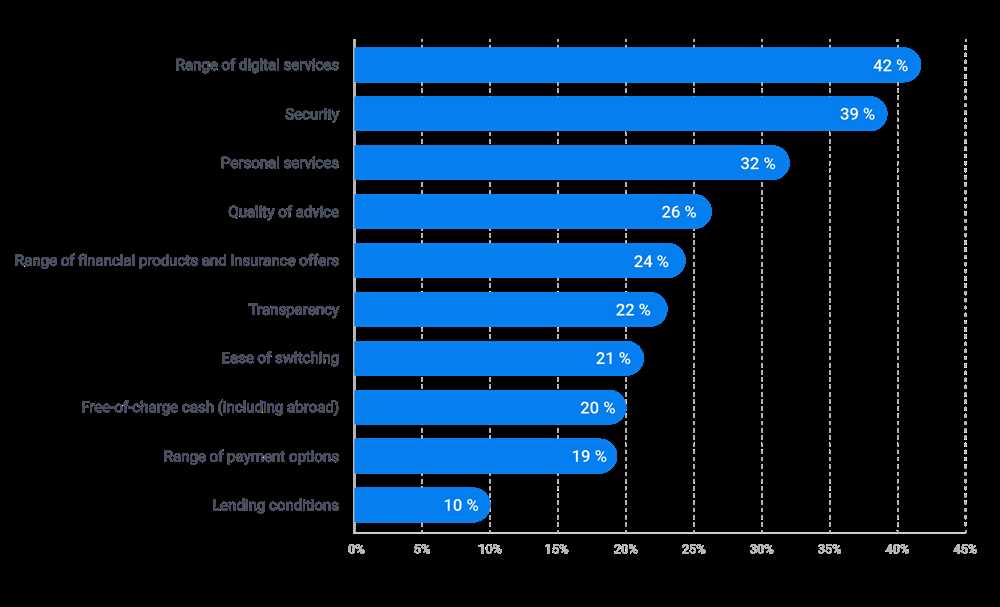

In the future, the banking industry will be increasingly focused on providing a personalized and tailored banking experience for each individual customer. With advancements in artificial intelligence and machine learning, banks will be able to analyze large amounts of data to better understand customer behavior and preferences.

This personalized approach will allow banks to offer customized products and services that meet the unique needs of each customer. Additionally, it will enable banks to provide real-time financial advice and support, making banking more convenient and accessible for individuals.

| Benefits of the Future of Banking |

|---|

| 1. Enhanced Efficiency: With the adoption of digital technologies, banking processes will become more streamlined and efficient, reducing the need for manual tasks and paperwork. |

| 2. Greater Accessibility: The future of banking will empower individuals who were previously underserved by traditional banks, allowing them to access financial services easily and conveniently. |

| 3. Improved Security: As technology advances, banks will invest more in robust security measures to protect customer data and prevent fraudulent activities. |

| 4. Integration with Emerging Technologies: Banks will embrace emerging technologies like artificial intelligence, blockchain, and biometrics to provide cutting-edge services to their customers. |

In conclusion, the future of banking will be shaped by digital transformation, personalized experiences, and integration with emerging technologies. Traditional banks will need to embrace these changes in order to stay competitive and meet the evolving needs of their customers. The impact of 1inch on traditional banking services in America is just one example of the transformative power of innovation in the banking industry.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible prices for their trades.

How does 1inch impact traditional banking services in America?

1inch is a blockchain-based platform that operates outside of the traditional banking system. It allows users to trade cryptocurrencies directly without the need for a traditional bank account or financial intermediary.

What benefits does 1inch offer compared to traditional banking services?

1inch offers several benefits compared to traditional banking services. Firstly, it provides users with access to a wide range of decentralized exchanges, giving them access to a larger pool of liquidity. Additionally, 1inch operates 24/7 and allows for fast and secure transactions, which can be particularly useful for international transfers. Lastly, 1inch eliminates the need for intermediaries and reduces the associated fees and delays.

Is 1inch safe and secure for users?

Yes, 1inch is designed to prioritize the security and privacy of its users. It utilizes smart contract technology and encryption to ensure that transactions are secure. Additionally, 1inch does not store any user funds, further reducing the risk of hacking or theft. However, it’s important for users to take precautions such as using strong passwords and enabling two-factor authentication to further protect their funds.