Exploring the Future of Decentralized Exchanges Through an In-Depth Analysis of 1inch

As the world of cryptocurrency continues to evolve, decentralized exchanges (DEXs) have emerged as a viable alternative to traditional centralized exchanges. These platforms offer users greater control over their funds and eliminate the need for intermediaries, making them more secure and transparent. One DEX that has gained significant attention is 1inch, a decentralized exchange aggregator that enables users to find the best prices across multiple liquidity sources.

What sets 1inch apart from other DEXs is its unique approach to liquidity aggregation. By connecting with various decentralized exchanges and liquidity protocols, 1inch is able to offer users the most optimal trading routes and competitive prices. This not only saves traders time and money but also reduces the risk of slippage when executing trades.

With its user-friendly interface and advanced algorithm, 1inch has quickly become a popular choice among cryptocurrency enthusiasts. The platform’s commitment to decentralized governance and community-driven decision-making also sets it apart from its centralized counterparts. Users of 1inch have the ability to participate in the platform’s governance through the 1inch DAO, ultimately giving them a say in the future development and direction of the exchange.

Looking ahead, the future of decentralized exchanges like 1inch appears promising. As the adoption of cryptocurrencies continues to grow and regulatory concerns surrounding centralized exchanges persist, decentralized exchanges offer an alternative that empowers users and ensures the security of their funds. With its innovative approach to liquidity aggregation and commitment to decentralization, 1inch is well-positioned to play a significant role in shaping the future of decentralized finance.

The Rise of Decentralized Exchanges

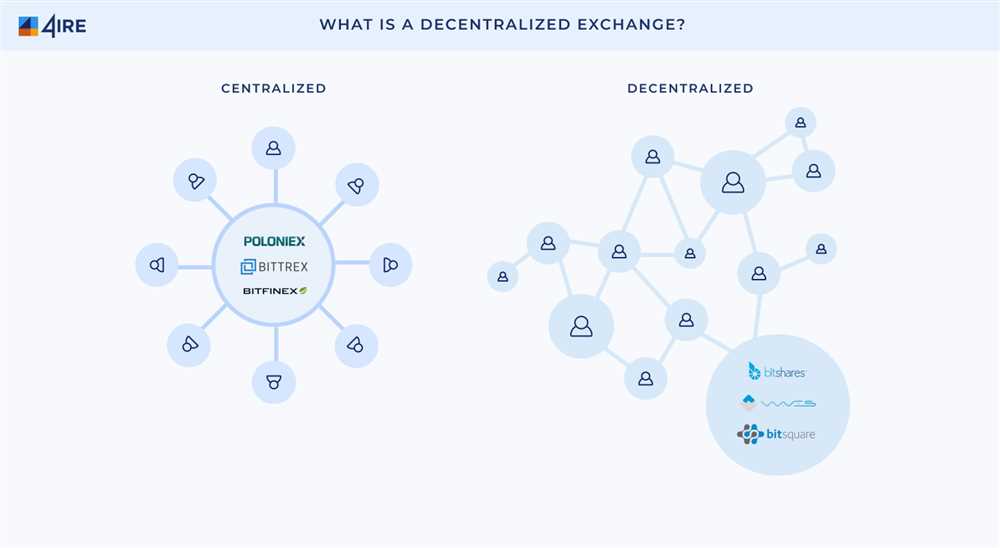

Decentralized exchanges, also known as DEXs, have gained significant prominence in recent years. Unlike traditional centralized exchanges, which rely on a central authority to facilitate transactions, decentralized exchanges operate on peer-to-peer networks that allow users to trade cryptocurrencies directly with each other, eliminating the need for intermediaries.

The rise of decentralized exchanges can be attributed to several key factors. Firstly, they offer greater security and privacy compared to centralized exchanges. By removing the need to trust a single entity with their funds, users can mitigate the risk of hacking and theft.

In addition to enhanced security, decentralized exchanges also enable greater financial freedom. They provide users with full control over their funds, as they are not required to deposit their assets on a centralized platform. This eliminates the risk of asset seizure or frozen accounts, which can occur on centralized exchanges.

Furthermore, decentralized exchanges promote transparency and fairness. Transactions on DEXs are executed on smart contracts, which are immutable and publicly auditable. This ensures that all trades are conducted in a trustless and tamper-proof manner.

The Benefits of Decentralized Exchanges

Decentralized exchanges offer several advantages over their centralized counterparts:

- Greater security and privacy

- Full control over funds

- Transparency and fairness

- Lower fees

- Global accessibility

These benefits have led to a surge in popularity for decentralized exchanges, with users increasingly flocking to platforms that prioritize security, freedom, and trustlessness. As the crypto market continues to expand, it is expected that the importance and adoption of decentralized exchanges will only continue to rise.

The Unique Features of 1inch

1inch is a decentralized exchange that offers several unique features that set it apart from other platforms in the market. These features aim to provide users with a seamless and efficient trading experience while also ensuring the best possible outcome for their trades.

- Smart Contract Aggregation: One of the standout features of 1inch is its ability to aggregate liquidity from various decentralized exchanges, allowing users to access a wide range of trading options. Through its smart contract aggregation, 1inch is able to find the most optimal route for a trade, splitting it across multiple exchanges to achieve the best possible price.

- Gas Token Mechanism: 1inch has introduced a unique gas token mechanism that helps users save on Ethereum gas fees during transactions. By utilizing the Chi Gastoken (CHI), users can reduce their gas costs by up to 42%, making trading on 1inch more cost-effective compared to other decentralized exchanges.

- Limit Orders: Unlike many decentralized exchanges that only support market orders, 1inch allows users to place limit orders. This feature enables users to specify the price at which they want to buy or sell an asset, giving them more control over their trades and increasing the possibilities for profitable trading strategies.

- DEX Aggregation: 1inch provides DEX aggregation, which allows users to leverage the liquidity available on multiple decentralized exchanges. Through this feature, users can access better prices and deeper liquidity for their trades, ensuring that they get the best possible outcome when executing a trade.

- Security and Transparency: 1inch places a strong emphasis on security and transparency. By utilizing smart contracts and audited code, it ensures that users’ funds remain secure and protected. Additionally, 1inch provides detailed information on each transaction, allowing users to track their trades and verify the results.

These unique features make 1inch a top choice for traders looking for a decentralized exchange that offers advanced trading options, optimized prices, and enhanced security. With its commitment to innovation and user-centric design, 1inch is well-positioned to continue leading the way in the future of decentralized exchanges.

The Implications for the Future

As decentralized exchanges continue to gain popularity, the implications for the future of the financial industry are significant. Here are some key implications:

1. Increased Accessibility

Decentralized exchanges like 1inch are accessible to anyone with an internet connection, eliminating the need for intermediaries such as banks or brokerage firms. This increased accessibility allows individuals from all around the world to participate in the global financial markets, regardless of their financial status or geographic location.

2. Reduced Counterparty Risk

Traditional exchanges often involve counterparty risk, where users trust centralized entities to hold their assets. With decentralized exchanges, the risk of fraud or theft is significantly reduced as users retain control over their assets throughout the transaction process. Smart contracts ensure that transactions are executed as intended, without the need for trust in a single entity.

3. Enhanced Privacy

Privacy is a key concern for many individuals when it comes to financial transactions. Decentralized exchanges offer enhanced privacy as users can trade directly with one another without the need to disclose personal information. This reduces the risk of identity theft and provides users with greater control over their personal data.

4. Lower Costs

Traditional exchanges often charge high fees for services such as trading, custody, and withdrawal. Decentralized exchanges, on the other hand, can significantly reduce or even eliminate many of these fees. By removing intermediaries and automating processes through smart contracts, users can save money and retain a larger portion of their trading profits.

In conclusion, the future of decentralized exchanges like 1inch is highly promising. The increased accessibility, reduced counterparty risk, enhanced privacy, and lower costs they offer are likely to disrupt the traditional financial industry and empower individuals worldwide. As the technology continues to evolve and more users embrace decentralized exchanges, we can expect to see further innovation and advancements in this space.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best prices and lowest slippage for their trades.

How does 1inch work?

1inch works by splitting a user’s trade across multiple decentralized exchanges to ensure the best execution and lowest slippage. It uses a combination of smart contract technology and advanced algorithms to route trades and find the most optimal paths.