In the world of decentralized finance, the 1inch protocol has emerged as a game-changer. It offers users the ability to swap tokens on various decentralized exchanges, providing them with the best possible rates. While the concept of swapping tokens may seem simple, the process of achieving the best rates is complex. This is where aggregation comes into play.

Aggregation, in the context of the 1inch protocol, refers to the process of pooling liquidity from different decentralized exchanges to find the most favorable rates for users. By utilizing multiple exchanges, the protocol increases the chances of finding the best possible rates, ensuring that users get the most value for their tokens.

The importance of aggregation in the 1inch protocol cannot be overstated. Without aggregation, users would have to manually check the rates on each individual exchange, which is a time-consuming and inefficient process. Aggregation streamlines this process by automatically scanning multiple exchanges and presenting users with the best rates in real-time.

Furthermore, aggregation helps to solve the problem of fragmented liquidity in the decentralized finance space. Liquidity on decentralized exchanges is often scattered across various platforms, making it difficult for users to find the best rates. Aggregation solves this issue by consolidating liquidity from different sources, creating a more efficient and user-friendly environment for swapping tokens.

The Significance of Aggregation in the 1inch Protocol

The 1inch Protocol is a decentralized exchange aggregator that aims to provide users with the best possible trading experience by optimizing the process of swapping tokens across multiple liquidity sources. One of the key features that sets the 1inch Protocol apart from other decentralized exchanges is its sophisticated aggregation algorithm.

Efficient Market Access

Aggregation plays a crucial role in enabling efficient market access for users of the 1inch Protocol. By aggregating liquidity from various decentralized exchanges and liquidity providers, the protocol ensures that users can access the best available prices and depths for their desired trades. This is particularly important in decentralized finance (DeFi) where liquidity is fragmented across multiple platforms.

Without aggregation, users would need to manually search and compare prices across different exchanges, which can be time-consuming and prone to error. Moreover, by providing a single point of access to multiple liquidity sources, the 1inch Protocol reduces the impact of slippage, ensuring that users get the most favorable trading outcomes.

Optimal Routing

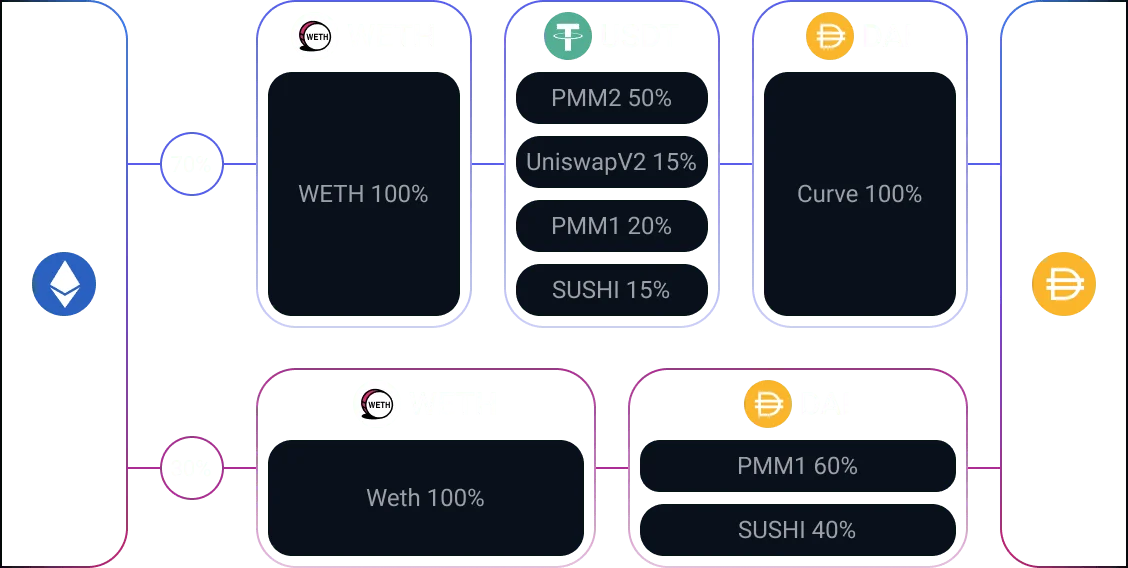

Another crucial aspect of aggregation in the 1inch Protocol is optimal routing. The protocol intelligently routes trades through the most efficient paths across various liquidity sources to minimize costs and maximize returns for users.

This is achieved through a combination of algorithms that take into account factors such as token prices, liquidity depths, and transaction fees across different exchanges. By dynamically monitoring and adjusting routes in real time, the 1inch Protocol ensures that users always get the best possible trading outcomes.

Optimal routing also helps to address the issue of liquidity fragmentation in DeFi. By combining liquidity from multiple sources and routing trades through the most efficient paths, the protocol increases overall liquidity and reduces the impact of low liquidity on trading prices.

In summary, aggregation plays a vital role in the 1inch Protocol by providing users with efficient market access and optimizing the routing of trades. By aggregating liquidity and intelligently routing trades, the protocol ensures that users can access the best available prices and depths, while minimizing costs and maximizing returns. This makes the 1inch Protocol a powerful tool for traders in the decentralized finance space.

Maximizing Liquidity and Efficiency

One of the key objectives of the 1inch Protocol is to maximize liquidity and efficiency in decentralized exchanges (DEXs). By aggregating liquidity from multiple DEXs, the protocol enables users to access the best prices and trading pairs available in the market.

When users make a trade on a DEX, they often face limited liquidity, which can lead to slippage and higher trading costs. The 1inch Protocol addresses this issue by splitting a trade into multiple smaller trades across different DEXs. This allows for better price execution and reduces the impact on the market.

In addition to maximizing liquidity, the 1inch Protocol also aims to increase efficiency in DEX trading. By aggregating liquidity, the protocol minimizes the need for users to manually search for the best prices and trading pairs across multiple DEXs. This saves time and effort for traders, while also improving the overall trading experience.

The aggregation algorithm used by the 1inch Protocol takes into account factors such as prices, liquidity, and fees across different DEXs. This ensures that users get the best possible outcomes for their trades. The protocol also supports smart contract interactions, allowing users to execute complex trading strategies and take advantage of various DeFi protocols.

Overall, the 1inch Protocol plays a crucial role in maximizing liquidity and efficiency in decentralized exchanges. By aggregating liquidity from multiple sources and optimizing trades, the protocol helps users get the most out of their trading activities while minimizing costs and slippage.

Enhancing Security and Transparency

In the 1inch Protocol, security and transparency are paramount. The protocol is designed to ensure that users’ funds are protected at all times, and that they have full visibility into the transactions they are making.

To enhance security, the protocol utilizes advanced security measures such as multi-signature wallets and smart contract audits. These measures help to minimize the risk of funds being lost or stolen, and provide users with peace of mind when using the protocol.

Additionally, the protocol is built on a transparent and open-source infrastructure. This means that anyone can audit the code and verify its security and functionality. This level of transparency ensures that the protocol is accountable to its users, and inspires trust in the community.

Furthermore, the protocol aggregates liquidity from various decentralized exchanges, which not only provides users with the best possible price for their trades but also reduces the risk of price manipulation. By aggregating liquidity, the protocol ensures a fair and secure trading experience for all users.

Overall, the emphasis on security and transparency in the 1inch Protocol sets it apart from other decentralized protocols. With its advanced security measures, transparent infrastructure, and aggregated liquidity, the protocol provides users with a secure and reliable trading platform.

Providing a Seamless User Experience

One of the key focuses of the 1inch Protocol is to provide a seamless user experience for traders and liquidity providers. By utilizing aggregation, the protocol is able to offer users the best possible prices and lowest slippage for their trades.

When a user wants to execute a trade on a decentralized exchange, they typically face the challenge of fragmented liquidity across multiple platforms. This can lead to higher fees, slower execution times, and suboptimal prices. However, with the 1inch Protocol, users can access liquidity from a wide range of decentralized exchanges without the need for manual searching and switching between platforms.

The protocol achieves this seamless user experience through its aggregation algorithm, which splits large orders into smaller ones across multiple decentralized exchanges. By doing so, the protocol is able to find the best possible prices and optimize the overall trade execution. This ensures that users get the most value out of their trades, with minimal slippage and fees.

Optimizing for Efficiency

In addition to providing a seamless user experience, the 1inch Protocol also focuses on optimizing the efficiency of trades. The protocol uses advanced algorithms to intelligently route trades and split them across different liquidity sources, including both centralized and decentralized exchanges.

This allows users to access the deepest liquidity pools available, increasing the chances of their trades being executed quickly and at the desired price. By using aggregation, the protocol minimizes the impact of large trades on the market, ensuring that prices remain stable and minimizing slippage.

Overall, by providing a seamless user experience and optimizing for efficiency, the 1inch Protocol aims to make decentralized trading accessible and profitable for users of all levels of experience.

Question-answer:

What is aggregation in the 1inch protocol?

Aggregation is the process of combining multiple liquidity sources to provide the best possible trading rates and reduce fees for users.

How does aggregation work in the 1inch protocol?

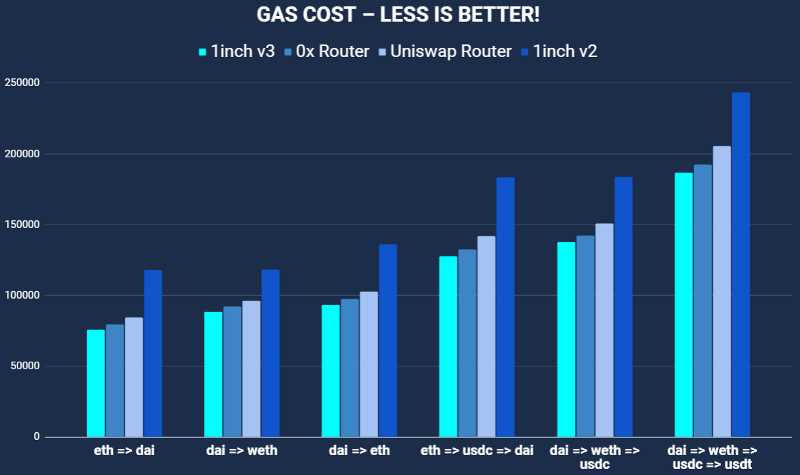

Aggregation in the 1inch protocol involves the use of an algorithm that splits a user’s trade across multiple decentralized exchanges to ensure the best possible price. It takes into account factors such as trading fees, slippage, and gas costs to optimize the trade.

Why is aggregation important in the 1inch protocol?

Aggregation is important in the 1inch protocol because it allows users to get the best possible trading rates and save on fees. By splitting a trade across multiple exchanges, users can avoid high slippage and take advantage of liquidity across different sources.

What are the benefits of aggregation in the 1inch protocol?

The benefits of aggregation in the 1inch protocol include getting the best trading rates, reduced slippage, and lower fees. It also allows users to access liquidity from multiple sources, which increases overall trading opportunities.

Can aggregation be used in other DeFi protocols?

Yes, aggregation can be used in other DeFi protocols. The concept of aggregating liquidity can be applied to any protocol that deals with decentralized trading or lending, as it helps users get the best possible rates and reduce fees.