Automated Market Makers (AMMs) have emerged as a vital component of decentralized exchanges, revolutionizing the way users trade and providing liquidity in a seamless and efficient manner. One of the leading platforms harnessing the power of AMMs is 1inch Exchange, which has quickly become a go-to destination for traders seeking reliable and cost-effective transactions.

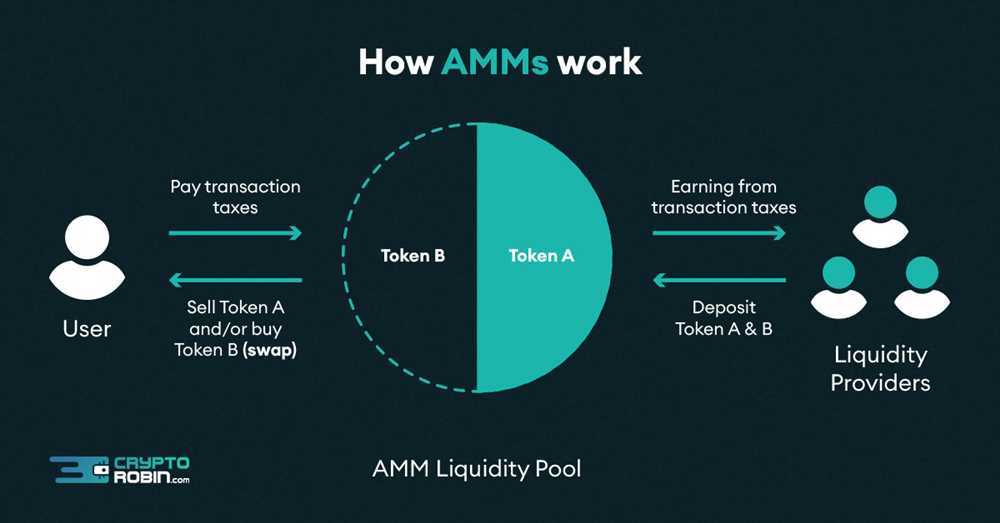

AMMs act as smart contracts that automatically execute and settle trades without the need for a traditional order book. Instead, they rely on liquidity pools and mathematical algorithms to determine prices based on the supply and demand of assets. This automated process ensures continuous liquidity and enables users to trade directly from their wallets, eliminating the need for intermediaries and enhancing security.

On 1inch Exchange, AMMs play a crucial role in enabling efficient and decentralized trading. The platform aggregates liquidity from various decentralized exchanges, known as decentralized liquidity protocols (DLPs), to provide users with the best trading rates across multiple markets. By tapping into the power of AMMs, 1inch Exchange is able to optimize trades and minimize slippage, allowing users to achieve the best possible prices for their trades.

Furthermore, 1inch Exchange has developed its own AMM protocol known as Mooniswap, which incorporates various innovations to enhance trading efficiency. Mooniswap utilizes a unique price slippage protection mechanism, preventing front-running and providing traders with fairer trading conditions. This innovative feature has gained significant traction among traders and has contributed to the rapid growth and adoption of 1inch Exchange.

The Importance of Automated Market Makers

Automated Market Makers (AMMs) play a crucial role in decentralized finance (DeFi) protocols like 1inch Exchange. These algorithms facilitate liquidity provision by enabling users to seamlessly trade assets without the need for intermediaries or traditional order books. Here are a few reasons why AMMs are important:

1. Providing Liquidity

AMMs ensure that there is always sufficient liquidity available for traders on decentralized exchanges. By utilizing smart contracts and utilizing liquidity pools, they enable users to buy and sell assets with minimal slippage. This consistent availability of liquidity encourages trading activity and contributes to the overall efficiency of the market.

2. Accessibility and Trustlessness

AMMs eliminate the need for intermediaries, removing the risk of manipulation or censorship. This allows anyone with an internet connection to participate in trading without relying on centralized entities. Additionally, AMMs are transparent and trustless, as all transactions are recorded on the blockchain, providing users with a high level of security and accountability.

3. Flexibility and Efficiency

AMMs offer flexibility by allowing users to list any ERC-20 token in their liquidity pools. This opens up opportunities for traders to access a wide range of assets and promotes innovative financial products. Moreover, AMMs optimize trading by automatically adjusting the price based on the ratio of assets in the liquidity pool, ensuring the most efficient execution for users.

In conclusion, Automated Market Makers are important components of decentralized finance ecosystems like 1inch Exchange. They provide crucial liquidity, enhance accessibility and trustlessness, and offer flexibility and efficiency to traders. As DeFi continues to evolve, AMMs will play an even bigger role in shaping the future of decentralized finance.

Enhancing Liquidity and Trading Efficiency

Automated market makers (AMMs) play a crucial role in enhancing liquidity and trading efficiency on 1inch Exchange. These innovative smart contracts are designed to automatically facilitate the exchange of tokens at a predictable and fair price.

One of the key benefits of AMMs is that they provide continuous liquidity, allowing traders to execute their trades without any delays or price slippages. This is particularly important in fast-paced markets where even a few seconds can make a significant difference.

AMMs operate by utilizing a pool of tokens to automatically match buy and sell orders. This eliminates the need for traditional order books and market makers, resulting in lower transaction costs for traders. With AMMs, traders have access to deep liquidity pools, enabling them to execute large trades without impacting the market price.

Furthermore, AMMs enhance trading efficiency by offering tight spreads. The smart contracts constantly rebalance the token pools to maintain an optimal price, ensuring that traders are always getting the best possible deal. This allows for seamless and efficient price discovery, as traders can quickly find the best available prices for their trades.

Additionally, the 1inch Exchange platform integrates various AMMs, such as Uniswap, Balancer, and Curve, to provide even greater liquidity and trading options. This integration allows users to access multiple liquidity sources from a single platform, enhancing convenience and reducing the need to navigate multiple exchanges.

Benefits of AMMs on 1inch Exchange:

1. Enhanced liquidity: AMMs on 1inch Exchange provide continuous liquidity, allowing for instant trades and reduced slippage.

2. Lower transaction costs: AMMs eliminate the need for traditional market makers, resulting in lower fees for traders.

3. Tight spreads: The constant rebalancing of token pools ensures optimal prices and tight spreads for traders.

4. Access to multiple liquidity sources: 1inch Exchange integrates various AMMs, providing users with a wide range of liquidity options from a single platform.

Overall, the integration of automated market makers on 1inch Exchange significantly enhances liquidity and trading efficiency, making it a preferred choice for traders looking for seamless and cost-effective trading experiences.

How Automated Market Makers Work

An automated market maker (AMM) is a type of decentralized exchange protocol that uses algorithms to provide liquidity for trading. Unlike traditional order book exchanges, AMMs do not rely on centralized intermediaries or traditional market makers to facilitate trades. Instead, they use smart contracts to automate the process of matching buy and sell orders.

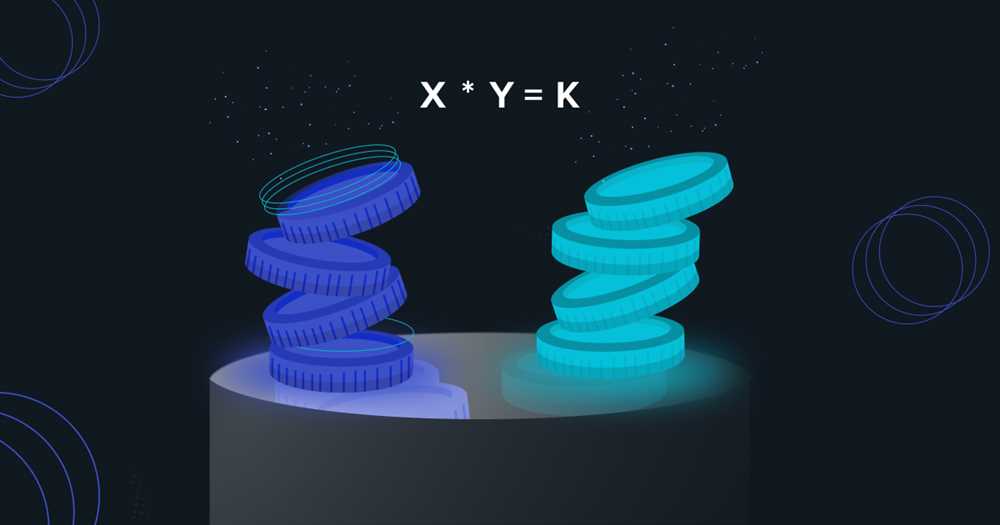

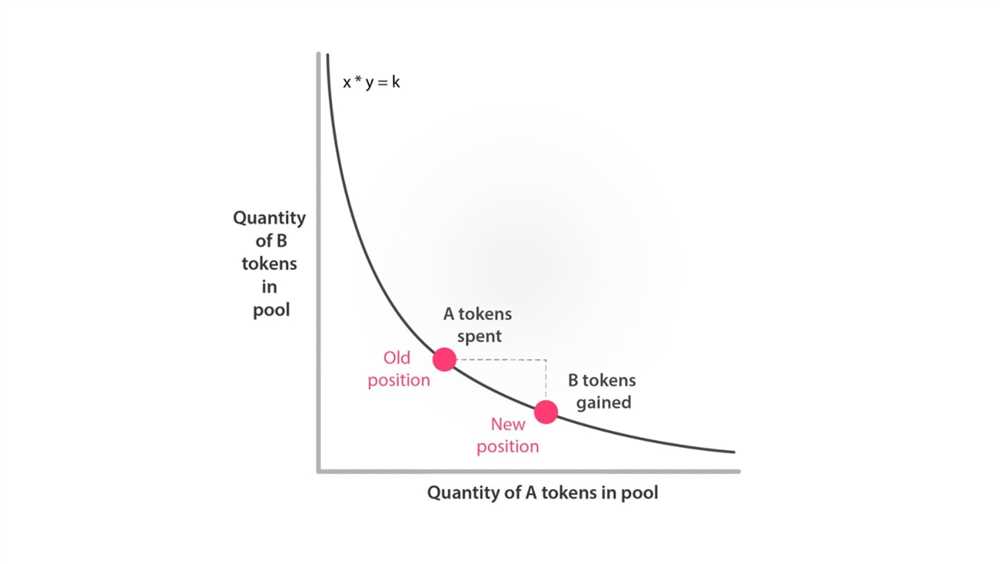

AMMs function by creating liquidity pools for different token pairs. These pools contain a reserve of both tokens, and users can trade between them based on a predetermined algorithmic equation. The most common equation used is the constant product formula, also known as the x * y = k formula.

When a user wants to make a trade on an AMM, they submit their order to the liquidity pool, which adjusts the token prices based on the equation. As more tokens are traded, the pool rebalances itself to ensure that the equation is always true. This means that as one token becomes more scarce due to increased demand, its price increases, while the price of the other token decreases.

Automated market makers enable continuous liquidity by providing a constant pool of tokens for trading, regardless of the trading volume. This eliminates the need for traditional market makers to constantly provide liquidity and ensures that traders can always find a counterparty for their trades.

AMMs also offer other advantages such as lower trading fees compared to traditional exchanges, fast execution times, and the ability to support a wide range of token pairs. However, they also have their limitations, including potential impermanent loss and slippage.

Overall, automated market makers have revolutionized the world of decentralized finance by providing a decentralized, efficient, and accessible way to trade tokens. They have played a crucial role in the growth of decentralization and have become a core component of many decentralized exchanges, including the 1inch Exchange.

Decentralized Trading and Smart Contracts

Decentralized trading refers to the process of conducting transactions on a blockchain network without the need for intermediaries or centralized authorities. In traditional financial markets, intermediaries such as brokers or exchanges play a crucial role in facilitating trades. However, decentralized trading removes the need for intermediaries, allowing users to trade directly with each other.

One key component that enables decentralized trading is smart contracts. Smart contracts are self-executing contracts with the terms of the agreement written into code. These contracts automatically execute once the predetermined conditions are met, without the need for intermediaries or third parties.

When it comes to decentralized trading, smart contracts are used to facilitate transactions, hold funds, and execute trades. They eliminate the need for trust in the counterparty, as the execution of the trade is based on predefined rules and conditions encoded within the smart contract.

Automated market makers (AMMs), such as those found on 1inch Exchange, utilize smart contracts to provide liquidity for trading pairs. These smart contracts enable users to swap between different tokens by providing liquidity to pools and ensuring that trades can be executed instantly.

Decentralized trading and smart contracts offer several advantages over traditional trading methods. Firstly, they eliminate the need for intermediaries, reducing transaction costs and increasing transparency. Additionally, smart contracts ensure that trades are executed in a trustless manner, reducing the risk of fraud or manipulation.

Overall, decentralized trading powered by smart contracts has the potential to revolutionize the financial markets, enabling anyone with an internet connection to participate in trading without the need for intermediaries or centralized authorities.

Benefits of Using 1inch Exchange

1inch Exchange offers several key benefits to users, making it a popular choice among traders and investors in the cryptocurrency market.

1. Aggregated Liquidity from Multiple Sources

1inch Exchange aggregates liquidity from various decentralized exchanges (DEXs), including Uniswap, SushiSwap, Balancer, and many others. This means that users can access a larger pool of liquidity compared to trading on a single DEX. By tapping into multiple liquidity sources, 1inch Exchange ensures better price execution and reduced slippage.

2. Automated Market Making

1inch Exchange utilizes automated market making algorithms, which are designed to provide the best possible prices for users. These algorithms automatically split a trade across different DEXs to optimize price execution and reduce fees. By leveraging automated market making, users can benefit from improved liquidity and reduced trading costs.

3. Gas Optimization

Gas fees on the Ethereum network can be high, especially during times of high demand. 1inch Exchange helps users save on gas fees by splitting a trade across multiple DEXs to find the most cost-effective path. By optimizing gas usage, users can save on transaction fees and maximize their trading returns.

4. User-Friendly Interface

1inch Exchange provides a user-friendly interface that is intuitive and easy to navigate. The platform offers a range of features, including trading, swapping, and providing liquidity. With a simple and user-friendly interface, even novice users can easily navigate and use the platform to trade their favorite cryptocurrencies.

5. Security and Privacy

1inch Exchange prioritizes the security and privacy of its users. The platform does not require users to create an account or provide personal information, ensuring anonymity and protecting user privacy. Additionally, 1inch Exchange only interacts with audited and trusted smart contracts, minimizing the risk of hacks or security breaches.

| Benefits | Description |

|---|---|

| Aggregated Liquidity | Access to a larger pool of liquidity from multiple DEXs |

| Automated Market Making | Optimized price execution and reduced fees through automated market making algorithms |

| Gas Optimization | Saving on gas fees through efficient trade routing |

| User-Friendly Interface | Intuitive and easy-to-use interface for seamless trading |

| Security and Privacy | Anonymity and protection of user privacy through a secure platform |

Question-answer:

What is an automated market maker?

An automated market maker (AMM) is a decentralized exchange mechanism that uses algorithms to determine the price of assets and facilitate trades. It replaces traditional order books with liquidity pools, where traders can swap tokens directly without the need for a counterparty.

How does 1inch Exchange utilize automated market makers?

1inch Exchange integrates multiple automated market makers into its platform to provide users with the best prices and the highest liquidity. It aggregates liquidity from various decentralized exchanges and AMMs, allowing users to access a wider range of trading options.

What are the advantages of using automated market makers on 1inch Exchange?

Using automated market makers on 1inch Exchange offers several advantages. Firstly, it provides users with competitive prices and better liquidity by aggregating liquidity from various sources. Additionally, it enables instant swaps without the need for order books or dealing with counterparty risk. It also allows users to enjoy lower fees and reduced slippage compared to traditional exchanges.