Exploring Tax Considerations When Converting 1inch Tokens to Various Cryptocurrencies

Discover How Converting 1inch Can Affect Your Taxes

In the ever-evolving world of cryptocurrencies, understanding the tax implications of converting your 1inch tokens is essential. Whether you’re considering converting to Bitcoin, Ethereum, or any other digital asset, it’s crucial to be informed about the potential tax consequences.

Stay compliant with the tax authorities while optimizing your investment portfolio.

At our expert tax advisory firm, we specialize in navigating the complex waters of cryptocurrency tax regulations. Our team of tax professionals understands the unique challenges and opportunities presented by the crypto market.

Key Tax Considerations for Converting 1inch:

- Capital Gains Taxes: Converting 1inch tokens may trigger a taxable event, potentially subjecting you to capital gains taxes based on the price difference between the time of acquisition and conversion.

- Reporting Requirements: Ensure accurate and timely reporting of your cryptocurrency transactions to avoid penalties and legal complications with tax authorities.

- Tax-efficient Strategies: Discover strategies to minimize your tax liability while maximizing your investment gains when converting your 1inch tokens.

Don’t let tax implications hold you back from exploring the vast possibilities of the cryptocurrency market.

Partner with our experienced tax advisors to gain clarity on the tax implications of converting 1inch to different cryptocurrencies. We provide personalized guidance tailored to your specific financial situation and goals. With our expertise, you can confidently navigate the tax landscape and make informed decisions about your 1inch conversions.

Contact us today to schedule a consultation with our crypto tax experts.

Understanding the Tax Implications

When it comes to converting 1inch to different cryptocurrencies, it’s important to understand the tax implications involved. While cryptocurrency transactions can be seen as a decentralized and anonymous form of exchange, it is essential to remember that tax authorities are increasingly focused on ensuring that individuals are correctly reporting their digital asset holdings and transactions.

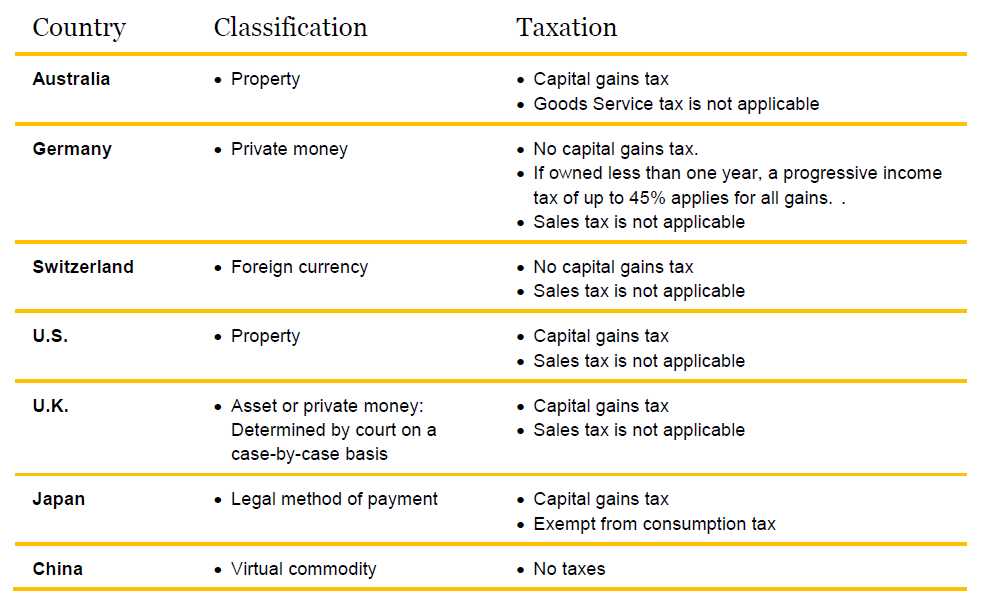

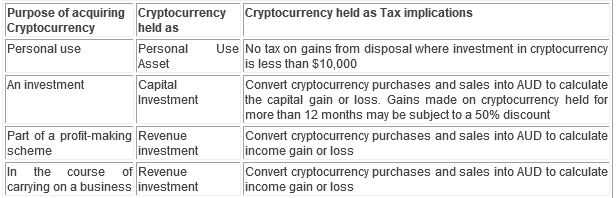

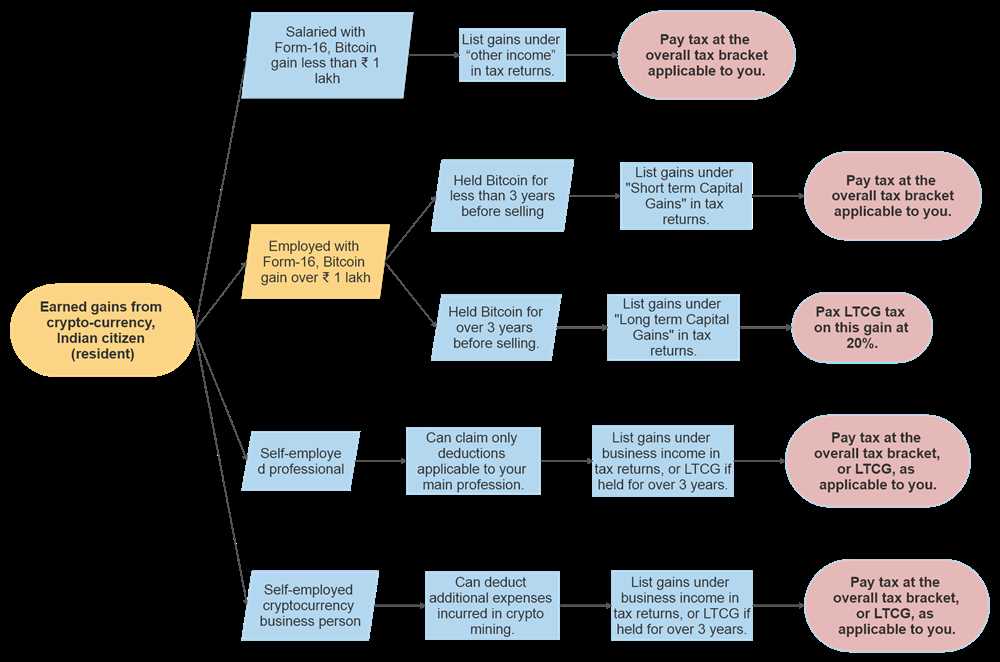

The tax implications of converting 1inch to different cryptocurrencies can vary depending on several factors, including the jurisdiction in which you reside and the specific tax laws and regulations that apply. For example, in some countries, cryptocurrencies may be treated as property for tax purposes, while in others, they may be treated as currency or commodities.

One key consideration when it comes to taxes and cryptocurrency conversions is the concept of capital gains. When you convert 1inch to a different cryptocurrency, it can be seen as a taxable event, similar to selling an asset and realizing a gain. The difference between the fair market value of the 1inch at the time of conversion and its original cost basis will determine the capital gain or loss that needs to be reported on your tax return.

It’s important to note that the tax obligations associated with cryptocurrency conversions may extend beyond capital gains. Other potential tax implications include the application of sales tax, the reporting of foreign financial accounts, and the treatment of cryptocurrency mining activities.

To ensure that you are compliant with the relevant tax laws and regulations, it is recommended to consult with a qualified tax professional who specializes in cryptocurrency taxation. They can provide guidance on how to accurately report your cryptocurrency conversions, determine your tax obligations, and maximize any available deductions or credits.

Being proactive and understanding the tax implications of converting 1inch to different cryptocurrencies can help you avoid potential legal and financial consequences. By staying informed and seeking professional advice, you can navigate the complex world of cryptocurrency taxation with confidence.

Overview and Importance

The tax implications of converting 1inch to different cryptocurrencies are essential for individuals and businesses to understand. Cryptocurrencies have gained widespread popularity in recent years, with 1inch being one of the leading digital assets. However, it is crucial to comprehend the tax obligations associated with converting 1inch to other cryptocurrencies.

Converting 1inch to different cryptocurrencies may trigger taxable events, depending on the jurisdiction and the specific circumstances. These taxable events can include capital gains or losses, which must be reported to the relevant tax authorities.

Understanding the tax implications is of utmost importance for several reasons. Firstly, it ensures compliance with tax laws and regulations. Failing to report and pay taxes on crypto conversions can result in penalties and legal consequences.

Secondly, comprehending the tax implications allows individuals and businesses to make informed financial decisions. By taking into account the potential tax liabilities, they can evaluate the profitability and feasibility of converting 1inch to other cryptocurrencies.

Lastly, having a clear understanding of the tax obligations associated with converting 1inch to different cryptocurrencies contributes to overall financial transparency. It enables individuals and businesses to track and analyze their crypto investments accurately and prepares them for potential audits or inquiries from tax authorities.

In conclusion, understanding the tax implications of converting 1inch to different cryptocurrencies is crucial for compliance, informed decision-making, and financial transparency. By being aware of the tax obligations, individuals and businesses can navigate the crypto landscape responsibly and optimize their financial strategies.

Converting 1inch to Different Cryptocurrencies

Converting 1inch to different cryptocurrencies opens up a world of possibilities for users. With the fast-paced and ever-evolving crypto market, being able to convert your 1inch tokens to other cryptocurrencies can provide you with greater flexibility and potential for growth.

When you convert 1inch to different cryptocurrencies, you have the opportunity to diversify your crypto portfolio. By spreading your investments across various cryptocurrencies, you can mitigate risks and potentially increase your chances of capitalizing on market opportunities.

Additionally, converting 1inch to different cryptocurrencies can be a strategic move to take advantage of market trends. If you believe that a particular cryptocurrency is poised for growth or that its value will increase in the future, converting your 1inch tokens to that currency can position you for potential gains.

Converting 1inch to different cryptocurrencies can also be a way to access new projects and technologies. As the crypto market continues to expand, new cryptocurrencies and blockchain projects emerge. By converting your 1inch tokens, you can participate in these projects and potentially benefit from their success.

However, when converting 1inch to different cryptocurrencies, it’s important to consider the tax implications. Depending on your jurisdiction and local tax laws, converting cryptocurrencies may trigger taxable events. It’s crucial to seek professional advice or consult with a tax expert to ensure compliance and maximize tax efficiency.

- Convert 1inch to Bitcoin: Bitcoin is the most well-known and widely accepted cryptocurrency. Converting 1inch tokens to Bitcoin can provide you with a stable and established digital asset.

- Convert 1inch to Ethereum: Ethereum is a leading blockchain platform that allows for the creation of smart contracts and decentralized applications. Converting 1inch to Ethereum can give you exposure to a vibrant and innovative ecosystem.

- Convert 1inch to Ripple: Ripple (XRP) is a cryptocurrency that focuses on facilitating fast and low-cost international money transfers. Converting 1inch to Ripple can be advantageous if you frequently engage in cross-border transactions.

- Convert 1inch to Litecoin: Litecoin is often considered the silver to Bitcoin’s gold. Converting 1inch to Litecoin can diversify your crypto portfolio and potentially offer different advantages.

Overall, converting 1inch to different cryptocurrencies can be a strategic move to optimize your crypto holdings and take advantage of market opportunities. However, it’s essential to stay informed, consider the tax implications, and make educated decisions based on your individual circumstances.

Tax Considerations and Strategies

Converting 1inch to different cryptocurrencies can have tax implications that you need to be aware of. It is important to understand the tax laws and regulations in your jurisdiction to ensure compliance and avoid any potential penalties or legal issues.

1. Capital Gains Tax

When you convert 1inch to a different cryptocurrency, it is considered a taxable event in many jurisdictions. This means that any gains or losses resulting from the conversion may be subject to capital gains tax.

Capital gains tax is typically calculated based on the difference between the fair market value of the 1inch at the time of conversion and its original cost basis. The tax rate applied to these gains may vary depending on factors such as your income bracket and how long you held the 1inch before converting it.

2. Reporting Requirements

It is important to be diligent in your tax reporting obligations when converting 1inch to different cryptocurrencies. In most jurisdictions, you are required to report your cryptocurrency transactions, including conversions, on your tax return.

Make sure to keep accurate records of your transactions, including the date, time, amount, and fair market value of the 1inch at the time of conversion. This information will be needed when determining your capital gains or losses for tax purposes.

3. Tax Planning Strategies

To minimize your tax liability when converting 1inch to different cryptocurrencies, consider implementing tax planning strategies. These strategies may include:

| Strategy | Description |

|---|---|

| Holding Period | Hold the 1inch for a longer period of time to qualify for preferential tax rates on long-term capital gains. |

| Tax Harvesting | Offset capital gains from the conversion by selling other investments at a loss. |

| Dollar-Cost Averaging | Convert 1inch in smaller increments over time to spread out capital gains and potentially reduce your tax liability. |

| Seek Professional Advice | Consult with a tax professional or accountant who specializes in cryptocurrency taxation to ensure you are taking advantage of all available tax-saving strategies. |

Remember, tax laws and regulations regarding cryptocurrency are constantly evolving, and it is important to stay informed and seek professional advice if needed. By understanding the tax implications and implementing effective tax planning strategies, you can navigate the conversion of 1inch to different cryptocurrencies in a tax-efficient manner.

Question-answer:

What is the purpose of this product?

The purpose of this product is to provide information on the tax implications of converting 1inch to different cryptocurrencies.

What are the potential tax implications of converting 1inch to other cryptocurrencies?

The tax implications of converting 1inch to other cryptocurrencies can vary depending on factors such as your country’s tax laws and the specific type of cryptocurrency being converted to. It’s important to consult with a tax professional for personalized advice.

Are there any specific tax strategies or considerations when converting 1inch to different cryptocurrencies?

Yes, there may be certain tax strategies or considerations to keep in mind when converting 1inch to different cryptocurrencies. For example, some countries may consider such conversions as taxable events and require reporting of capital gains or losses. It’s important to stay informed about your country’s tax regulations and consult with a tax professional for guidance.