In the world of decentralized finance (DeFi), innovations emerge at a rapid pace, and 1inch has quickly captured the attention of both investors and enthusiasts alike. This analysis aims to evaluate the potential impact of the 1inch project, as presented in its whitepaper, on the market. With a focus on providing efficient and user-friendly DeFi solutions, 1inch has the potential to revolutionize the way users access and navigate the decentralized ecosystem.

The core concept behind 1inch is the aggregation of decentralized exchanges (DEXs) to provide users with the best possible trading rates and minimal slippage. By leveraging smart contract technology and advanced algorithms, 1inch intelligently splits users’ orders across multiple DEXs to ensure optimal price execution. This unique approach not only saves users time and effort but also maximizes their potential returns.

One of the standout features of 1inch is its Pathfinder algorithm, which dynamically routes users’ trades across different liquidity sources. This decentralized liquidity protocol considers various factors, such as gas fees, liquidity depth, and market prices, to ensure the highest possible efficiency and cost-effectiveness. By utilizing multiple DEXs simultaneously, 1inch minimizes the risk of market manipulation and ensures fair and transparent trading.

Furthermore, 1inch is empowering users with the ability to create their own liquidity pools and optimize their capital allocation. Through its Mooniswap feature, users can become liquidity providers and earn passive income by contributing to the liquidity of various tokens. This not only stimulates liquidity across the ecosystem but also incentivizes users to actively participate and contribute to the growth of the 1inch network.

In conclusion, 1inch has the potential to disrupt the decentralized finance landscape with its innovative approach to aggregating and optimizing trades across multiple DEXs. By providing users with the best possible trading rates and minimal slippage, while also facilitating the creation of liquidity pools, 1inch consolidates its position as a leading player in the DeFi space. The analysis of its whitepaper highlights the project’s market impact and lays the foundation for its future growth and success.

Analyzing 1inch Whitepaper

The 1inch whitepaper provides a comprehensive overview of the protocol and its potential impact on the market. This analysis aims to delve deeper into the details presented in the whitepaper and evaluate the viability of the project.

Overview

The whitepaper begins with an introduction to the 1inch protocol, highlighting its purpose to enable users to access the most efficient liquidity across various decentralized exchanges (DEXs). It discusses the challenges faced by DEX users in terms of fragmented liquidity and high slippage and how 1inch aims to address these issues.

The whitepaper then provides an overview of the key components of the 1inch protocol, including the routing algorithm, the gas token, and the liquidity protocol aggregator. It explains how the routing algorithm enables users to find the most cost-effective paths for token swaps, while the gas token reduces transaction costs. The liquidity protocol aggregator combines multiple liquidity sources to provide users with the best possible rates.

Market Impact

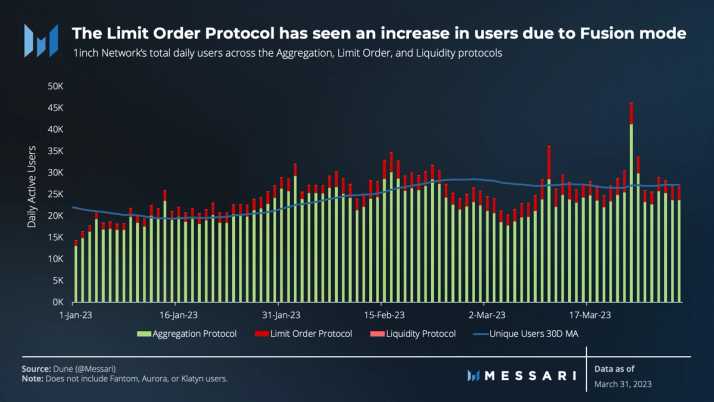

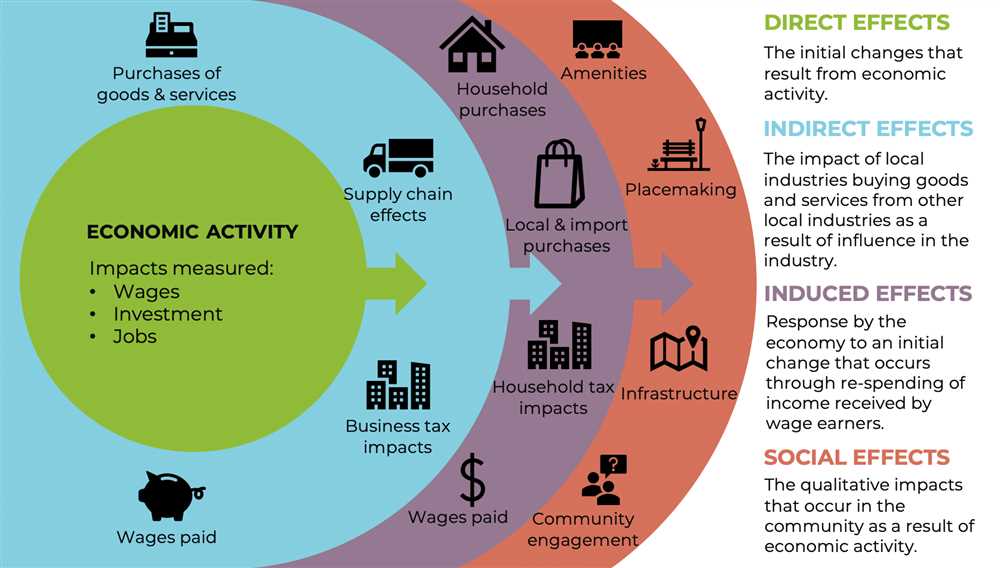

One of the key strengths of the 1inch protocol, as outlined in the whitepaper, is its ability to significantly improve the user experience on DEXs. By aggregating liquidity from multiple sources and optimizing token swaps, 1inch aims to reduce slippage and provide users with better rates. This could attract a larger user base to DEXs and potentially increase trading volumes.

Besides improving the user experience, the 1inch protocol also has the potential to disrupt the existing decentralized finance (DeFi) landscape. By enabling users to access the best liquidity across DEXs, it could challenge the dominance of established platforms and lead to a more decentralized ecosystem. Additionally, the gas token introduced by 1inch has the potential to reduce transaction costs, making DeFi more accessible to a wider audience.

However, it is important to note that the success of the 1inch protocol depends on various factors, including the availability and quality of liquidity sources, user adoption, and potential regulatory challenges. These factors can significantly impact the market impact of the project.

Conclusion

In conclusion, the 1inch whitepaper provides a detailed analysis of the protocol and its potential impact on the market. While the project has the potential to significantly improve the user experience on DEXs and disrupt the existing DeFi landscape, it is crucial to consider various factors that could affect its success. Further research and analysis are needed to assess the viability and long-term sustainability of the 1inch protocol.

Market Impact of 1inch

1inch is a decentralized exchange aggregator that allows users to find the best trading prices across multiple exchanges. The platform aims to provide users with the most efficient and cost-effective way to trade cryptocurrencies.

With its innovative technology and user-friendly interface, 1inch has gained significant traction in the market. The platform’s popularity has grown rapidly due to its ability to offer lower fees and better prices compared to traditional exchanges.

1inch has also made significant advancements in terms of liquidity. By utilizing various liquidity sources, such as decentralized exchanges and liquidity providers, the platform ensures that users have access to the most competitive prices and a wide range of trading options.

As a result of these factors, 1inch has had a notable impact on the crypto market. The platform has attracted a large number of users, including both retail and institutional investors, who are looking to optimize their trading strategies and maximize their returns.

Furthermore, the introduction of its native token, 1INCH, has further increased the platform’s market impact. The token provides users with additional benefits, such as discounted fees and governance rights, incentivizing users to hold and use the token within the 1inch ecosystem.

Overall, 1inch’s market impact has been significant, bringing about increased competition and innovation in the decentralized finance (DeFi) space. The platform’s ability to offer better prices and lower fees, combined with its advanced liquidity solutions, has positioned it as a leading player in the market, driving adoption and reshaping the way users trade cryptocurrencies.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges and provides users with the best possible trading rates. It is built on Ethereum and uses smart contracts to facilitate seamless and secure transactions.

How does 1inch work?

1inch works by splitting user trades across multiple decentralized exchanges (DEXs) to find the most optimal trading route. It uses a combination of on-chain smart contracts and off-chain algorithms to ensure that users get the best possible prices and lowest slippage.

What are the advantages of using 1inch?

There are several advantages of using 1inch. Firstly, it allows users to access liquidity from multiple DEXs, increasing the chances of finding the best rates and reducing slippage. Secondly, it offers users the ability to execute trades without needing to create multiple accounts on different exchanges. Lastly, 1inch is built on Ethereum, which provides a high level of security and transparency.

What impact does 1inch’s whitepaper have on the market?

1inch’s whitepaper has a significant impact on the market as it outlines the project’s vision, goals, and technical details. It provides potential investors and users with a clear understanding of how the platform works and the potential benefits it offers. The whitepaper also serves as a marketing tool, attracting attention from the crypto community and helping to build trust and credibility.