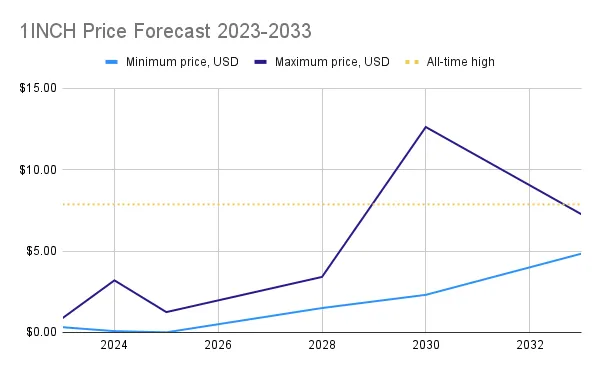

Decentralized finance (DeFi) has revolutionized the way we think about traditional financial systems. It has introduced innovative solutions that provide users with more control over their assets and reduced dependency on intermediaries. One of the most promising DeFi platforms is 1inch Fusion, a decentralized exchange aggregator that offers a range of features and benefits. In this article, we will compare 1inch Fusion with traditional exchanges and analyze how it stands out in the ever-evolving DeFi landscape.

Traditional exchanges have long been the go-to platform for buying and selling cryptocurrencies. However, they often suffer from liquidity issues and high fees. This is where 1inch Fusion comes in. By utilizing a combination of smart contracts and an intuitive interface, 1inch Fusion is able to offer users access to multiple decentralized exchanges, effectively solving the liquidity problem. This means that users can find the best possible rates for their trades and benefit from lower fees compared to traditional exchanges.

Another important aspect where 1inch Fusion excels is the user experience. Traditional exchanges can be complex and intimidating for newcomers, requiring a steep learning curve. On the other hand, 1inch Fusion provides a user-friendly interface that simplifies the trading process. It offers a seamless and intuitive experience, making it accessible to both beginners and experienced traders. Additionally, 1inch Fusion incorporates the latest security measures to protect users’ funds, ensuring a safe and reliable trading environment.

Furthermore, 1inch Fusion goes beyond the capabilities of traditional exchanges by introducing innovative features. One such feature is the possibility to perform yield farming within the platform. Users can easily stake their assets and earn attractive yields, all without leaving the 1inch Fusion ecosystem. This not only enhances the earning opportunities for users but also simplifies the overall DeFi experience by consolidating multiple functionalities into a single platform.

In conclusion, 1inch Fusion sets itself apart from traditional exchanges by offering enhanced liquidity, a user-friendly interface, and innovative features. It provides users with better control over their assets and enables them to take advantage of the benefits offered by the rapidly growing DeFi industry. As DeFi continues to evolve, platforms like 1inch Fusion will play a crucial role in reshaping the financial landscape, empowering individuals, and promoting financial inclusion.

1inch Fusion: Revolutionizing the Crypto Trading Experience

Crypto trading has come a long way since its inception, with traditional exchanges dominating the market for a significant period of time. However, with the emergence of innovative decentralized platforms, such as 1inch Fusion, the landscape of crypto trading is undergoing a revolutionary change.

1inch Fusion is a cutting-edge decentralized exchange aggregator that is designed to provide users with the best possible trading experience. By utilizing state-of-the-art technology and advanced algorithms, 1inch Fusion is able to aggregate liquidity from various decentralized exchanges, optimizing the trading process for users.

Enhanced Liquidity

One of the key features that sets 1inch Fusion apart from traditional exchanges is its ability to access liquidity from multiple sources. Instead of relying on a single exchange, 1inch Fusion taps into a network of decentralized exchanges, ensuring that users have access to the best available rates and a wide variety of trading pairs.

This enhanced liquidity is especially valuable during periods of high volatility, as it allows users to execute trades quickly and efficiently without experiencing slippage or price manipulation.

Reduced Fees

In addition to enhanced liquidity, 1inch Fusion also offers significantly lower fees compared to traditional exchanges. By aggregating liquidity and routing trades through the most cost-effective paths, 1inch Fusion is able to minimize transaction costs for users.

This reduction in fees can have a substantial impact on traders’ profitability, especially for those who engage in high-frequency trading or execute large volume trades.

Furthermore, 1inch Fusion’s transparent fee structure ensures that users have complete visibility into the costs associated with their trades, promoting trust and accountability within the platform.

Overall, 1inch Fusion is revolutionizing the crypto trading experience by providing enhanced liquidity and reducing fees for users. With its decentralized and innovative approach, 1inch Fusion is paving the way for a new era of crypto trading that is more accessible, efficient, and user-centric.

Traditional Exchanges: The Established Titans of Crypto Trading

Traditional exchanges have long been the dominant players in the world of cryptocurrency trading. These well-known platforms, such as Binance, Coinbase, and Kraken, have built a reputation for reliability, security, and liquidity.

One of the main advantages of traditional exchanges is their extensive trading volume. With millions of users and a wide range of available cryptocurrencies, these exchanges offer deep liquidity, enabling traders to execute large orders without significantly impacting the market.

Additionally, traditional exchanges often provide advanced trading features and tools, such as limit orders, stop-loss orders, and margin trading. These features allow experienced traders to implement complex trading strategies and manage risk effectively.

Another key advantage of established exchanges is their compliance with regulatory requirements. Many traditional exchanges operate within legal frameworks and adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This compliance helps to ensure the safety of user funds and prevents illicit activities.

Moreover, traditional exchanges have a track record of handling security incidents professionally and compensating affected users. Their robust security measures, such as cold storage wallets and two-factor authentication, provide an added layer of protection for users’ funds.

Despite these advantages, traditional exchanges are not without their drawbacks. One significant disadvantage is the lack of interoperability between different exchanges. Transferring funds between exchanges often requires multiple steps and can be time-consuming and costly.

Furthermore, traditional exchanges typically charge higher fees compared to decentralized exchanges like 1inch Fusion. These fees can eat into profits, especially for high-volume traders or frequent traders.

In conclusion, traditional exchanges have established themselves as the giants of crypto trading. With their deep liquidity, advanced trading features, and regulatory compliance, they continue to attract millions of users. However, the emergence of decentralized exchanges poses a new challenge, as they offer lower fees and improved interoperability. It will be interesting to see how traditional exchanges evolve and adapt to these changes in the ever-evolving cryptocurrency ecosystem.

Comparative Analysis: Evaluating the Pros and Cons

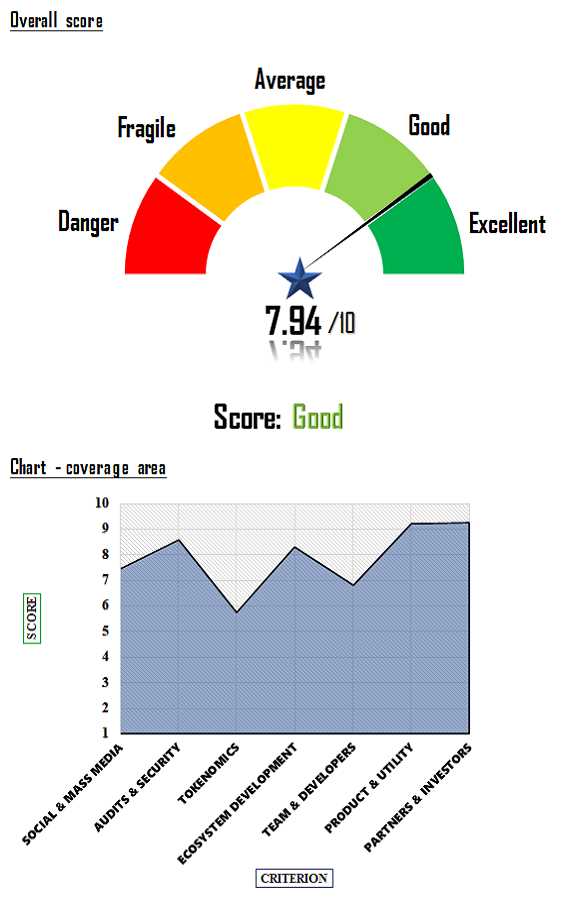

When it comes to choosing between 1inch Fusion and traditional exchanges, it is essential to consider the pros and cons of each option. This comparative analysis aims to highlight the advantages and disadvantages associated with both platforms.

1inch Fusion

- Advantages:

- 1. Superior liquidity: 1inch Fusion aggregates liquidity from various decentralized exchanges, ensuring that users get the best possible rates for their trades.

- 2. Reduced slippage: The advanced algorithm behind 1inch Fusion minimizes slippage by splitting orders across multiple decentralized exchanges.

- 3. Lower fees: 1inch Fusion offers competitive fees compared to traditional exchanges, thanks to its decentralized nature and innovative technology.

- 4. Enhanced security: As a non-custodial platform, 1inch Fusion protects user funds by allowing them to retain control of their private keys.

- Disadvantages:

- 1. Learning curve: Users unfamiliar with decentralized exchanges may find it challenging to navigate through the 1inch Fusion interface initially.

- 2. Limited asset availability: While 1inch Fusion supports a wide range of assets, there may be certain tokens or coins that are not available on the platform.

- 3. Potential smart contract risks: Despite audit and security measures, there is always a risk associated with using smart contracts on decentralized platforms like 1inch Fusion.

Traditional Exchanges

- Advantages:

- 1. Familiar interface: Traditional exchanges have a user-friendly interface that is easy to navigate, making it accessible for both beginners and experienced traders.

- 2. Variety of trading pairs: Traditional exchanges generally offer a wide range of trading pairs, allowing users to trade various cryptocurrencies and fiat currencies.

- 3. Established reputation: Many traditional exchanges have been operating for years and have built a solid reputation within the cryptocurrency community.

- 4. Additional features: Some traditional exchanges offer advanced features such as margin trading, futures contracts, and lending services.

- Disadvantages:

- 1. High fees: Traditional exchanges often charge higher fees compared to decentralized platforms like 1inch Fusion.

- 2. Lack of privacy: Traditional exchanges require users to go through a lengthy verification process, compromising their privacy.

- 3. Centralized control: With traditional exchanges, users have to trust a centralized authority to handle their funds, which can be a security risk.

- 4. Slower transactions: Traditional exchanges may take longer to process transactions due to their centralized nature and the involvement of intermediaries.

Ultimately, the choice between 1inch Fusion and traditional exchanges depends on individual preferences and requirements. While 1inch Fusion offers enhanced liquidity, lower fees, and improved security, traditional exchanges provide a familiar interface and additional features. It is important to carefully evaluate the pros and cons before making a decision.

Question-answer:

What is 1inch Fusion?

1inch Fusion is a new protocol that allows users to execute trades across multiple decentralized exchanges (DEXs) at once. It combines liquidity from various DEXs to offer users the best possible prices and optimal trading routes. 1inch Fusion aims to provide a seamless trading experience by aggregating liquidity and minimizing slippage.

How does 1inch Fusion compare to traditional exchanges?

1inch Fusion offers several advantages over traditional exchanges. Firstly, it allows users to access liquidity from multiple DEXs, which can lead to better prices and reduced slippage. Traditional exchanges may have limited liquidity, especially for less popular tokens. Additionally, 1inch Fusion provides users with more control over their trades, as they can choose from a variety of liquidity sources. This transparency is not always present in traditional exchanges. However, it’s important to note that 1inch Fusion operates on the Ethereum blockchain, which means that users must pay gas fees for each transaction.