Discover the future of cryptocurrency with 1inch Coin, a dynamic digital asset that continues to redefine the global financial landscape. As regulatory developments take center stage, the 1inch Coin market cap is poised for exponential growth.

Empower your investments with 1inch Coin, a decentralized cryptocurrency that puts you in control. With its innovative smart contract system and advanced trading algorithms, 1inch Coin offers unparalleled security and efficiency in the ever-evolving digital economy.

Stay ahead of the curve as regulatory frameworks shape the future of the cryptocurrency market. With an increasing number of jurisdictions embracing digital currencies, 1inch Coin is paving the way for mainstream adoption and global acceptance.

Invest in the future of finance with 1inch Coin. Join the revolution today and seize the opportunity to be part of the next generation of wealth creation.

The Importance of Regulatory Developments

The world of cryptocurrency is constantly evolving, with new coins and projects being introduced all the time. As the market matures, regulatory developments play a crucial role in shaping the landscape for these digital assets.

Building Trust and Confidence

Regulatory developments help build trust and confidence among investors and users in the cryptocurrency market. The introduction of regulations ensures that proper checks and balances are in place, protecting investors from fraud and other forms of abuse. This, in turn, encourages more people to participate in the market, driving its growth and mainstream adoption.

Mitigating Risks

The cryptocurrency market is not without its risks. Regulatory developments help mitigate these risks by introducing measures to prevent money laundering, terrorist financing, and other illicit activities. By enforcing compliance with these regulations, authorities can create a safer environment for both investors and users, minimizing the likelihood of financial crimes.

Furthermore, regulatory developments also address concerns regarding the integrity and stability of the market. Rules and guidelines are put in place to prevent market manipulation, enhancing transparency and fairness in trading. This fosters a level playing field for all participants, promoting healthy competition and the overall development of the market.

Fostering Innovation

While some may view regulations as restrictive, they can actually foster innovation in the cryptocurrency market. Clear guidelines and frameworks provide companies and entrepreneurs with a clearer path to navigate, reducing uncertainty and encouraging investment. With more certainty, innovators can focus on developing new technologies and solutions, driving the industry forward.

Regulatory developments also promote collaboration between traditional financial institutions and the cryptocurrency sector. As regulations clarify the legal and compliance requirements, banks and other financial institutions can more confidently engage with cryptocurrency companies. This collaboration can lead to the development of new financial products and services that bridge the traditional and digital asset worlds.

Conclusion

Regulatory developments have become an essential part of the cryptocurrency market. They bring trust, mitigate risks, foster innovation, and pave the way for widespread adoption. As the industry continues to evolve, it is crucial to stay informed about regulatory developments and adapt to the changing landscape to ensure a secure and prosperous future for the cryptocurrency market.

Understanding the Market

In order to fully grasp the implications of regulatory developments on the 1inch Coin market cap, it is crucial to have a deep understanding of the market itself. The market for cryptocurrencies is highly complex and constantly evolving, influenced by a multitude of factors and players.

First and foremost, it is important to recognize that the 1inch Coin market is a subset of the broader cryptocurrency market. Cryptocurrencies are decentralized digital assets that rely on cryptography for security and operate independently of central banks. As such, they are not subject to traditional financial regulations and can be traded freely on various decentralized exchanges.

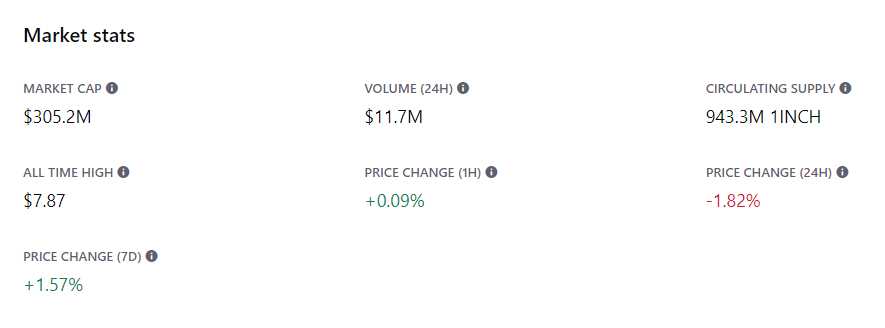

The 1inch Coin market cap is a measure of its total market value, calculated by multiplying the circulating supply of coins by the current market price. This market cap is a key indicator of the popularity and value of 1inch Coin within the broader cryptocurrency market.

Regulatory developments can have a significant impact on the 1inch Coin market cap. Governments and regulatory bodies around the world are still grappling with how to regulate cryptocurrencies, as they represent a new and disruptive force in the financial industry. Various countries have taken different approaches, ranging from outright bans to more permissive frameworks.

For example, if a major country were to implement strict regulations on cryptocurrencies, such as banning their use or imposing heavy taxes, it could have a severe impact on the 1inch Coin market cap. Investors may become hesitant to buy or hold 1inch Coins, leading to a decrease in demand and ultimately a decrease in market value.

On the other hand, if regulatory developments are favorable and create a supportive environment for cryptocurrencies, it can have a positive effect on the 1inch Coin market cap. Increased acceptance and recognition by governments and financial institutions can lead to a surge in demand and increased market value.

It is also worth noting that regulatory developments are not the only factor influencing the 1inch Coin market cap. Other factors, such as technological advancements, market sentiment, and the actions of influential market players, can also play a significant role.

Overall, understanding the market dynamics and how regulatory developments can shape the 1inch Coin market cap is essential for anyone looking to invest in or trade cryptocurrencies. It requires a careful analysis of the broader cryptocurrency market, as well as keeping a close eye on regulatory news and developments around the world.

Impact on Coin Market Cap

1. Market Volatility

Regulatory developments can have a significant impact on the volatility of the coin market cap. New regulations or policies can create uncertainty and cause price fluctuations in the market. Investors may be hesitant to enter or exit the market until they have a clear understanding of the regulations and their implications. This can result in increased volatility and a decline in the overall market cap of coins.

2. Investor Sentiment

Regulatory developments can also influence investor sentiment, thereby affecting the coin market cap. Positive regulatory developments, such as the introduction of favorable regulations or the recognition of coins as legitimate assets, can boost investor confidence and drive up the market cap. On the other hand, negative regulatory developments, such as bans or strict regulations, can dampen investor sentiment and lead to a decrease in the market cap.

3. Market Accessibility

Regulatory developments that enhance market accessibility can have a positive impact on the coin market cap. For example, the introduction of clear regulations and licensing frameworks can attract institutional investors and traditional financial institutions to enter the market. This influx of new participants can increase the liquidity and market cap of coins.

However, regulatory developments that restrict market accessibility, such as strict KYC (Know Your Customer) requirements or limited trading hours, can hinder the growth of the coin market cap. It may discourage new investors from entering the market and limit the overall adoption and usage of coins.

4. Market Innovation

Regulatory developments can also shape the level of market innovation and technological advancements in the coin market cap. Supportive regulations that promote technological innovation and provide a conducive environment for startups and developers can drive the development of new and innovative coins. This can lead to an increase in the market cap as investors recognize the potential of these new coins.

However, overly restrictive regulations can stifle innovation and limit the growth of the coin market cap. If regulations are too burdensome or hinder the development of new technologies, it can deter investors and limit the overall market cap of coins.

Conclusion

The role of regulatory developments in shaping the coin market cap cannot be underestimated. These developments can impact market volatility, investor sentiment, market accessibility, and market innovation. It is essential for investors and market participants to closely monitor regulatory developments and assess their potential impact on the coin market cap.

The Role of Regulation

Regulation plays a crucial role in shaping the 1inch Coin market cap. As the cryptocurrency market continues to grow and evolve, regulatory developments have become increasingly important in creating a stable and secure environment for investors and users.

The Need for Regulation

With the rising popularity of cryptocurrencies like 1inch Coin, there is a growing need for regulatory oversight to protect investors and prevent fraudulent activities. Regulation provides a framework to ensure fair trading practices, transparency, and accountability in the market.

Ensuring Investor Protection

Regulatory developments aim to protect investors from scams, fraud, and market manipulation. They establish rules and standards that companies and individuals in the cryptocurrency industry must adhere to, promoting trust and confidence among investors.

By implementing measures such as Know Your Customer (KYC) and Anti-Money Laundering (AML) policies, regulators ensure that only legitimate participants are involved in the market, reducing the risk of money laundering and other illicit activities.

Regulation also plays a crucial role in safeguarding investors’ funds. It sets requirements for custodial services, exchanges, and other service providers to implement robust security measures and best practices to protect users’ assets.

Promoting Market Stability

Regulation helps maintain market stability by implementing measures to prevent market manipulation, insider trading, and price manipulation. By monitoring and enforcing compliance with these regulations, authorities protect the integrity of the 1inch Coin market cap.

Furthermore, regulatory developments contribute to the overall development and maturation of the cryptocurrency market. They provide clarity and certainty to market participants, attracting institutional investors and fostering mainstream adoption of cryptocurrencies like 1inch Coin.

In conclusion, regulation plays a vital role in shaping the 1inch Coin market cap. It ensures investor protection, promotes market stability, and contributes to the overall growth of the cryptocurrency industry. By establishing a secure and transparent environment, regulatory developments lay the foundation for a sustainable and prosperous market.

Question-answer:

What is the role of regulatory developments in shaping the 1inch Coin Market Cap?

The role of regulatory developments in shaping the 1inch Coin Market Cap is significant. Regulations, such as those related to the cryptocurrency industry, can greatly impact the market cap of coins like 1inch. These regulations can affect how the coin is traded, listed on exchanges, and used within the industry. Any changes in regulations can lead to fluctuations in the market cap of 1inch.

How do regulatory developments affect the market cap of 1inch Coin?

Regulatory developments can affect the market cap of 1inch Coin in several ways. First, if regulations become more stringent, it may deter investors from entering the market and investing in 1inch Coin, which can lead to a decrease in market cap. On the other hand, if regulations become more favorable and provide a favorable environment for cryptocurrency investments, it may attract more investors and result in an increase in market cap. Therefore, regulatory developments can have both positive and negative impacts on the market cap of 1inch Coin.