The 1inch decentralized exchange aggregator has emerged as a game-changer in the world of cryptocurrency trading. With its unique approach to achieving optimal trades, the 1inch platform has quickly gained popularity among traders and investors alike. In this in-depth analysis, we will delve into the 1inch whitepaper to understand the underlying technology and concepts behind this revolutionary platform.

At its core, the 1inch platform aims to solve the problem of fragmented liquidity across various decentralized exchanges (DEXs). By aggregating liquidity from multiple DEXs, 1inch is able to provide users with the best possible trading rates and minimize slippage. The platform achieves this through the use of smart contracts and sophisticated algorithms, ensuring that users can execute trades at the most favorable prices.

The 1inch whitepaper outlines a number of innovative features that set it apart from other DEX aggregators. One such feature is the Pathfinder algorithm, which automatically splits a user’s trade across multiple DEXs to achieve the best possible outcome. The whitepaper provides a detailed explanation of how the Pathfinder algorithm works, including its methodology for calculating trade volumes and determining the optimal distribution of funds.

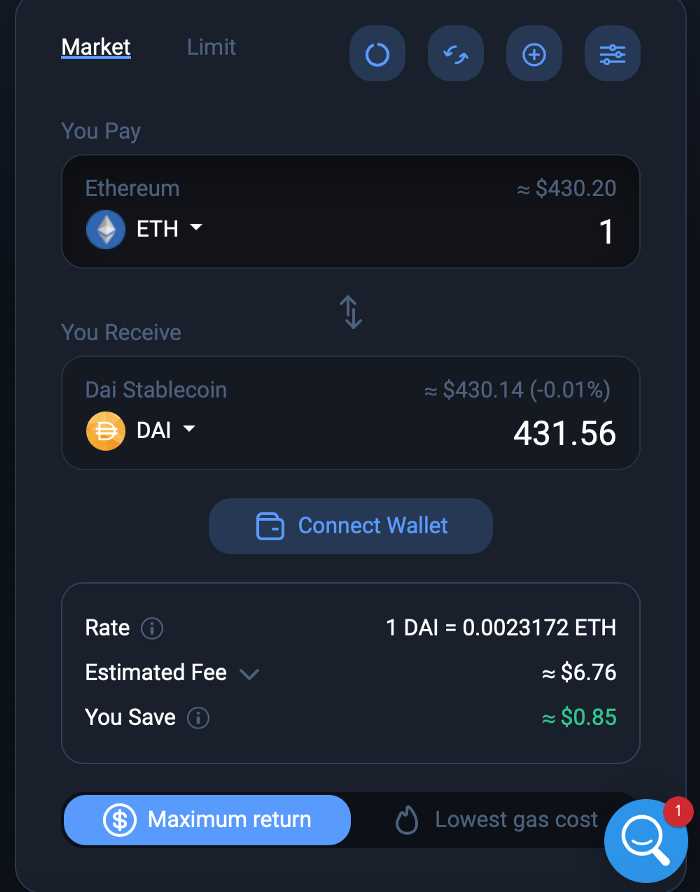

Another key aspect of the 1inch platform is its focus on gas optimization. Gas fees have long been a hurdle for traders on Ethereum, often making small trades prohibitively expensive. To address this issue, the 1inch team has developed a technique known as “Chi Gas Token.” This innovative approach allows users to reduce gas fees by up to 40%, making trading on the 1inch platform more accessible and cost-effective.

In conclusion, the 1inch whitepaper offers a comprehensive analysis of the underlying technology and concepts that make the platform one of the leading DEX aggregators in the market. By leveraging advanced algorithms, smart contracts, and gas optimization techniques, 1inch is able to provide users with an unrivaled trading experience. As the cryptocurrency industry continues to evolve, platforms like 1inch are paving the way for a more efficient and accessible trading ecosystem.

Understanding the 1inch Protocol

The 1inch protocol is a decentralized exchange (DEX) aggregator that aims to provide users with the most efficient trades across multiple liquidity sources. It was created to solve the issue of fragmented liquidity in the decentralized finance (DeFi) space, where users often have to split their trades across different platforms to find the best prices.

How does it work?

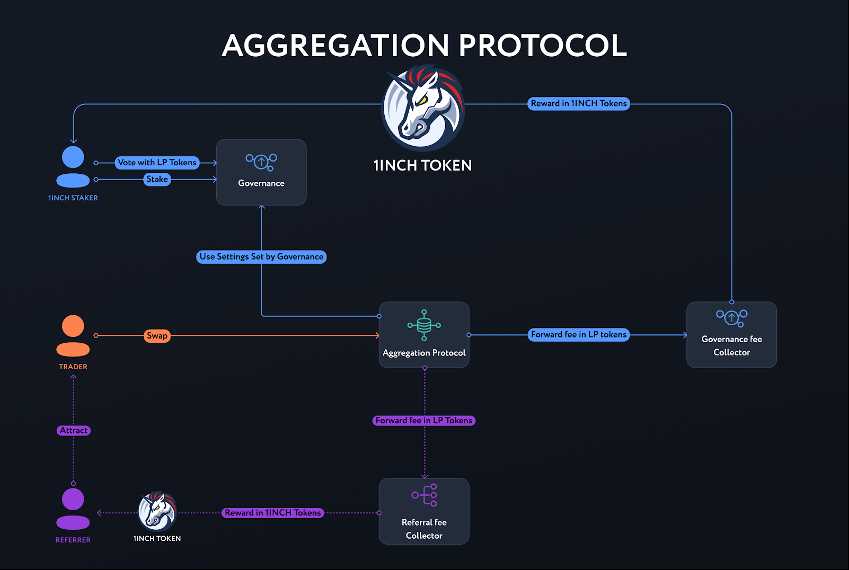

The 1inch protocol achieves optimal trades by splitting a user’s trade across multiple DEXs and liquidity pools. It utilizes smart contract technology to interact with various liquidity sources, including popular DEXs like Uniswap, SushiSwap, and Balancer, as well as other liquidity aggregators.

When a user submits a trade request on 1inch, the protocol analyzes the available liquidity across different platforms and identifies the best possible route to execute the trade. It takes into account factors such as token prices, trading fees, and slippage to ensure the user gets the most favorable outcome.

Benefits of using the 1inch protocol

The 1inch protocol offers several advantages over traditional DEXs and other liquidity aggregators:

- Optimal trade execution: By splitting trades across multiple platforms, the protocol can achieve better prices and lower slippage, resulting in more favorable outcomes for users.

- Reduced fees: The protocol aims to minimize trading fees by finding the best possible route and taking into account different fee structures across platforms.

- Increased liquidity: By aggregating liquidity from various sources, the protocol provides users with access to a larger pool of assets, improving liquidity and reducing the risk of failed trades.

- User-friendly interface: The 1inch platform offers an intuitive interface that allows users to easily submit trade requests and track their transactions.

- Decentralized and transparent: The protocol is built on blockchain technology, ensuring transparency and eliminating the need for intermediaries.

In conclusion, the 1inch protocol is a powerful tool for users looking to optimize their trades in the decentralized finance space. By leveraging the protocol’s aggregation capabilities and smart contract technology, users can achieve better prices, lower fees, and increased liquidity, ultimately enhancing their trading experience.

Key Features of the 1inch Whitepaper

1. One Token Governance: The 1inch whitepaper introduces a unique governance model that is based on holding the 1INCH token. This token allows holders to participate in the decision-making process of the protocol, including voting on important updates and changes.

2. Liquidity Aggregation: One of the key features of 1inch is its ability to aggregate liquidity from multiple decentralized exchanges (DEXs). This allows users to access the best possible prices for their trades by finding the most optimal paths across different exchanges.

3. Smart Contract Wallet: The whitepaper introduces the concept of a smart contract wallet, which enables users to optimize their trades by automatically splitting them across multiple DEXs. This feature maximizes the chances of getting the best possible price for a trade.

4. Gas Optimization: The 1inch protocol aims to minimize the gas fees paid by users when executing trades. The whitepaper outlines various techniques that can be used to reduce gas costs, including the use of data compression, gas token strategies, and flash loans.

5. Security: The whitepaper emphasizes the importance of security and provides details on how the 1inch protocol addresses security concerns. This includes the use of audits, bug bounties, and a robust governance process to ensure the safety and integrity of the protocol.

6. Cross-Chain Swaps: Another key feature of the 1inch protocol is its ability to facilitate cross-chain swaps. This allows users to trade assets across different blockchain networks, such as Ethereum and Binance Smart Chain, without the need for intermediaries.

7. User-Friendly Interface: The whitepaper highlights the importance of providing a user-friendly interface for users to interact with the 1inch protocol. This includes easy-to-use tools and features that allow users to customize and optimize their trades according to their preferences.

8. Governance Rewards: Lastly, the whitepaper introduces the concept of governance rewards, which incentivizes token holders to actively participate in the governance process. By holding 1INCH tokens and participating in voting, users can earn additional rewards.

These key features outlined in the 1inch whitepaper demonstrate the innovative and user-centric approach of the protocol, aiming to provide users with the best possible trading experience across decentralized exchanges.

The Benefits of Optimal Trades

Optimal trades provide numerous advantages for traders and investors in the cryptocurrency market. By achieving optimal trades, users can unlock the following benefits:

1. Increased Profitability

When trades are executed optimally, it leads to increased profitability for users. By minimizing slippage and maximizing trading volumes, traders can take advantage of price discrepancies across multiple decentralized exchanges (DEXs). This allows them to buy low and sell high, ultimately generating higher profits.

2. Reduced Costs

Optimal trades help users save on costs associated with fees and gas prices. Through the use of smart contract technology, the 1inch protocol scans multiple DEXs to find the best prices, thereby minimizing transaction costs. Additionally, by aggregating liquidity, the protocol reduces gas fees and prevents overpayment by selecting the most cost-effective routes for trades.

3. Improved Liquidity

By leveraging decentralized finance (DeFi) protocols, optimal trades contribute to improved liquidity in the cryptocurrency market. Liquidity is enhanced as the 1inch protocol taps into multiple DEXs, allowing users to access a larger pool of assets. This increased liquidity provides more opportunities for users to execute trades and ensures that their orders are filled at the best available prices.

4. Enhanced Security and Privacy

Through the use of smart contracts, the 1inch protocol offers enhanced security and privacy for users. Trades are executed directly on-chain, eliminating the need for intermediaries and minimizing the risk of hacks or security breaches. Additionally, as the protocol does not require any personal information or user identification, it provides a high level of privacy.

Overall, optimal trades bring significant advantages to traders and investors, improving their profitability, reducing costs, enhancing liquidity, and offering enhanced security and privacy. By utilizing the 1inch protocol, users can optimize their trading strategies and take full advantage of the opportunities in the cryptocurrency market.

The Future of the 1inch Protocol

The 1inch Protocol has quickly become a leading decentralized exchange aggregator in the DeFi space, providing users with the ability to optimize their trades across multiple liquidity sources. However, the team behind 1inch is not content to rest on their laurels. They have a clear vision for the future of the protocol, which involves several key developments.

Expanding Liquidity Sources: One of the main goals for the future is to continue expanding the number of liquidity sources available to users. The more liquidity sources that can be aggregated, the more efficient and cost-effective trading becomes. In addition to decentralized exchanges, 1inch is actively exploring partnerships with centralized exchanges and other liquidity providers to further enhance liquidity options.

Optimizing Trading Algorithms: To achieve the best possible trade outcomes for users, the 1inch team is continuously working on improving and refining their trading algorithms. This involves analyzing vast amounts of data to identify patterns and trends, and implementing innovative strategies to optimize trades. By fine-tuning the algorithms, the protocol aims to consistently provide users with the best possible trading experience.

Scaling and Interoperability: As the demand for decentralized finance continues to grow, scalability and interoperability become essential. The 1inch Protocol plans to address these challenges by exploring layer 2 solutions and cross-chain interoperability. This will enable users to access the protocol’s capabilities seamlessly across different blockchains, while also ensuring scalability to handle increased transaction volumes.

Governance and Community Involvement: As a decentralized protocol, 1inch recognizes the importance of community involvement and governance. The team aims to further decentralize decision-making processes and empower the community to actively participate in shaping the protocol’s future. This includes initiatives such as decentralized governance and the implementation of tokenomics that align the interests of all stakeholders.

In conclusion, the future of the 1inch Protocol holds exciting prospects. With plans to expand liquidity sources, optimize trading algorithms, address scalability and interoperability, and empower the community, the team is committed to continually evolving and improving the protocol to provide users with the best possible trading experience.

Question-answer:

What is the 1inch protocol?

The 1inch protocol is a decentralized exchange aggregator that allows users to find and execute the most optimal trades across multiple decentralized exchanges.

How does the 1inch protocol achieve optimal trades?

The 1inch protocol achieves optimal trades by splitting a user’s trade across multiple decentralized exchanges to find the best prices and lowest slippage. It also uses Pathfinder, an automated market maker representation, to optimize trade paths and minimize costs.