1inch is a powerful decentralized exchange aggregator that allows users to make automated market making transactions quickly, efficiently, and securely. With its cutting-edge technology and user-friendly interface, 1inch offers a range of advantages for both seasoned traders and newcomers to the world of decentralized finance.

One of the key benefits of using 1inch is its ability to access and route transactions across multiple decentralized exchanges, ensuring users get the best possible deal for their trades. By leveraging its extensive network of liquidity providers, 1inch offers competitive prices and minimizes slippage, providing users with more favorable rates than they would find on a single exchange.

Additionally, 1inch offers significant cost savings by reducing gas fees. By splitting large trades into smaller parts and executing them across different exchanges, 1inch minimizes the cost of executing transactions on the Ethereum network. This cost-saving mechanism is especially beneficial for users who regularly engage in high-volume trading.

Moreover, 1inch is built on decentralized protocols, which guarantees the security and privacy of users’ transactions. By using advanced smart contract technology and cryptographic encryption, 1inch ensures that users have full control over their funds at all times, without the need to trust any third-party intermediaries.

Whether you are a professional trader looking to optimize your trading strategies or a beginner seeking an intuitive platform to enter the world of decentralized finance, 1inch offers unparalleled benefits for automated market making. Join the growing community of users who are taking advantage of 1inch’s advanced features and start making the most out of your trading experience today.

What is Automated Market Making?

Automated Market Making (AMM) is a revolutionary technology that has transformed the way traders and investors participate in decentralized finance (DeFi) markets. AMM refers to the use of algorithms and smart contracts to enable the automatic creation and maintenance of liquidity in trading pairs.

Traditional markets rely on order books, where buyers and sellers place orders to trade assets at specific prices. However, in DeFi, where trustless and permissionless trading is the norm, order books can be inefficient and expensive to maintain.

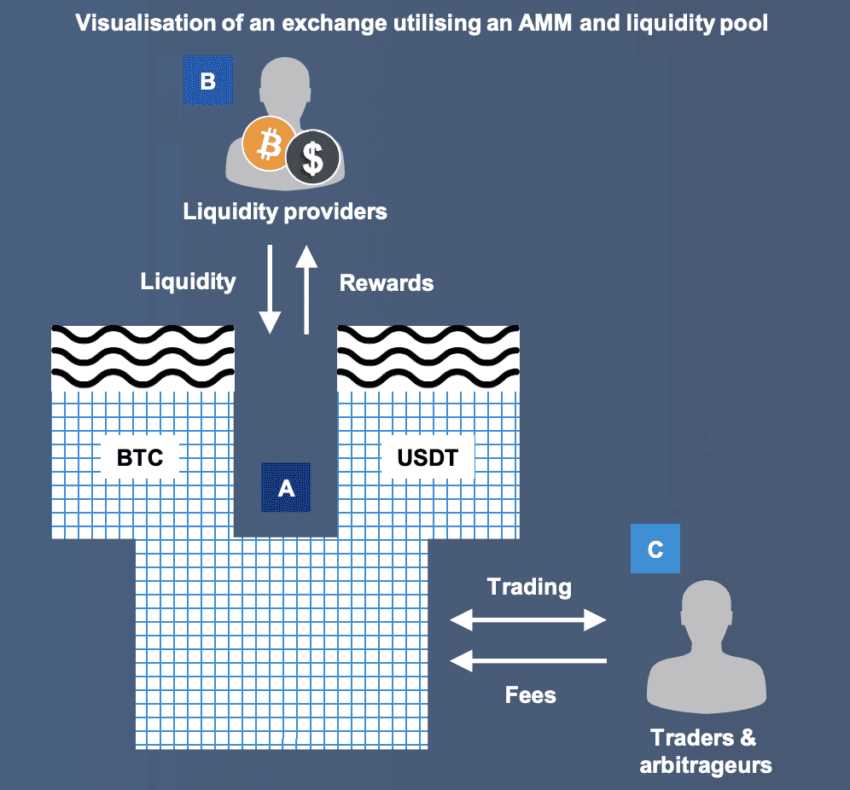

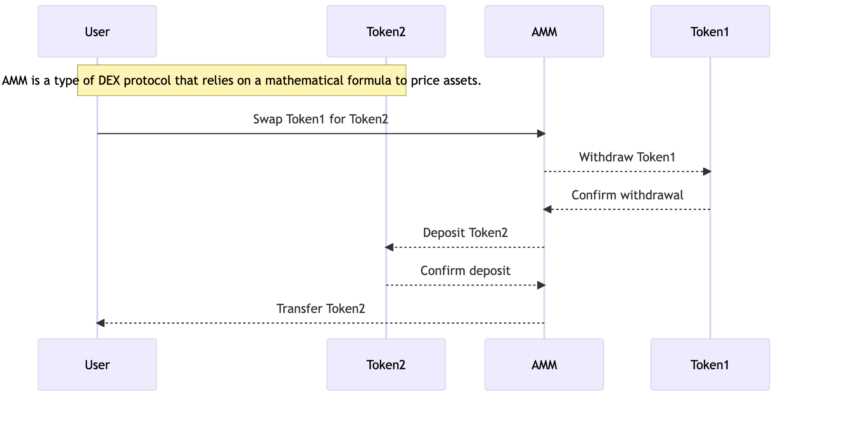

AMM protocols, like 1inch, utilize liquidity pools and mathematical algorithms to facilitate trades without relying on centralized order books. Instead of matching orders between buyers and sellers, AMM platforms provide liquidity by pooling funds into smart contracts.

When a user wants to trade a specific asset, the AMM algorithm calculates the most efficient trade route within the network, taking into account the available liquidity and prices across various liquidity pools. This automated process ensures that traders can instantly execute their trades at fair and competitive prices, without depending on the availability of other traders on the platform.

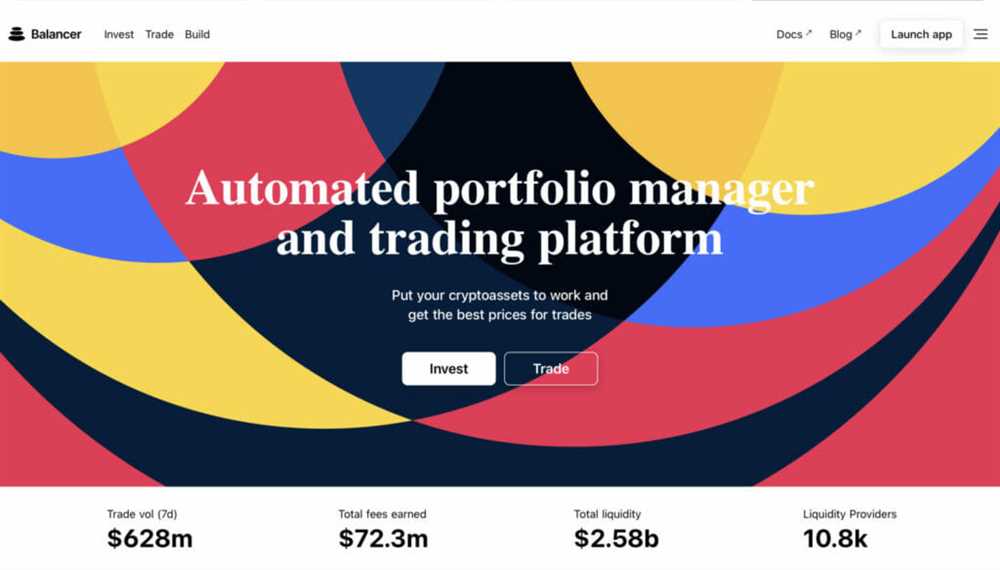

1inch is a leading AMM aggregator that combines multiple liquidity sources and protocols into a single platform, allowing users to access the best prices and highest liquidity across various decentralized exchanges (DEXs).

By using AMM protocols like 1inch, users enjoy several benefits:

- 24/7 Liquidity: AMMs provide continuous liquidity, allowing traders to execute trades anytime without worrying about finding a counterparty.

- Lower Slippage: AMMs use mathematical formulas to determine asset prices based on supply and demand, reducing slippage compared to traditional order book exchanges.

- Reduced Fees: By eliminating the need for intermediaries or order matching services, AMMs can significantly reduce trading fees.

- Access to Various Tokens: AMMs support a wide range of tokens, enabling users to trade and interact with a diverse set of assets and investment opportunities.

- Decentralization and Security: AMMs operate on decentralized networks, ensuring transparency, security, and censorship resistance.

As the DeFi ecosystem continues to grow and evolve, Automated Market Making is playing a crucial role in democratizing access to liquidity and creating a more efficient and inclusive financial system.

The Growing Importance of Automated Market Making

In today’s fast-paced financial markets, the importance of automated market making cannot be overstated. With the increasing popularity of decentralized finance (DeFi) and the rise of cryptocurrency trading, there is a growing need for efficient and reliable market making services.

Automated market making refers to the use of algorithms and smart contracts to facilitate the buying and selling of assets. By providing liquidity to the market, automated market makers (AMMs) enable traders to execute transactions quickly and seamlessly.

One of the key advantages of automated market making is the elimination of middlemen, such as traditional banks or brokers. By leveraging decentralized platforms like 1inch, traders can interact directly with the market and enjoy lower fees and faster execution times.

Moreover, automated market making ensures a fair and transparent trading environment. AMMs use mathematical formulas, such as the constant product formula, to determine the price of assets and maintain balanced liquidity pools. This eliminates the risk of price manipulation and provides traders with reliable and accurate market information.

As the cryptocurrency market continues to grow and evolve, the need for efficient and reliable market making solutions is becoming increasingly important. Automated market makers like 1inch play a crucial role in providing liquidity, improving market efficiency, and empowering traders to participate in the DeFi revolution.

Whether you are a seasoned trader or a DeFi enthusiast, leveraging the benefits of automated market making can greatly enhance your trading experience. With platforms like 1inch, you can enjoy fast and secure transactions, low fees, and a wide range of supported assets.

So, don’t miss out on the growing importance of automated market making. Join the DeFi revolution and experience the benefits for yourself with 1inch.

Lowest Slippage and Best Prices

When it comes to automated market making, one of the most important factors to consider is the slippage. Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. High slippage can eat into potential profits and result in suboptimal trading outcomes.

At 1inch, we understand the significance of lowest slippage in automated market making. Our platform is designed to ensure that users get the best prices for their trades, with minimal slippage. Our advanced algorithms and liquidity aggregators analyze multiple decentralized exchanges and sources to find the best prices and execute trades with the least slippage possible.

Benefits of Lowest Slippage

1. Maximizing Profits: By reducing slippage, users can maximize their profits by getting better prices for their trades. This is especially important when dealing with large transactions or volatile markets where even a small difference in price can have a significant impact on profitability.

2. Minimizing Risks: Low slippage helps to mitigate the risks associated with trading. By executing trades at the expected prices, users can avoid losses caused by unfavorable price movements during the execution of their orders.

3. Better Trading Experience: The combination of lowest slippage and best prices on our platform provides users with a seamless and satisfying trading experience. They can trust that their orders will be executed at the expected prices, resulting in a higher level of confidence and trust in our platform.

With 1inch, users can enjoy the benefits of lowest slippage and best prices, allowing them to make more profitable and successful trades in the world of automated market making.

Experience the power of 1inch and start trading with lowest slippage and best prices today!

Access to Multiple Liquidity Sources

One of the greatest benefits of using 1inch for automated market making is its access to multiple liquidity sources. Traditional decentralized exchanges (DEXs) typically rely on a single liquidity pool, which can lead to limited trading options and higher slippage rates. However, 1inch leverages the power of its unique aggregation algorithm to tap into multiple liquidity sources, unlocking a broader range of trading opportunities for users.

By utilizing multiple liquidity sources, 1inch is able to provide users with improved liquidity and better prices. The aggregation algorithm compares prices and liquidity across various DEXs, selecting the most efficient routes for each trade. This ensures that users can access the best possible prices and obtain optimal trade execution.

Reduced Slippage

With access to multiple liquidity sources, 1inch minimizes slippage, which is the difference between the expected price of a trade and the executed price. Slippage is a common issue in decentralized finance (DeFi), as limited liquidity can cause prices to change rapidly. By aggregating liquidity from different sources, 1inch helps reduce slippage and provides users with more accurate trade executions.

Increased Trading Options

Another advantage of accessing multiple liquidity sources is the increased trading options it offers. Users can access a wider variety of tokens and trading pairs, allowing for greater flexibility in their investment strategies. Whether users are looking to trade popular tokens or explore new and emerging markets, 1inch provides a diverse selection of trading options.

| Benefits of using 1inch for Automated Market Making: |

|---|

| Access to Multiple Liquidity Sources |

| Reduced Slippage |

| Increased Trading Options |

High Efficiency and Cost Savings

When it comes to automated market making, efficiency is key. With 1inch, you can expect high efficiency and cost savings.

Efficient Trading Execution

1inch is designed to provide optimal trading execution, ensuring that your transactions are executed quickly and efficiently. By leveraging cutting-edge technology, 1inch offers low slippage and minimal trade delays, allowing you to make the most of market opportunities.

Cost Savings

By using 1inch for automated market making, you can enjoy significant cost savings. 1inch’s smart routing algorithm scans multiple liquidity sources to find you the best prices and lowest fees, saving you money on every trade. Additionally, 1inch’s gas optimization feature helps reduce transaction costs on the Ethereum network, further enhancing your cost savings.

With 1inch, you can optimize your automated market making strategies, maximizing efficiency and minimizing costs. Start using 1inch today and experience the benefits for yourself.

Question-answer:

What are the benefits of using 1inch for automated market making?

Using 1inch for automated market making offers several benefits. Firstly, it allows users to access liquidity from multiple decentralized exchanges, which increases the chances of getting the best price. Additionally, 1inch has a unique routing algorithm that finds the most efficient paths for executing trades. This can result in lower fees and better execution rates compared to other platforms. Finally, 1inch is known for its user-friendly interface and easy integration, making it a popular choice among traders and developers.

Is 1inch suitable for beginners in automated market making?

While 1inch is a powerful tool for automated market making, it may not be the best choice for beginners. The platform offers a wide range of features and advanced trading strategies that may be overwhelming for someone new to the space. However, if you are willing to put in the time and effort to learn how to use 1inch effectively, it can be a valuable tool for enhancing your trading strategies.

How does 1inch compare to other decentralized exchanges?

1inch sets itself apart from other decentralized exchanges by offering a unique aggregation feature. Instead of relying on a single exchange for liquidity, 1inch aggregates liquidity from multiple decentralized exchanges, giving users access to a larger pool of funds. Additionally, 1inch’s smart contract automatically splits orders across different exchanges to ensure the best possible execution. This can result in better prices and lower slippage compared to other platforms.