1inch is a decentralized exchange aggregator that allows users to find the best trading prices across various decentralized exchanges (DEXs). It is built on the Ethereum blockchain and uses smart contracts to execute trades.

Trading on 1inch exchange offers several advantages over traditional centralized exchanges. Firstly, it provides access to a wide range of liquidity pools, allowing users to trade directly from their wallets without the need for KYC or trusting a centralized service with their funds.

Additionally, 1inch uses an algorithm called Pathfinder, which automatically splits a trade across multiple DEXs to find the best possible prices. This ensures that users get the most favorable exchange rates and reduces slippage.

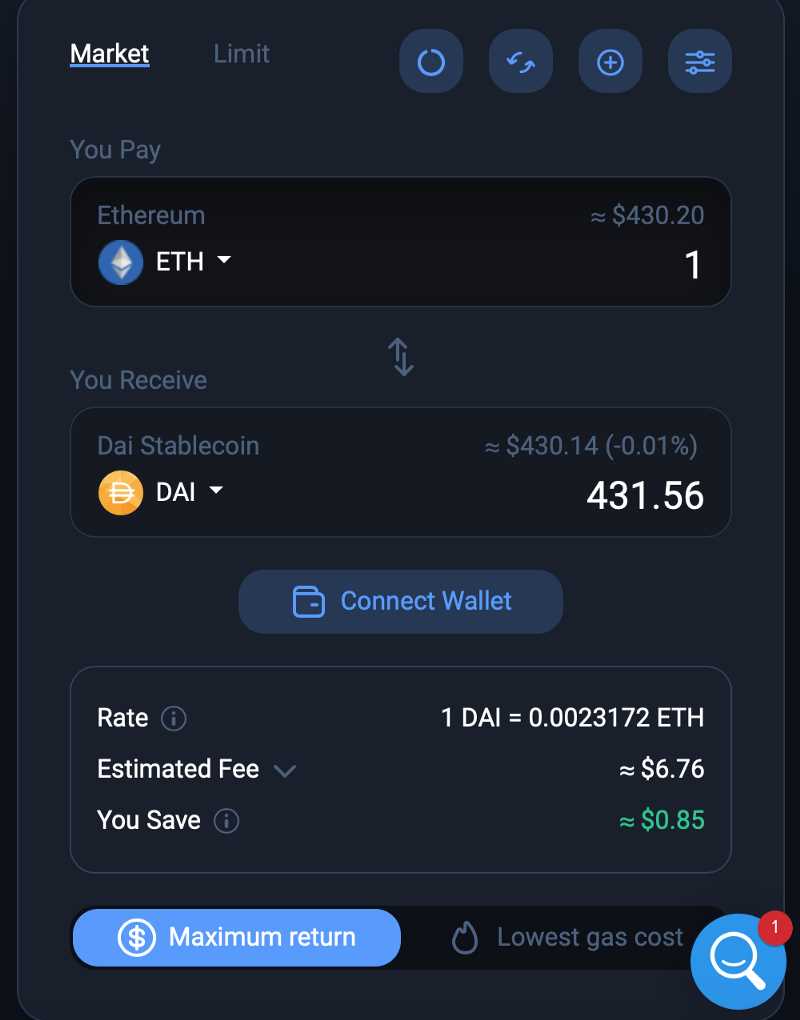

To start trading on 1inch exchange, users need to connect their wallets using the supported wallet extensions such as MetaMask. Once connected, they can choose the tokens they want to trade and set the desired amount. 1inch will then search for the best prices and present the available trading options.

Before confirming a trade, users can review the estimated gas fees, which are the transaction fees required to execute the trade on the Ethereum network. It is important to note that gas fees can vary depending on network congestion.

Once the trade is confirmed, users can track its status on the Ethereum blockchain. It is recommended to double-check all the details before confirming a trade to ensure accuracy.

In conclusion, trading on 1inch exchange provides users with a decentralized and efficient way to trade tokens across multiple DEXs. With its advanced algorithm and wide range of liquidity pools, 1inch offers competitive exchange rates and reduced slippage. So, if you are looking for a comprehensive trading experience, 1inch exchange is definitely worth considering.

A Beginner’s Guide to Trading on 1inch Exchange

If you’re new to the world of cryptocurrency trading, you may have heard of 1inch Exchange. This decentralized exchange is known for its advanced features and user-friendly interface. In this guide, we’ll walk you through the process of trading on 1inch Exchange step by step.

Step 1: Setting up your Wallet

Before you can start trading on 1inch Exchange, you’ll need to set up a compatible wallet. Popular options include MetaMask and WalletConnect. Make sure to download and install the wallet extension or app for your chosen device or browser.

Step 2: Connecting your Wallet to 1inch Exchange

Once you have your wallet set up, open the 1inch Exchange website. Click on the “Connect Wallet” button and choose your wallet provider from the list. Follow the prompts to connect your wallet to the exchange.

Step 3: Selecting the Tokens to Trade

Now that your wallet is connected, you can start trading! On the main trading page, you’ll see a list of available tokens. Use the search bar or browse through the categories to find the tokens you want to trade. You can also select a specific trading pair to narrow down your options.

Step 4: Placing a Trade

Once you’ve selected the tokens you want to trade, enter the amount you want to buy or sell in the respective input fields. 1inch Exchange automatically fetches the best rates from various decentralized exchanges to ensure you get the most favorable price for your trade. When you’re ready, click on the “Swap” button to initiate the trade.

Step 5: Confirming the Trade

Before the trade is executed, you’ll be presented with a confirmation screen. Double-check the details of your trade, including the tokens and the transaction fees. If everything looks correct, confirm the trade and wait for it to be processed on the blockchain.

Step 6: Monitoring your Trade

Once your trade is executed, you can monitor its progress on the 1inch Exchange interface. You’ll be able to track the transaction on the blockchain and see the updated balance in your wallet. Keep in mind that transaction times may vary depending on network congestion.

Step 7: Withdrawing your Funds

If you’re ready to withdraw your funds, navigate to the “Wallet” section on 1inch Exchange and select the tokens you want to withdraw. Follow the prompts to initiate the withdrawal and confirm the transaction. Once the withdrawal is processed on the blockchain, you’ll see the updated balance in your wallet.

That’s it! You’ve successfully traded on 1inch Exchange. Remember to do your own research and exercise caution when trading cryptocurrencies. Happy trading!

Understanding 1inch Exchange

1inch Exchange is a decentralized exchange aggregator that sources liquidity from various DEXs to provide users with the best possible trading rates. As a user, you can think of 1inch as a platform that automatically finds the most optimal routes across different exchanges to execute your trades.

When you place a trade on 1inch, it splits your order across multiple liquidity pools in order to minimize slippage and maximize the value of your trade. This is done using smart contract technology on the Ethereum blockchain.

How does 1inch exchange work?

1inch harnesses the power of decentralized finance (DeFi) protocols to find the best possible trade paths for users. It uses advanced algorithms to route trades through different exchanges and liquidity sources, taking into account variables such as gas fees, slippage, and token prices.

When a user places a trade on 1inch, the protocol splits the trade across multiple DEXs in order to find the most efficient path. This path may involve swapping between tokens several times in order to minimize slippage and maximize the trade value.

1inch also incorporates its own native governance and utility token called 1INCH. Holding 1INCH allows users to participate in the platform’s governance and decision-making processes.

Benefits of using 1inch Exchange

There are several key benefits to using 1inch Exchange:

- Best trading rates: By aggregating liquidity from multiple DEXs, 1inch is able to offer users the best trading rates available on the market.

- Lower slippage: By splitting trades across different liquidity sources, 1inch minimizes slippage and ensures that users get the best value for their trades.

- Easy to use: 1inch has a user-friendly interface that makes it easy for both beginners and experienced traders to navigate the platform and execute trades.

- Secure and transparent: Since 1inch operates on the Ethereum blockchain, all transactions are secure and transparent. Users can verify all transactions on the blockchain and have full control over their funds.

- Low fees: 1inch has low transaction fees compared to traditional centralized exchanges, saving users money on each trade.

Overall, 1inch Exchange is a powerful tool for traders looking to get the best possible trading rates and maximize their profits in the decentralized finance space.

Getting Started with Trading on 1inch Exchange

1inch Exchange is a decentralized exchange aggregator that allows users to trade their cryptocurrencies across multiple liquidity sources. If you’re new to trading on 1inch Exchange, this guide will walk you through the process of getting started.

Step 1: Connect your Wallet

The first step to start trading on 1inch Exchange is to connect your wallet. 1inch supports multiple wallet options, such as MetaMask, WalletConnect, and Fortmatic. Choose the wallet of your choice and connect it to the 1inch Exchange platform.

Step 2: Select the Tokens

Once your wallet is connected, you can select the tokens you want to trade. 1inch Exchange supports a wide range of tokens, including popular ones like Bitcoin (BTC), Ethereum (ETH), and many more. You can search for specific tokens or browse through the available options.

Step 3: Choose the Trading Pair

After selecting the tokens, you need to choose the trading pair. A trading pair consists of two tokens that can be exchanged for each other. For example, if you want to trade Ethereum (ETH) for Bitcoin (BTC), you would select the ETH/BTC trading pair.

Step 4: Set the Slippage Tolerance and Amount

Before placing a trade, you have the option to set the slippage tolerance and the amount you want to trade. Slippage refers to the difference between the expected and executed price of a trade. Setting a higher slippage tolerance can help ensure that your transaction gets executed even during periods of high volatility.

Step 5: Review and Confirm the Trade

Once you have set the slippage tolerance and entered the desired amount, review the details of your trade. Make sure that the trading pair and the amount are correct before proceeding. If everything looks good, click on the “Swap” button to confirm the trade.

Step 6: Track Your Transactions

After confirming the trade, you can track the progress of your transaction on the 1inch Exchange platform. You can view the status of your transaction and monitor the number of confirmations it receives on the blockchain.

Step 7: Manage Your Funds

Once the trade is complete, you can manage your funds directly from your connected wallet. You can choose to hold your assets or transfer them to another wallet or exchange.

That’s it! You have successfully started trading on 1inch Exchange. Remember to do your own research and exercise caution while trading cryptocurrencies to minimize risks. Happy trading!

Advanced Trading Strategies on 1inch Exchange

1inch Exchange is a decentralized exchange that offers a wide range of trading opportunities. To maximize your potential profits, it is important to utilize advanced trading strategies. These strategies can help you navigate the volatile cryptocurrency market and make informed trading decisions. Here are some advanced trading strategies you can use on 1inch Exchange:

Arbitrage Trading:

Arbitrage trading involves taking advantage of price differences between different exchanges. You can buy a cryptocurrency from one exchange at a lower price and sell it on 1inch Exchange at a higher price, making a profit from the price difference. To successfully execute an arbitrage trade, you need to closely monitor prices on multiple exchanges and act quickly to take advantage of price discrepancies.

Liquidation Hunting:

Liquidation hunting is a strategy that involves taking advantage of forced liquidations on the platform. When a trader’s position falls below a certain threshold, their assets are liquidated and sold on the market. As a trader, you can place limit orders near these liquidation prices, hoping to get filled at a lower price than the market. This strategy requires careful monitoring of the market and quick execution to capitalize on liquidation opportunities.

Layered Limit Orders:

Layered limit orders are a strategy that involves placing multiple limit orders at different price levels. By doing this, you can take advantage of price fluctuations and accumulate more assets at lower prices. This strategy allows you to distribute your risk and maximize your potential profits. However, it requires closely monitoring the market and adjusting your orders accordingly.

Stop-Loss Orders:

Stop-loss orders are an essential tool for risk management. They allow you to set a predefined price at which your assets will be sold automatically to limit potential losses. By setting a stop-loss order, you can protect yourself from significant market downturns and minimize your risk exposure. It is important to carefully analyze the market and set an appropriate stop-loss level to avoid unnecessary liquidations.

Margin Trading:

Margin trading on 1inch Exchange allows you to borrow funds to leverage your trading position. This strategy can amplify your potential profits, but it also increases your risk exposure. Margin trading requires careful risk management and a thorough understanding of the market. It is recommended to start with a small position and gradually increase your leverage as you gain more experience and confidence in your trading abilities.

Pairs Trading:

Pairs trading involves taking advantage of price divergences between two correlated assets. You can identify two assets that usually move together and take opposing positions when their prices diverge. For example, if Asset A is overvalued compared to Asset B, you can short Asset A and long Asset B, expecting the prices to converge. This strategy requires thorough analysis of market trends and a good understanding of asset correlations.

Remember, advanced trading strategies come with increased risk. It is important to do thorough research, use proper risk management techniques, and start with small positions to minimize potential losses. Additionally, it is recommended to consult with a financial advisor or experienced trader before implementing these strategies.

Question-answer:

What is 1inch exchange?

1inch exchange is a decentralized exchange aggregator that sources liquidity from various exchanges like Uniswap, Kyber, and Balancer to provide users with the best prices and low slippage for their trades.

How does 1inch exchange work?

1inch uses an algorithm called Pathfinder to split user’s trades across multiple decentralized exchanges and find the most efficient trading routes to provide the best prices and lowest slippage. It also incorporates gas cost optimization to minimize transaction fees.

What are the advantages of trading on 1inch exchange?

Trading on 1inch exchange has several advantages. It provides users with the best prices and low slippage by sourcing liquidity from multiple exchanges. It also offers a wide range of tokens for trading and supports advanced trading features like limit orders and stop-loss orders.

Are there any fees for trading on 1inch exchange?

Yes, there are fees for trading on 1inch exchange. The fee structure includes a 0.3% trading fee and gas fees for executing transactions on the Ethereum network. However, 1inch exchange aims to provide the best prices for users and minimizes fees as much as possible.