Yield farming has become a popular way for crypto enthusiasts to earn passive income. It involves staking or lending cryptocurrencies in decentralized finance (DeFi) protocols to earn rewards in the form of additional tokens. One platform that has gained significant attention in the yield farming space is 1inch.

1inch is a decentralized exchange aggregator that sources liquidity from various platforms to provide users with the best trading rates. However, it’s not just limited to trading. 1inch also offers yield farming opportunities through its liquidity pools. These pools allow users to provide liquidity to specific token pairs and earn rewards.

To get started with yield farming on 1inch, you’ll first need to connect your wallet. You can use popular wallets like MetaMask, WalletConnect, or others supported by the platform. Once your wallet is connected, you can navigate to the “Farming” section on the 1inch website and explore the available liquidity pools.

Each liquidity pool on 1inch has its own set of rules and rewards. It’s important to do your research and understand the risks involved before deciding which pool to participate in. Look for pools that offer attractive rewards and have a good track record of security and reliability.

Once you’ve chosen a pool, you can provide liquidity by depositing your desired tokens. This will involve approving the transfer of your tokens to the 1inch smart contract. After the approval, you can deposit your tokens into the pool and start earning rewards.

It’s important to note that yield farming involves certain risks, such as impermanent loss and smart contract vulnerabilities. You should only invest what you can afford to lose and always do thorough research before participating in any yield farming opportunity. Additionally, it’s a good idea to monitor your investments regularly and consider diversifying your portfolio to minimize risk.

Yield farming can be a lucrative way to earn passive income in the crypto space, and 1inch provides a user-friendly platform to get started. By following this beginner’s guide, you’ll be able to navigate the world of yield farming and start earning rewards on 1inch.

1inch Yield Farming: A Step-by-Step Guide for Beginners

If you’re new to the world of decentralized finance (DeFi), yield farming can seem intimidating. However, with the help of the 1inch platform, you can easily start yield farming and maximize your earnings. This step-by-step guide will walk you through the process, so you can begin your yield farming journey today.

Step 1: Set up a Wallet

The first step in yield farming is to set up a wallet. You can choose from various wallets, such as MetaMask or Trust Wallet, that are compatible with the Ethereum network. Make sure to keep your private keys safe and secure, as they give you access to your funds.

Step 2: Connect to 1inch

After setting up your wallet, navigate to the 1inch website and connect your wallet to the platform. This will allow you to interact with the different protocols and start yield farming.

Step 3: Choose a Pool

Once you’re connected to 1inch, you need to choose a pool to start yield farming. 1inch offers a wide selection of pools with different risk levels and yield rates. Take your time to research and compare the available options to find the pool that suits your investment goals.

Step 4: Provide Liquidity

After selecting a pool, you need to provide liquidity by depositing your tokens. This involves adding both the base token and the yield farming token to the pool. Make sure to follow the instructions provided by 1inch to complete this step correctly.

Step 5: Start Yield Farming

Once your liquidity has been added to the pool, you can start yield farming. This involves earning rewards in the form of additional tokens or fees for providing liquidity. Keep an eye on your earnings and monitor the performance of your investments regularly.

Note: Yield farming carries risks, including impermanent loss and smart contract vulnerabilities. It’s important to do your due diligence and only invest what you can afford to lose.

Step 6: Harvest and Withdraw

As you accumulate rewards from yield farming, you can choose to harvest them and withdraw your funds. This can usually be done by interacting with the pool contract on the 1inch platform. Be aware of any fees or minimum requirements when withdrawing your funds.

Yield farming can be a rewarding way to earn passive income in the world of DeFi. By following this step-by-step guide and researching your options carefully, you can start yield farming with 1inch and make the most of your investments.

Understanding the Basics of Yield Farming

Yield farming, also known as liquidity mining, is a way to earn passive income by staking or lending your cryptocurrency assets on decentralized finance (DeFi) platforms. It has gained popularity in the crypto community as a means to generate higher returns compared to traditional savings accounts or investments.

What is Yield Farming?

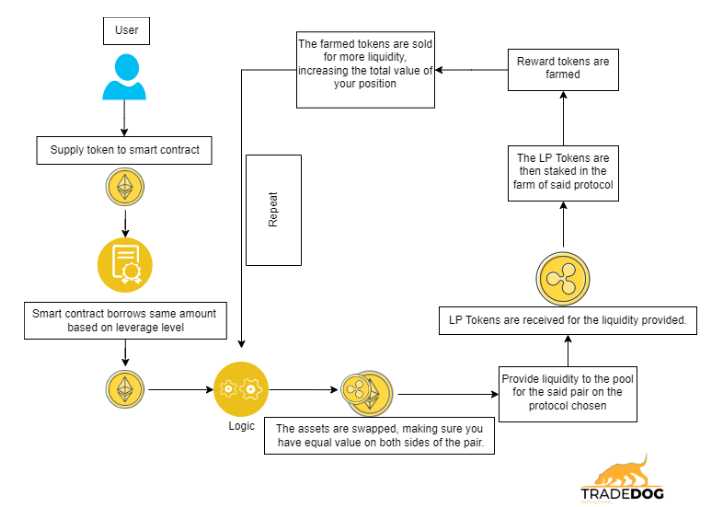

Yield farming involves providing liquidity to decentralized exchanges (DEXs) or lending platforms in order to earn rewards in the form of additional tokens. These tokens are often native to the platform or project and can have value in the open market. By supplying liquidity, you help facilitate trades and transactions on the platform, while also earning a share of the platform’s fees or rewards.

How Does Yield Farming Work?

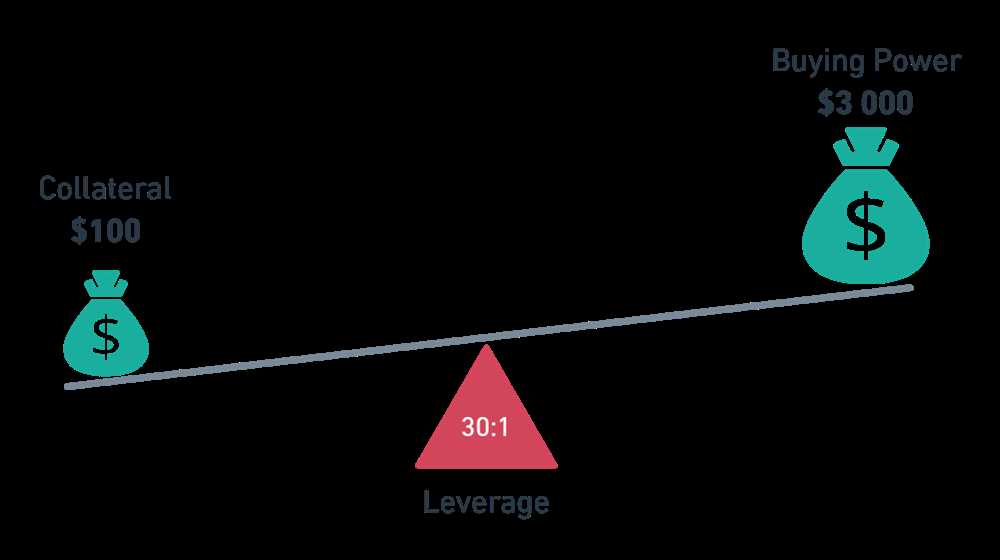

Yield farming typically involves depositing your cryptocurrency assets into a liquidity pool. A liquidity pool is a smart contract that holds funds from various users, which are then used to facilitate trades or loans on the platform. In return for providing liquidity, you receive liquidity pool tokens that represent your share of the pool.

These liquidity pool tokens can then be staked or deposited into yield farming platforms, where they are used to generate additional rewards. The rewards can vary but are often in the form of additional tokens or fees earned from the platform’s activities.

Yield farming can be a complex process as there are various factors to consider, such as the platform’s tokenomics, returns, and risks. It’s important to do thorough research and understand the risks before participating in yield farming.

Benefits and Risks of Yield Farming

Yield farming offers several potential benefits, including the opportunity to earn high returns on your cryptocurrency assets, diversify your holdings, and participate in the growth of emerging DeFi projects. Additionally, yield farming can provide a means to earn passive income through automated smart contract protocols.

However, yield farming also carries risks. The volatile nature of cryptocurrency markets means that the value of your deposited assets could decrease significantly. Additionally, there may be risks associated with the platform itself, such as smart contract vulnerabilities or liquidity risks.

It’s important to consider your risk tolerance, conduct thorough due diligence, and only invest what you can afford to lose when participating in yield farming.

Conclusion

Yield farming can be an exciting way to generate passive income and participate in the growing world of decentralized finance. By understanding the basics of yield farming and doing thorough research, you can make informed decisions and potentially earn attractive returns on your cryptocurrency assets.

Getting Started with 1inch Yield Farming

If you’re interested in yield farming and looking for a user-friendly platform to get started, 1inch is a great option. 1inch is a decentralized exchange aggregator that allows you to find the best prices across multiple liquidity sources. In addition to trading, 1inch also offers yield farming opportunities through its 1inch Liquidity Protocol.

1. Connect your Wallet

The first step to start yield farming with 1inch is to connect your wallet. 1inch supports multiple popular wallets such as MetaMask and Trust Wallet. Simply click on the “Connect Wallet” button on the 1inch website and choose your preferred wallet provider. Follow the prompts to connect your wallet and authorize the transaction.

2. Choose a Pool

Once your wallet is connected, you can browse the available pools on 1inch and choose the one you want to participate in. Make sure to consider factors such as the pool’s APY, token pair, and any potential risks associated with the protocol. It’s important to do your own research and understand the risks before investing in any yield farming pool.

3. Deposit Tokens

After selecting a pool, you’ll need to deposit your tokens into the pool. 1inch will guide you through the process and provide you with the necessary transaction details. Confirm the transaction in your wallet and wait for it to be processed on the blockchain.

4. Start Yield Farming

Once your tokens are deposited, you can start yield farming. Yield farming typically involves providing liquidity to decentralized exchanges or protocols in exchange for rewards in the form of additional tokens. Keep an eye on your farming progress and the rewards you’re earning.

Remember, yield farming can be a risky venture, and it’s important to understand the potential risks involved. Do your own research, start with small investments, and consider diversifying your holdings to mitigate risk.

Overall, 1inch offers an accessible and user-friendly platform for yield farming. By following these steps, you can start participating in yield farming opportunities and potentially earn additional tokens as rewards.

Choosing the Right Yield Farming Pool

When it comes to yield farming, choosing the right pool is essential for maximizing your rewards. Here are some factors to consider when selecting a yield farming pool.

1. APY: The Annual Percentage Yield (APY) is a key metric that determines the potential earnings from a yield farming pool. Look for pools with high APYs to maximize your returns.

2. Token: Consider the token being farmed in the pool. Is it a reputable and established token? Does it have a strong community and market demand? These factors can affect the long-term value of the token and the potential rewards from farming it.

3. Risks: Yield farming can involve risks, such as smart contract vulnerabilities and impermanent loss. Evaluate the risks associated with a pool and assess if you are comfortable with them. Additionally, consider the security measures and audits conducted on the pool’s smart contracts.

4. Fees: Yield farming pools often charge fees for depositing and withdrawing funds. Compare the fees across different pools and consider how they will impact your overall earnings.

5. Liquidity: Higher liquidity in a pool can provide better trading opportunities and reduce slippage when entering or exiting a position. Look for pools with sufficient liquidity to ensure smooth transactions.

6. Governance: Some yield farming pools have governance tokens that enable holders to participate in the decision-making process. If you are interested in having a say in the pool’s future developments, consider pools that offer governance tokens.

7. Historical Performance: Look at the historical performance of a pool to assess its stability and reliability. Consider factors such as the pool’s uptime, historical APY, and any major incidents or hacks that have affected the pool in the past.

By considering these factors, you can make an informed decision when choosing a yield farming pool that aligns with your risk tolerance and investment goals.

Maximizing Yield Farming Rewards with 1inch

Yield farming has become an increasingly popular way to earn passive income in the cryptocurrency space. By utilizing decentralized finance (DeFi) platforms, users can lend or stake their tokens and earn rewards in return. One platform that has gained significant traction in the DeFi space is 1inch.

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs). It provides users with the best possible trading prices by splitting their trades across multiple exchanges. Additionally, 1inch offers a yield farming program that allows users to maximize their returns.

How to Maximize Yield Farming Rewards with 1inch

Here are some tips to help you maximize your yield farming rewards with 1inch:

- Choose the right pools: When participating in yield farming, it’s important to choose pools that offer high APY (Annual Percentage Yield) and have a low risk of impermanent loss. 1inch provides a comprehensive list of available pools and their respective APYs, allowing you to make informed decisions.

- Consider impermanent loss: Impermanent loss is a risk associated with providing liquidity to decentralized exchanges. It occurs when the value of the tokens you have provided changes in relation to each other. Before participating in a yield farming pool, it’s important to understand the potential risks and rewards.

- Regularly monitor your positions: Yield farming can be a dynamic and ever-changing space. It’s crucial to regularly monitor your positions and evaluate their performance. This will allow you to make necessary adjustments and maximize your returns.

- Diversify your portfolio: Just like in traditional finance, diversification is key in yield farming. By diversifying your positions across multiple pools and platforms, you can spread out the risks and increase your chances of earning higher rewards.

- Stay informed: The DeFi space is constantly evolving, and new opportunities arise frequently. Stay updated with the latest news, trends, and developments in the cryptocurrency space to ensure you’re making informed decisions and maximizing your yield farming rewards.

By following these tips and utilizing 1inch’s yield farming program, you can maximize your earnings and make the most out of your yield farming endeavors.

Question-answer:

What is yield farming?

Yield farming refers to the practice of utilizing decentralized finance (DeFi) protocols to earn passive income on cryptocurrency holdings. It involves the process of lending or staking crypto assets in order to earn interest or rewards in the form of additional tokens.

How does 1inch help with yield farming?

1inch is a decentralized exchange aggregator that helps users find the best trading rates across various decentralized exchanges. In terms of yield farming, 1inch provides a feature called “1inch Liquidity Protocol” which allows users to deposit their tokens and earn yield by providing liquidity to the platform.