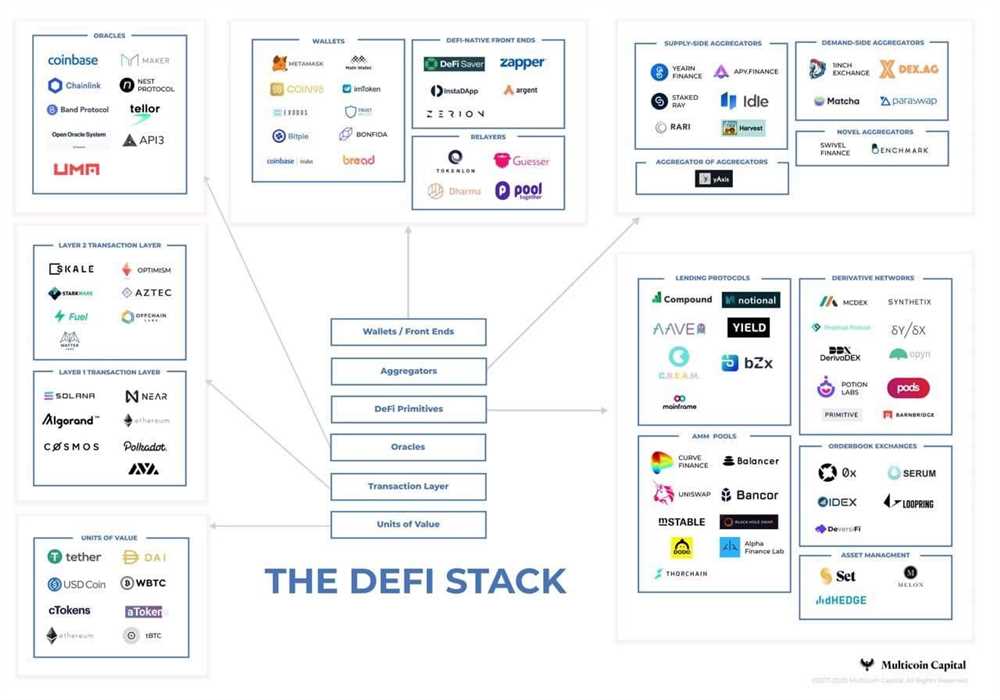

Decentralized Finance (DeFi) has taken the world by storm, revolutionizing traditional finance through the power of blockchain technology. One of the most prominent players in this space is the 1inch DeFi protocol. If you’re looking to delve into the world of decentralized exchanges and liquidity protocols, understanding 1inch is essential.

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide users with the best trading rates. By combining different liquidity pools, 1inch ensures optimal pricing for traders by mitigating slippage and maximizing returns.

At its core, 1inch aims to address one of the biggest pain points in the DeFi ecosystem – fragmented liquidity. With multiple decentralized exchanges operating independently, finding the best rates across different platforms can be a daunting task. 1inch’s smart contract algorithm solves this problem by splitting users’ trades across various platforms, resulting in lower fees and improved overall efficiency.

How does the 1inch DeFi protocol actually work? When a user initiates a trade on 1inch, the protocol sources liquidity from various decentralized exchanges, including Uniswap, SushiSwap, Balancer, and others. It splits the user’s desired trade into multiple parts, distributing them across different liquidity pools to find the best rates.

To ensure transparency and fairness, 1inch employs a process called “path-finding” optimization. This means that the protocol searches for the most efficient trading route, considering factors such as gas cost, slippage, and trade volume. By doing so, 1inch minimizes unnecessary costs and maximizes returns for its users.

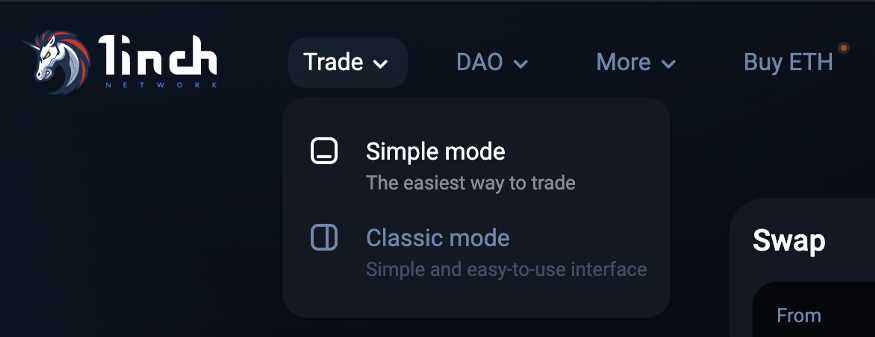

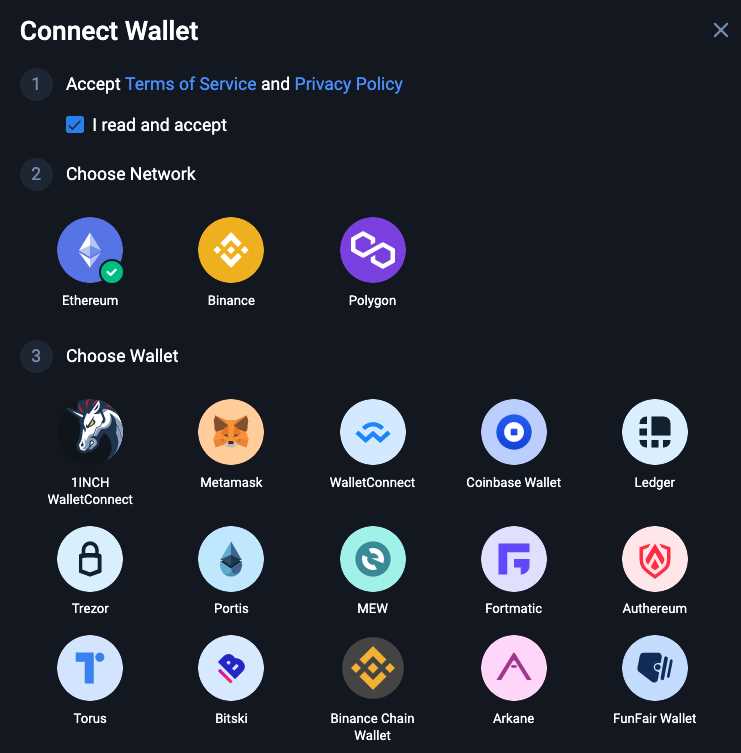

With its intuitive user interface, 1inch makes it seamless for traders to access the benefits of decentralized finance. The platform supports multiple networks, including Ethereum and Binance Smart Chain, catering to a wide range of users. Whether you’re a beginner or an experienced DeFi enthusiast, 1inch provides a comprehensive and user-friendly experience.

In conclusion, the 1inch DeFi protocol has emerged as a game-changer in the world of decentralized finance. By aggregating liquidity from various exchanges and optimizing trading routes, 1inch offers users superior rates, reduced fees, and an improved trading experience. As the DeFi space continues to evolve, understanding and utilizing protocols like 1inch is crucial for anyone looking to navigate the decentralized finance landscape.

What is the 1inch DeFi Protocol?

The 1inch DeFi Protocol is a decentralized finance (DeFi) platform that enables users to optimize their cryptocurrency trades across various decentralized exchanges. It was launched in 2019 by Sergej Kunz and Anton Bukov and has gained significant popularity due to its ability to provide users with the best possible prices for their trades.

The protocol operates by aggregating liquidity from multiple decentralized exchanges, such as Uniswap, SushiSwap, and Balancer, into one platform. This allows users to access deeper liquidity pools and find the best prices for their trades. By utilizing smart contract technology, the 1inch Protocol automatically splits and routes user trades across multiple decentralized exchanges to ensure optimal execution and reduce slippage.

One of the key features of the 1inch DeFi Protocol is its Pathfinder algorithm. This algorithm analyzes different decentralized exchanges and their liquidity pools to determine the most efficient route for a trade. It takes into account factors such as trading fees, liquidity depth, and price impact to ensure that users get the best possible deal.

Additionally, the protocol offers users various features and tools, such as limit orders, flash swaps, and yield farming. These features provide users with more flexibility and opportunities to maximize their returns on their cryptocurrency holdings.

Overall, the 1inch DeFi Protocol aims to provide users with a user-friendly and cost-effective solution for their cryptocurrency trading needs. It strives to enhance liquidity and efficiency in the decentralized finance space, ultimately empowering users to make the most of their digital assets.

Understanding the core concepts of the 1inch DeFi protocol

The 1inch DeFi protocol is a decentralized exchange aggregator that allows users to find the best prices for their token swaps across multiple liquidity sources. In order to understand how the 1inch protocol works, it is important to grasp the core concepts that underpin its functionality.

Automated Market Makers (AMMs)

At the heart of the 1inch protocol are Automated Market Makers (AMMs). AMMs are smart contracts that enable decentralized exchanges by replacing traditional order books with liquidity pools that traders can trade against. These liquidity pools are filled with funds by liquidity providers who earn a portion of the trading fees as a reward.

Decentralized Exchange Aggregation

The 1inch protocol aggregates liquidity from various decentralized exchanges, allowing users to find the best possible prices for their trades. By splitting a trade across multiple liquidity sources, the protocol ensures that users get the most favorable rates and lower slippage.

Furthermore, the protocol takes into account several factors, such as gas fees, to optimize the overall trade execution. It evaluates all available options, including swapping tokens directly or using multiple exchanges to get the best rates while minimizing costs.

Pathfinder Algorithm

To efficiently route trades through multiple exchanges, the 1inch protocol uses a proprietary pathfinding algorithm called the Pathfinder. This algorithm determines the most cost-effective and efficient route for a trade by considering various parameters such as liquidity, fees, and price impact.

The Pathfinder algorithm is crucial in minimizing slippage and optimizing trades, as it calculates the optimal path for the trade in real-time based on the current state of the liquidity pools.

Note: The 1inch protocol ensures that trades are executed securely and without the need for trust, as all interactions with the protocol take place on-chain.

In summary, the core concepts of the 1inch DeFi protocol involve utilizing Automated Market Makers, aggregating liquidity from multiple decentralized exchanges, and utilizing the Pathfinder algorithm for optimal trade execution. By combining these components, the 1inch protocol provides users with the best possible prices and trading experience.

How does the 1inch DeFi Protocol work?

The 1inch DeFi Protocol is a decentralized exchange aggregator that operates across various decentralized networks such as Ethereum, Binance Smart Chain, and Polygon. It aims to find users the best possible trading routes across multiple decentralized exchanges by splitting orders and routing trades through different liquidity sources.

The protocol works by scanning different decentralized exchanges to identify the best rates for a given trade. It takes into account factors such as slippage, fees, and trading volume to determine the most efficient route. The algorithm behind the protocol automatically splits the user’s trade into smaller parts and executes them through different exchanges, optimizing for the best possible outcome.

1inch has integrated with multiple decentralized exchanges, including Uniswap, SushiSwap, and PancakeSwap, among others. It constantly monitors these exchanges for changes in prices and liquidity to ensure users get the most up-to-date information for their trades.

To provide users with the best rates, the 1inch DeFi Protocol utilizes liquidity pools, which are pools of funds locked into smart contracts. These liquidity pools enable users to trade directly with the protocol without having to rely on centralized exchanges. By aggregating liquidity from multiple sources, the protocol can offer users better rates and lower slippage compared to trading on a single platform.

The 1inch DeFi Protocol also features a user-friendly interface that allows users to easily input their desired trade details and receive real-time quotes. Users can also choose between various trading strategies, such as swapping tokens at the best available rate or maximizing their savings through stablecoin farming. The protocol provides transparency by displaying detailed information about the chosen trading route, including the expected slippage, fees, and estimated gas costs.

Overall, the 1inch DeFi Protocol leverages the power of decentralized exchanges, liquidity pools, and advanced algorithms to provide users with the best possible trading experience. It offers efficient and cost-effective trading solutions while ensuring users maintain control over their assets and trade directly on decentralized networks.

Exploring the mechanics of the 1inch DeFi protocol

The 1inch DeFi protocol is a decentralized exchange aggregator that allows users to find the best trading prices across multiple decentralized exchanges (DEXs) in order to optimize their trades. This protocol leverages smart contracts to automatically split a trade across multiple DEXs in order to get the best possible price for the user.

When a user initiates a trade on the 1inch platform, the protocol uses a combination of on-chain and off-chain data to find the best trading route. The protocol considers factors such as liquidity and slippage across different DEXs in order to determine the optimal route for the trade.

Once the optimal route is determined, the 1inch protocol uses smart contracts to execute the trade. The protocol splits the trade into multiple smaller trades, each of which is executed on a different DEX. By splitting the trade, the protocol is able to minimize slippage and optimize the overall trading price for the user.

In addition to finding the best trading route, the 1inch protocol also incorporates other features to enhance the user experience. For example, the protocol supports limit orders, which allow users to set a target price for their trade. The protocol constantly monitors the market and automatically executes the trade when the target price is reached. This feature allows users to take advantage of price fluctuations and potentially increase their trading profits.

The 1inch DeFi protocol is built on the Ethereum blockchain, which ensures the security and transparency of the trades. The protocol’s smart contracts are audited and thoroughly tested to mitigate the risk of vulnerabilities or hacks.

Overall, the mechanics of the 1inch DeFi protocol provide users with a powerful tool for optimizing their trades on decentralized exchanges. The combination of smart contract technology, liquidity aggregation, and advanced trading features make the 1inch protocol a valuable resource for the DeFi community.

Benefits of using the 1inch DeFi Protocol

The 1inch DeFi Protocol offers several key benefits for users looking to trade and swap tokens in the decentralized finance (DeFi) ecosystem.

1. Efficient and cost-effective trades

1inch utilizes an advanced routing algorithm that searches for the best trading path across multiple decentralized exchanges (DEXs). This allows users to achieve optimal prices and minimize slippage when swapping tokens. Additionally, 1inch aggregates liquidity from various DEXs, ensuring users have access to a wide range of trading options. By combining these features, the protocol provides efficient and cost-effective trades for users.

2. Access to deep liquidity

Through its liquidity aggregation mechanism, 1inch provides users with access to deep liquidity pools from various DEXs. This means that users can trade tokens at larger volumes without significantly affecting the market price. Deep liquidity ensures that users can execute their trades quickly and efficiently, especially for larger transactions.

3. Flexible token swapping options

1inch supports a wide range of tokens across various blockchain networks, such as Ethereum and Binance Smart Chain. This allows users to swap tokens seamlessly between different chains, opening up more opportunities for arbitrage and cross-chain trading. Furthermore, the protocol offers customizable slippage settings, giving users control over their desired level of price impact when executing trades.

4. Gas optimization

Gas fees on the Ethereum network can be high, especially during periods of congestion. 1inch addresses this issue by using gas optimization techniques, such as trade aggregation and smart contract batching. These techniques help reduce gas costs for users, making trading more affordable and accessible for all.

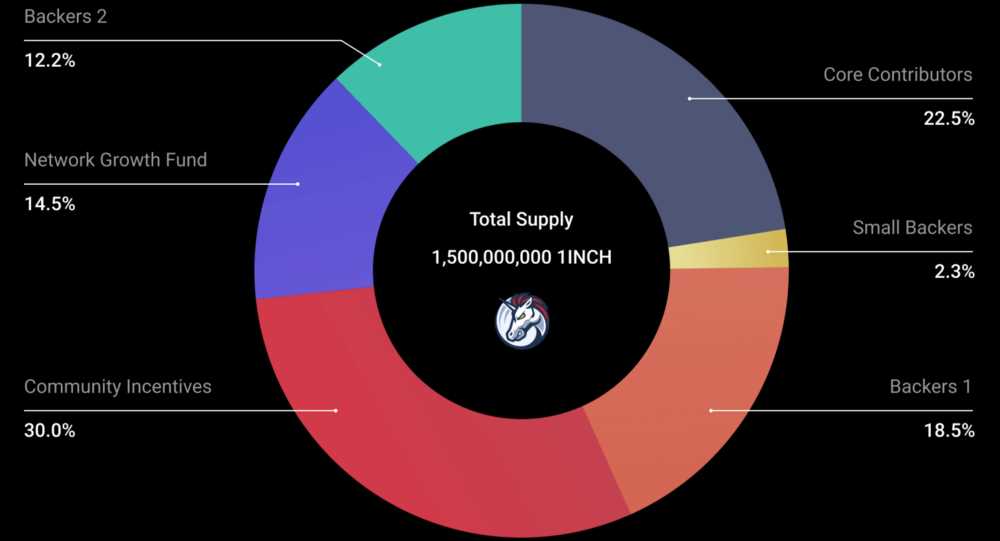

5. Community-driven governance

The 1inch DeFi Protocol is governed by its community through a decentralized autonomous organization (DAO). Token holders can participate in the decision-making process by voting on proposed protocol changes and improvements. This ensures that the protocol remains responsive to the needs and preferences of its users while fostering a sense of ownership and involvement.

Overall, the 1inch DeFi Protocol offers a range of benefits, including efficient and cost-effective trades, access to deep liquidity, flexible token swapping options, gas optimization, and community-driven governance. These features make it a valuable tool for traders and DeFi enthusiasts looking to navigate the decentralized finance landscape.

Question-answer:

What is the 1inch DeFi protocol?

The 1inch DeFi protocol is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide users with the best possible trading rates.

How does the 1inch DeFi protocol work?

The 1inch DeFi protocol works by using smart contracts to split a user’s trade across multiple decentralized exchanges, allowing them to find the best possible trading rates and save on fees.