Looking for a seamless and efficient trading experience? Look no further! The 1inch Network is here to revolutionize the way you trade cryptocurrencies. Say goodbye to traditional exchanges and step into the future of decentralized finance.

Unparalleled Efficiency: With the 1inch Network, you’ll never miss out on the best trading opportunities. Our advanced algorithm sources liquidity from various decentralized exchanges, ensuring that you get the most competitive prices and lowest slippage.

Optimal Savings: Don’t let excessive fees eat into your profits. Unlike traditional exchanges with high trading fees, the 1inch Network offers minimal fees and even lets you save on gas costs by aggregating transactions.

Unrivaled Security: Your funds are of utmost importance, and we take that seriously. The 1inch Network leverages smart contracts and audited protocols, providing you with enhanced security and mitigating the risk of hacks.

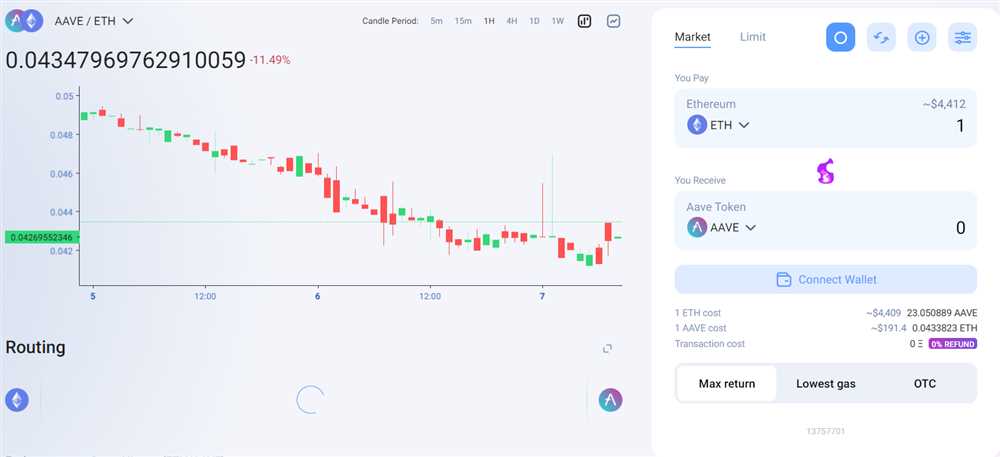

Empowering Choice: Take control of your trading experience. The 1inch Network allows you to choose the best path for your trades by offering multiple routing options. You can customize your swaps and select the liquidity sources that align with your preferences.

Experience the future of trading with the 1inch Network. Join our growing community of traders who are already enjoying the benefits of DeFi and take a leap into the world of decentralized exchanges today.

Overview of 1inch Network

The 1inch Network is a decentralized exchange aggregator that allows users to find the best prices across multiple decentralized exchanges (DEXs). It also provides liquidity and trading solutions for DeFi enthusiasts and professional traders alike.

Key Features of 1inch Network

The 1inch Network offers several key features that set it apart from traditional exchanges:

| Decentralized Exchange Aggregation | The 1inch Network aggregates liquidity from various decentralized exchanges, allowing users to access the best prices for their trades. |

| Optimal Routing | By utilizing complex algorithms, 1inch Network ensures that your trades are routed through the most efficient paths to provide the best possible outcomes. |

| Liquidity Protocol | 1inch Network provides its own liquidity protocol, which enables users to provide liquidity to the network and earn rewards. |

| Gas Optimization | The 1inch Network optimizes gas costs by splitting up large trades into smaller ones across different DEXs, reducing fees for users. |

| User-Friendly Interface | The 1inch Network is designed to be user-friendly, with a simple and intuitive interface that allows users to easily navigate and execute trades. |

Benefits of Using the 1inch Network

Here are some of the benefits of using the 1inch Network compared to traditional exchanges:

Lower Costs: By aggregating liquidity and optimizing gas costs, the 1inch Network allows users to save on fees and access the best prices for their trades.

Increased Efficiency: The optimal routing algorithm ensures that trades are executed through the most efficient paths, resulting in improved execution and reduced slippage.

Enhanced Privacy: As a decentralized exchange aggregator, the 1inch Network provides users with greater privacy and security compared to traditional exchanges.

Access to More Assets: The 1inch Network connects users to a wide range of tokens available on various decentralized exchanges, providing greater access to the DeFi ecosystem.

Rewards for Liquidity Providers: Users can earn rewards by providing liquidity to the 1inch Network’s liquidity protocol, allowing them to passively earn income on their assets.

Overall, the 1inch Network offers a comprehensive solution for decentralized trading, combining the best features of different exchanges and providing users with a seamless and cost-effective trading experience in the decentralized finance space.

Overview of Traditional Exchanges

Traditional exchanges have been the cornerstone of the financial industry for decades. These exchanges provide a centralized marketplace for buyers and sellers to trade various financial instruments, including stocks, bonds, commodities, and derivatives.

One of the key features of traditional exchanges is their extensive regulatory framework. These exchanges are regulated by governmental authorities and follow strict rules and regulations to ensure fair and transparent trading. This oversight helps to maintain market integrity and protect investors from fraudulent activities.

Another important aspect of traditional exchanges is the presence of intermediaries, such as brokers and market makers. These intermediaries facilitate the trading process by connecting buyers and sellers and executing trades on their behalf. They play a crucial role in providing liquidity to the market and ensuring efficient price discovery.

Traditional exchanges typically operate during specified trading hours and have fixed trading fees. Investors can place different types of orders, such as market orders, limit orders, and stop orders. These orders are matched based on the exchange’s order matching algorithms, which determine the best available price and execute trades accordingly.

Furthermore, traditional exchanges provide access to a wide range of financial instruments and investment opportunities. They offer centralized order books, where buyers and sellers can see the available bids and asks for a particular instrument. This transparency helps investors make informed decisions and find counterparties for their trades.

Despite the many advantages of traditional exchanges, they also have some limitations. These include the lack of accessibility for retail investors, high fees, and limited trading hours. Additionally, traditional exchanges are susceptible to market manipulation and can experience technical issues that result in trading disruptions.

Overall, traditional exchanges have played a crucial role in the financial industry, providing a trusted and regulated marketplace for trading various financial instruments. However, the emergence of decentralized exchanges, such as 1inch Network, has introduced new possibilities and challenges for investors. It is important to understand the features and benefits of both traditional exchanges and decentralized platforms to make informed investment decisions.

Comparison of Features

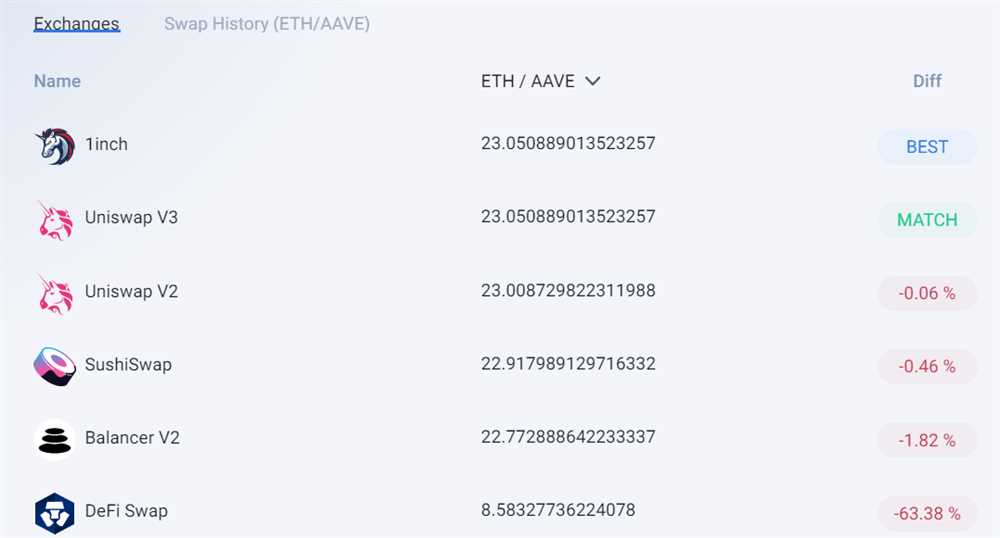

Liquidity: Traditional exchanges often suffer from low liquidity, leading to higher prices and slippage. However, the 1inch Network aggregates liquidity from multiple sources, including decentralized exchanges, to ensure optimal trading conditions with deep liquidity.

Trading Pairs: While traditional exchanges offer a limited range of trading pairs, the 1inch Network provides access to a wide variety of tokens and trading pairs. This allows users to easily take advantage of diverse investment opportunities and explore new assets.

Decentralization: Unlike traditional exchanges that are centralized, the 1inch Network operates in a decentralized manner. This means that users maintain full control of their funds and trades, without the need for intermediaries or third parties. This enhances security and ensures that users are not exposed to the risks associated with centralized exchanges.

Automated Market Making (AMM): The 1inch Network leverages the power of AMM algorithms to provide efficient and cost-effective trading. These algorithms automatically adjust prices based on supply and demand, ensuring fair and competitive rates for all users.

Slippage Control: Slippage, which refers to the difference between the expected and actual price of an asset, can significantly impact trading outcomes. Traditional exchanges often struggle with high slippage, but the 1inch Network employs innovative technologies and advanced algorithms to minimize slippage, providing users with better execution prices.

User Experience: The 1inch Network offers a user-friendly interface designed to make trading easy and intuitive. With a seamless and efficient user experience, users can quickly navigate the platform, execute trades, and monitor their assets with ease.

Cost Efficiency: Traditional exchanges are often associated with high fees, making trading costly for users. In contrast, the 1inch Network aims to provide cost-efficient trading by minimizing fees and offering competitive rates.

Security: The 1inch Network prioritizes the security of user funds and employs various security measures, including encryption and smart contract audits, to safeguard against potential vulnerabilities. This gives users peace of mind and confidence in the platform.

Accessibility: Compared to traditional exchanges that may have restrictions based on geographic location or regulatory compliance, the 1inch Network is accessible to users worldwide. Users can trade and interact with the platform without any limitations, enabling a truly global and inclusive trading experience.

As a comprehensive comparison of features, the 1inch Network clearly stands out as a superior choice for traders looking for liquidity, diverse trading options, decentralization, fair pricing, user-friendly interface, cost efficiency, robust security, and global accessibility.

Liquidity

One of the key factors that distinguish the 1inch Network from traditional exchanges is its superior liquidity. Liquidity refers to the ease with which an asset or token can be bought or sold without causing significant price movement.

The 1inch Network utilizes a unique aggregation algorithm that combines liquidity from various decentralized exchanges (DEXs) and liquidity sources, such as automated market makers (AMMs), to ensure optimal liquidity for its users. This aggregation enables traders to access a wide pool of liquidity, leading to better execution prices and reduced slippage.

Traditional exchanges, on the other hand, often suffer from limited liquidity, especially for less popular tokens or assets. This lack of liquidity can result in higher trading costs and increased price volatility. Additionally, the centralized nature of traditional exchanges means that they rely on market makers to provide liquidity, which can be a slow and expensive process.

By leveraging the power of decentralized finance (DeFi), the 1inch Network is able to tap into a vast array of liquidity sources. This includes popular DEXs such as Uniswap, SushiSwap, and Balancer, as well as various liquidity protocols and aggregators. As a result, users of the 1inch Network can enjoy access to deep liquidity pools and benefit from competitive prices.

Furthermore, the 1inch Network’s intelligent routing algorithm ensures that trades are executed across multiple liquidity sources to minimize slippage and maximize price efficiency. This advanced algorithm takes into account various factors, such as liquidity depth, fees, and exchange rates, to ensure the most favorable trading conditions for users.

In summary, liquidity is a critical component of any trading platform, and the 1inch Network excels in this aspect. With its innovative aggregation algorithm and access to a wide range of liquidity sources, the 1inch Network provides users with superior liquidity, better trading prices, and reduced slippage compared to traditional exchanges.

Experience the power of enhanced liquidity with the 1inch Network today.

Transaction Speed

Transaction speed is a critical factor when comparing 1inch Network and traditional exchanges. In the fast-paced world of cryptocurrency trading, every second counts, and delays can result in missed opportunities or financial losses.

1inch Network

1inch Network leverages advanced technology and decentralized protocols to offer lightning-fast transaction speeds. With its innovative aggregation and routing algorithm, 1inch Network ensures that users can execute trades quickly and without slippage.

The decentralized nature of 1inch Network also means that the platform is not dependent on a single central server. This significantly reduces latency and minimizes the risk of bottlenecks, resulting in faster transaction confirmations.

Traditional Exchanges

In contrast, traditional exchanges often suffer from slower transaction speeds due to their centralized architecture. The reliance on a centralized server can lead to delays as the server handles a large volume of transactions simultaneously.

Additionally, traditional exchanges may have longer confirmation times, especially during periods of high trading activity or network congestion. This can result in frustrating delays for traders, impacting their ability to capitalize on market opportunities swiftly.

In summary, 1inch Network’s decentralized approach and innovative algorithms give it a clear advantage in transaction speed over traditional exchanges. The ability to execute trades quickly and efficiently is crucial for traders looking to seize profitable opportunities in the dynamic cryptocurrency market.

Security

The security of your assets is a critical factor to consider when choosing a cryptocurrency exchange or protocol. In this section, we will compare the security features of 1inch Network and traditional exchanges to help you make an informed decision.

1inch Network Security Features

- Decentralization: The 1inch Network operates on decentralized protocols and smart contracts, which reduces the risk of hacking or theft.

- Audited Smart Contracts: The smart contracts used by 1inch Network have undergone thorough security audits by reputable third-party firms to ensure their safety and reliability.

- Non-Custodial: 1inch Network is a non-custodial protocol, which means that users always maintain control and ownership of their assets, reducing the risk of exchange hacks or mismanagement.

- Permissionless: Anyone can access and use the 1inch Network without needing permission from a central authority, making it more resistant to censorship and control.

Traditional Exchange Security Features

- Custodial Model: Traditional exchanges often operate on a custodial model, where users’ funds are held on centralized platforms. This introduces a higher risk of hacking or theft.

- Single Point of Failure: Traditional exchanges have a single point of failure, which means that if the exchange is compromised, all user assets are at risk.

- Regulation and Compliance: Traditional exchanges are subject to regulatory requirements, which can add an additional layer of security but may also introduce limitations and restrictions.

- Private Keys: Traditional exchanges generally hold users’ private keys, which means that users do not have full control over their assets and are reliant on the exchange’s security measures.

Overall, the decentralized and non-custodial nature of 1inch Network, coupled with audited smart contracts and permissionless access, provides a higher level of security compared to traditional exchanges. However, it’s important to consider your individual risk tolerance and preferences when it comes to trading and storing your assets.

Question-answer:

What is 1inch Network?

1inch Network is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best available prices and low slippage. It enhances the trading experience by splitting a single trade across multiple DEXs to maximize the value for users.

What are some advantages of using 1inch Network over traditional exchanges?

1inch Network has several advantages over traditional exchanges. Firstly, it offers better prices as it aggregates liquidity from multiple DEXs, ensuring users get the best available rates. Secondly, it provides low slippage, reducing the impact of large orders on the market. Additionally, it offers a wide range of tokens and pairs, allowing users to trade a variety of assets. Lastly, it is decentralized, which means users have full control over their funds and do not need to trust a central authority.

How does 1inch Network compare to traditional exchanges in terms of security?

1inch Network is built on the Ethereum blockchain and utilizes smart contracts to execute trades, providing a high level of security. Traditional exchanges, on the other hand, are centralized and often store user funds in a single location, which makes them more vulnerable to hacks and theft. With 1inch Network, users retain control of their private keys and funds, reducing the risk of centralized exchange hacks.