Welcome to 1inch’s guide for beginners on how to use the limit order feature for USDT trades. If you’re new to cryptocurrency trading or looking to expand your trading strategy, the limit order feature offered by 1inch can be a powerful tool to help you optimize your trades.

The limit order feature allows you to set specific conditions for buying or selling USDT (Tether) at a desired price. Instead of constantly monitoring the market and executing trades manually, you can set a price target and let 1inch automatically execute the trade for you when that target is reached.

Using the limit order feature is simple and straightforward. First, you need to connect your wallet to 1inch. Once your wallet is connected, you can select the trading pair and choose the USDT token. Next, you need to choose whether you want to buy or sell USDT and set the target price at which you want the trade to be executed. Finally, you can review the details of your limit order and confirm the trade. 1inch will handle the execution for you, even if you’re not actively monitoring the market.

The limit order feature for USDT trades can be a game-changer for both beginners and experienced traders. It allows you to take advantage of market fluctuations and execute trades at opportune moments, even when you’re not constantly monitoring the market. So, whether you’re looking to improve your trading strategy or simply save time and effort, 1inch’s limit order feature is definitely worth exploring.

Understanding 1inch’s limit order feature

1inch’s limit order feature is a powerful tool that allows users to buy or sell USDT at a specific price. This feature enables users to set their desired price for a trade and automatically executes the trade when the market reaches that price.

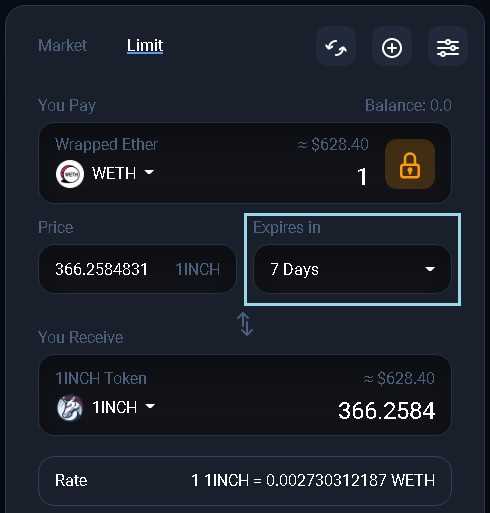

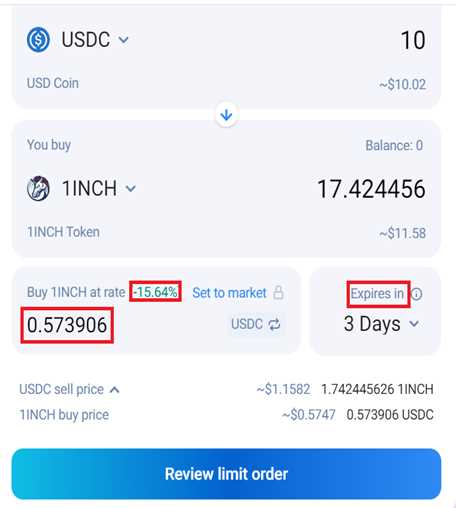

When using the limit order feature, users can specify the amount of USDT they want to trade, the price they want to execute the trade at, and the duration for which the limit order should remain active. This allows users to have more control over their trades and potentially get better prices than executing a market order.

Once a limit order is set, it is added to the 1inch order book, where it waits for the market to reach the specified price. When the market reaches the desired price, the limit order is executed, and the user will receive the USDT or the desired asset in exchange.

It is important to note that the limit order feature does not guarantee that the trade will be executed. The market conditions may not reach the specified price, and in that case, the limit order will expire without executing.

Using the limit order feature can be beneficial for users who want to take advantage of specific price levels in the market or who want to automate their trading strategies. However, it is important for users to carefully consider their trading decisions and set limit orders accordingly.

Overall, 1inch’s limit order feature provides users with more flexibility and control over their trades, allowing them to potentially optimize their trading strategies and achieve better outcomes.

How to use 1inch’s limit order feature for USDT trades

1inch’s limit order feature for USDT trades allows you to set specific conditions for your trades, ensuring that you get the best possible price. Here’s a step-by-step guide on how to use this feature:

Step 1: Connect your wallet

Before you can start using 1inch’s limit order feature, you need to connect your wallet to the platform. Supported wallets include MetaMask, WalletConnect, and Ledger. Choose the option that suits you best and follow the instructions to connect your wallet.

Step 2: Select the USDT trading pair

Once your wallet is connected, navigate to the trading page and select the USDT trading pair you want to place a limit order for. For example, if you want to trade USDT for Ethereum, select the USDT/ETH trading pair.

Step 3: Choose the limit order option

Next, find the option that allows you to place a limit order. This may be labeled as “Limit Order” or “Advanced Trading” depending on the platform you are using. Click on this option to proceed.

Step 4: Set your trade conditions

Now it’s time to set your trade conditions. This includes specifying the price at which you want to buy or sell and the quantity of USDT you want to trade. Make sure to review your conditions carefully before proceeding.

Step 5: Confirm and execute your limit order

After setting your trade conditions, review them one final time and click on the “Confirm” or “Execute” button to submit your limit order. Once the order is submitted, the platform will automatically execute the trade when the specified conditions are met.

Step 6: Monitor your limit order

After your limit order is placed, you can monitor its status on the trading page. Keep an eye on the price movements and check if the order is executed according to your conditions. If the conditions are not met, your order will remain open until it is canceled or fulfilled.

Step 7: Manage your limit order

If you need to make any changes to your limit order or cancel it altogether, you can do so from the trading page. Look for the options labeled “Manage Orders” or “Open Orders” and follow the instructions provided.

By following these steps, you can effectively use 1inch’s limit order feature for USDT trades and have more control over your trading strategy. Remember to always do your own research and consider the risks involved before placing any trades.

Tips for effectively using 1inch’s limit order feature for USDT trades

1. Set a realistic price target: Before placing a limit order, research the market and set a price target that you believe is achievable. This will help you optimize your trading strategy and increase the likelihood of your order being executed.

2. Use stop-loss orders: Protect your investments by using stop-loss orders. These orders automatically trigger a market sell order if the price of the asset falls below a certain level. This can help limit potential losses and prevent your trades from turning into disasters.

3. Consider slippage: When placing a limit order, keep in mind that there may be slippage, which is the difference between your desired price and the actual executed price. To avoid surprises, set your limit price slightly lower than your desired entry price to account for potential slippage.

4. Monitor the market closely: Stay updated with the latest market trends and price movements. By keeping a close eye on the market, you can make informed decisions and adjust your limit orders accordingly. This will allow you to take advantage of favorable market conditions and maximize your trading opportunities.

5. Start small and test the waters: If you are new to limit orders or trading in general, it is advisable to start with small amounts and gradually increase your exposure as you gain experience and confidence. This will help minimize potential losses and allow you to learn and refine your trading strategies without putting too much at risk.

6. Understand the fees involved: Familiarize yourself with the fees associated with using 1inch’s limit order feature. This will help you calculate the potential costs of your trades and make more informed decisions. Keep in mind that fees can vary based on the platform and trading volume, so it’s important to stay updated on any changes.

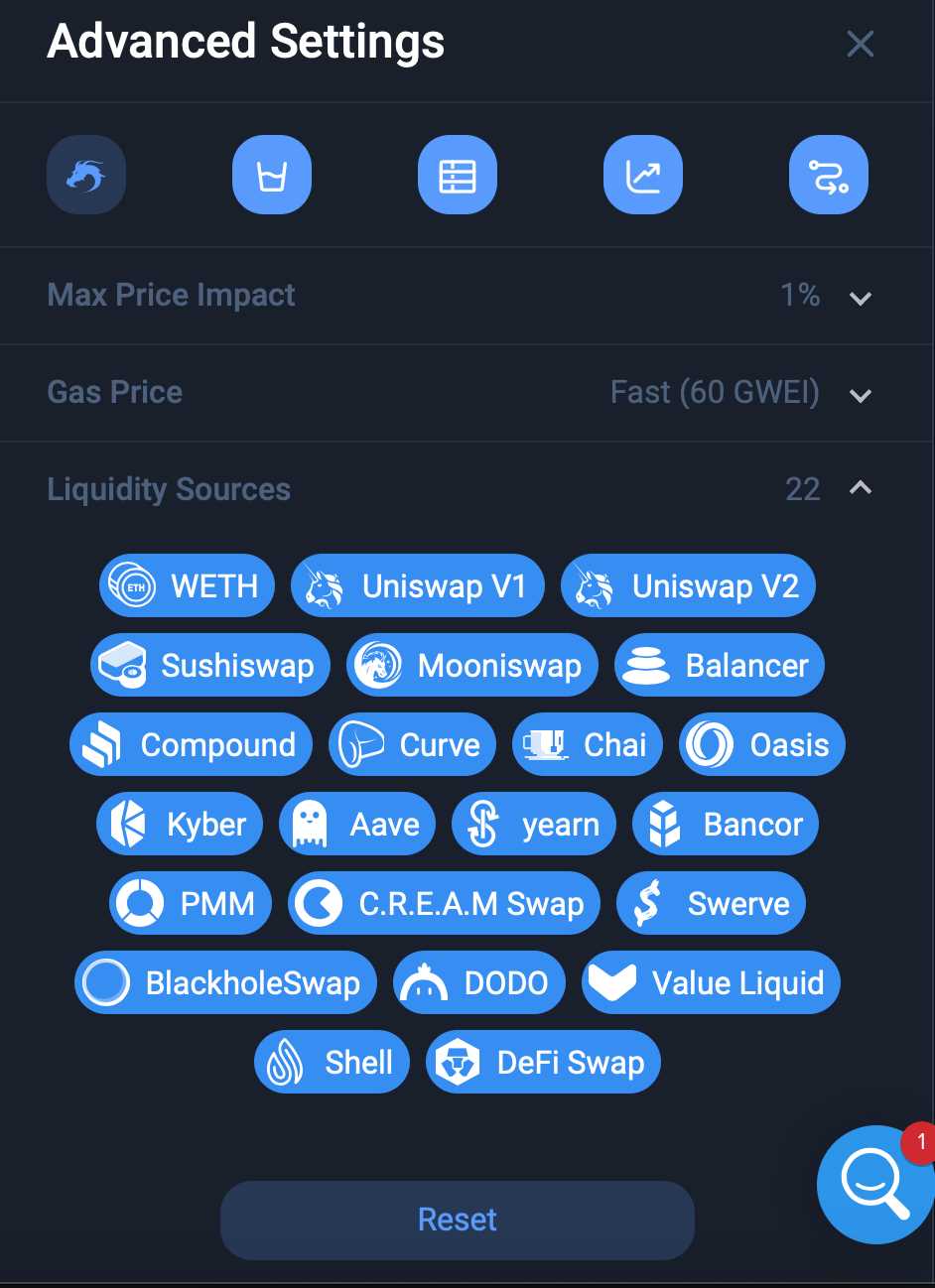

7. Take advantage of advanced order options: 1inch’s limit order feature offers advanced options such as time limits, fill or kill orders, and immediate or cancel orders. These options can provide more flexibility and control over your trades. Take the time to understand and explore these advanced options to enhance your trading experience.

8. Utilize risk management strategies: Implement risk management strategies such as diversifying your portfolio, setting profit targets, and using trailing stops. These strategies can help minimize losses and protect your investments in volatile market conditions.

9. Keep an eye on gas fees: Gas fees on Ethereum can fluctuate depending on network congestion. Be mindful of the gas fees associated with placing limit orders and consider adjusting your order size or timing to optimize cost efficiency.

10. Stay informed about platform updates: Stay updated with the latest developments and updates from 1inch, as they may introduce new features or make changes to the limit order functionality. Staying informed will ensure that you are utilizing the platform to its fullest potential and taking advantage of any new opportunities.

Question-answer:

What is 1inch’s limit order feature for USDT trades?

1inch’s limit order feature allows users to set specific price conditions for their trades with USDT. Instead of making a trade at the current market price, users can set a limit order to buy or sell USDT at a desired price.

How does the limit order feature work on 1inch?

When using 1inch’s limit order feature, users specify the desired price at which they want to buy or sell USDT. If the market price reaches the specified price, the limit order is executed automatically. If the market price does not reach the specified price, the order remains open until it is either canceled by the user or executed at a later time.

Can I use 1inch’s limit order feature for other cryptocurrencies?

No, currently the limit order feature on 1inch is only available for USDT trades. Users can set limit orders to buy or sell USDT, but not other cryptocurrencies.

Is there a fee for using 1inch’s limit order feature?

Yes, there is a fee for using the limit order feature on 1inch. The fee is deducted from the user’s wallet when the limit order is executed. The fee amount depends on the specific transaction and is disclosed to the user before confirming the order.