Discover the Future of Trading

Are you tired of the limitations and inefficiencies of traditional exchanges? Look no further! With 1inch, you can experience the next generation of trading.

Smart, Secure, and Seamless

1inch offers a decentralized exchange platform that revolutionizes the way you trade. Gone are the days of high fees, slow transactions, and lack of control.

Unleash Your Potential

With 1inch, you have the power to make informed decisions. Our comprehensive comparison highlights the advantages of 1inch over traditional exchanges, allowing you to maximize your trading potential.

Why settle for less?

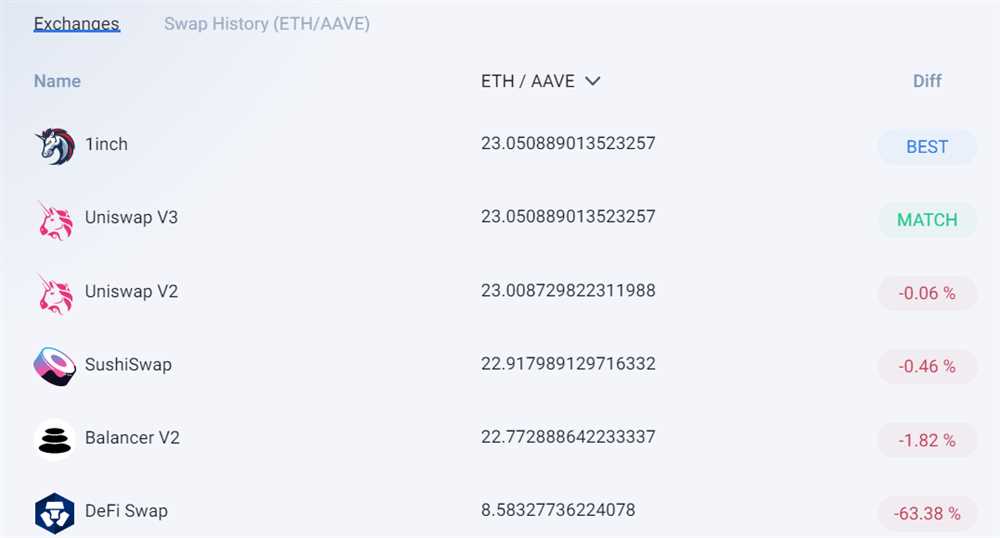

1inch provides users with access to the best available rates across multiple exchanges, ensuring that you always get the most out of your trades. No more missed opportunities or wasted time.

Trade with Confidence

Our platform is built on advanced technology and secure protocols, giving you peace of mind while you trade. Your assets are protected and your transactions are executed with precision and speed.

Join the Future Today

Don’t be left behind. Embrace the future of trading with 1inch and experience a new level of freedom, convenience, and control. Start making the most of your trades now!

What is 1inch

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible trading rates. It was founded in 2019 by Sergej Kunz and Anton Bukov.

Unlike traditional exchanges, 1inch operates on the Ethereum blockchain and utilizes smart contracts to execute trades. This allows users to trade directly from their wallets, without the need for intermediaries or custodial services.

1inch is designed to prioritize user experience and financial efficiency. By scanning multiple DEXs, including platforms such as Uniswap and Balancer, it finds the optimal routes for transactions across various liquidity pools. This ensures that users receive the most competitive rates and low slippage for their trades.

Key Features of 1inch:

Decentralization: 1inch operates as a decentralized platform, meaning that all transactions and operations are executed on the blockchain without the need for a centralized authority.

Aggregation: By aggregating liquidity from multiple DEXs, 1inch ensures that users have access to a wide range of tokens, allowing them to trade with minimal slippage and at the best possible rates.

Optimal Routing: The advanced algorithm used by 1inch scans multiple DEXs and liquidity pools to find the most efficient routes for trades. This ensures that users can execute transactions with minimal fees and maximum returns.

User-Friendly Interface: 1inch aims to provide a seamless user experience, with a simple and intuitive interface that allows users to easily navigate the platform and execute trades.

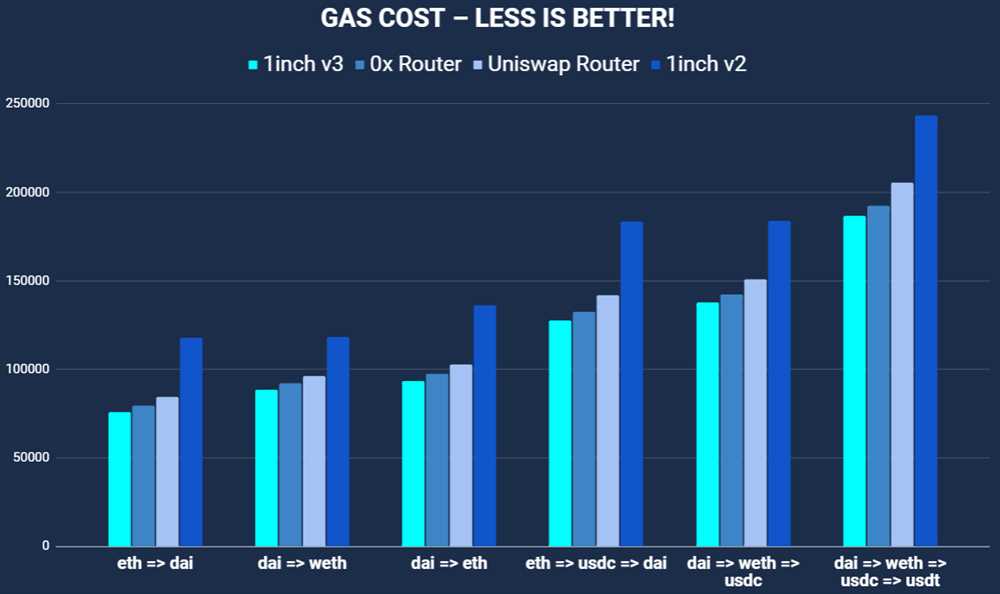

Gas Fee Optimization: 1inch employs an innovative gas fee optimization feature that allows users to save on transaction costs by splitting trades across different DEXs to minimize gas fees.

Overall, 1inch is a revolutionary decentralized exchange aggregator that aims to provide users with the best possible trading experience by offering competitive rates, optimal routing, and a user-friendly interface.

Comparison

When it comes to comparing 1inch with traditional exchanges, there are several key differences to consider. In this comprehensive comparison, we will explore these differences and highlight the advantages that 1inch offers over traditional exchanges.

Decentralization

One of the main advantages of 1inch is its decentralized nature. Unlike traditional exchanges, which rely on a centralized authority to facilitate transactions, 1inch operates on decentralized networks such as Ethereum. This means that 1inch users have full control over their funds and do not need to trust a centralized exchange with their assets.

Trading Fees

Another important factor to consider is the trading fees. Traditional exchanges often charge high fees for trading and withdrawing funds, which can eat into your profits. On the other hand, 1inch has a unique fee aggregation mechanism, which helps users find the best prices across multiple decentralized exchanges, resulting in lower fees overall.

| Feature | 1inch | Traditional Exchanges |

|---|---|---|

| Decentralization | Yes | No |

| Trading Fees | Low | High |

| Liquidity | High | Variable |

| Security | Strong | Depends on Exchange |

In addition to these key differences, 1inch also offers high liquidity, thanks to its integration with multiple decentralized exchanges. This means that users can access a large pool of liquidity and execute trades quickly and efficiently.

Furthermore, security is another area where 1inch excels. By operating on decentralized networks, 1inch eliminates the risk of hacks and security breaches that are often associated with centralized exchanges. Users can have peace of mind knowing that their funds are secure.

In conclusion, when comparing 1inch with traditional exchanges, it is clear that 1inch offers several significant advantages. From its decentralized nature to its low trading fees and high liquidity, 1inch stands out as a reliable and efficient option for traders and investors.

Fees and Costs

When it comes to fees and costs, 1inch and traditional exchanges have some key differences. Traditional exchanges are known for their high trading fees, which can eat into your profits. On the other hand, 1inch operates on a decentralized exchange (DEX) model, which allows for lower fees.

With 1inch, you can expect to pay minimal fees for trading. The platform is designed to find the most cost-effective route for your trades, ensuring that you get the best possible deal. Additionally, 1inch has a unique feature called “Chi Gastoken,” which allows users to reduce their gas fees by up to 30%.

Traditional exchanges, on the other hand, often have complex fee structures that vary depending on factors such as trade volume and account type. You may be charged a taker fee for executing trades or a maker fee for providing liquidity to the order book. These fees can quickly add up, especially if you are an active trader.

Furthermore, traditional exchanges may also charge deposit and withdrawal fees. These fees can vary depending on the cryptocurrency you are using and the method you choose to deposit or withdraw funds. It’s essential to consider these fees when choosing a traditional exchange.

Overall, 1inch offers a more cost-effective trading experience compared to traditional exchanges. With its low fees and innovative features, 1inch is a popular choice for traders looking to maximize their profits.

Liquidity and Trading Volume

When it comes to liquidity and trading volume, 1inch and traditional exchanges have some distinct differences. Understanding these differences is crucial for traders and investors looking to make informed decisions.

1inch Liquidity

1inch is known for its decentralized nature, which means that it pools liquidity from various sources, including decentralized exchanges (DEXs) and liquidity protocols. This pooling mechanism allows 1inch to offer competitive liquidity across multiple platforms, giving users access to deeper order books.

With 1inch’s innovative aggregation algorithm, known as Pathfinder, the platform intelligently routes trades to the most cost-effective liquidity sources. This means that users can enjoy enhanced liquidity even for illiquid assets or low-volume pairs.

Traditional Exchange Liquidity

Traditional exchanges, on the other hand, operate on a centralized infrastructure. They typically have their own order books and create liquidity by matching buy and sell orders. The depth of liquidity on these exchanges primarily depends on the popularity and trading activity of the platform.

While traditional exchanges may have higher trading volumes for popular assets, they can struggle to provide competitive liquidity for less-traded or exotic assets. This is due to the limited number of participants and the centralized nature of these platforms.

Furthermore, traditional exchanges often have trading fees, which can eat into a trader’s profits. These fees can vary based on the trading volume and are typically imposed on both makers (those who place limit orders) and takers (those who execute market orders).

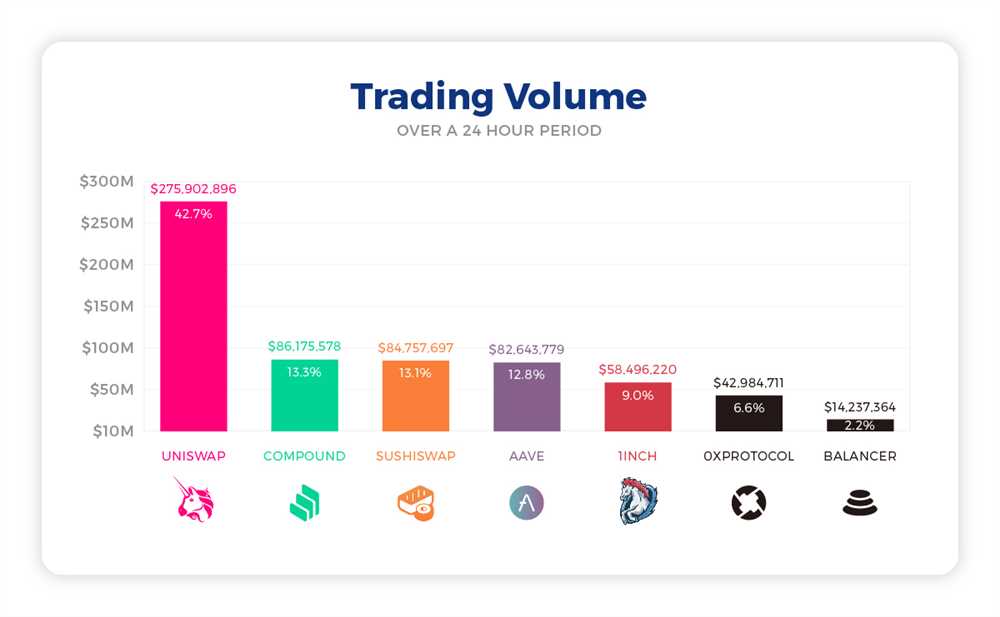

Trading Volume

1inch has gained significant traction in the decentralized finance (DeFi) space, which has resulted in a growing trading volume on the platform. As more users seek to benefit from the advantages of decentralized trading, the trading volume on 1inch continues to increase.

Traditional exchanges, however, still dominate the overall trading volume in the cryptocurrency market. These exchanges have been in operation for a longer time and have a larger user base, which leads to higher trading volumes.

It is important for traders to assess their specific trading needs and the liquidity available on both 1inch and traditional exchanges. While traditional exchanges may offer higher trading volumes, 1inch’s decentralized approach provides unique opportunities for enhanced liquidity, particularly for illiquid assets.

Overall, the liquidity and trading volume landscape is constantly evolving, and both 1inch and traditional exchanges have their own strengths and weaknesses. Traders and investors should carefully consider their priorities and objectives to choose the most suitable platform for their trading activities.

User Interface and Experience

When it comes to user interface and experience, 1inch and traditional exchanges have some key differences. Traditional exchanges often have complex and cluttered interfaces, which can be overwhelming for new users. On the other hand, 1inch offers a sleek and intuitive interface that is easy to navigate.

Simplicity and Intuitiveness

1inch is designed to provide a user-friendly experience, with a simple and intuitive interface. The platform offers clear and concise instructions, making it easy for users of all levels of experience to understand and navigate the exchange process.

Traditional exchanges, on the other hand, often require users to go through multiple steps and menus to perform basic actions. This can be confusing and time-consuming, especially for beginners. The cluttered interfaces of traditional exchanges can also make it difficult to find the information or options users are looking for.

Customizability and Personalization

1inch allows users to customize their experience by offering a range of options and settings. Users can choose their preferred language, adjust the display settings, and personalize their dashboard. This level of customizability allows users to tailor the platform to their needs and preferences.

In contrast, traditional exchanges tend to have fixed interfaces with limited customization options. Users have little control over the layout or appearance of the platform, which can make it feel rigid and less personalized.

In summary, 1inch offers a user interface and experience that is simple, intuitive, and customizable. It aims to provide a seamless and personalized experience for users, in contrast to the complex and cluttered interfaces of traditional exchanges. This makes 1inch a user-friendly option for both beginners and experienced traders.

Question-answer:

What is 1inch and how does it compare to traditional exchanges?

1inch is a decentralized exchange aggregator that allows users to find the best prices for trading cryptocurrencies across multiple platforms. It offers better pricing and lower fees compared to traditional exchanges.

How does 1inch achieve better pricing compared to traditional exchanges?

1inch utilizes smart contract technology to split orders across multiple decentralized exchanges, which allows users to get the best possible prices for their trades. It aggregates liquidity from various platforms, leading to more competitive pricing.

What are the advantages of using 1inch over traditional exchanges?

There are several advantages of using 1inch over traditional exchanges. Firstly, 1inch offers better pricing by finding the best rates across multiple platforms. Secondly, it has lower fees compared to centralized exchanges. Additionally, 1inch provides a more secure and private trading experience as it is built on blockchain technology.