Decentralized Finance (DeFi) has revolutionized the way we transact and manage our finances. One of the key aspects of DeFi is the ability to swap between different stablecoins, such as USDT, USDC, and DAI, to take advantage of different interest rates, liquidity, and other opportunities. Two of the most popular protocols for stablecoin swapping are 1inch and Curve Finance. In this article, we will provide a comprehensive comparison of these two protocols, highlighting their unique features, benefits, and limitations.

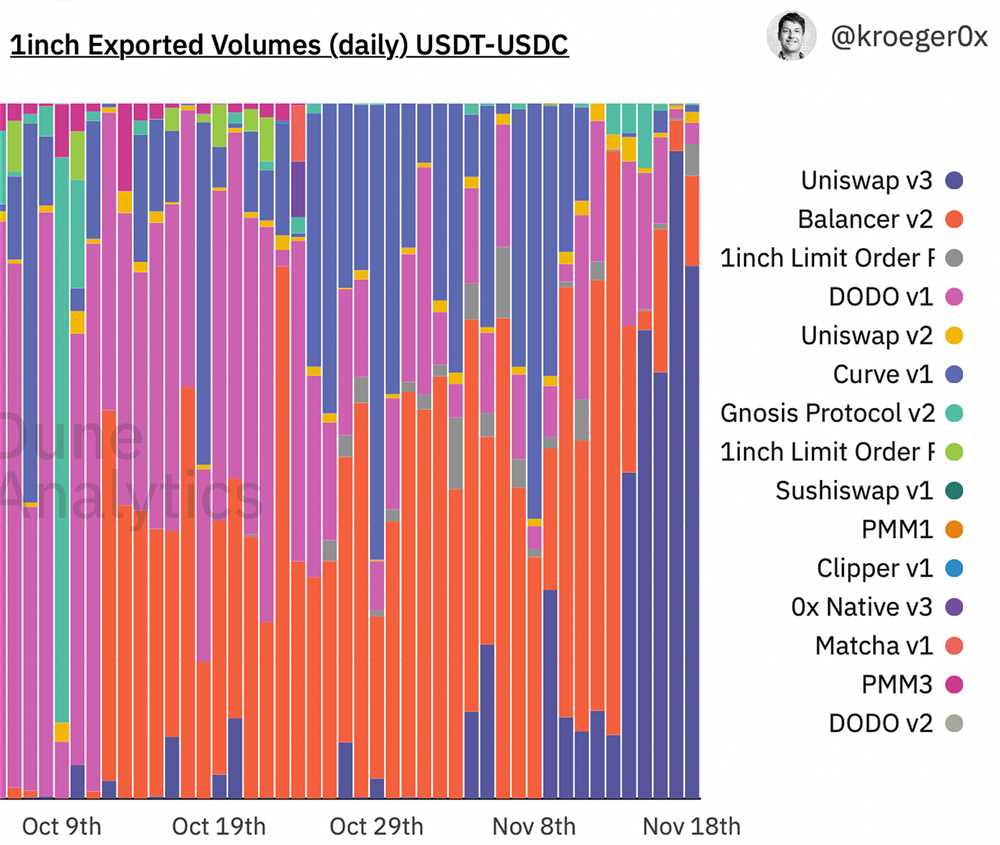

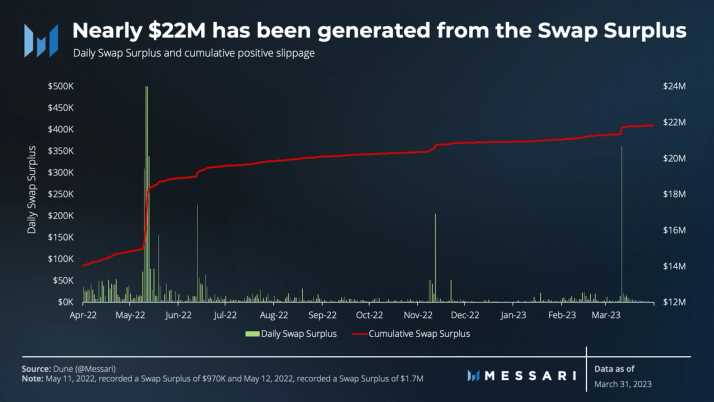

1inch is a decentralized exchange aggregator that sources liquidity from various platforms, including Curve Finance. It aims to provide users with the best possible rates by splitting large orders across multiple platforms and finding the most optimal trading routes. This algorithmic approach ensures that users get the most value for their trades and minimizes slippage. Additionally, 1inch offers users the option to trade with limit orders, giving them more control over their transactions.

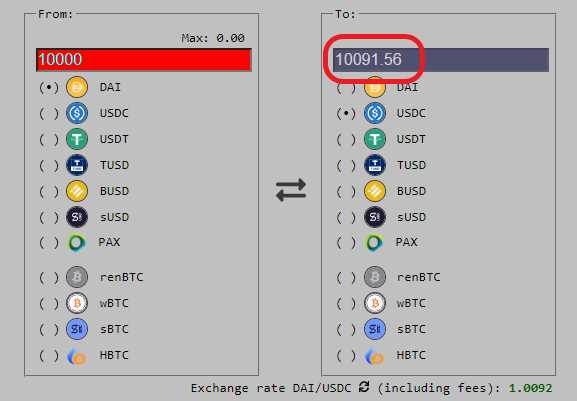

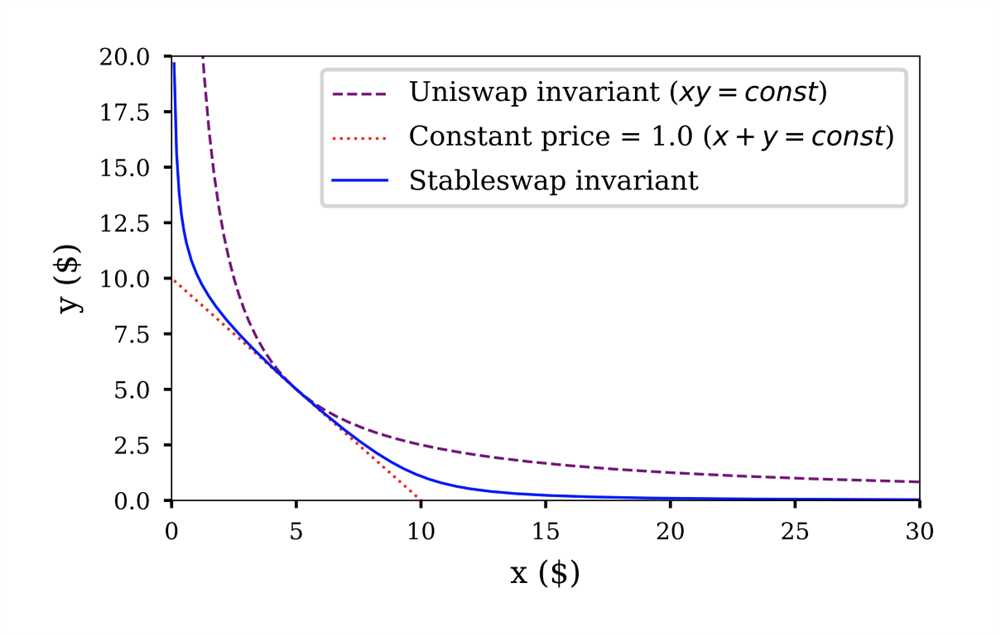

On the other hand, Curve Finance is a decentralized exchange protocol specifically designed for stablecoin swapping. It focuses on providing low slippage and low fees, making it ideal for large-volume trades. Curve achieves this by utilizing an automated market maker (AMM) algorithm that keeps stablecoin prices in a tight range. This feature makes Curve attractive for traders and liquidity providers who want to benefit from stablecoin arbitrage opportunities.

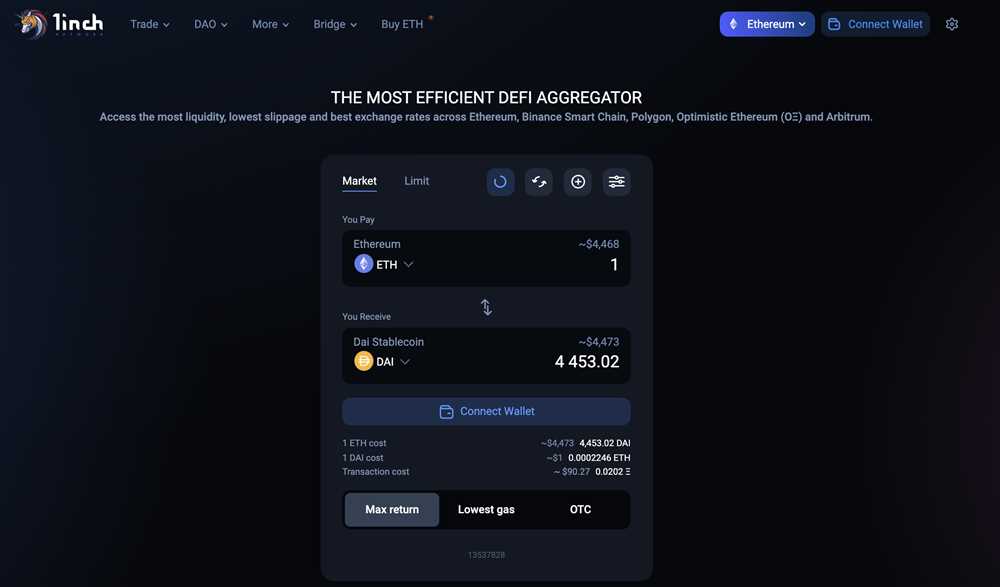

When comparing 1inch and Curve Finance, it’s important to consider their user interfaces and user experiences. 1inch offers a user-friendly interface that is simple to navigate and provides users with detailed information about their trades, including estimated gas fees and slippage. On the other hand, Curve Finance offers a more minimalistic interface, focusing on providing quick and efficient swaps without unnecessary distractions. Both interfaces have their strengths and cater to different user preferences.

In conclusion, both 1inch and Curve Finance offer unique features and advantages for stablecoin swapping in the DeFi ecosystem. 1inch’s algorithmic approach and limit order functionality provide users with more control and optimal trading routes, while Curve Finance’s focus on low slippage and low fees makes it attractive for large-volume trades and stablecoin arbitrage. Ultimately, the choice between the two protocols depends on the specific needs and preferences of the user.

1inch vs Curve Finance: Key Features and Differences

1inch and Curve Finance are both decentralized finance (DeFi) protocols that aim to provide efficient and low-cost stablecoin swapping services. However, they have some key differences in terms of features and functionality.

1inch:

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges, including Curve Finance, to provide users with the best possible rates for stablecoin swapping. It utilizes an automated market maker (AMM) model and smart contract technology to ensure fast and secure transactions.

Key features of 1inch include:

- Liquidity aggregation: 1inch aggregates liquidity from multiple decentralized exchanges, including Curve Finance, to offer users the most competitive rates for stablecoin swapping.

- Optimized routing: The protocol uses sophisticated algorithms to find the most efficient path for swapping stablecoins, taking into account factors such as fees and slippage.

- Gas optimization: 1inch aims to minimize transaction costs by optimizing gas usage and routing transactions through the most cost-effective paths.

- Limit orders: Users can set limit orders on 1inch to execute trades at specific price levels, allowing for more control over their transactions.

Curve Finance:

Curve Finance is a decentralized exchange protocol that focuses specifically on stablecoin swapping. It is designed to offer low slippage and low fees for stablecoin trades, making it particularly attractive for liquidity providers and traders dealing with stablecoins.

Key features of Curve Finance include:

- Stablecoin pools: Curve Finance operates liquidity pools that are composed entirely of stablecoins, such as USDT, USDC, DAI, and TUSD. This concentration of stablecoins allows for highly efficient and low-cost stablecoin swapping.

- Low slippage: Due to the low volatility of stablecoins, Curve Finance is able to provide trades with minimal slippage, resulting in more accurate and cost-effective transactions.

- Advanced bonding curve: The protocol utilizes an advanced bonding curve mechanism, which helps to maintain a relatively stable price for stablecoin swaps.

- High yield farming opportunities: Curve Finance offers various yield farming opportunities for liquidity providers, allowing them to earn additional returns on their stablecoin holdings.

In summary, while both 1inch and Curve Finance provide stablecoin swapping services, they differ in their approach and features. 1inch focuses on liquidity aggregation and optimized routing, while Curve Finance specializes in low slippage and stablecoin pools. Both protocols offer unique benefits for users and contribute to the growth and development of the DeFi ecosystem.

inch: The Swapping Protocol

1inch is a decentralized exchange aggregator and liquidity protocol that aims to provide users with the best possible rates for swapping stablecoins and other tokens. It utilizes an algorithm that takes into account various decentralized exchanges and liquidity pools to find the most optimal trading paths. The protocol is designed to minimize slippage and maximize the value of the traded assets.

One of the key features of 1inch is its integration with various liquidity sources, including Curve Finance. This allows users to access a wide range of liquidity pools and trade stablecoins efficiently. By aggregating liquidity from different sources, 1inch is able to provide users with better rates and lower fees, making it an attractive option for traders and liquidity providers.

Furthermore, 1inch offers a user-friendly interface that enables users to easily swap between different stablecoins and tokens. The platform displays all available trading paths and their corresponding rates, allowing users to choose the most favorable option. The swapping process is quick and efficient, providing users with a seamless experience.

1inch also prioritizes security and transparency. The protocol undergoes regular security audits to identify and address any vulnerabilities. Additionally, all transactions on 1inch are recorded on the Ethereum blockchain, ensuring that the platform remains transparent and decentralized.

In conclusion, 1inch is a powerful swapping protocol that offers users competitive rates, efficient trading paths, and a user-friendly interface. Its integration with Curve Finance and other liquidity sources enhances its liquidity offering, making it a popular choice among traders and liquidity providers.

Curve Finance: The Stablecoin Protocol

Curve Finance is a decentralized finance (DeFi) protocol that focuses on providing efficient stablecoin swapping capabilities on the Ethereum blockchain. It is designed to allow users to exchange stablecoins with minimal slippage and low fees, making it an attractive option for traders and liquidity providers.

One of the key features of Curve Finance is its emphasis on stablecoins. The protocol supports a wide range of stablecoins, including USDT, USDC, DAI, and others. This allows users to easily swap between different stablecoins without the need for additional conversions or transactions.

Curve Finance achieves its low slippage and low fee model through the use of automated market makers (AMMs) and liquidity pools. Liquidity providers deposit their stablecoins into these pools, and in return, they receive Curve LP tokens. These tokens can be used to earn trading fees and participate in the governance of the protocol.

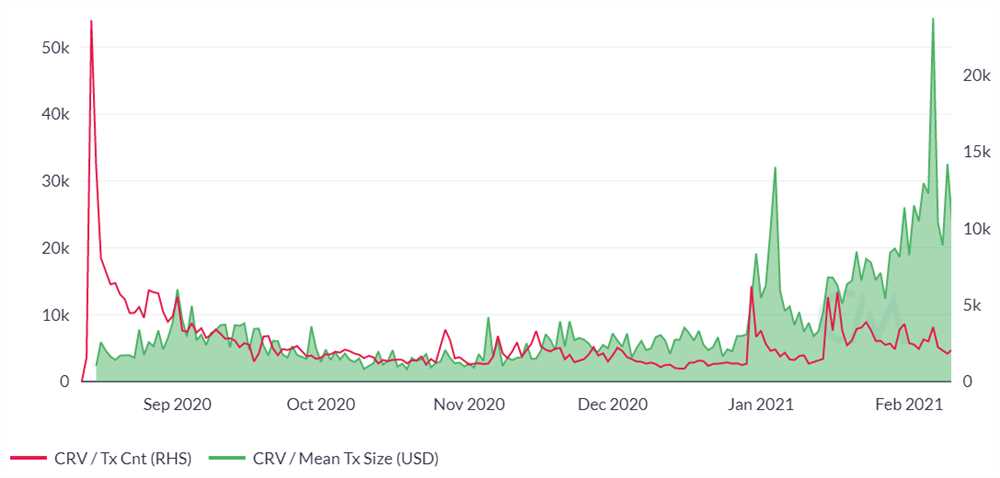

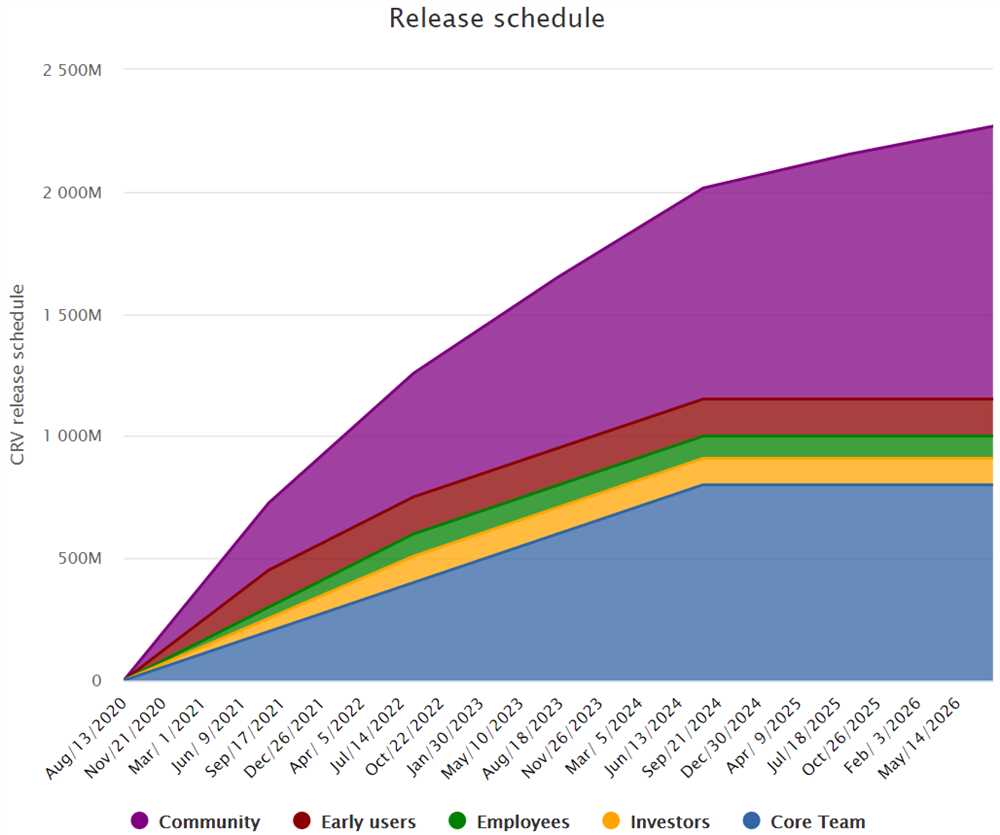

Curve.fi Token (CRV) is the native token of the Curve Finance protocol. CRV holders can stake their tokens and earn additional rewards. Additionally, CRV is used for voting on governance proposals and making decisions related to the protocol’s future development and upgrades.

Curve Finance has gained popularity in the DeFi space due to its focus on stablecoins and its efficient stablecoin swapping capabilities. Its low slippage and low fees make it a preferred choice for traders and liquidity providers looking to move their stablecoins with minimal cost and friction.

In conclusion, Curve Finance is a stablecoin protocol that offers efficient stablecoin swapping capabilities on the Ethereum blockchain. With its focus on stablecoins, AMMs, and liquidity pools, it has become a popular choice for users looking to exchange stablecoins with minimal slippage and low fees.

1inch vs Curve Finance: Comparative Analysis and Use Cases

Decentralized Finance (DeFi) has seen tremendous growth in recent years, with various protocols and platforms emerging to facilitate efficient trading and swapping of digital assets. Two notable platforms in this space are 1inch and Curve Finance. While both platforms aim to provide decentralized stablecoin swapping solutions, they differ in several aspects, including their underlying algorithms, tokenomics, and supported use cases.

1. Algorithm

1inch operates using an automated market maker (AMM) algorithm that splits users’ orders across multiple decentralized exchanges to achieve the best possible price. It leverages various liquidity sources, including both centralized and decentralized exchanges, to optimize trading and reduce slippage.

On the other hand, Curve Finance is specifically designed for stablecoin swapping and employs a unique algorithm that focuses on low-slippage trades. It achieves this by utilizing liquidity pools with low volatility and tight spreads, providing stablecoin traders with near-optimal trading conditions.

2. Tokenomics

1inch has its native token, also called 1inch, which plays a crucial role in the platform’s governance and incentivization mechanism. Holders of the 1inch token can stake it to earn rewards and participate in voting for protocol upgrades and improvements.

Curve Finance, on the other hand, does not have a native token. Instead, it utilizes a stablecoin-based fee structure to generate revenue and incentivize liquidity providers. Stability fees collected from stablecoin swaps are distributed proportionally among liquidity providers based on their contribution.

3. Use Cases

1inch and Curve Finance cater to different use cases within the stablecoin swapping ecosystem. 1inch’s algorithm allows users to swap between various stablecoins, providing them with the best possible rates and reduced slippage. It is ideal for users who want to optimize their stablecoin trading and achieve the best available prices.

On the other hand, Curve Finance is specifically tailored for traders who want to swap between different stablecoins while minimizing slippage and transaction costs. Its algorithm focuses on low-volatility, tight-spread liquidity pools, making it suitable for stablecoin arbitrage and low-slippage stablecoin trading.

| Comparison | 1inch | Curve Finance |

|---|---|---|

| Algorithm | Automated Market Maker | Low-Slippage Stablecoin Swapping |

| Tokenomics | 1inch Token (Governance & Incentivization) | Stablecoin-based Fee Structure (Revenue & Incentives) |

| Use Cases | Optimized Stablecoin Swapping | Low-Slippage Stablecoin Trading & Arbitrage |

In conclusion, 1inch and Curve Finance provide unique solutions for stablecoin swapping in the DeFi ecosystem. While 1inch focuses on optimizing trading rates and reducing slippage, Curve Finance is designed for low-slippage stablecoin trading. Depending on their specific needs and trading strategies, users can choose the platform that best aligns with their requirements.

Comparative Analysis of 1inch and Curve Finance

In the decentralized finance (DeFi) space, 1inch and Curve Finance are two prominent protocols that offer stablecoin swapping services. While they both aim to provide efficient and cost-effective liquidity solutions, there are certain differences between the two.

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs). It uses an algorithmic routing mechanism to split trades across multiple DEXs to ensure the best possible execution. The protocol also offers the possibility of gas token refunds, reducing transaction costs for users. 1inch supports a wide range of stablecoins and other ERC-20 tokens, providing users with access to a diverse set of trading options.

On the other hand, Curve Finance is a decentralized exchange focused specifically on stablecoin swapping. It is optimized for low slippage and low fees, making it an attractive option for traders looking to exchange stablecoins with minimal price impact. Curve Finance achieves this by utilizing stablecoin pools that maintain a pegged price and low volatility. The protocol also offers yield farming opportunities through its Liquidity Gauge program, where users can earn additional rewards by providing liquidity to stablecoin pools.

While both 1inch and Curve Finance offer stablecoin swapping services, their approaches and features differ. 1inch focuses on aggregating liquidity from various DEXs to provide the best execution for trades across multiple tokens. Curve Finance, on the other hand, specializes in stablecoin swapping, prioritizing low slippage and low fees.

Another key difference is the liquidity sources. 1inch taps into multiple DEXs, which allows it to provide higher liquidity and access to a wider range of tokens. Curve Finance, on the other hand, utilizes liquidity pools specifically designed for stablecoins, resulting in lower slippage and reduced price impact for stablecoin swaps.

Both platforms have their strengths and cater to different user needs. 1inch is ideal for traders looking for access to a wide range of tokens and the best possible execution. On the other hand, Curve Finance is well-suited for those specifically interested in stablecoin swaps with minimal price impact and the possibility of earning additional rewards through yield farming.

In conclusion, while both 1inch and Curve Finance offer stablecoin swapping services, they differ in their approaches and features. Traders and users should carefully consider their specific requirements and priorities when choosing between the two protocols.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs).

What is Curve Finance?

Curve Finance is a decentralized exchange and automated market maker (AMM) that focuses on providing low-slippage trading for stablecoins.

What are the main differences between 1inch and Curve Finance?

The main difference is that 1inch is an exchange aggregator that sources liquidity from different DEXs, while Curve Finance is a dedicated AMM for stablecoins. Additionally, 1inch offers a wide range of token swapping options, while Curve Finance specializes in stablecoin swapping.

How does 1inch ensure the best possible trading rates?

1inch uses an algorithm called Pathfinder, which searches for the most efficient paths for token swaps across multiple DEXs in order to provide the best possible rates for users.