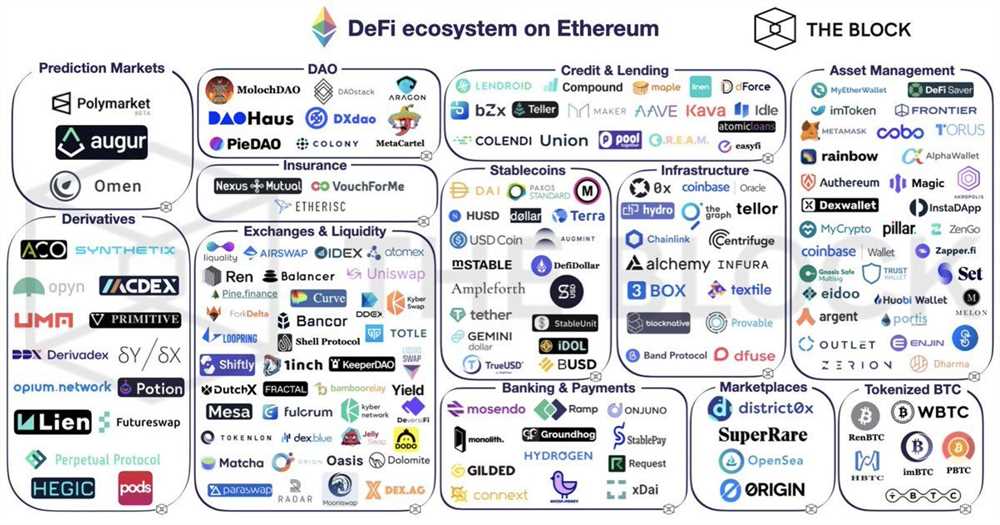

Decentralized Finance (DeFi) has revolutionized the traditional financial landscape, offering users a wide array of options to manage and grow their assets. 1inch Swap, a leading decentralized exchange aggregator, has emerged as a key player in this ecosystem, providing traders with seamless access to liquidity across multiple platforms. What sets 1inch Swap apart is its extensive integration with other DeFi protocols, allowing users to tap into the full potential of the DeFi ecosystem.

1inch Swap’s integration with other DeFi protocols is a game-changer for DeFi enthusiasts. By leveraging the power of smart contracts and blockchain technology, 1inch Swap is able to source liquidity from various decentralized exchanges, including Uniswap, PancakeSwap, SushiSwap, and many others. This integration enables users to find the best rates for their trades instantly, while also minimizing slippage and reducing costs.

But it doesn’t stop there. 1inch Swap’s integration extends beyond decentralized exchanges. The platform has integrated with lending and borrowing protocols like Aave, Compound, and MakerDAO, allowing users to utilize their assets as collateral and earn interest on their holdings. This integration opens up new avenues for users to maximize their returns and manage their risk effectively.

Furthermore, 1inch Swap has integrated with yield farming protocols, such as Yearn Finance and Curve Finance, enabling users to participate in profitable farming opportunities. By leveraging these integrations, users can automatically allocate their assets to the most lucrative farming strategies, optimizing their yield and minimizing their effort.

Overall, 1inch Swap’s integration with other DeFi protocols creates a synergistic ecosystem where users can seamlessly navigate between different platforms and protocols to make the most of their assets. Whether you’re a trader looking for the best rates, a yield farmer seeking profitable opportunities, or a borrower in need of liquidity, 1inch Swap’s deep integration with other DeFi protocols ensures that you have all the tools and resources at your disposal to achieve your financial goals.

1inch Swap’s Integration with Other DeFi Protocols

1inch Swap is a decentralized exchange aggregator that allows users to get the best possible trading rates across multiple DeFi protocols. As part of its mission to provide optimal liquidity and trading options for users, 1inch Swap has integrated with several other DeFi protocols. These integrations enable users to access a wider range of assets and liquidity pools, and also improve the overall trading experience.

One of the key DeFi protocols that 1inch Swap has integrated with is Uniswap. Uniswap is a popular decentralized exchange protocol that allows users to swap ERC-20 tokens directly from their wallets. By integrating with Uniswap, 1inch Swap is able to source liquidity from the various Uniswap pools, providing users with a larger pool of assets to trade.

Another notable integration is with SushiSwap, a decentralized exchange platform that offers enhanced liquidity options. By integrating with SushiSwap, 1inch Swap is able to tap into additional liquidity sources and offer users even better rates for their trades.

1inch Swap has also integrated with other DeFi protocols such as Balancer and Curve. Balancer is an automated portfolio manager and liquidity provider that allows users to create and manage liquidity pools with multiple tokens. By integrating with Balancer, 1inch Swap is able to access larger and more diverse liquidity pools, allowing for more efficient trades.

Curve is another important DeFi protocol that 1inch Swap has integrated with. Curve specializes in stablecoin trading and offers low-slippage swaps between stablecoins. By integrating with Curve, 1inch Swap is able to provide users with better rates and lower slippage when trading stablecoins.

Overall, 1inch Swap’s integration with other DeFi protocols enhances its ability to provide users with the best possible trading rates and liquidity options. By tapping into a wide range of DeFi protocols and liquidity sources, 1inch Swap is able to offer users a seamless and efficient trading experience.

A Deep Dive into the Ecosystem

1inch Swap is not just a stand-alone decentralized exchange; it is an integral part of a vibrant DeFi ecosystem. By integrating with other DeFi protocols, 1inch Swap enables users to access a wide range of features and liquidity options.

1. Liquidity Aggregation

One of the key features of 1inch Swap is its liquidity aggregation. By tapping into multiple liquidity sources such as decentralized exchanges (DEXs) and automated market makers (AMMs), 1inch Swap ensures that users always get the best possible rates for their trades. This not only improves the user experience but also maximizes the efficiency of trading on the platform.

2. AMM Protocol Integration

1inch Swap integrates with various AMM protocols, including Uniswap, SushiSwap, and Curve Finance, among others. This integration allows users to trade directly on these protocols without leaving the 1inch Swap platform. By leveraging the liquidity and pricing algorithms of these protocols, 1inch Swap provides users with access to a deep pool of liquidity and competitive trading rates.

3. Flash Swaps

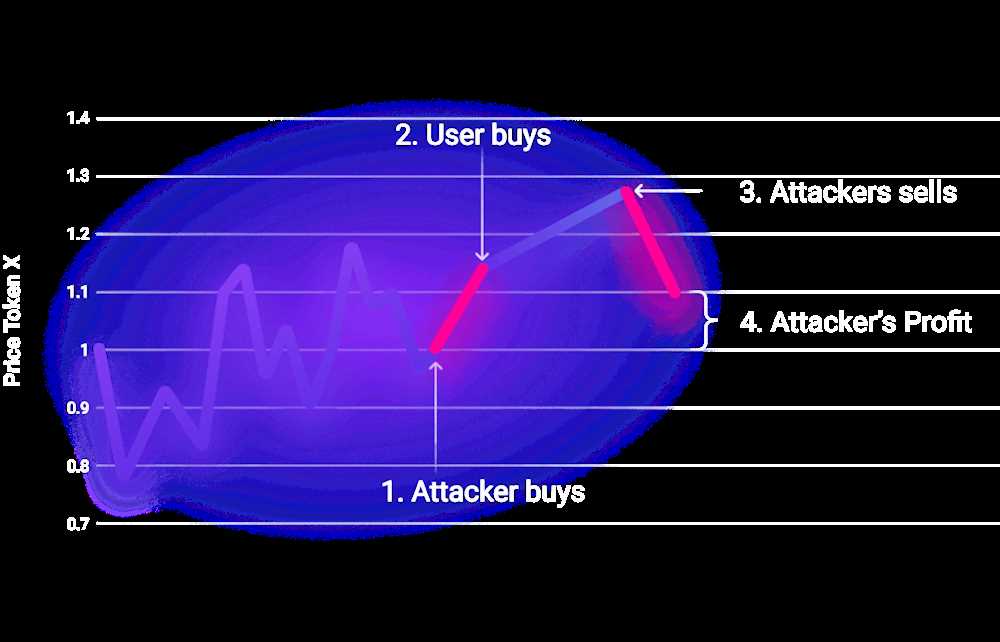

Another innovative feature of 1inch Swap is its support for flash swaps. Flash swaps allow users to borrow assets temporarily without upfront collateral, as long as the borrowed assets are returned within the same transaction. This opens up new opportunities for arbitrage and liquidity provision strategies, enabling users to profit from temporary imbalances in the market.

4. Yield Farming Aggregator

In addition to its swapping capabilities, 1inch Swap also acts as a yield farming aggregator. By integrating with various decentralized lending and borrowing protocols, such as Aave and Compound, 1inch Swap allows users to easily find and maximize their yield farming opportunities. The platform automatically optimizes the allocation of user funds across different protocols to maximize their returns while minimizing the risks associated with yield farming.

Overall, 1inch Swap’s integration with other DeFi protocols creates a powerful ecosystem that offers users a seamless and efficient trading experience. By providing access to a wide range of liquidity sources, pricing algorithms, and yield farming opportunities, 1inch Swap empowers users to make the most out of their DeFi investments.

Exploring 1inch Swap’s Integration with DeFi Protocols

1inch Swap has emerged as a leading decentralized exchange aggregator, providing users with the ability to find the best prices and execute trades across multiple DeFi protocols. Through its integration with various protocols, 1inch Swap has become a powerful tool for DeFi users looking to optimize their trading strategies.

The Integration Landscape

1inch Swap is integrated with a wide range of DeFi protocols, including popular platforms such as Uniswap, SushiSwap, Balancer, and Curve Finance. This extensive integration allows users to access liquidity from multiple sources, maximizing their chances of finding the best possible trade execution.

The integration with these protocols is particularly significant for users looking to swap tokens. By aggregating liquidity from various sources, 1inch Swap minimizes slippage and ensures that users can execute trades at the most favorable prices.

Benefits of Integration

One of the key benefits of 1inch Swap’s integration with DeFi protocols is the ability to swap tokens quickly and efficiently. By accessing liquidity from multiple sources, users can avoid the need to manually search for the best prices on different platforms.

Furthermore, the integration with different protocols also enables 1inch Swap to provide users with a wide range of trading options. Whether it’s swapping tokens, providing liquidity, or participating in yield farming, 1inch Swap offers a comprehensive suite of features to cater to diverse trading strategies.

The integration with DeFi protocols also enhances the security and reliability of 1inch Swap. By leveraging established protocols, users can trust that their trades are executed in a transparent and secure manner, without the risk of centralized exchange hacks or manipulations.

Moreover, the integration with various protocols allows 1inch Swap to synergize with other DeFi platforms and services. For example, users can leverage the integration to interact with lending platforms like Compound or MakerDAO, enabling them to borrow or lend assets as part of their trading strategies.

The Future of Integration

As the DeFi ecosystem continues to evolve and expand, 1inch Swap’s integration with other protocols is set to become even more crucial. The team behind 1inch Swap is committed to continuously integrating with new platforms and improving the overall user experience.

With its strong focus on decentralization and innovation, 1inch Swap aims to be at the forefront of the DeFi space, providing users with seamless access to diverse liquidity sources and empowering them to make the most informed trading decisions.

In conclusion, 1inch Swap’s integration with DeFi protocols opens up a world of possibilities for users, allowing them to access liquidity from multiple sources, swap tokens at the best prices, and explore a variety of trading strategies. The ongoing integration efforts by the team behind 1inch Swap ensure that users continue to benefit from an ever-expanding ecosystem of DeFi protocols and services.

A Comprehensive Analysis of the Ecosystem

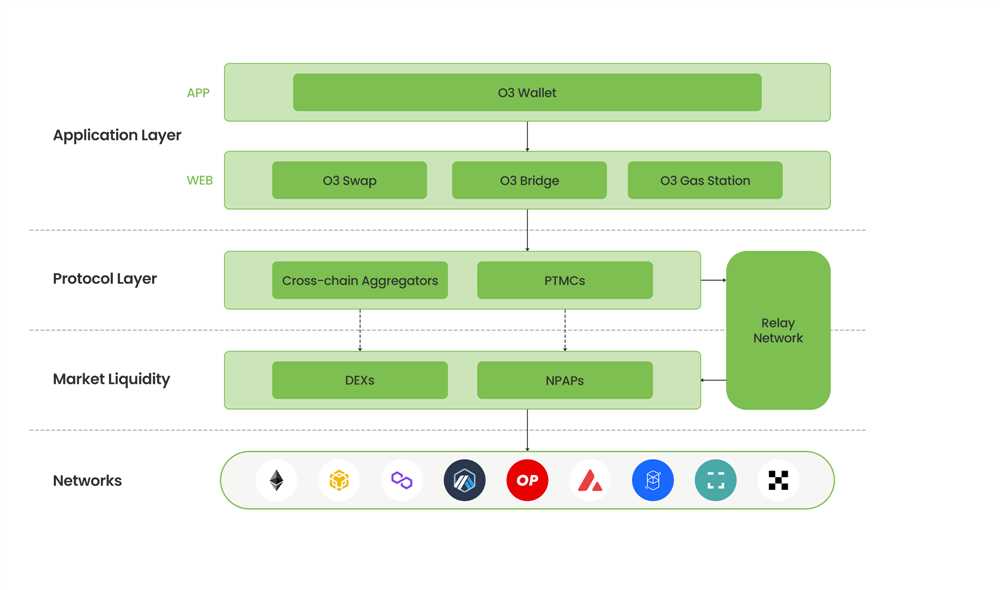

The 1inch Swap ecosystem is a dynamic and rapidly growing network of decentralized finance protocols that work together to provide users with a seamless experience in swapping and trading their digital assets. This analysis will delve into the key components of the ecosystem, highlighting the interconnections and functionalities offered by each protocol.

1. 1inch DEX Aggregator

At the heart of the ecosystem is the 1inch DEX aggregator, which allows users to find the best prices across multiple decentralized exchanges. By integrating with various DEXs, the aggregator enables users to make informed decisions when swapping their tokens, ensuring they receive the most favorable rates.

Utilizing advanced algorithms, the aggregator scans multiple liquidity sources in real-time, calculating the optimal trading path to maximize returns for users. This technology sets it apart from traditional DEXs, which often lack depth and liquidity.

2. Liquidity Protocol

The ecosystem’s liquidity protocol plays a vital role in ensuring that the 1inch DEX aggregator has access to a deep pool of liquidity. By integrating with various liquidity providers, the protocol is able to aggregate liquidity across multiple platforms, including other decentralized exchanges, lending protocols, and yield farming platforms.

This integration with external liquidity sources enhances the ecosystem’s ability to offer users the best possible rates when swapping their tokens. Furthermore, by utilizing liquidity pools, the protocol reduces the impact of slippage, allowing for more efficient and cost-effective trades.

3. Governance and Tokenomics

The 1inch token (1INCH) serves as the governance and utility token of the ecosystem. Holders of 1INCH have the ability to participate in protocol governance, including voting on proposals and shaping the future direction of the ecosystem. Additionally, token holders are eligible to receive rewards through various liquidity mining programs.

The tokenomics of the ecosystem are designed to incentivize network participants to contribute liquidity and actively engage with the protocols. This ensures the growth and sustainability of the ecosystem, while also benefiting token holders through the distribution of fees and rewards.

In conclusion, the 1inch Swap ecosystem is a robust and interconnected network of DeFi protocols that work together to provide users with a seamless and efficient experience in swapping their digital assets. The integration of the 1inch DEX aggregator, liquidity protocol, and governance mechanism enables the ecosystem to offer users the best possible rates, deep liquidity, and a voice in shaping the future of the ecosystem.

The Interconnectedness of 1inch Swap and DeFi Protocols

One of the key features that sets 1inch Swap apart from other decentralized exchanges is its ability to seamlessly integrate with other DeFi protocols. Through strategic partnerships and collaborations, 1inch Swap has formed a vast ecosystem that maximizes user experience and liquidity.

At the heart of this interconnectedness is the 1inch liquidity protocol. 1inch Aggregation Protocol, a key component of 1inch Swap, sources liquidity from various decentralized exchanges, providing users with the best swapping rates across different protocols. This allows users to benefit from the deep liquidity pools of multiple platforms all in one place.

1inch Swap’s integration with other DeFi protocols doesn’t stop at just aggregating liquidity. The platform also collaborates with lending and yield farming protocols to offer users additional opportunities to earn passive income. By integrating with lending protocols like Aave and Compound, users can borrow and lend assets with ease, while also staking their assets to earn yield on platforms like Yearn Finance.

Furthermore, 1inch Swap has established strategic partnerships with other decentralized exchanges like SushiSwap and Uniswap. This integration allows users to access liquidity from these platforms directly through 1inch Swap, further enhancing the platform’s liquidity options.

The interconnectedness of 1inch Swap and DeFi protocols extends beyond just swapping and yield farming. Through integrations with decentralized insurance platforms like Nexus Mutual, users can also protect their assets and hedge against smart contract risks. This allows users to have peace of mind knowing that their funds are protected in case of any unforeseen events.

In addition to these collaborations, 1inch Swap is continuously exploring new partnerships and integrations to expand its ecosystem. This commitment to interoperability ensures that users have access to a wide range of DeFi services, all within the convenience of a single platform.

| 1inch Swap’s Integrations with DeFi Protocols: |

|---|

| 1. 1inch Aggregation Protocol |

| 2. Aave |

| 3. Compound |

| 4. Yearn Finance |

| 5. SushiSwap |

| 6. Uniswap |

| 7. Nexus Mutual |

Question-answer:

What is 1inch Swap?

1inch Swap is a decentralized exchange aggregator that sources liquidity from various other exchanges to provide users with the best possible trading rates.

How does 1inch Swap integrate with other DeFi protocols?

1inch Swap integrates with other DeFi protocols through its partnership and integration program. It collaborates with various protocols, such as Uniswap, Compound, and Balancer, to provide users with access to a wide range of liquidity and features.

What are the benefits of 1inch Swap’s integration with other DeFi protocols?

The integration of 1inch Swap with other DeFi protocols allows users to access a larger pool of liquidity, enabling them to find the best trading rates and maximize their profits. It also provides users with a wider range of features and options for trading and yield farming.

Can 1inch Swap be integrated with any DeFi protocol?

1inch Swap can be integrated with any DeFi protocol that allows for integration and partnership. However, the extent of integration may vary depending on the compatibility and collaboration between 1inch Swap and the specific protocol.