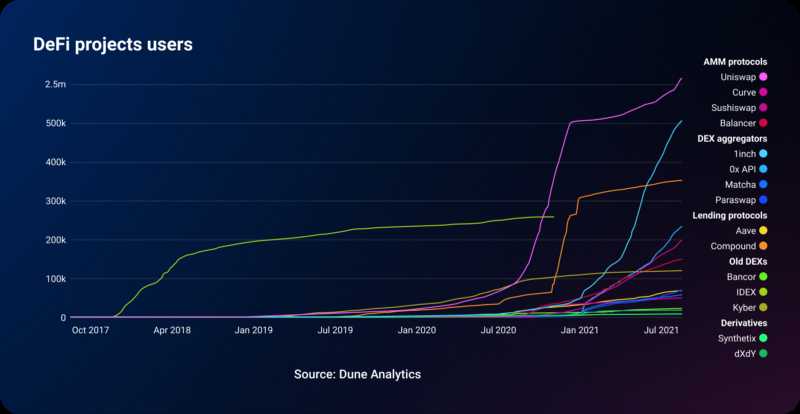

The world of decentralized finance (DeFi) has witnessed numerous groundbreaking innovations in recent years. One such innovation that has been making waves is the rise of 1inch, a decentralized exchange aggregator that has transformed the way users interact with the DeFi ecosystem.

1inch, founded in 2019 by Sergej Kunz and Anton Bukov, aims to address some of the biggest challenges faced by DeFi users, such as high slippage, high gas fees, and fragmented liquidity. Through its unique combination of smart contract technology and algorithmic trading, 1inch has created a platform that enables users to access the best prices and liquidity across multiple decentralized exchanges.

What sets 1inch apart from other decentralized exchanges is its innovative approach to liquidity aggregation. By splitting user orders across multiple liquidity sources, such as Uniswap, Kyber, Balancer, and more, 1inch is able to minimize slippage and provide users with the best possible price for their trades. This not only improves the trading experience for users but also enhances overall market efficiency.

Additionally, 1inch utilizes its own native token, called 1INCH, to incentivize users and liquidity providers. The token can be staked and used to vote on platform proposals, further decentralizing the governance process. With a total supply of 1.5 billion tokens, 1inch aims to distribute its token fairly among its community members and stakeholders.

The Emergence of 1inch as a Revolutionary DeFi Platform

Decentralized Finance (DeFi) has taken the world by storm, revolutionizing the way people manage their finances and interact with blockchain technology. One of the platforms at the forefront of this revolution is 1inch.

1inch is a decentralized exchange (DEX) aggregator that allows users to access multiple liquidity sources and swap tokens at the best possible prices. It was launched in 2019 by Sergej Kunz and Anton Bukov, two experienced developers in the blockchain space.

What sets 1inch apart from other DEX aggregators is its innovative approach to liquidity optimization. The platform uses an algorithm called Pathfinder, which combines multiple liquidity sources, such as decentralized exchanges, to find the most efficient token swap routes. This ensures that users always get the best possible prices for their trades.

But 1inch goes beyond just being a DEX aggregator. It also offers a range of other DeFi services, such as yield farming, lending, and staking. These services allow users to maximize their returns on their crypto assets and participate in the growing DeFi ecosystem.

Another key feature of 1inch is its commitment to transparency and security. The platform is built on the Ethereum blockchain and operates in a fully decentralized manner. This means that users have full control over their funds and can trust that their transactions are secure and tamper-proof.

Since its launch, 1inch has rapidly gained popularity and has become one of the leading platforms in the DeFi space. Its user-friendly interface, competitive prices, and wide range of services have attracted a large and active user base.

The emergence of 1inch as a revolutionary DeFi platform marks a new era in decentralized finance. With its innovative approach to liquidity optimization and commitment to transparency, 1inch is empowering individuals to take control of their finances and participate in the decentralized economy.

| Advantages of 1inch | Disadvantages of 1inch |

|---|---|

| Efficient token swaps at the best prices | Dependence on Ethereum network’s congestion and fees |

| Range of DeFi services for maximized returns | Limited number of supported tokens |

| Full transparency and security | No fiat on-ramp |

The Impact of 1inch on the Decentralized Exchanges

1inch has emerged as a game-changer in the world of decentralized exchanges (DEX). With its innovative approach to decentralized finance (DeFi) and superior technology, 1inch has had a significant impact on the decentralized exchange landscape.

Improved Liquidity

One of the key contributions of 1inch to decentralized exchanges is its ability to provide improved liquidity. By leveraging its unique aggregation algorithm, 1inch is able to split orders across multiple DEXs, ensuring the best possible execution prices for traders. This enhanced liquidity has attracted a large number of users to the platform, making it one of the most popular choices for DeFi enthusiasts.

Reduced Slippage

Another major impact of 1inch on decentralized exchanges is the significant reduction in slippage. Slippage refers to the difference between the expected price of a trade and the executed price. With its efficient routing mechanism, 1inch minimizes slippage by intelligently navigating through different liquidity sources. This feature is particularly beneficial for traders looking to execute large transactions without causing substantial price changes.

Enhanced User Experience

1inch has also had a profound impact on the user experience of decentralized exchanges. Its user-friendly interface, intuitive design, and seamless integration with popular DeFi wallets have made it easy for both experienced and novice users to navigate the platform. Additionally, its gas optimization feature helps to reduce transaction costs, further enhancing user satisfaction.

Driving Innovation in DeFi

1inch has not only made a significant impact on decentralized exchanges but has also played a pivotal role in driving innovation in the DeFi space. Through its research and development initiatives, partnership programs, and active engagement with the DeFi community, 1inch has continuously pushed the boundaries of what is possible in the world of decentralized finance. Its constant endeavor to introduce new features and improve existing ones has spurred a wave of innovation, benefiting the entire DeFi ecosystem.

In conclusion, 1inch has revolutionized decentralized exchanges by providing improved liquidity, reducing slippage, enhancing user experience, and driving innovation in the DeFi space. As the popularity of decentralized finance continues to grow, the impact of 1inch on the decentralized exchange landscape is expected to remain significant.

How 1inch is Revolutionizing Liquidity Aggregation

Decentralized Finance (DeFi) has transformed the financial landscape, enabling users to access a wide range of financial services without intermediaries. However, one major challenge with DeFi is liquidity fragmentation, where the liquidity is spread across different decentralized exchanges (DEXs), resulting in fragmented pools and higher slippage.

1inch is a decentralized exchange aggregator that addresses this issue by revolutionizing liquidity aggregation. It provides users with access to the best prices and deepest liquidity from multiple DEXs through a single platform.

How does 1inch revolutionize liquidity aggregation?

1. Smart contract routing: 1inch utilizes smart contract technology to split a user’s trade across multiple liquidity sources, ensuring the best possible prices and minimal slippage. By aggregating liquidity from different DEXs, users can access the most competitive rates without manually searching and executing trades on multiple platforms.

2. Gas optimization: Gas fees are an important consideration in DeFi transactions. 1inch intelligently routes trades to minimize gas costs, optimizing user experience and reducing transaction fees.

3. Security: 1inch is built on a robust security infrastructure to protect user funds. It has undergone rigorous security audits and adopts various security measures to ensure the safety of user assets.

4. Advanced features: In addition to liquidity aggregation, 1inch offers a range of advanced features such as limit orders, gas fee estimation, and token swaps. These features enhance the user experience and enable users to execute trades more efficiently.

The impact of 1inch:

1inch has had a significant impact on the DeFi ecosystem, solving the liquidity fragmentation issue and improving overall liquidity efficiency. Its innovative approach to liquidity aggregation has made it a popular choice among traders and investors, enabling them to access the best prices and liquidity in a seamless manner.

Moreover, 1inch has spurred innovation in the DeFi space by inspiring other projects to adopt similar liquidity aggregation models. This has led to increased competition and improved services in the DeFi ecosystem.

In conclusion, 1inch is revolutionizing liquidity aggregation in the DeFi space. By leveraging smart contract technology, optimizing gas fees, and providing advanced features, it simplifies the trading process, enhances liquidity efficiency, and improves the overall user experience. Through its innovative approach, 1inch has made a significant impact on the DeFi ecosystem, paving the way for further advancements in decentralized finance.

The Future of 1inch: What Lies Ahead for Decentralized Finance

As the decentralized finance space continues to evolve, 1inch finds itself at the forefront of innovation and adoption. With its unique aggregation and trading protocol, 1inch has quickly become one of the most popular platforms for decentralized trading, enabling users to access liquidity across multiple decentralized exchanges (DEXs) and maximize their trading opportunities.

Looking ahead, the future of 1inch holds immense potential for further growth and development. With the increasing demand for decentralized finance solutions, 1inch aims to expand its services and offerings to cater to a wider range of users and use cases.

One of the key areas of focus for 1inch is improving the user experience and interface. Enhancing usability and simplifying the onboarding process will be crucial in attracting new users to the platform and driving mass adoption. Additionally, 1inch plans to optimize its infrastructure and improve transaction speed and efficiency, ensuring a seamless trading experience for its users.

Furthermore, 1inch will continue to foster partnerships and collaborations with other DeFi projects and platforms. By integrating with other protocols and DEXs, 1inch can further expand its liquidity pool and offer even more diverse trading options to its users. This interoperability will be instrumental in creating a robust and interconnected decentralized finance ecosystem.

In terms of the 1inch token (1INCH), the future holds great promise. 1INCH is not just a utility token but also a governance token, giving holders voting rights and the ability to shape the future of the protocol. As the ecosystem grows, so does the value and importance of the 1INCH token, making it a valuable asset for investors and users alike.

Overall, the future of 1inch looks bright as it continues to innovate and adapt to the ever-changing landscape of decentralized finance. With its strong focus on user experience, partnerships, and the development of its token ecosystem, 1inch is well-positioned to be a leading player in the decentralized finance space.

As more and more individuals and institutions recognize the benefits of decentralized finance, the demand for platforms like 1inch will continue to grow. Through continuous improvement and expansion, 1inch is poised to meet this demand and play a pivotal role in shaping the future of decentralized finance.

Question-answer:

What is 1inch and why is it important in decentralized finance?

1inch is a decentralized exchange aggregator that allows users to find the best prices for their trades across various decentralized exchanges. It is important in decentralized finance because it helps users save money by ensuring they get the best trading prices and reduces the complexity of trading on multiple platforms.

How does 1inch work?

1inch works by splitting the user’s trade across multiple decentralized exchanges to find the best prices. It uses an algorithm that takes into account the liquidity and price on each exchange to determine the optimal route for a trade. As a result, users can get better prices compared to trading on a single exchange.

What are the benefits of using 1inch?

Using 1inch has several benefits. Firstly, it allows users to save money by getting the best prices for their trades. Additionally, it reduces the complexity of trading on multiple exchanges by aggregating liquidity from various sources. Moreover, it offers competitive gas fees and has a user-friendly interface, making it accessible to both experienced and novice traders.