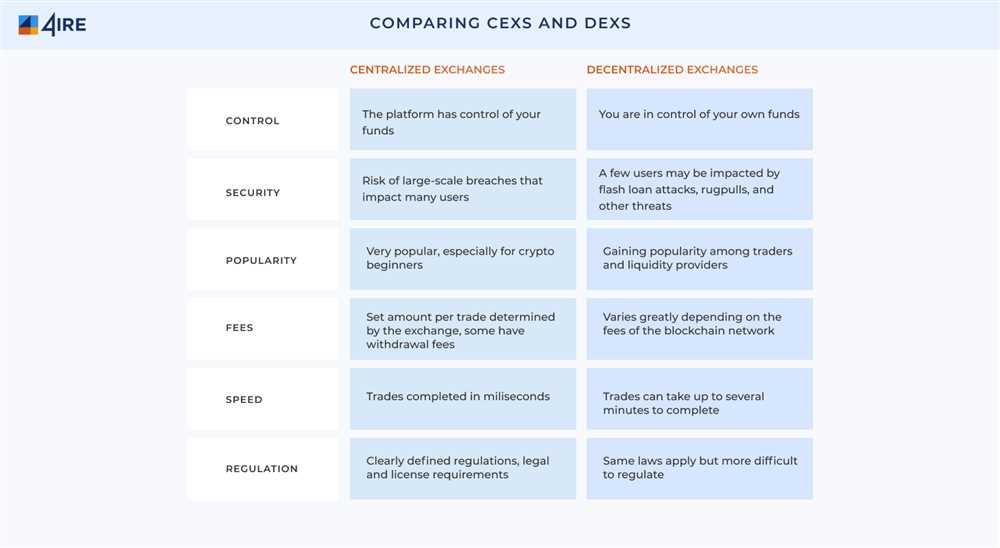

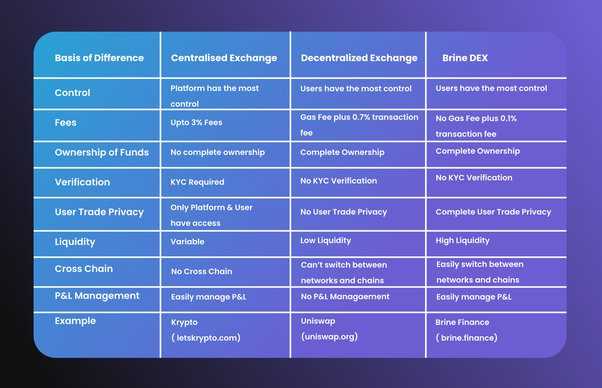

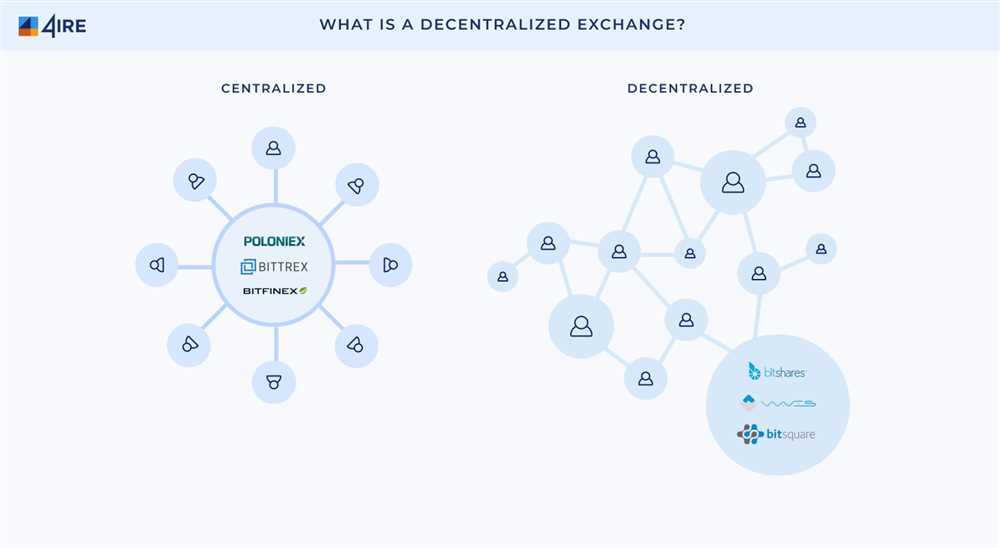

Centralized exchanges (CEX) and decentralized exchanges (DEX) have long been seen as two separate worlds within the cryptocurrency ecosystem. Centralized exchanges offer high liquidity and a user-friendly interface, while decentralized exchanges provide greater security and control over users’ funds. However, the emergence of 1inch has sought to bridge the gap between these two worlds, offering users the best of both worlds.

1inch is a decentralized exchange aggregator that enables users to access multiple DEXs in a single platform. By integrating with various DEXs such as Uniswap, SushiSwap, and Curve, 1inch is able to offer users the best prices and the lowest slippage for their trades. It achieves this through its innovative Pathfinder algorithm, which splits orders across multiple DEXs to provide users with the most optimal routes for their trades.

One of the key advantages of 1inch is its ability to aggregate liquidity from different DEXs. This means that users can access a much larger pool of liquidity than they would on any single DEX, resulting in better trade execution and lower trading costs. Additionally, 1inch offers users the option to swap tokens on-chain or directly through their wallets, providing a seamless user experience.

Furthermore, 1inch offers a range of advanced features, such as limit orders and gas optimization, to enhance the trading experience for users. These features allow users to set specific price targets for their trades and optimize their gas usage, resulting in more efficient and cost-effective transactions. 1inch also offers a governance token, 1INCH, which provides users with voting rights and rewards.

With its innovative approach to trading and its commitment to bridging the gap between CEXs and DEXs, 1inch is poised to revolutionize the decentralized exchange landscape. By offering users the liquidity and user experience of centralized exchanges combined with the security and control of decentralized exchanges, 1inch is enabling users to trade with confidence and convenience. As the cryptocurrency market continues to grow, platforms like 1inch will play an increasingly important role in the financial ecosystem.

inch: Revolutionizing the Exchange Ecosystem

1inch is a groundbreaking platform that is transforming the exchange ecosystem by bridging the gap between centralized and decentralized exchanges. This innovative protocol combines the advantages of both centralized and decentralized exchange platforms to provide users with a seamless and efficient trading experience.

Changing the game with liquidity aggregation

One of the key features of 1inch is its liquidity aggregation technology. Traditional decentralized exchanges often suffer from fragmented liquidity, which results in higher slippage and poorer trading conditions for users. However, 1inch solves this problem by aggregating liquidity from various decentralized exchanges into one platform.

By accessing liquidity from multiple sources, 1inch is able to provide users with better prices and improved trading conditions. This not only enhances the overall trading experience but also maximizes the chances of executing trades at optimal prices, saving users money in the process.

Giving users control with smart contract routing

Another innovative feature of 1inch is its smart contract routing mechanism. This mechanism allows users to split their orders across multiple decentralized exchanges to get the best possible price for their trades. By utilizing advanced algorithms and real-time market data, 1inch ensures that users always get the most favorable outcome for their trades.

Furthermore, the smart contract routing mechanism also enables users to bypass potential restrictions or limitations imposed by individual decentralized exchanges. This gives users greater flexibility and control over their trading activities, allowing them to take full advantage of the decentralized finance ecosystem.

In conclusion, 1inch is revolutionizing the exchange ecosystem by combining the best elements of centralized and decentralized exchanges. With its liquidity aggregation technology and smart contract routing mechanism, 1inch provides users with a seamless and efficient trading experience. By bridging the gap between centralized and decentralized exchanges, 1inch is paving the way for the future of cryptocurrency trading.

Merging Centralized and Decentralized Exchanges for Seamless Trading

The emergence of decentralized exchanges (DEXs) has brought a new level of accessibility and privacy to the world of cryptocurrency trading. However, these platforms often lack the liquidity and trading tools found on centralized exchanges (CEXs). 1inch is a protocol that aims to bridge this gap by aggregating liquidity from multiple DEXs and CEXs to provide users with the best prices and lowest slippage for their trades.

1inch achieves this by splitting large trades across multiple exchanges using smart contract technology. This allows users to access the liquidity of both CEXs and DEXs without the need for multiple accounts or complicated trading setups. The platform automatically routes trades through the most efficient paths, minimizing slippage and maximizing returns.

In addition to liquidity aggregation, 1inch also provides a range of other features to enhance the trading experience. These include limit orders, stablecoin swaps, and gas optimization tools. The protocol is designed to be user-friendly, with a simple and intuitive interface that appeals to both experienced traders and newcomers to the crypto space.

By merging centralized and decentralized exchanges, 1inch is able to combine the best features of both types of platforms. Users can enjoy the security and privacy of decentralized trading, while also benefiting from the liquidity and trading tools offered by centralized exchanges. This hybrid approach eliminates many of the limitations typically associated with DEXs, such as low liquidity and limited trading options.

Overall, 1inch is revolutionizing the world of cryptocurrency trading by creating a seamless bridge between centralized and decentralized exchanges. Through its innovative protocol, users can access the best prices and lowest slippage for their trades, while also enjoying the benefits of decentralization. With its user-friendly interface and range of features, 1inch is making the world of crypto trading more accessible and efficient for everyone.

The Power of Automated Market Makers

Automated Market Makers (AMMs) have revolutionized the way trades are executed in the decentralized finance (DeFi) ecosystem. These innovative protocols, powered by smart contracts, provide users with the ability to trade assets seamlessly, efficiently, and with minimal slippage.

What is an Automated Market Maker?

An Automated Market Maker is a decentralized exchange protocol that uses a mathematical formula to determine the price of assets and execute trades. Unlike traditional centralized exchanges, AMMs do not rely on order books and instead use liquidity pools to facilitate transactions between users.

The main concept behind AMMs is the creation of liquidity pools consisting of two or more assets. These pools serve as the source of funds for executing trades, and users can contribute their assets to the pools in exchange for liquidity provider (LP) tokens.

How do Automated Market Makers Work?

AMMs rely on a mathematical formula known as a bonding curve to determine the price of assets in the liquidity pools. When a user wants to trade one asset for another, they submit a transaction to the AMM’s smart contract, which automatically executes the trade based on the current price determined by the bonding curve.

One of the key advantages of AMMs is that they provide users with constant liquidity, irrespective of the trading volume. Trades can be executed instantly, without the need to find a counterparty, resulting in reduced trading fees and slippage. Furthermore, AMMs eliminate the need for order matching, making it more efficient and cost-effective to trade assets.

AMMs have become a vital component of the DeFi ecosystem, providing the necessary infrastructure for decentralized exchanges to thrive. They have played a significant role in making DeFi more accessible and user-friendly, attracting a broader range of users to engage with decentralized finance.

| Advantages | Disadvantages |

|---|---|

| Constant liquidity | Potential for impermanent loss |

| Efficient and cost-effective trading | Dependency on accurate pricing from the bonding curve |

| No need for order matching | Less control over price execution |

Despite some potential drawbacks, the power and convenience offered by Automated Market Makers have made them a dominant force in the DeFi landscape. As the industry continues to evolve, AMMs are likely to continue playing a crucial role in bridging the gap between centralized and decentralized exchanges.

Enhancing Security and User Control

1inch is committed to providing a secure and trusted platform for users to trade their digital assets. Security is a top priority, and the team continuously works to ensure that the platform is protected against potential risks and threats.

One of the ways 1inch enhances security is by utilizing smart contract technology. All trades on 1inch are executed via smart contracts, which are self-executing contracts with terms of agreement directly written into the code. This eliminates the need for intermediaries and reduces the risk of human error or fraud.

In addition to smart contracts, 1inch also implements various security protocols to protect user funds. These protocols include multi-signature wallets, where multiple private keys are required to authorize transactions, and hardware wallets, which store private keys offline and provide an extra layer of protection.

Furthermore, 1inch empowers users by giving them full control over their funds. Unlike centralized exchanges, where users typically have to deposit their funds onto the exchange platform, 1inch allows users to keep their assets in their own wallets throughout the trading process. This means that users always maintain control over their private keys and have the ability to access their funds at any time.

Additionally, 1inch provides users with transparent and real-time information about available liquidity and trading fees across various decentralized exchanges. This enables users to make informed decisions and choose the most favorable trading options. The platform also offers advanced features such as limit orders and gas optimization to further enhance the trading experience.

In conclusion, 1inch is dedicated to enhancing security and user control in the decentralized exchange space. By leveraging smart contract technology, implementing robust security protocols, and empowering users with full control over their funds, 1inch provides a safe and user-friendly trading environment for all.

The Path to Financial Freedom: 1inch’s Vision

1inch is on a mission to bridge the gap between centralized and decentralized exchanges, and in doing so, empower individuals to achieve financial freedom. By combining the benefits of both types of exchanges, 1inch is creating a platform that offers users the best of both worlds.

Centralized exchanges have long been the go-to choice for traders due to their easy-to-use interfaces and high liquidity. However, they come with significant drawbacks, including centralized control, lack of transparency, and vulnerability to hacks and security breaches.

On the other hand, decentralized exchanges (DEXs) offer enhanced security, privacy, and control over funds, but have traditionally suffered from low liquidity and a steep learning curve. 1inch aims to address these issues by aggregating liquidity from multiple DEXs, thereby ensuring competitive pricing and reducing slippage.

With 1inch, users can access a wide range of tokens and trading pairs in a decentralized manner, without compromising on speed or security. The platform employs complex algorithms and smart contract technology to ensure that every transaction is executed at the best possible rate across different liquidity sources.

Additionally, 1inch is constantly innovating and expanding its services to provide users with more opportunities to earn and grow their wealth. One example is the recent launch of the 1inch Liquidity Protocol, which allows users to become liquidity providers and earn rewards in return.

By combining the benefits of centralized and decentralized exchanges, 1inch is paving the way for a more inclusive and accessible financial system. The platform’s vision is to give individuals full control over their financial assets, enabling them to make informed decisions and take advantage of new opportunities in the rapidly evolving crypto landscape.

Whether you’re a seasoned trader or new to the world of cryptocurrencies, 1inch offers a user-friendly and secure platform to explore, trade, and grow your wealth. Join the revolution and take the first step towards financial freedom with 1inch.

Question-answer:

What is 1inch and what problem does it solve?

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges. It solves the problem of fragmentation in the decentralized exchange landscape by providing users with the best possible price for their trades across multiple platforms.

How does 1inch work?

1inch works by splitting a user’s trade across multiple decentralized exchanges in order to achieve the best possible price. It uses an algorithm called Pathfinder to find the most efficient route for the trade and executes it on behalf of the user.