Exploring the Pros and Cons of Investing in 1inch Coin Market Cap: Assessing the Possible Upsides and Downfalls.

Are you looking to invest in the cryptocurrency market?

1inch Coin Market Cap is a promising option that has been gaining attention in recent months. With its unique features and potential for growth, it’s no wonder investors are taking notice.

But before you jump in headfirst, it’s important to understand the potential risks and rewards that come with investing in 1inch Coin Market Cap.

Let’s start with the rewards:

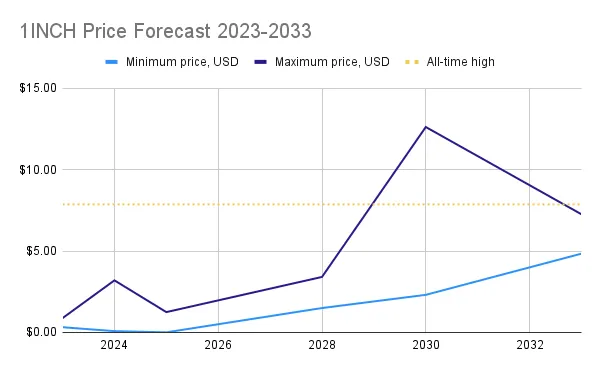

1. High Potential for Growth: The cryptocurrency market is known for its volatility, but with its growing popularity and innovative technology, 1inch Coin Market Cap has the potential to see significant growth in the coming years.

2. Increasing Adoption: More and more people are starting to see the value of cryptocurrencies, and 1inch Coin Market Cap is no exception. As adoption increases, so does the potential value of your investment.

3. Opportunity for Diversification: Investing in 1inch Coin Market Cap allows you to diversify your portfolio. By spreading your investments across different sectors, you can reduce the overall risk and potentially increase your returns.

Now, let’s discuss the potential risks:

1. Volatility: As with any investment in the cryptocurrency market, there is a risk of volatility. Prices can fluctuate wildly in a short period, and the value of your investment may decrease just as quickly as it increased.

2. Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving. Changes in regulations could impact the value and usage of 1inch Coin Market Cap.

3. Competition: 1inch Coin Market Cap operates in a highly competitive market. There are numerous other cryptocurrencies vying for attention, and the success of 1inch Coin Market Cap depends on its ability to stand out from the crowd.

Before making any investment decisions, it’s important to carefully consider the potential risks and rewards of investing in 1inch Coin Market Cap. By staying informed and diversifying your portfolio, you can increase your chances of success in this exciting and ever-changing market.

Benefits of Investing in 1inch Coin Market Cap

Investing in 1inch Coin Market Cap offers several potential benefits for investors:

|

1. Potential for High Returns: 1inch Coin Market Cap has shown significant growth potential in the cryptocurrency market. By investing in this coin, investors have the opportunity to earn impressive returns on their investment. |

|

2. Diversification: Adding 1inch Coin Market Cap to an investment portfolio can provide diversification benefits. By including a variety of cryptocurrencies, investors can reduce their overall risk and potentially increase their chances of earning profits. |

|

3. Liquidity: 1inch Coin Market Cap has a high level of liquidity, which means that investors can easily buy and sell this coin without impacting its market price. This liquidity allows investors to quickly enter or exit positions, providing flexibility and minimizing potential losses. |

|

4. Innovative Technology: 1inch Coin Market Cap is powered by innovative blockchain technology. Its decentralized exchange platform offers unique features such as automated trading, liquidity aggregation, and low slippage. Investing in this technology allows investors to be part of the growing development of the cryptocurrency market. |

|

5. Potential for Adoption: As the cryptocurrency market continues to gain mainstream acceptance, there is the potential for widespread adoption of 1inch Coin Market Cap. Increased adoption can lead to increased demand and potentially drive up the value of the coin, resulting in significant returns for investors. |

Potential Rewards for Investors

Investing in the 1inch Coin Market Cap can potentially bring significant rewards for investors. Some of the potential rewards include:

- High Returns: The 1inch Coin Market Cap has seen substantial growth in its market value, providing investors with the opportunity to earn high returns on their investment.

- Liquidity Rewards: 1inch Coin Market Cap offers various liquidity pools, where investors can earn rewards by providing liquidity to the platform. These rewards can be in the form of additional tokens, fees, or other incentives.

- Staking Rewards: By staking 1inch tokens, investors can earn additional rewards. These rewards are often distributed in the form of more 1inch tokens, allowing investors to increase their holdings and potential profits.

- Opportunity for Portfolio Diversification: Investing in the 1inch Coin Market Cap allows investors to diversify their investment portfolio. This can help reduce risk and potentially maximize returns by spreading investments across different assets.

- Participation in a Growing Ecosystem: The 1inch Coin Market Cap is part of a larger DeFi ecosystem. By investing in 1inch, investors can participate in the growth and success of the DeFi industry, which has the potential to revolutionize traditional financial systems.

It’s important to note that investing in cryptocurrency involves risks, and potential rewards should always be weighed against these risks. Therefore, it is crucial to conduct thorough research, consider personal financial goals, and consult with a financial advisor before making any investment decisions.

Factors Influencing Investment Risks

While considering the potential risks of investing in 1inch Coin Market Cap, there are several factors that can influence the level of risk involved. Understanding these factors can help investors make informed decisions regarding their investments.

Market Volatility: One of the primary factors that can influence investment risks is the volatility of the market. Cryptocurrencies, including 1inch Coin, are known for their highly volatile nature. Prices can fluctuate rapidly, leading to potential gains or losses for investors.

Regulatory Environment: The regulatory environment in which 1inch Coin operates can also impact investment risks. Changes in regulations, government policies, and legal frameworks can have a significant impact on the value and stability of the cryptocurrency market.

Competition: Another factor to consider is the level of competition in the market. The success and growth of 1inch Coin may depend on its ability to compete with other cryptocurrencies and decentralized finance platforms. Increased competition can pose risks to investors if it affects the demand and adoption of the token.

Technological Advancements: The rapid pace of technological advancements can also influence investment risks. New technologies or innovations may pose challenges to the existing infrastructure of cryptocurrencies like 1inch Coin. Investors should stay informed about potential technological disruptions that could impact their investment.

Market Sentiment and News: Investor sentiment and market reaction to news can also play a significant role in investment risks. Negative news, such as security breaches or regulatory crackdowns, can lead to a decline in investor confidence and the value of 1inch Coin. It is important for investors to stay updated with the latest news and market trends.

Liquidity: The liquidity of a cryptocurrency can also affect investment risks. Higher liquidity can allow for easier buying and selling of tokens, reducing the risks associated with market manipulation and price volatility. Lower liquidity, on the other hand, can lead to higher risks and potential challenges in executing trades.

Investment Horizon: Lastly, the investment horizon plays a crucial role in determining the level of risk an investor is willing to take. Short-term investments may be subject to higher price volatility and market uncertainties, while long-term investments may offer greater potential rewards but also come with their own set of risks.

It is important for investors to thoroughly research and assess these factors before making any investment decisions regarding 1inch Coin Market Cap. Only by understanding and considering these factors can investors make well-informed choices that align with their risk tolerance and investment objectives.

Strategies for Mitigating Investment Risks

Investing in 1inch Coin Market Cap can be a lucrative opportunity, but it is not without its risks. To minimize the potential downsides and increase your chances of success, consider implementing the following strategies:

| Strategy | Description |

|---|---|

| 1. Conduct thorough research | Before investing in 1inch Coin Market Cap, take the time to research the project, its team, and its potential for growth. Look for any red flags or concerns that could indicate a higher level of risk. |

| 2. Diversify your portfolio | Don’t put all your eggs in one basket. Spread your investments across different cryptocurrencies and other assets to reduce the impact of any single investment’s performance. |

| 3. Set clear investment goals and limits | Define your investment objectives and establish limits for potential losses. This will help you stay disciplined and avoid making impulsive decisions based on short-term market fluctuations. |

| 4. Stay informed | Keep yourself updated with the latest news and developments in the cryptocurrency market. Stay alert to any changes or events that may impact your investment in 1inch Coin Market Cap. |

| 5. Consider consulting with a financial advisor | If you are unsure about your investment decisions or lack the expertise, consider seeking professional advice from a qualified financial advisor who specializes in cryptocurrencies. |

| 6. Use risk management tools | Take advantage of risk management tools and techniques, such as stop-loss orders or trailing stops, to automatically limit potential losses and protect your investment. |

| 7. Start with a smaller investment | If you are new to investing or unsure about the project, consider starting with a smaller investment. This will give you a chance to learn and assess the performance before committing larger amounts. |

By implementing these strategies, you can mitigate the risks associated with investing in 1inch Coin Market Cap and increase your chances of achieving positive returns in the long run.

Question-answer:

What is 1inch Coin Market Cap?

1inch Coin Market Cap is a cryptocurrency that is designed to help users find the best trading opportunities and maximize their profits. It works by aggregating liquidity from various decentralized exchanges and routing trades to get the best possible rates.

What are the potential risks of investing in 1inch Coin Market Cap?

Like any investment in cryptocurrency, there are risks involved with investing in 1inch Coin Market Cap. The value of the coin can be volatile, and there is always a risk of losing your investment. Additionally, the cryptocurrency market as a whole is still relatively new and unregulated, making it subject to various uncertainties and potential risks.

What are the potential rewards of investing in 1inch Coin Market Cap?

Investing in 1inch Coin Market Cap has the potential for significant rewards. If the platform becomes widely adopted and successful, the value of the coin could increase substantially. Additionally, by utilizing the platform, users may be able to take advantage of arbitrage opportunities and generate profits from trading.