As the crypto industry continues to evolve and grow at an unprecedented pace, it is crucial for investors and traders to keep a close eye on market trends to make informed decisions. One of the most exciting aspects of this rapidly changing landscape is the emergence of decentralized exchanges (DEXs) and their potential to revolutionize the way we trade cryptocurrencies. In this article, we will explore the market trends surrounding the 1inch to BTC pair and discuss the future prospects for this popular trading pair.

1inch is a decentralized exchange aggregator that sources liquidity from various DEXs to provide users with the best possible trading rates. With its intelligent routing algorithm, 1inch ensures that traders can access the most cost-effective trades across multiple platforms. This unique feature has made 1inch a popular choice among cryptocurrency enthusiasts looking to optimize their trading strategies.

Bitcoin (BTC), on the other hand, is the largest and most well-known cryptocurrency in the world. Its market dominance and widespread adoption make it a crucial asset for any serious crypto investor. The ability to trade BTC on decentralized exchanges like 1inch opens up new opportunities for traders, allowing them to take advantage of the benefits offered by both DEXs and Bitcoin.

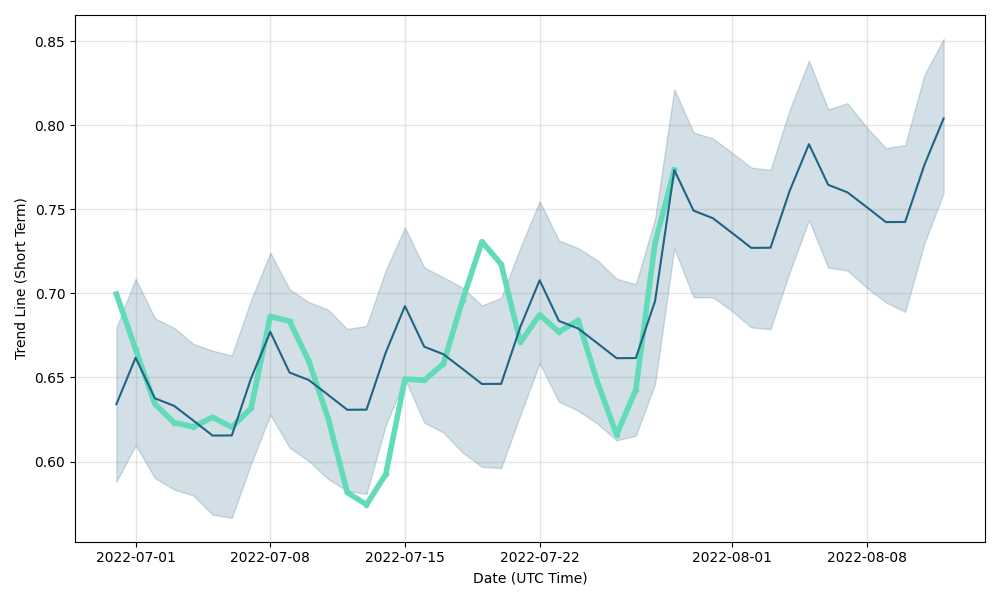

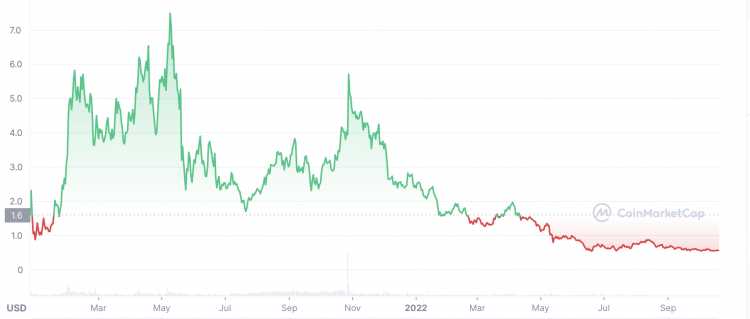

When it comes to market trends, the 1inch to BTC pair has shown promising signs of growth. As more users discover the benefits of decentralized trading and the convenience of 1inch’s platform, the trading volume for this pair has been steadily increasing. This indicates a growing interest in both 1inch and Bitcoin, as traders seek to capitalize on their potential for profit and market opportunities.

Understanding the Current Market Environment

As the cryptocurrency market continues to evolve, it is crucial for investors and traders to have a clear understanding of the current market environment. This knowledge allows them to make informed decisions and take advantage of potential opportunities. In the case of 1inch to BTC, understanding the market trends is especially important.

1. Volatility

The cryptocurrency market, including the 1inch to BTC market, is known for its high volatility. Prices can fluctuate dramatically within a short period, creating both risks and opportunities. Understanding this level of volatility can help traders develop appropriate risk management strategies and determine their desired level of exposure to potential gains or losses.

2. Liquidity

Liquidity is another essential aspect of the current market environment. It refers to the ability to buy or sell an asset without significantly impacting its price. In the case of 1inch to BTC, liquidity is influenced by the number of buyers and sellers in the market. Higher liquidity generally means tighter spreads and more favorable trading conditions.

- Depth of the Order Book: The depth of the order book indicates the number of buy and sell orders at different price levels. A deeper order book suggests higher liquidity.

- Volume: Trading volume represents the total number of shares or contracts traded during a given period. Higher trading volume often indicates higher liquidity.

- Exchange Selection: Different exchanges may offer varying levels of liquidity for the 1inch to BTC market. Choosing an exchange with sufficient liquidity is crucial for executing trades efficiently.

3. Market Sentiment

Market sentiment refers to the overall attitude or feeling of investors in the market. It can influence their buying and selling decisions, ultimately impacting prices. Understanding market sentiment can provide insights into potential market movements and help traders identify trends or reversals.

- Social Media and News: Monitoring social media platforms and news outlets can give an indication of prevailing market sentiment.

- Technical Analysis: Technical indicators and chart patterns can provide insights into market sentiment, helping traders make informed predictions about future price movements.

- Market Research Reports: Consulting market research reports and analysis from reputable sources can provide a comprehensive perspective on market sentiment.

By understanding the current market environment, investors and traders can navigate the 1inch to BTC market more effectively. They can capitalize on opportunities, manage risks, and make informed decisions based on the prevailing market conditions. Staying up-to-date with market trends and constantly monitoring the relevant factors mentioned above will enable market participants to navigate the dynamic world of cryptocurrencies successfully.

Analyzing the Growth Potential of 1inch to BTC

As the cryptocurrency industry continues to evolve and innovate, the potential for growth in the 1inch to BTC market is worth exploring. 1inch, a decentralized exchange aggregator, aims to provide users with the best possible trading rates by combining liquidity from various exchanges.

The growth potential of 1inch to BTC is driven by several factors. Firstly, the increasing adoption and acceptance of cryptocurrencies, especially Bitcoin, is fueling the demand for efficient and reliable trading platforms. As Bitcoin remains the leading cryptocurrency in terms of market capitalization and popularity, the demand for exchanging it with other digital assets like 1inch is likely to grow.

Furthermore, 1inch’s unique features and value proposition make it an attractive option for investors and traders looking to diversify their cryptocurrency holdings. The platform’s ability to source liquidity from multiple exchanges ensures that users can access a wide range of trading options, reducing slippage and maximizing their potential returns.

Another factor contributing to the growth potential of 1inch to BTC is the increasing awareness and understanding of decentralized finance (DeFi) among the wider crypto community. 1inch operates on the principles of DeFi, offering users greater transparency, security, and control over their assets. As more people recognize the benefits of decentralized exchanges and DeFi protocols, the demand for platforms like 1inch is likely to grow.

In addition, the strategic partnerships and collaborations that 1inch has established with other prominent players in the cryptocurrency industry further enhance its growth potential. By integrating with popular wallets, exchanges, and blockchain projects, 1inch can tap into their existing user base and expand its reach, opening up new market opportunities.

However, it’s important to consider the potential challenges and risks that may affect the growth of 1inch to BTC. Regulatory uncertainties, market volatility, and competition from other decentralized exchanges could pose obstacles to its growth trajectory. Therefore, it’s crucial for 1inch to adapt and innovate in order to maintain its competitive edge and capture a larger market share.

In conclusion, the growth potential of 1inch to BTC is significant and promising. With the increasing adoption of cryptocurrencies, the unique features of 1inch, and the growing interest in decentralized finance, 1inch is well-positioned to capture a larger share of the BTC trading market. By addressing challenges and leveraging strategic partnerships, 1inch can maximize its growth potential and contribute to the further development of the cryptocurrency ecosystem.

Key Factors Influencing Future Trends

As the 1inch to BTC market continues to evolve, several key factors are influencing its future trends. Understanding and monitoring these factors can provide valuable insights for traders and investors looking to capitalize on potential opportunities in the market.

1. Bitcoin Market Performance

Bitcoin’s performance in the overall cryptocurrency market plays a crucial role in shaping the trends of 1inch to BTC pair. Bitcoin is often seen as a benchmark for the entire crypto market, and its price movements can have a significant impact on the sentiment and trading activity of other cryptocurrencies, including 1inch. Traders should closely monitor Bitcoin’s price and market trends to anticipate potential changes in the 1inch to BTC market.

2. Liquidity and Trading Volume

The liquidity and trading volume of the 1inch to BTC market are key factors that can influence future trends. Higher liquidity and trading volume generally indicate a more active and stable market, making it easier for traders to execute trades and for price trends to develop. Additionally, increased liquidity can attract more participants and promote further growth in the market. Traders should assess the liquidity and trading volume of the 1inch to BTC market before making any trading decisions.

3. Market Sentiment and Regulatory Developments

Market sentiment and regulatory developments in the cryptocurrency industry can significantly impact the future trends of the 1inch to BTC market. Positive news, such as regulatory clarity or institutional adoption, can fuel bullish sentiment and attract more investors to the market. Conversely, negative news, such as regulatory crackdowns or security breaches, can lead to bearish sentiment and decrease trading activity. Traders should stay informed about the latest news and regulatory developments to gauge the potential impact on the 1inch to BTC market.

4. Technology and Platform Updates

Technological advancements and platform updates related to 1inch and Bitcoin can also influence future trends. Improvements in the underlying technology, such as scalability solutions or interoperability enhancements, can increase the utility and adoption of these cryptocurrencies. Similarly, updates to trading platforms, such as the integration of new features or partnerships, can attract more users and improve the overall trading experience. Traders should keep abreast of technological and platform developments to stay ahead of potential market trends.

5. Overall Market Conditions

The overall market conditions, including macroeconomic factors and global events, can have a significant impact on the 1inch to BTC market trends. Geopolitical tensions, economic recessions, or changes in monetary policies can all influence investor sentiment and trading activity. It is important for traders to consider the broader market conditions when analyzing the future trends of the 1inch to BTC market.

| Key Factors | Influencing Future Trends |

|---|---|

| Bitcoin Market Performance | Market sentiment |

| Liquidity and Trading Volume | Regulatory Developments |

| Market Sentiment | Technology and Platform Updates |

| Technology and Platform Updates | Overall Market Conditions |

| Overall Market Conditions |

By keeping a close eye on these key factors and regularly analyzing their impact on the 1inch to BTC market, traders can make more informed decisions and take advantage of potential future trends in the market.

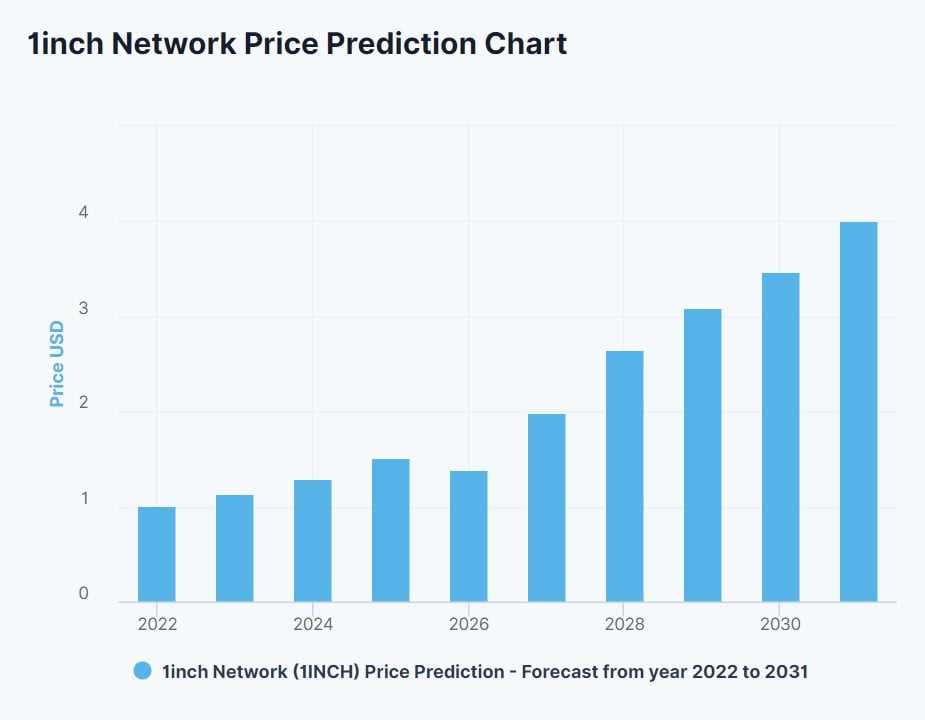

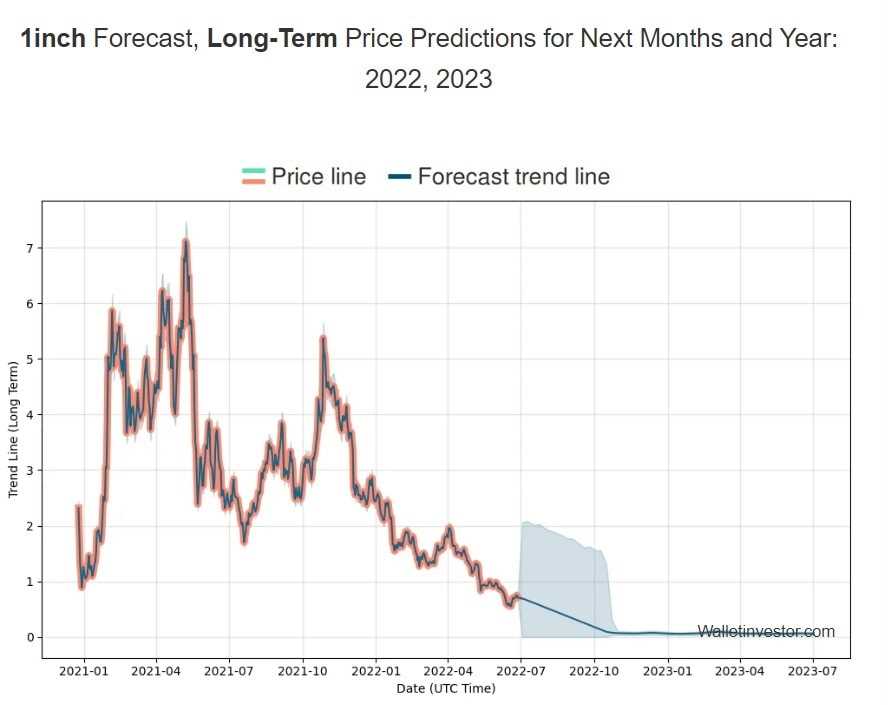

Expert Insights and Predictions for the Future

As the 1inch to BTC market continues to evolve, experts in the field are offering their insights and predictions for the future. These industry leaders have analyzed the current trends and market conditions to provide valuable guidance for investors and traders.

The Rise of Decentralized Exchanges

One expert predicts that decentralized exchanges will play a major role in shaping the future of the 1inch to BTC market. As more users become aware of the benefits of decentralized finance (DeFi), trading volumes on decentralized exchanges are expected to increase. This increased adoption will lead to greater liquidity and improved price discovery for 1inch to BTC trading pairs.

The Impact of Regulatory Developments

Regulatory developments are also expected to influence the future of the 1inch to BTC market. Experts anticipate that as governments around the world establish clearer regulations for cryptocurrencies and DeFi platforms, investor confidence will increase. This increased confidence will likely attract more institutional investors and facilitate the integration of traditional financial systems with the 1inch to BTC market.

Overall, the experts agree that the future of the 1inch to BTC market is promising. With the rise of decentralized exchanges and the impact of regulatory developments, investors and traders can look forward to a more mature and stable market. However, as with any investment, it is important to stay informed and assess the risks before making any decisions.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various DEXs to provide users with the best possible trading rates. It also offers a user-friendly interface that allows users to easily trade their assets.

How does 1inch to BTC market trend analysis determine future price movements?

1inch to BTC market trend analysis examines historical price data, trading volumes, and other factors to identify patterns and trends. By analyzing these trends, analysts can make predictions about the future price movements of 1inch in relation to BTC.