Analyzing the Performance of the 1inch Aggregator during High Volatility Market Conditions

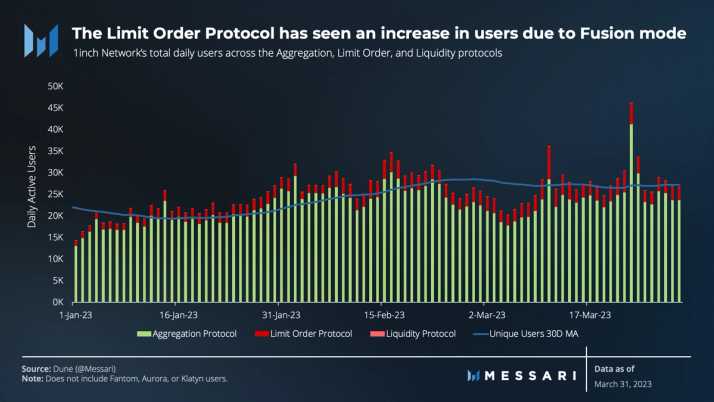

In today’s fast-paced and volatile cryptocurrency market, investors are constantly looking for tools and strategies to optimize their trading performance. With the rise of decentralized finance (DeFi), platforms like 1inch Aggregator have emerged as powerful tools for traders to access multiple liquidity sources and find the best prices for their trades. However, with high volatility comes the need for careful analysis of how these platforms perform in different market conditions.

1inch Aggregator is a decentralized exchange (DEX) aggregator that connects users to multiple DEXs to source liquidity for their trades. Its algorithm scans various DEXs to find the most efficient trading route, ensuring that users get the best possible prices and minimize slippage. This makes it an attractive option for traders, especially during high volatility when price movements can be swift and unpredictable.

However, it is crucial to analyze the performance of 1inch Aggregator in high volatility market conditions to understand how well it handles rapid price fluctuations and ensures optimal trade execution. By studying its performance during volatile periods, traders can gain insights into its efficiency, reliability, and ability to navigate turbulent market conditions.

Through this article, we will delve into the performance of 1inch Aggregator in high volatility market conditions, exploring its response time, price discovery capabilities, and overall efficiency. By examining these factors, we aim to provide traders with valuable insights on the platform’s performance during periods of heightened market volatility, enabling them to make informed decisions and optimize their trading strategies.

Performance Analysis of 1inch Aggregator: High Volatility Market Conditions

Volatility is a common factor in the cryptocurrency market, and it can greatly impact the performance of decentralized finance (DeFi) platforms. In this article, we will analyze the performance of the 1inch Aggregator in high volatility market conditions and determine how it handles fluctuations in the market.

1inch Aggregator Overview

The 1inch Aggregator is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs). It scans multiple DEXs in real-time to provide users with the best possible rates for their trades. By splitting the orders across different DEXs, the 1inch Aggregator aims to minimize slippage and maximize trading efficiency.

Impact of High Volatility

High volatility in the cryptocurrency market can result in significant price fluctuations within short periods. This volatility can make it challenging for traders to execute trades at favorable rates, as prices can change rapidly. The 1inch Aggregator’s performance in high volatility conditions becomes crucial, as it must be able to quickly adapt and provide users with the best possible rates despite the rapid market changes.

| Performance Metrics | Results |

|---|---|

| Execution Speed | The 1inch Aggregator has shown impressive execution speed in high volatility market conditions. It is capable of scanning multiple DEXs and providing users with the best rates within seconds, ensuring that users can take advantage of favorable opportunities. |

| Slippage Mitigation | One of the key features of the 1inch Aggregator is its ability to minimize slippage. In high volatility conditions, it actively adjusts the distribution of orders across different DEXs to minimize price impact. This helps users to obtain better execution prices even when the market is highly volatile. |

| Robustness | The 1inch Aggregator has proven to be robust and resilient in high volatility market conditions. It has consistently maintained its performance and provided reliable service, even during periods of extreme market turbulence. |

| User Feedback | User feedback on the performance of the 1inch Aggregator in high volatility conditions has been overwhelmingly positive. Users have praised its speed, efficiency, and ability to find the best rates, even during times of intense market volatility. |

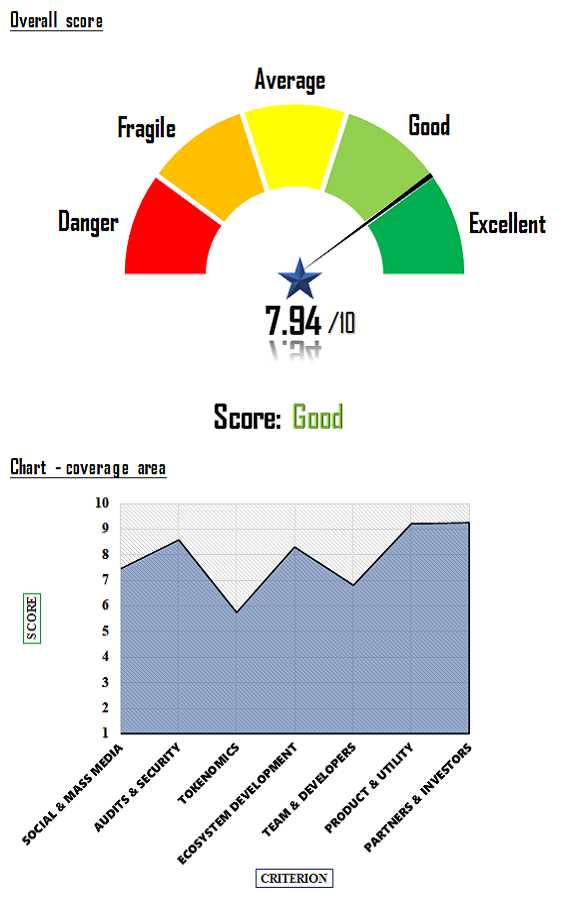

Based on the performance analysis, we can conclude that the 1inch Aggregator performs exceptionally well in high volatility market conditions. Its fast execution speed, slippage mitigation techniques, robustness, and positive user feedback make it a reliable choice for traders looking to navigate the cryptocurrency market during times of high volatility.

Understanding the Impact of High Volatility on 1inch Aggregator

Volatility is a key factor in the cryptocurrency market, and it can have a significant impact on the performance of decentralized exchanges and aggregators like 1inch. High volatility refers to large price fluctuations within a short period of time, which can create both opportunities and risks for traders and investors.

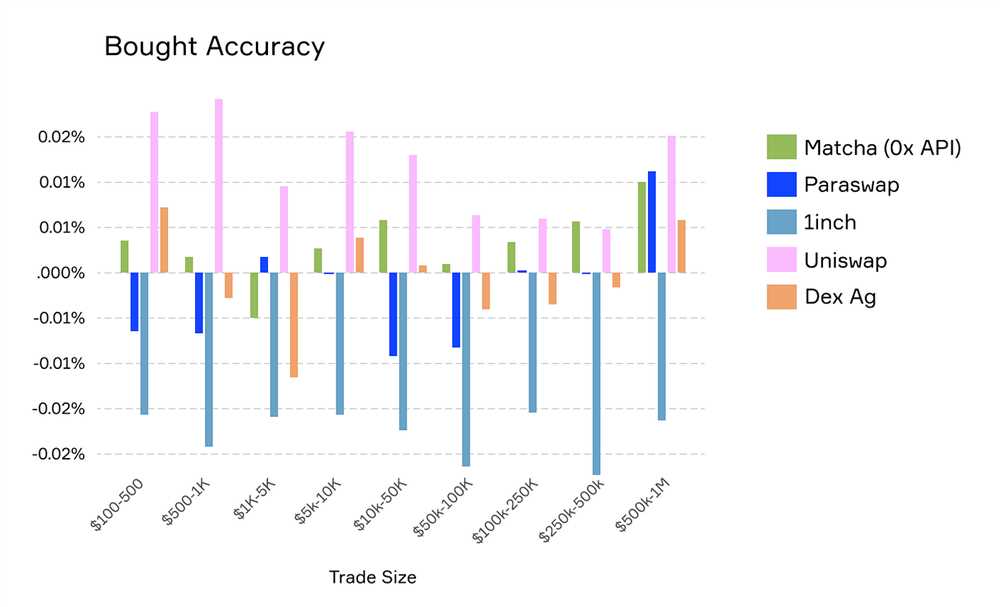

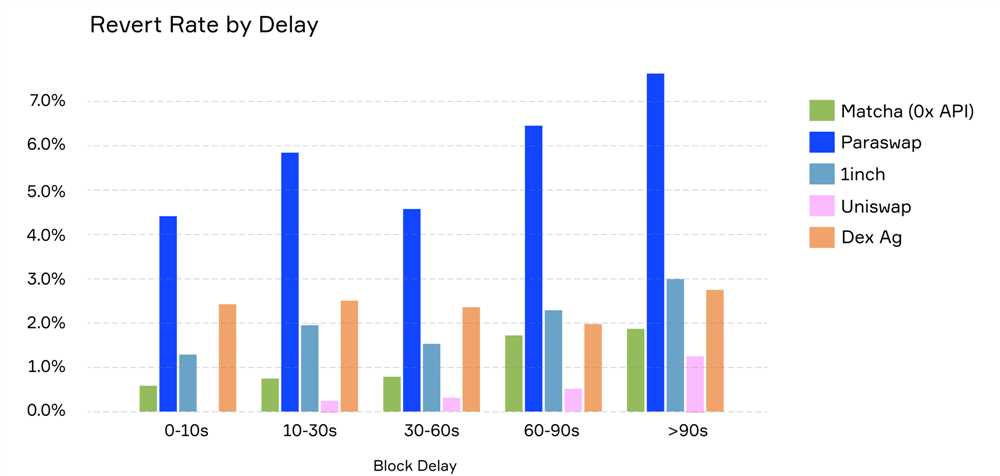

For 1inch Aggregator, high volatility can affect its performance in several ways. Firstly, it can lead to increased slippage, which refers to the difference between the expected price of a trade and the price at which the trade is executed. When prices are rapidly changing, it can be challenging for the aggregator to find the best possible prices across multiple decentralized exchanges, resulting in higher slippage for users.

In addition, high volatility can also impact the speed and efficiency of trades executed through the 1inch Aggregator. During periods of high volatility, there may be congestion on the Ethereum network, resulting in slower transaction times and higher gas fees. This can lead to delays and increased costs for users of the aggregator.

Furthermore, high volatility can also affect the liquidity available on decentralized exchanges, which can impact the overall performance of the 1inch Aggregator. When prices are rapidly changing, liquidity providers may withdraw their funds or adjust their prices, which can result in lower liquidity for trades executed through the aggregator. Lower liquidity can lead to increased slippage and decreased efficiency for users.

It is important for users of the 1inch Aggregator to understand and account for the impact of high volatility when making trades. They should be aware of the potential risks and costs associated with executing trades during periods of high volatility and consider using risk management strategies such as setting appropriate slippage tolerance levels and diversifying their trading across multiple exchanges.

Overall, high volatility can have a significant impact on the performance of the 1inch Aggregator. It can lead to increased slippage, slower transaction times, higher gas fees, and lower liquidity. Users should be cautious and informed when trading in high volatility market conditions and take appropriate measures to mitigate risks and maximize their trading outcomes.

Evaluating the Effectiveness of 1inch Aggregator’s Performance in High Volatility Markets

The performance of the 1inch Aggregator in high volatility markets is a critical aspect to consider when analyzing its effectiveness. In this article, we aim to evaluate the performance of the 1inch Aggregator in such market conditions and assess its ability to provide efficient and reliable trading solutions.

Understanding High Volatility Markets

High volatility markets are characterized by significant price fluctuations and rapid changes in market sentiment. These market conditions can pose challenges for traders, as it becomes difficult to execute trades at the desired price and effectively manage risk.

1inch Aggregator’s Approach

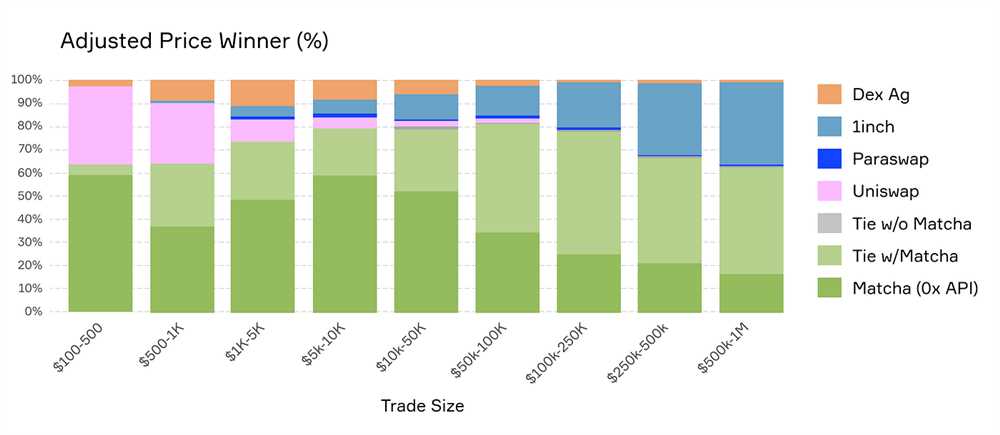

The 1inch Aggregator aims to address these challenges by offering a decentralized trading solution that sources liquidity from various decentralized exchanges (DEXs) and executes trades at optimal prices. By aggregating liquidity and routing trades through different DEXs, the aggregator aims to reduce slippage and provide traders with the best possible trading experience.

Evaluating Performance

To evaluate the effectiveness of the 1inch Aggregator’s performance in high volatility markets, we analyze key metrics including slippage, transaction speed, and cost efficiency.

Slippage: Slippage refers to the difference between the expected price of a trade and the executed price. In high volatility markets, slippage can be particularly high due to the rapid changes in market prices. Evaluating the 1inch Aggregator’s ability to minimize slippage is crucial in determining its effectiveness.

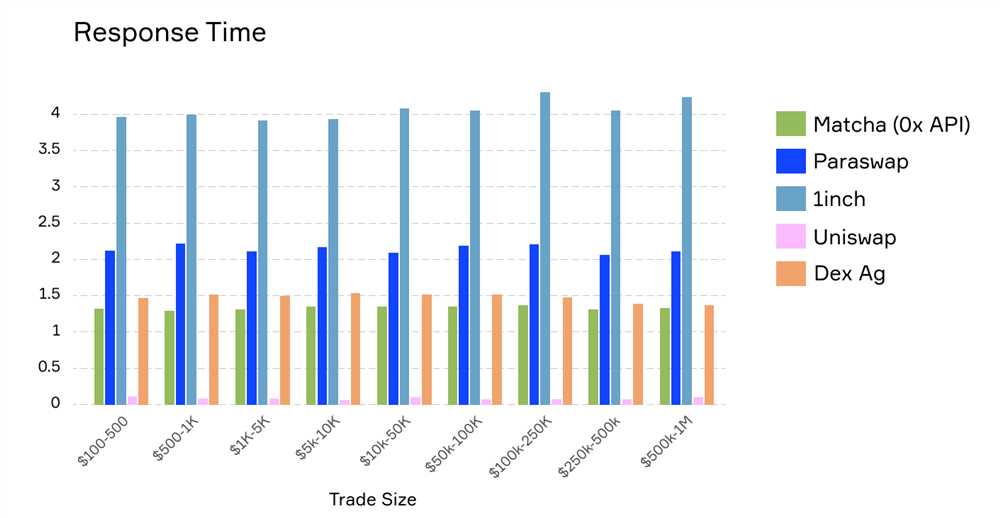

Transaction Speed: In high volatility markets, speed is of the essence. Traders need to execute trades quickly to take advantage of market opportunities or manage risk effectively. The speed at which the 1inch Aggregator can source liquidity and execute trades will greatly impact its overall performance.

Cost Efficiency: Cost efficiency is another important factor to consider. High volatility markets often come with increased transaction fees and other costs. The 1inch Aggregator should aim to minimize these costs and provide traders with cost-effective trading solutions.

Conclusion

Overall, evaluating the performance of the 1inch Aggregator in high volatility markets is essential in understanding its effectiveness as a trading solution. By examining metrics such as slippage, transaction speed, and cost efficiency, we can gain insights into how well the aggregator performs in these challenging market conditions.

Understanding the aggregator’s approach and its ability to mitigate slippage, execute trades quickly, and minimize costs will help traders make informed decisions when utilizing the 1inch Aggregator for trading in high volatility markets.

Strategies for Maximizing Profits with 1inch Aggregator in High Volatility Scenarios

High volatility scenarios in the cryptocurrency market can present both opportunities and risks for traders. With the 1inch Aggregator, there are several strategies that can be employed to maximize profits during these volatile market conditions.

1. Take Advantage of Price Swings

During high volatility periods, the prices of cryptocurrencies can experience significant fluctuations. Traders can take advantage of these price swings by utilizing the 1inch Aggregator to find the best prices across multiple decentralized exchanges (DEXs). By using the aggregator’s smart contract technology, traders can execute trades quickly and efficiently to capitalize on the price differentials.

2. Utilize Advanced Trading Features

The 1inch Aggregator offers advanced trading features that can help traders maximize profits in high volatility scenarios. Features such as limit orders, stop-loss orders, and trailing stops allow traders to set specific parameters for their trades. These features can help traders automate their trading strategies and protect their profits in volatile markets.

Additionally, the 1inch Aggregator’s liquidity protocol can provide traders with access to deep liquidity pools, even during times of high volatility. This can help ensure that traders are able to execute their trades at favorable prices, minimizing slippage and maximizing profits.

3. Diversify Trading Across Multiple Exchanges

In high volatility scenarios, it is important to diversify trading across multiple exchanges to minimize risk and maximize potential profits. The 1inch Aggregator’s integration with multiple DEXs allows traders to easily access different liquidity pools and take advantage of the best prices available. By diversifying trading activities across multiple exchanges, traders can reduce the impact of any single exchange’s volatility on their overall portfolio.

| Key Takeaways |

|---|

| 1. Take advantage of price swings by utilizing the 1inch Aggregator to find the best prices across multiple DEXs. |

| 2. Utilize advanced trading features such as limit orders, stop-loss orders, and trailing stops to automate trading strategies and protect profits. |

| 3. Diversify trading across multiple exchanges to minimize risk and take advantage of the best prices available. |

Question-answer:

How does the 1inch Aggregator perform in high volatility market conditions?

The 1inch Aggregator is designed to perform well in high volatility market conditions. It uses advanced algorithms to find the best prices and liquidity across various decentralized exchanges, helping users to optimize their trades and mitigate risks. However, it is important to note that market conditions can fluctuate, and the performance of the aggregator may vary.

What makes the 1inch Aggregator stand out from other similar platforms?

The 1inch Aggregator stands out from other similar platforms due to its efficient and intelligent routing algorithm. It navigates through different decentralized exchanges to find the best possible prices and liquidity for the users. Additionally, the 1inch Aggregator offers low slippage and low fees, making it an attractive option for users looking to maximize their gains.

Does the 1inch Aggregator provide any risk management features?

Yes, the 1inch Aggregator provides several risk management features to help users navigate high volatility market conditions. It offers a feature called “Mooniswap slippage risk mitigator” that helps to minimize slippage. Additionally, the aggregator factors in gas costs to ensure that users are aware of the total costs involved in their trades. Users can also set up custom limits and execute their trades only when specific conditions are met.