Are you looking to invest in a promising cryptocurrency project? Look no further than 1inch! 1inch is a decentralized exchange aggregator that aims to provide users with the best possible trading experience. By accessing multiple liquidity sources, 1inch ensures competitive prices and minimized slippage.

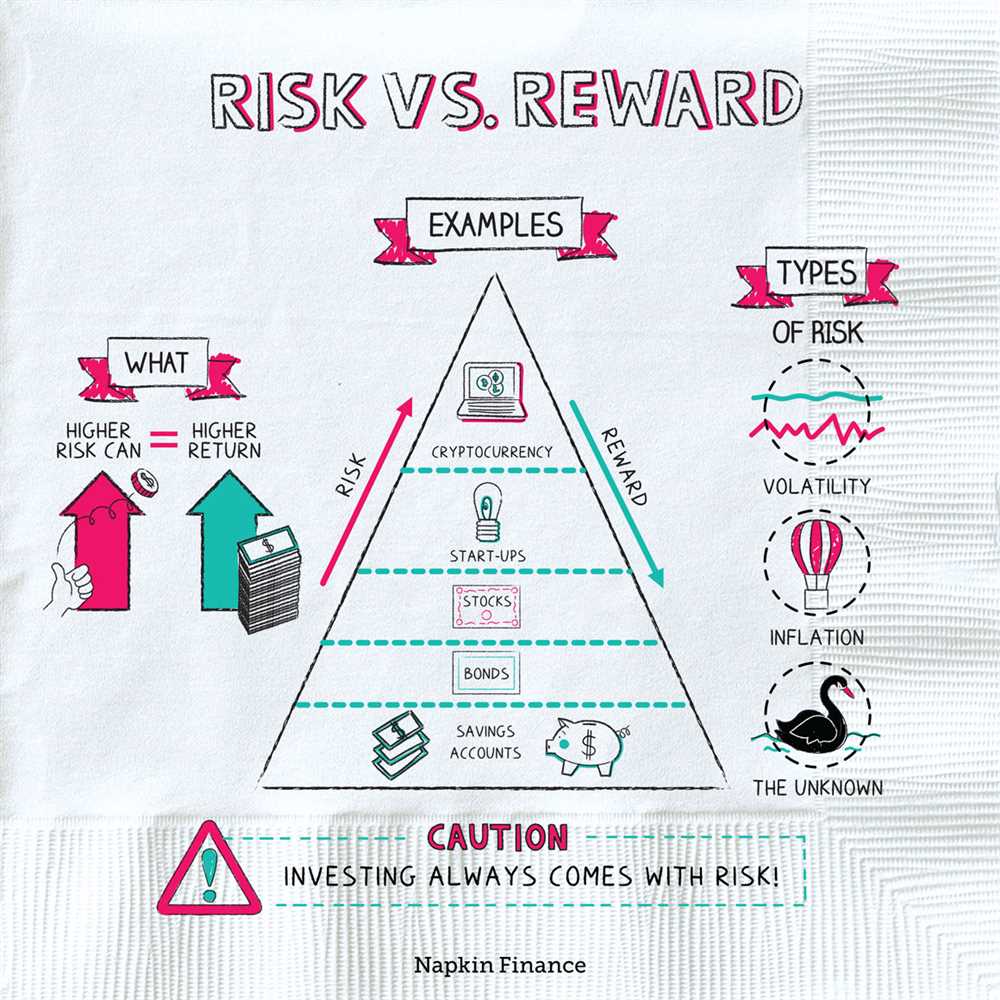

So, why should you consider investing in 1inch? Let’s dive into the potential rewards and risks.

Potential Rewards:

- High growth potential: 1inch has quickly established itself as a go-to platform for traders looking for the best rates and optimized trading strategies. As the decentralized finance (DeFi) market continues to expand, 1inch is well-positioned to benefit from the growing demand.

- Liquidity incentives: 1inch offers various liquidity programs, allowing users to earn rewards by providing liquidity to the exchange. These incentives attract liquidity providers and contribute to the overall growth of the platform.

- Strong team and partnerships: 1inch boasts a team of experienced developers and industry experts, ensuring continuous innovation and improvement. Additionally, the project has established strategic partnerships with leading DeFi projects, enhancing its credibility and potential for success.

Potential Risks:

- Volatility: Cryptocurrencies are known for their price volatility, and investing in 1inch is no exception. While high volatility can provide substantial gains, it also comes with the risk of significant losses. It’s important to consider your risk tolerance and investment strategy before diving into the market.

- Regulatory uncertainties: The decentralized nature of 1inch and other DeFi projects raises regulatory concerns in various jurisdictions. Regulatory changes or restrictions can impact the operation and growth of the platform, potentially affecting your investment.

- Competition: The DeFi market is highly competitive, with new projects emerging regularly. While 1inch has established itself as a top player, competition from other platforms could potentially affect its market share and long-term growth.

Investing in 1inch can be a rewarding venture, but it’s essential to conduct thorough research, assess your risk tolerance, and diversify your investments. Stay informed about the latest developments in the DeFi space and consult with financial advisors if needed. With careful consideration, 1inch could be a valuable addition to your investment portfolio.

Why Invest in 1inch?

Investing in 1inch can provide you with significant potential rewards and a unique opportunity in the growing decentralized finance (DeFi) market. Here are some compelling reasons why you should consider investing in 1inch:

1. Revolutionary Technology:

1inch is powered by an innovative and efficient technology that aims to solve the liquidity problem in decentralized exchanges (DEXs). Their smart contract routing algorithm enables users to find the best prices across multiple DEXs, resulting in reduced slippage and improved trading experience.

2. Growing Market:

The DeFi market is experiencing rapid growth, with more and more users and investors recognizing its potential. By investing in 1inch, you can tap into this emerging market and potentially benefit from the increasing adoption and usage of decentralized exchanges.

3. Strong Community and Team:

1inch has a vibrant and active community that actively contributes to the platform’s development and success. The team behind 1inch consists of experienced professionals with a deep understanding of the DeFi space, ensuring continuous innovation and improvement of the platform.

4. Competitive Advantage:

1inch offers a competitive advantage over other DEX aggregators by constantly implementing new features and integration with various blockchain networks. Their commitment to providing the best user experience and delivering value to their investors sets them apart in the market.

Investing in 1inch involves risks, as with any investment. It’s important to conduct thorough research, consider your risk tolerance, and consult with a financial advisor before making any investment decisions.

However, with its revolutionary technology, the growing DeFi market, strong community and team, and competitive advantage, investing in 1inch could potentially be a lucrative opportunity for those seeking exposure to the decentralized finance space.

Potential Benefits of Investing in 1inch

Investing in 1inch provides several potential benefits to investors. Here are some of the key advantages:

1. High Returns

1inch has gained significant attention in the decentralized finance (DeFi) space due to its innovative approach to liquidity aggregation. By investing in 1inch, you have the potential to earn high returns on your investment as the platform continues to grow and gain popularity.

2. Diversification

Investing in 1inch allows you to diversify your investment portfolio. By holding 1inch tokens, you have exposure to the growing DeFi market, which can help to mitigate risk in your overall investment strategy. Through 1inch, you can access a wide range of decentralized exchanges, providing you with the opportunity to invest in various assets and projects.

3. Transparent and Secure

1inch prides itself on its transparency and security measures. The platform is built on the Ethereum blockchain, utilizing smart contracts to ensure the integrity of transactions. By investing in 1inch, you can take advantage of the security features offered by blockchain technology and have peace of mind knowing that your investments are protected.

4. Community Governance

Investing in 1inch means becoming part of the 1inch community. 1inch token holders have the right to participate in the governance of the platform. This means that you can have a say in important decisions regarding the future direction of 1inch. Participating in community voting and decision-making can give you a sense of ownership and engagement in the platform.

These are just a few of the potential benefits of investing in 1inch. It is important to conduct your own research and due diligence before making any investment decisions. However, with its strong position in the DeFi market and the potential for high returns, 1inch presents an attractive opportunity for investors.

Risks to Consider When Investing in 1inch

While investing in 1inch can potentially provide significant rewards, it is essential to carefully consider the risks involved.

1. Volatility: Like any cryptocurrency, the value of 1inch can be highly volatile. It may experience rapid price fluctuations, which can result in significant gains or losses for investors. Therefore, it is essential to be prepared for the possibility of losing a portion or all of your investment.

2. Market Manipulation: The cryptocurrency market, including 1inch, can be susceptible to market manipulation. Due to its relatively low market cap and trading volume, certain individuals or groups may attempt to manipulate the price of 1inch for their own benefit. This can lead to sudden and drastic price movements, potentially causing substantial financial losses for investors.

3. Regulatory Risks: As the cryptocurrency market is still relatively new and evolving, there are regulatory risks associated with investing in 1inch. Governments and regulatory authorities around the world may introduce new laws or policies that could impact the use, trading, or value of cryptocurrencies like 1inch. This regulatory uncertainty can create additional risks and uncertainties for investors.

4. Technology and Security Risks: 1inch operates on blockchain technology, which is inherently complex and subject to potential technological and security risks. While the technology has proven to be robust, there is always a possibility of vulnerabilities or exploitable weaknesses being discovered. This could result in loss of funds or private information for users of the platform, including investors.

5. Competition: The decentralized finance (DeFi) sector, in which 1inch operates, is highly competitive. There are numerous projects and platforms offering similar services and seeking to capture market share. The success and adoption of 1inch may be influenced by the ability to differentiate itself and maintain a competitive edge. Any failure to do so could impact the value of the 1inch token and the overall project.

It is crucial to thoroughly research and assess these and other potential risks before investing in 1inch or any other cryptocurrency. Consider consulting with a financial advisor or conducting your own due diligence to make an informed investment decision.

Disclaimer: This information should not be taken as financial advice. Cryptocurrency investments are subject to market risk, and individuals should invest only what they can afford to lose.

How to Get Started with Investing in 1inch

If you’re interested in investing in 1inch, here is a step-by-step guide to get you started:

1. Educate Yourself

Before you start investing in 1inch, it’s important to educate yourself about the project, its technology, and its potential risks and rewards. Familiarize yourself with the concept of decentralized finance (DeFi) and how 1inch operates within this ecosystem.

2. Set Up a Wallet

In order to invest in 1inch, you’ll need to set up a cryptocurrency wallet that supports the Ethereum blockchain. There are several popular wallets available, such as MetaMask or MyEtherWallet.

3. Buy Ethereum

Once you have a wallet set up, you’ll need to acquire Ethereum (ETH), as 1inch is built on the Ethereum blockchain. You can purchase Ethereum from various cryptocurrency exchanges using fiat currency or other cryptocurrencies.

4. Choose a Decentralized Exchange (DEX)

1inch can be traded on a number of decentralized exchanges (DEXs), such as Uniswap or SushiSwap. Research different DEXs and choose one that suits your needs in terms of liquidity, user interface, and security.

5. Connect Your Wallet to the DEX

After selecting a DEX, you’ll need to connect your wallet to the exchange. This will allow you to access your funds and make trades. Follow the instructions provided by the DEX to connect your wallet.

6. Deposit Ethereum into the DEX

Transfer the Ethereum you bought earlier from your wallet to the DEX. This will fund your trading account and allow you to start investing in 1inch.

7. Trade 1inch

Once your Ethereum is deposited into the DEX, you can start trading 1inch. You can either place a market order to instantly buy 1inch at the current market price or place a limit order to set a specific price at which you want to buy or sell.

Keep in mind that investing in 1inch, like any other investment, comes with its own risks. It’s important to do thorough research, diversify your portfolio, and only invest what you can afford to lose.

With this guide, you should now be equipped with the basic knowledge to get started with investing in 1inch. Good luck!

Question-answer:

What is 1inch and why should I invest in it?

1inch is a decentralized exchange aggregator that sources liquidity from various platforms and provides users with the best possible trading rates. Investing in 1inch can be beneficial because it has shown impressive growth and has the potential to become a major player in the decentralized finance (DeFi) landscape.

What are the potential rewards of investing in 1inch?

Investing in 1inch can potentially yield significant rewards. As the platform gains more users and adoption, the value of the 1inch token may increase. Additionally, 1inch has a unique model that allows users to earn rewards by providing liquidity to the platform. These rewards can be quite lucrative, especially in the fast-growing DeFi market.

Are there any risks associated with investing in 1inch?

Like any investment, investing in 1inch carries some risks. One of the main risks is the volatility of the cryptocurrency market. The value of the 1inch token can fluctuate greatly, potentially resulting in losses. Additionally, the DeFi space is still relatively new and evolving rapidly, so there are inherent risks associated with investing in any DeFi project.

What is the long-term potential of 1inch?

The long-term potential of 1inch is promising. The platform has gained significant traction and has already positioned itself as a leading decentralized exchange aggregator. With the continued growth of the DeFi market, 1inch has the potential to capture a larger share of the market and increase in value over time. However, it’s important to note that this is speculative, and the market can be unpredictable.