Token swapping has become an essential part of the decentralized finance (DeFi) ecosystem, allowing users to quickly and easily exchange one cryptocurrency for another. One of the most popular decentralized exchanges (DEXs) for token swapping is 1inch. This platform has gained significant traction in the past few years, thanks to its innovative approach to liquidity aggregation and its ability to find the best prices across multiple DEXs.

At its core, token swapping on 1inch involves a complex process that combines smart contracts, liquidity pools, and various algorithms to ensure the best possible trade execution. When a user initiates a swap on 1inch, the platform searches for the most optimal route across different liquidity sources, such as Uniswap, SushiSwap, and Kyber Network, to find the best price and minimize slippage.

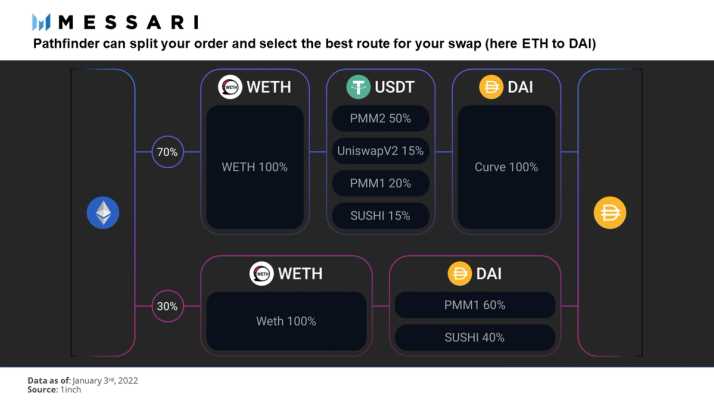

One of the key features of 1inch is its Pathfinder algorithm, which dynamically calculates the most efficient path for a given trade. This algorithm takes into account various factors, including liquidity depth, token prices, and transaction fees, to determine the optimal route. By splitting the trade across multiple liquidity sources, the Pathfinder algorithm aims to reduce price impact and improve overall trade execution.

Another important aspect of token swapping on 1inch is the platform’s governance tokens, 1INCH. Holders of 1INCH tokens have the ability to participate in the platform’s decision-making process and earn rewards by providing liquidity. This tokenomics mechanism creates an incentive for users to hold and stake 1INCH tokens, thereby increasing overall liquidity on the platform and enhancing trade execution efficiency.

In conclusion, token swapping on 1inch offers users a powerful and efficient way to exchange cryptocurrencies. With its innovative liquidity aggregation mechanism, advanced routing algorithms, and governance token model, 1inch has established itself as a leading player in the DeFi ecosystem. As the demand for decentralized exchanges continues to grow, understanding the intricacies of token swapping on platforms like 1inch becomes increasingly crucial for both experienced traders and newcomers alike.

Understanding Token Swapping on 1inch

Token swapping is a fundamental concept in decentralized finance (DeFi) platforms like 1inch. It allows users to exchange one token for another in a seamless and efficient manner. 1inch is a popular decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible exchange rates and lowest fees.

When swapping tokens on 1inch, users can choose from a wide range of supported tokens and select the token pair they want to trade. The platform automatically finds the best liquidity pools across different DEXs to provide the optimal swap route. This ensures that users get the most favorable rates and minimal slippage.

The token swapping process on 1inch involves several steps. First, users need to connect their wallet to the platform to access their tokens. Then, they specify the input token, output token, and the desired swap amount. 1inch then calculates the estimated output amount, taking into account the available liquidity and the chosen swap route.

After confirming the swap details, 1inch interacts with the chosen DEXs to execute the trade. The platform splits the trade across multiple liquidity pools, if necessary, to ensure the best rate. Behind the scenes, 1inch uses various algorithms and smart contracts to find the most efficient route and execute the swap quickly.

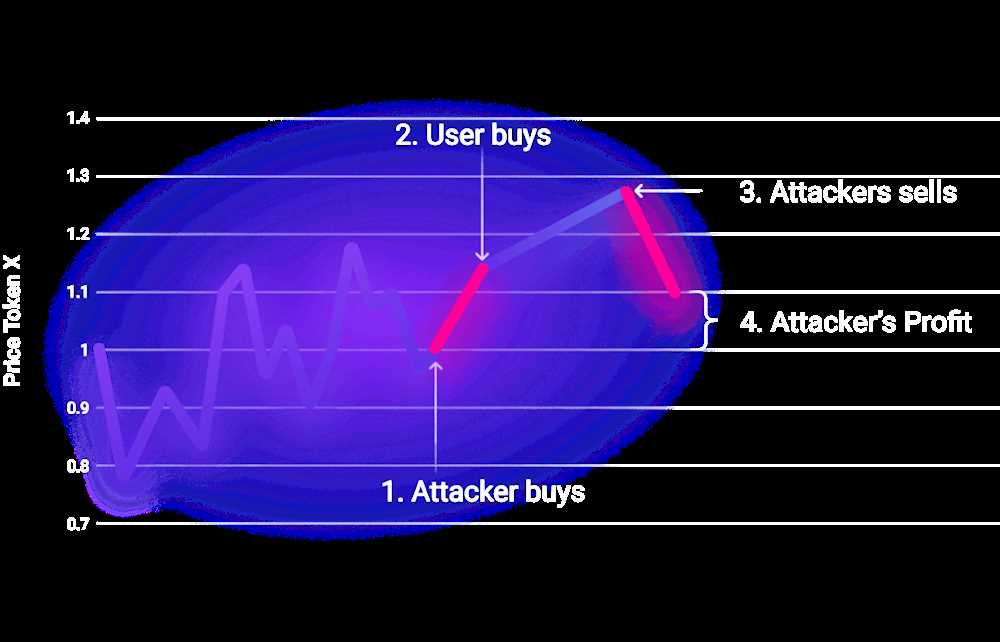

During the token swap, there may be some slippage, which refers to the difference between the expected and actual traded price. This can occur when the market conditions change rapidly or when there is insufficient liquidity in the selected pools. However, 1inch’s aggregation protocol minimizes slippage by splitting the trade and routing it through multiple liquidity sources.

Overall, token swapping on 1inch provides users with a convenient and cost-effective way to exchange their tokens in the decentralized finance ecosystem. By leveraging the platform’s liquidity aggregation and smart routing capabilities, users can access the best rates and avoid the hassle of manually searching for liquidity across different DEXs.

How 1inch Facilitates Token Swapping

1inch is a decentralized exchange aggregator that allows users to access multiple decentralized exchanges (DEXs) and find the most optimal prices for token swapping. The platform aggregates liquidity from various DEXs and routes the swaps to offer the best possible rates and minimize slippage.

When a user initiates a token swap on 1inch, the platform first searches for the best prices available across different DEXs. This is done by splitting the user’s transaction into multiple smaller transactions and routing them through different liquidity sources.

1inch utilizes a unique algorithm known as Pathfinder, which analyzes multiple liquidity protocols and routing strategies simultaneously to find the most cost-efficient swaps for users. This algorithm takes into account factors such as gas costs, trading fees, and liquidity depth to ensure users get the best possible rates.

Once the optimal route is identified, 1inch executes the split transactions on behalf of the user. This involves interacting with multiple smart contracts on different DEXs to swap tokens and ensure the transaction is completed securely and efficiently.

In addition to finding the best prices for token swaps, 1inch also integrates with other DeFi protocols to offer users additional benefits. For example, the platform supports various yield farming strategies by allowing users to swap tokens directly into liquidity pools or provide liquidity to earn passive income.

| Key Features of 1inch |

|---|

| Decentralized exchange aggregator |

| Optimal price discovery |

| Routing through multiple DEXs |

| Pathfinder algorithm for cost-efficient swaps |

| Integration with other DeFi protocols |

In conclusion, 1inch simplifies the process of token swapping by aggregating liquidity from various DEXs and employing a sophisticated algorithm to find the best possible rates. With its decentralized and user-friendly platform, 1inch is contributing to the growth and accessibility of the DeFi ecosystem.

The Benefits of Token Swapping on 1inch

Token swapping on 1inch brings numerous benefits to users, making it a popular choice for decentralized exchange transactions. Here are some key advantages:

1. Best Price Execution

1inch employs an innovative algorithm that identifies the most optimal trading routes for users, ensuring the best price execution possible. By leveraging its aggregation engine, 1inch scans multiple decentralized exchanges to find the best rates, resulting in lower slippage and improved overall trading efficiency.

2. Cost Savings

With 1inch, users can save on transaction costs by taking advantage of its gas token. The gas token, which is denominated in ETH, can be used to offset gas fees for transactions executed on the 1inch platform. This feature helps users reduce costs and maximize their token swapping experience.

3. Security and Trust

1inch is built on decentralized protocols, ensuring that users retain control of their funds throughout the token swapping process. By avoiding the need for users to deposit their assets into a centralized exchange, 1inch eliminates the risk of a single point of failure and potential hacking incidents. Additionally, 1inch utilizes audited smart contracts to provide an additional layer of security and trust.

4. User-Friendly Interface

1inch offers a user-friendly interface that makes token swapping accessible and intuitive for both experienced traders and newcomers to the decentralized finance space. The platform provides clear and concise information about token pairs, liquidity, and transaction details, allowing users to make well-informed decisions.

5. Wide Range of Tokens

1inch supports an extensive list of tokens, enabling users to trade a wide variety of assets. Whether it’s popular cryptocurrencies or emerging tokens, 1inch provides access to a diverse range of trading options, giving users the flexibility to manage their portfolios effectively.

Overall, token swapping on 1inch offers a seamless and efficient trading experience, empowering users to enjoy the benefits of decentralized exchanges with enhanced security, cost savings, and improved liquidity. As the decentralized finance ecosystem continues to grow, 1inch remains a reliable and trusted platform for token swapping.

Tips for Efficient Token Swapping on 1inch

When using the 1inch DEX aggregator to swap tokens, there are several tips that can help ensure a smooth and efficient transaction:

| TIP | DESCRIPTION |

|---|---|

| 1 | Choose the best liquidity source |

| 2 | Consider slippage tolerance |

| 3 | Check gas fees and network congestion |

| 4 | Enable “Partial Fill” |

| 5 | Review transaction details |

Choosing the best liquidity source is crucial for getting the most favorable swap rates. 1inch scans multiple decentralized exchanges and selects the one that offers the best rates at the moment. Be sure to compare the rates and liquidity pools before making a decision.

Slippage tolerance refers to the maximum difference between the expected and final prices of the swapped tokens. This parameter can help avoid failed transactions due to price changes during the swapping process. Set a reasonable slippage tolerance based on market conditions and your risk appetite.

Gas fees and network congestion can significantly impact the cost and speed of your token swaps. Check the current gas fees on the Ethereum network and consider using alternative networks or optimizing gas fees if necessary. Keep in mind that higher gas fees may result in faster transaction execution.

Enabling the “Partial Fill” option allows your transaction to be executed even if the full amount of tokens cannot be swapped. This is useful when there is insufficient liquidity in the selected exchange at the moment. You can choose to accept a partial fill or cancel the transaction if it cannot be fully executed.

Review the transaction details before confirming the swap. Ensure that the token addresses and amounts are correct, as any mistakes can lead to irreversible loss of funds. Pay attention to the estimated gas fees and network confirmations required for the transaction to be processed.

By following these tips, you can optimize your token swapping experience on 1inch and make more efficient trades. Always stay informed about market conditions and be cautious when dealing with decentralized exchanges.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges, protocols, and liquidity pools to provide users with the best possible trading prices and low slippage.

How does token swapping work on 1inch?

When a user wants to swap one token for another on 1inch, the platform splits the trade into multiple parts and routes them through different paths to achieve the most efficient and cost-effective trade for the user, taking into account available liquidity and prices on various platforms.

What are the advantages of using token swapping on 1inch?

Using token swapping on 1inch provides several advantages, including access to a wide range of liquidity sources, competitive pricing, low slippage, and the ability to execute trades quickly and efficiently.

How is price impact mitigated on 1inch?

Price impact is mitigated on 1inch by splitting large trades into smaller parts and routing them through different paths, which helps to minimize slippage and ensure that the user gets the best possible price for their trade.

Are there any fees associated with token swapping on 1inch?

Yes, there are fees associated with token swapping on 1inch. These fees include gas fees for executing transactions on the Ethereum network and a service fee, which is charged by 1inch for providing the liquidity aggregation service.