1inch Swap is a decentralized exchange aggregator that enables users to trade tokens across multiple liquidity sources. While it offers various benefits, it is crucial to understand the potential risks associated with using the platform. Knowing these risks can help users make informed decisions and mitigate any potential losses or challenges.

Smart contract risk: 1inch Swap operates using smart contracts, which are self-executing contracts with terms written directly into code. While these contracts are designed to be secure, they are not immune to vulnerabilities or bugs. Users should be cautious when interacting with smart contracts, as there is always a risk of hacking or unforeseen issues that could lead to losses.

Impermanent loss: Users who provide liquidity to 1inch Swap may face the risk of impermanent loss. This occurs when the value of the assets in the liquidity pool changes compared to holding the assets individually. The loss is temporary and only impacts those who choose to become liquidity providers, but it is important to be aware of this risk and consider it when making investment decisions.

Slippage: When using 1inch Swap, there is a risk of slippage, which is the difference between the expected price of a trade and the executed price. This can occur when there is insufficient liquidity or when the market experiences high volatility. Slippage can result in unexpected losses or reduced profits, so users should carefully consider the potential impact before trading on the platform.

Regulatory risks: The regulatory landscape around decentralized finance (DeFi) and cryptocurrency is still evolving. There is a risk that governments or regulatory bodies may introduce new regulations or restrictions that could affect the operations of platforms like 1inch Swap. Users should stay informed about the regulatory environment and be prepared for potential changes that could impact their ability to use the platform.

By understanding the risks associated with 1inch Swap, users can make more informed decisions and take appropriate measures to protect their investments. It is important to stay updated on the latest developments in the DeFi space, as the risks and challenges may evolve over time. While 1inch Swap offers numerous benefits, it is essential to approach its usage with caution and conduct thorough research before engaging in any transactions.

Overview of 1inch Swap

1inch Swap is a decentralized exchange aggregator that sources liquidity from various exchanges in order to provide users with the best possible trading rates. It was developed by the 1inch team and launched in 2020.

How does 1inch Swap work?

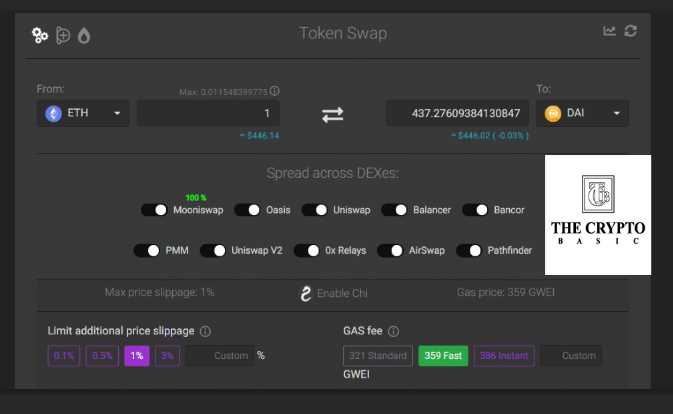

When a user wants to make a trade on 1inch Swap, the platform scans multiple decentralized exchanges to find the best possible rates and automatically routes the trade to those exchanges. This allows users to get the most favorable exchange rate and save on fees.

1inch utilizes a smart contract that splits users’ trades across multiple liquidity sources, taking into account factors such as rates, gas fees, and slippage. By splitting the trade, 1inch is able to optimize the trade execution and ensure that users get the best possible outcome.

Key features of 1inch Swap

1. Best rates: 1inch scans multiple exchanges to give users the most favorable exchange rates for their trades.

2. Low fees: By aggregating liquidity from various sources, 1inch helps users save on fees.

3. Gas optimization: 1inch splits trades across multiple liquidity sources to optimize gas fees and minimize slippage.

4. Wide range of assets: 1inch supports a variety of tokens and allows users to trade between different Ethereum-based assets.

5. Security: 1inch is built on audited smart contracts and undergoes regular security audits to ensure the safety of user funds.

In summary, 1inch Swap is a decentralized exchange aggregator that offers users the best trading rates by scanning multiple exchanges. It optimizes trades by splitting them across various liquidity sources and provides users with a wide range of assets to trade. With its low fees and focus on security, 1inch Swap has quickly become a popular choice for decentralized trading.

Why it’s Important to Understand the Risks

When it comes to using the 1inch Swap platform, it is crucial to have a clear understanding of the risks involved. By being aware of these risks, you can make informed decisions and take necessary precautions to protect your funds and investments.

1. Impermanent loss

One of the primary risks associated with using 1inch Swap is the concept of impermanent loss. Impermanent loss occurs when the value of your liquidity pool tokens changes compared to the value of the assets you initially deposited. This can result in a loss of potential gains or even a reduction in the overall value of your investment.

2. Smart contract vulnerabilities

Like any decentralized finance (DeFi) platform, 1inch Swap operates using smart contracts. While smart contracts are designed to be secure, there is always a potential for vulnerabilities and bugs. It’s essential to understand the risks associated with these potential vulnerabilities and to be cautious when interacting with the platform.

It’s important to note that 1inch Swap has undergone extensive audits to minimize the risk of smart contract vulnerabilities. However, it’s still crucial to stay updated on any security announcements and to only interact with the platform using trusted devices and networks.

3. Slippage and transaction failures

When using 1inch Swap, there is a possibility of experiencing slippage or transaction failures. Slippage occurs when the execution price of a trade differs from the expected price, which can result in an unfavorable outcome. Additionally, transaction failures can occur due to network congestion or other technical issues.

To minimize the risk of slippage and transaction failures, it’s important to carefully monitor the market conditions and consider adjusting the transaction settings to account for potential price fluctuations.

- Always conduct thorough research and due diligence before using 1inch Swap.

- Never invest more than you can afford to lose

- Keep track of any announcements, audits, or updates related to the platform’s security.

- Consider diversifying your portfolio and using risk management strategies to mitigate potential losses.

- Ensure that you’re using a secure wallet and practice good security hygiene when interacting with the platform.

By understanding the risks associated with using 1inch Swap and taking appropriate measures to mitigate these risks, you can navigate the platform more confidently and make informed investment decisions.

Security Risks

While 1inch Swap offers a convenient and efficient way to trade cryptocurrencies, it is important to be aware of the potential security risks involved. Here are some important things to know:

1. Smart Contract Vulnerabilities: Like many decentralized applications (dApps), 1inch Swap relies on smart contracts to facilitate trades. Smart contracts are lines of code that execute predefined actions when certain conditions are met. However, smart contracts are not infallible and can contain vulnerabilities that hackers may exploit. It is crucial to thoroughly audit and review the smart contracts before using 1inch Swap.

2. Loss of Funds: Using 1inch Swap involves transferring your funds to an external platform. While the platform has implemented various security measures to protect user funds, there is always a risk of losing your funds due to a hack or technical issue. It is essential to only trade with funds you are willing to lose and to ensure you are using a reputable and secure platform.

3. Phishing Attacks: Phishing attacks are a common security threat in the cryptocurrency space. Hackers may create fake websites or send fraudulent emails that appear to be from 1inch Swap to trick users into revealing their private keys or other sensitive information. Always double-check the URL of the website and be cautious of any suspicious requests for personal information.

4. Third-party Integration Risks: 1inch Swap integrates with various third-party platforms to provide users with access to multiple liquidity sources. While these integrations can enhance the trading experience, they also introduce additional security risks. Make sure to review the security practices of any third-party platforms before connecting them to your 1inch Swap account.

5. Regulatory Risks: Cryptocurrency regulations vary across different jurisdictions. Before using 1inch Swap or engaging in cryptocurrency trading, it is crucial to familiarize yourself with the regulations in your country or region. Failure to comply with applicable regulations could result in legal consequences.

In conclusion, while 1inch Swap offers numerous benefits for cryptocurrency traders, it is important to be aware of the potential security risks involved. By staying informed, using reputable platforms, and implementing good security practices, you can minimize these risks and trade with confidence.

Smart Contract Vulnerabilities

Smart contracts are essentially self-executing contracts with the terms of the agreement directly written into lines of code. While they bring numerous benefits to the world of blockchain technology, they are not without their vulnerabilities. Understanding these vulnerabilities is crucial when it comes to utilizing platforms like 1inch Swap and protecting your assets.

Risk of Exploitable Bugs

One major smart contract vulnerability is the presence of exploitable bugs. These bugs can be introduced during the development process or be the result of unintended consequences of code interactions. If left undiscovered or unresolved, these bugs can be exploited by malicious actors to manipulate the contract’s behavior, potentially leading to loss of funds.

It is important to note that even well-audited and thoroughly tested contracts can have vulnerabilities due to the complexity of the code and the potential for unexpected interactions between different components. This is why ongoing security audits and continuous updates are essential to address any potential bugs as they arise and prevent exploitation.

Smart Contract Security Failures

Another vulnerability is the possibility of smart contract security failures. These failures can arise when developers make mistakes in the design or implementation of the contract, leading to unintended consequences or security loopholes. For example, if the contract lacks proper access controls or does not account for all possible edge cases, it can become vulnerable to attacks.

Additionally, third-party dependencies can also introduce vulnerabilities. If a smart contract relies on external libraries or APIs, any vulnerabilities in those dependencies can become a potential point of weakness in the contract’s security. Regular monitoring and updating of these dependencies is crucial to maintain the security and integrity of the smart contract.

It is important for users of platforms like 1inch Swap to be aware of these vulnerabilities and take necessary precautions to mitigate risks. Here are some key steps to enhance your protection:

- Thoroughly research and understand the smart contract before using it.

- Stay updated on security audits and open bug bounties offered by the platform.

- Avoid using contracts with unknown or unaudited code.

- Regularly update your contracts with the latest security patches.

- Use multi-signature wallets to add an extra layer of security.

By following these precautions, users can minimize the risks associated with smart contract vulnerabilities and protect their assets when utilizing platforms like 1inch Swap.

Malicious Actors and Scams

When using the 1inch Swap platform, it is important to be aware of potential risks associated with malicious actors and scams. While 1inch strives to provide a secure and reliable service, there are still individuals and organizations that may try to take advantage of unsuspecting users. Below are some of the common scams and malicious activities to watch out for:

- Phishing: Be cautious of phishing attempts, where scammers try to trick users into revealing their private keys, passwords, or other sensitive information. Always double-check the website’s URL and ensure you are on the authentic 1inch Swap platform.

- Impersonation: Malicious actors may create fake social media accounts, groups, or channels that appear to be affiliated with 1inch. They often impersonate official team members and try to solicit funds or steal personal information. Always verify the legitimacy of any communication channel before engaging.

- Token Scams: Scammers may create fraudulent tokens that mimic established cryptocurrencies. They often promote these tokens as the next big investment opportunity but ultimately aim to steal users’ funds. Be cautious when investing in unfamiliar tokens and do thorough research before making any transactions.

- Unofficial Apps and Extensions: Avoid using unofficial mobile apps or browser extensions claiming to provide additional functionality for 1inch Swap. These can be potential security risks and may compromise your funds. Stick to the official 1inch platform and verified applications.

- Unsolicited Offers: Beware of unsolicited offers, giveaways, or investment opportunities that promise high returns. These are often attempts to deceive users and steal their funds. Never send funds to anyone you don’t trust and do not provide your private keys or sensitive information to unknown parties.

By understanding these risks and staying vigilant, you can better protect yourself when using 1inch Swap and ensure a safe and secure trading experience.

Financial Risks

When using 1inch Swap or any decentralized exchange, there are several financial risks that users should be aware of.

1. Market Volatility: The cryptocurrency market is highly volatile, which means that the prices of tokens can fluctuate significantly in a short period of time. This can result in price slippage and potentially lead to losses.

2. Impermanent Loss: When providing liquidity on 1inch Swap, there is a risk of impermanent loss. Impermanent loss occurs when the price of the tokens in the liquidity pool changes relative to the price at which they were deposited. This can result in the loss of value compared to simply holding the tokens.

3. Smart Contract Risks: Smart contracts are the backbone of decentralized exchanges like 1inch Swap. However, there is always a risk of smart contract bugs or vulnerabilities. These can potentially be exploited by malicious actors, leading to financial losses for users.

4. High Transaction Fees: Transaction fees on decentralized exchanges can be high, especially during periods of high network congestion. This can eat into the profits or increase the losses for users, especially for smaller transactions.

5. Regulatory Risks: The regulatory landscape for cryptocurrencies and decentralized exchanges is still evolving. There is a risk that new regulations or legal actions could adversely affect the operation of 1inch Swap or other decentralized exchanges, potentially leading to financial losses for users.

It is important for users to thoroughly understand these financial risks before using 1inch Swap or any other decentralized exchange. Users should also consider their risk tolerance and only invest what they can afford to lose.

Question-answer:

What is 1inch Swap?

1inch Swap is a decentralized exchange aggregator that sources liquidity from various exchanges and liquidity pools, allowing users to find the best prices for their trades. It automatically splits the trade into multiple parts to ensure the best possible execution.

How does 1inch Swap work?

1inch Swap works by tapping into multiple liquidity sources, such as decentralized exchanges and liquidity pools, to find the best prices for users’ trades. It automatically splits the trade and executes it across these sources to optimize the trade execution and get the best possible outcome for the user.

What are the risks of using 1inch Swap?

There are several risks associated with using 1inch Swap. First, there is the risk of smart contract vulnerabilities, as 1inch Swap relies on smart contracts to execute trades. These vulnerabilities could potentially be exploited by hackers. Second, there is the risk of trade slippage, where the executed trade price may deviate from the expected price due to market volatility or insufficient liquidity. Lastly, there is the risk of transaction delays or failures, as the Ethereum network can sometimes experience congestion or other technical issues.

Are my funds safe on 1inch Swap?

While 1inch Swap takes measures to ensure the security of users’ funds, there is still a risk of smart contract vulnerabilities and potential hacking attacks. It is always important to exercise caution and only use funds that you are willing to lose when using decentralized exchanges or protocols like 1inch Swap.

How can I mitigate the risks of using 1inch Swap?

To mitigate the risks of using 1inch Swap, it is recommended to do thorough research and understand the risks involved. Additionally, users should consider using smaller trade sizes and utilizing limit orders to minimize the impact of trade slippage. It is also advisable to use external wallets, such as hardware wallets, to secure your funds and enable additional layers of security.