The world of cryptocurrencies is a complex and ever-evolving one. With thousands of coins available in the market, it can be challenging to determine which ones will thrive and which ones will fade away. One coin that has gained significant attention recently is the 1inch coin. The market cap of a cryptocurrency is a crucial measure of its value and potential for growth, and understanding the factors that influence it, such as supply and demand, is of utmost importance.

Supply and demand play a vital role in determining the market cap of any cryptocurrency, including the 1inch coin. In simple terms, supply refers to the total number of coins that are available, while demand represents the desire of investors to buy those coins. When the demand for a particular cryptocurrency is high, and the supply is limited, the price tends to go up, resulting in an increase in the market cap. Conversely, if the supply outstrips the demand, the price may drop, leading to a decrease in the market cap.

One factor that affects the supply of the 1inch coin is its distribution method. The 1inch coin was initially distributed through an airdrop, where users were given coins for free. This method resulted in a wide distribution of the coin, allowing many people to acquire it. As a result, the supply of the coin is relatively high, which can impact its market cap.

The demand for the 1inch coin is influenced by several factors, including its technology, partnerships, and real-world application. The 1inch coin is built on the Ethereum blockchain and aims to provide decentralized exchange services. Its innovative technology and ability to offer users better trading rates have garnered attention from investors. Additionally, partnerships with other cryptocurrency projects and collaborations with industry leaders have further boosted the demand for the 1inch coin. The more people who see value in the 1inch coin and want to invest in it, the higher its market cap will be.

In conclusion, supply and demand are crucial factors in determining the market cap of the 1inch coin. A balance between supply and demand is necessary for the coin to maintain its value and potential for growth. As the cryptocurrency landscape continues to evolve, it is essential for investors to closely monitor these factors to make informed decisions and capitalize on opportunities in the market.

The Significance of Supply and Demand in Influencing the Market Capitalization of the 1inch Coin

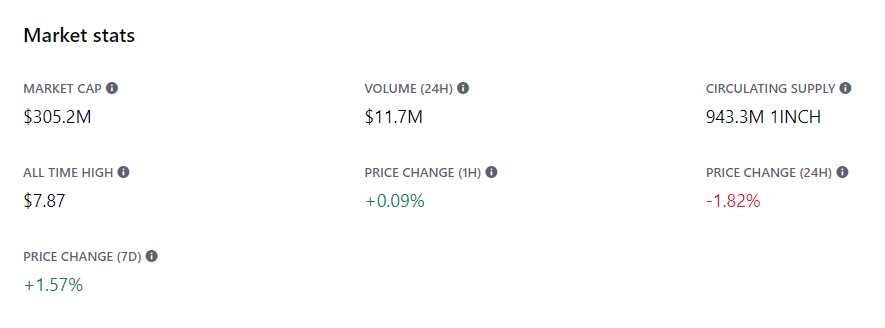

Supply and demand play a critical role in determining the market capitalization of the 1inch Coin. Market capitalization is a measure of the total value of a cryptocurrency and is calculated by multiplying the price per coin by the total number of coins in circulation.

Supply refers to the total number of coins available for trading. In the case of the 1inch Coin, a higher supply can lead to a lower price per coin, assuming demand remains constant. Conversely, a lower supply can create scarcity and drive up the price per coin if there is high demand.

Demand, on the other hand, refers to the willingness of investors and traders to buy the 1inch Coin at a given price. Factors that can influence demand include market sentiment, news, technological developments, and external events. If there is high demand for the 1inch Coin, it can increase the price per coin, thereby increasing the market capitalization.

Supply and Market Capitalization

The supply of the 1inch Coin has a direct impact on its market capitalization. When the total number of coins in circulation increases, it dilutes the value of each individual coin, leading to a lower market capitalization. This is because the increased supply makes each individual coin less scarce and therefore less valuable.

Conversely, when the supply of the 1inch Coin decreases, it can create scarcity and increase the value of each individual coin. As a result, the market capitalization can increase even if the price per coin remains the same or experiences a modest increase.

Demand and Market Capitalization

Demand is a key driver of the market capitalization of the 1inch Coin. High demand can lead to a surge in the price per coin, driving up the market capitalization. This can be fueled by various factors such as positive news, partnerships, or increased adoption of the 1inch Coin by users and businesses.

Conversely, low demand can result in a decrease in the price per coin, leading to a decline in the market capitalization. Negative news, regulatory concerns, or lack of awareness can all contribute to a decrease in demand for the 1inch Coin.

| Factors influencing supply | Factors influencing demand |

|---|---|

| Max supply of the 1inch Coin | Positive news and developments |

| Minting and distribution policies | Partnerships and collaborations |

| Token burning mechanisms | User adoption and acceptance |

| Overall market trends | Market sentiment and perception |

It is important to note that both supply and demand are influenced by a wide range of factors, and their interplay ultimately determines the market capitalization of the 1inch Coin. By understanding and analyzing these factors, investors and traders can make informed decisions about their investments in the cryptocurrency market.

The Basics of Supply and Demand

The supply and demand concept is a fundamental principle in economics that plays a crucial role in determining the market cap of cryptocurrencies such as the 1inch coin. Understanding how supply and demand interact can provide valuable insights into the market dynamics and price movements.

Supply refers to the quantity of a product or service that is available in the market. In the case of cryptocurrencies, the supply is usually predetermined and governed by the underlying technology. For example, the total supply of 1inch coin may be fixed at a certain number of tokens.

Demand, on the other hand, is the quantity of a product or service that buyers are willing and able to purchase at a given price. It represents the desire and affordability of buyers in the market. Factors such as utility, perceived value, and market sentiment can influence the demand for a cryptocurrency.

When the demand for a cryptocurrency exceeds its supply, it often leads to an increase in its price. Conversely, if the supply surpasses the demand, the price tends to decrease. This relationship between supply and demand forms the basis of price discovery in the market.

Supply and demand are influenced by various factors, including market conditions, investor sentiment, macroeconomic factors, and regulatory developments. For example, positive news or announcements about the 1inch coin can increase demand and drive up its price. Similarly, negative news or regulatory restrictions can decrease demand and cause the price to fall.

To illustrate the relationship between supply and demand, let’s consider a hypothetical scenario. Suppose the supply of 1inch coin remains constant, but there is suddenly a surge in demand due to increased adoption or positive market sentiment. As more buyers enter the market, they compete to purchase the limited supply of coins, resulting in a price increase.

Conversely, if there is a sudden decrease in demand or an increase in supply, the price of 1inch coin may decrease. This can happen, for example, if there is negative news about the project or a large number of coins are released into circulation.

In conclusion, supply and demand are essential factors that determine the market cap and price of cryptocurrencies like the 1inch coin. Understanding these concepts can help investors and traders make informed decisions and navigate the volatile crypto market.

Factors Influencing Supply and Demand in the 1inch Coin Market

The 1inch coin market is influenced by several key factors that impact the supply and demand dynamics of the cryptocurrency. These factors play a crucial role in determining the market cap and overall value of the 1inch coin. Understanding these factors can provide valuable insights for investors and traders.

1. User Adoption and Demand

One of the primary factors influencing supply and demand in the 1inch coin market is user adoption and demand. The level of interest and demand for the 1inch coin among investors and users can significantly impact its price and market cap. Higher demand typically leads to an increase in price and market value, whereas lower demand can result in a decrease in value.

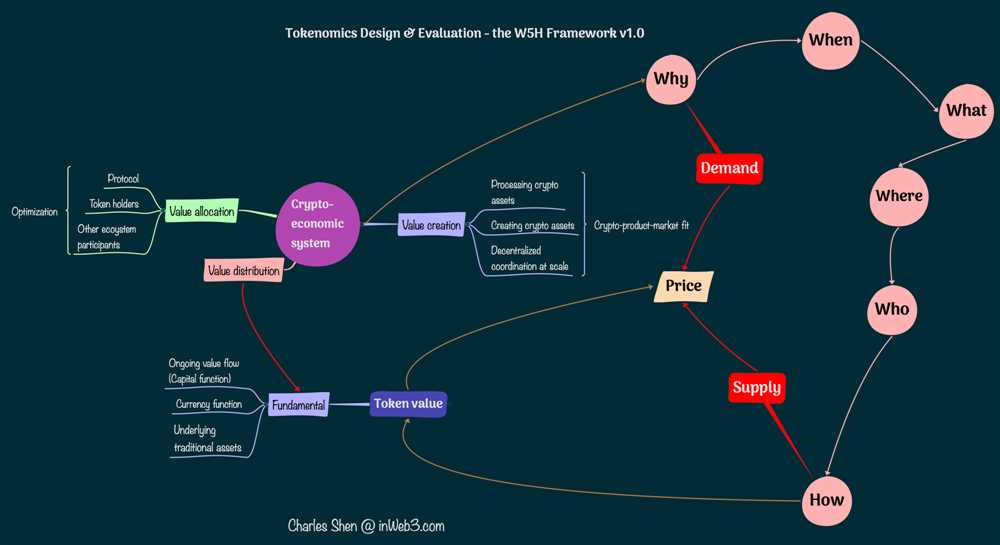

2. Tokenomics and Circulating Supply

The tokenomics and circulating supply of the 1inch coin also play a crucial role in determining its supply and demand dynamics. The circulating supply refers to the number of coins available for trading on the market. If the circulating supply is limited, it can create scarcity and increase the demand for the coin. On the other hand, if the circulating supply is high, it can potentially lead to decreased demand and a decrease in price.

Tokenomics, which includes factors such as token distribution and inflation rate, can impact supply and demand as well. For example, if there is a large portion of coins held by a small group of individuals or if there is a high inflation rate, it can negatively impact the demand for the 1inch coin.

3. Market Sentiment and Investor Confidence

Market sentiment and investor confidence also play a significant role in determining supply and demand in the 1inch coin market. Positive market sentiment and high investor confidence can lead to increased demand and a higher market cap. Conversely, negative sentiment and low investor confidence can result in decreased demand and a lower market cap.

Factors influencing market sentiment and investor confidence can include regulatory developments, news events, and overall market trends. It is essential for investors and traders to stay informed about these factors to make educated decisions.

4. Competition and Technological Advancements

The level of competition and technological advancements in the cryptocurrency market can also influence supply and demand for the 1inch coin. If there are competing projects that offer similar functionalities or if new technologies emerge that provide better solutions, it can impact the demand for the 1inch coin. Investors and users may choose to allocate their resources to other projects, resulting in decreased demand for the 1inch coin.

On the other hand, technological advancements that enhance the functionalities or capabilities of the 1inch coin can lead to increased demand. The development of new features or partnerships can attract investors and users, driving up the demand and market cap of the 1inch coin.

In conclusion, the supply and demand dynamics in the 1inch coin market are influenced by various factors, including user adoption, tokenomics, market sentiment, competition, and technological advancements. Understanding and monitoring these factors can provide valuable insights for investors and traders looking to navigate the 1inch coin market.

Impact of Supply and Demand on Market Capitalization

The market capitalization of a cryptocurrency like the 1inch coin is greatly influenced by the forces of supply and demand. Supply refers to the number of coins available in circulation, while demand represents the interest and desire of investors and users to acquire and hold these coins.

Influence of Supply

The supply of 1inch coins in the market is determined by various factors such as mining rewards, token release schedules, and token burn events. When the supply of coins is limited, it can create scarcity and increase the value of each individual coin. Conversely, when the supply increases significantly, it can result in a decrease in the value of each coin due to dilution.

Furthermore, the supply of 1inch coins can also impact market liquidity. Higher liquidity, which is achieved through a larger circulating supply, can lead to a healthier and more stable market with less price volatility. On the other hand, a smaller supply of coins may result in limited liquidity, making it easier for large buy or sell orders to substantially impact the market price.

Effect of Demand

The demand for 1inch coins is influenced by various factors including market sentiment, investor confidence, and utility within the 1inch ecosystem. Positive market sentiment and increased confidence in the project can drive up demand for the coin, leading to an increase in its market capitalization. Additionally, if the 1inch coin provides unique features and utilities within the 1inch ecosystem, it may attract more users and investors, further increasing its demand and market value.

The interaction between supply and demand dynamics can have a significant impact on the market capitalization of the 1inch coin. If the demand for 1inch coins consistently outpaces the available supply, it can result in a rapid increase in market capitalization. Conversely, if the supply exceeds the demand, it may cause a decline in market capitalization.

It is important for investors and market participants to closely monitor the supply and demand dynamics of the 1inch coin, as it can provide valuable insights into the potential future movements of its market capitalization. Factors such as upcoming token release schedules, partnership announcements, and market trends should be considered when assessing the impact of supply and demand on the market capitalization of the 1inch coin.

Question-answer:

What is supply and demand?

Supply and demand refer to the fundamental forces that drive market prices. Supply is the quantity of a good or service that sellers are willing to provide at a given price, while demand is the quantity that buyers are willing to purchase at a given price.

How does supply and demand affect the 1inch coin market cap?

Supply and demand play a crucial role in determining the market cap of the 1inch coin. If the supply of 1inch coins is limited and there is a high demand for them, the price of the coin will increase, leading to a higher market cap. On the other hand, if there is an oversupply of coins or low demand, the price will decrease, resulting in a lower market cap.

Why is supply and demand important for investors?

Understanding supply and demand is essential for investors as it helps them make informed decisions about buying and selling assets. By recognizing the dynamics of supply and demand, investors can identify potential opportunities and risks in the market, allowing them to better manage their portfolios and potentially maximize their profits.

Can external factors influence supply and demand in the 1inch coin market?

Yes, external factors can definitely influence supply and demand in the 1inch coin market. For example, regulatory changes, market sentiment, and news announcements can all impact the demand for and supply of 1inch coins. Additionally, macroeconomic factors like inflation or economic growth can also affect the overall market conditions and consequently influence the supply and demand dynamics of the 1inch coin market.

How can the understanding of supply and demand help predict future market trends?

By analyzing supply and demand factors, market participants can gain insights into the potential future movements of the 1inch coin market. For instance, if the supply of 1inch coins is expected to decrease while demand remains steady or increases, it may indicate a potential price increase in the future. Conversely, if the supply is anticipated to increase substantially without a corresponding increase in demand, it may suggest that the price will decline in the near future.