Are you interested in making profits from price differences in the market?

Look no further than 1inch.exchange!

Arbitrage plays a crucial role in the success of 1inch.exchange, allowing traders to take advantage of the price discrepancies across different decentralized exchanges.

But what exactly is arbitrage?

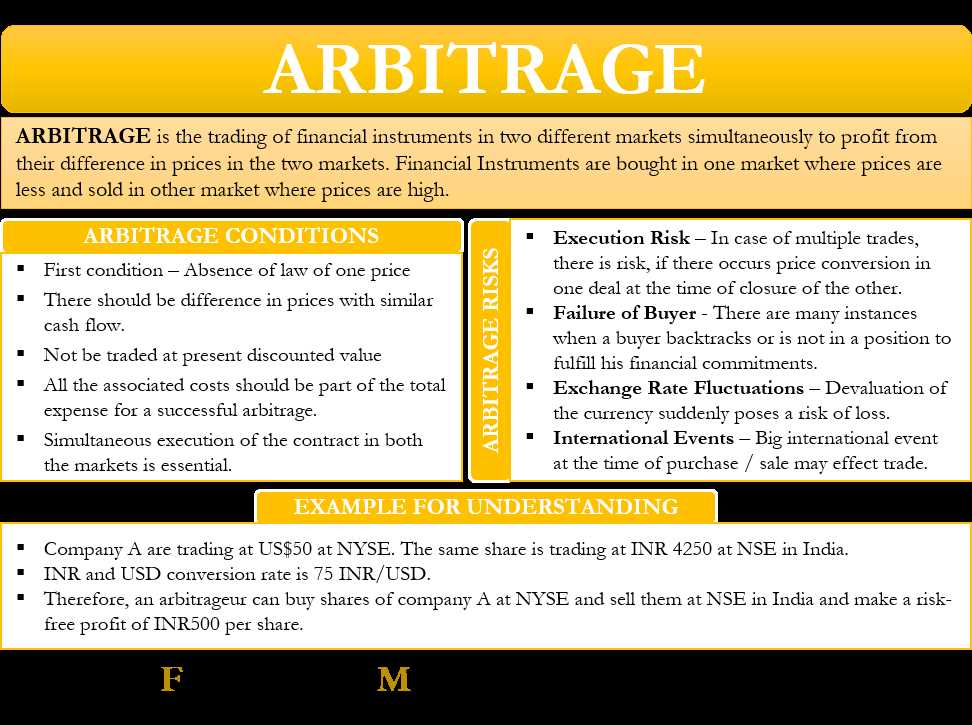

Arbitrage is the practice of buying an asset at a lower price on one exchange and selling it at a higher price on another exchange, thereby profiting from the price difference.

This strategy is made possible by 1inch.exchange’s advanced technology and liquidity protocol, which integrates multiple decentralized exchanges into one platform. As a result, users gain access to a vast pool of liquidity and can find the best prices for their desired assets.

By leveraging arbitrage opportunities on 1inch.exchange, traders can maximize their profits and optimize their trading strategies. Whether you are a seasoned trader or just starting out, arbitrage on 1inch.exchange can significantly boost your earnings.

Don’t miss out on the advantages that arbitrage brings! Join 1inch.exchange today and start profiting from price differences like never before.

The Role of Arbitrage in 1inch.exchange

Arbitrage plays a vital role in the operations of 1inch.exchange, a decentralized exchange platform operating on the Ethereum blockchain. As a concept, arbitrage refers to the practice of taking advantage of price differences between different markets or exchanges to make a profit.

In the context of 1inch.exchange, traders can leverage arbitrage opportunities to optimize their trading strategies and maximize their returns. The decentralized nature of the platform allows users to tap into various liquidity sources and take advantage of price discrepancies across these sources.

By utilizing smart contracts and advanced algorithms, 1inch.exchange scans multiple decentralized exchanges and aggregates liquidity from across the market. This enables traders to find the best available prices for their trades and execute them at optimal levels.

Arbitrage helps promote efficient market dynamics by narrowing down price differences and reducing market inefficiencies. It incentivizes traders to bring liquidity to the market and bridge the gaps between different exchanges, making it easier for users to access the best prices.

Furthermore, arbitrage can also contribute to improving overall market liquidity. As traders engage in arbitrage to exploit price differences, they help equalize prices across different markets, leading to a more balanced and liquid market environment.

1inch.exchange provides a user-friendly interface and advanced tools to help traders identify and capitalize on arbitrage opportunities. The platform empowers users with real-time data, market insights, and efficient trading execution, enabling them to navigate the complexities of arbitrage with ease.

In summary, arbitrage plays a crucial role in 1inch.exchange by driving liquidity, promoting price efficiency, and empowering traders to optimize their trading strategies. Through its innovative approach, 1inch.exchange revolutionizes the way traders interact with decentralized exchanges and unlocks new opportunities for profit and growth.

Understanding the Basics

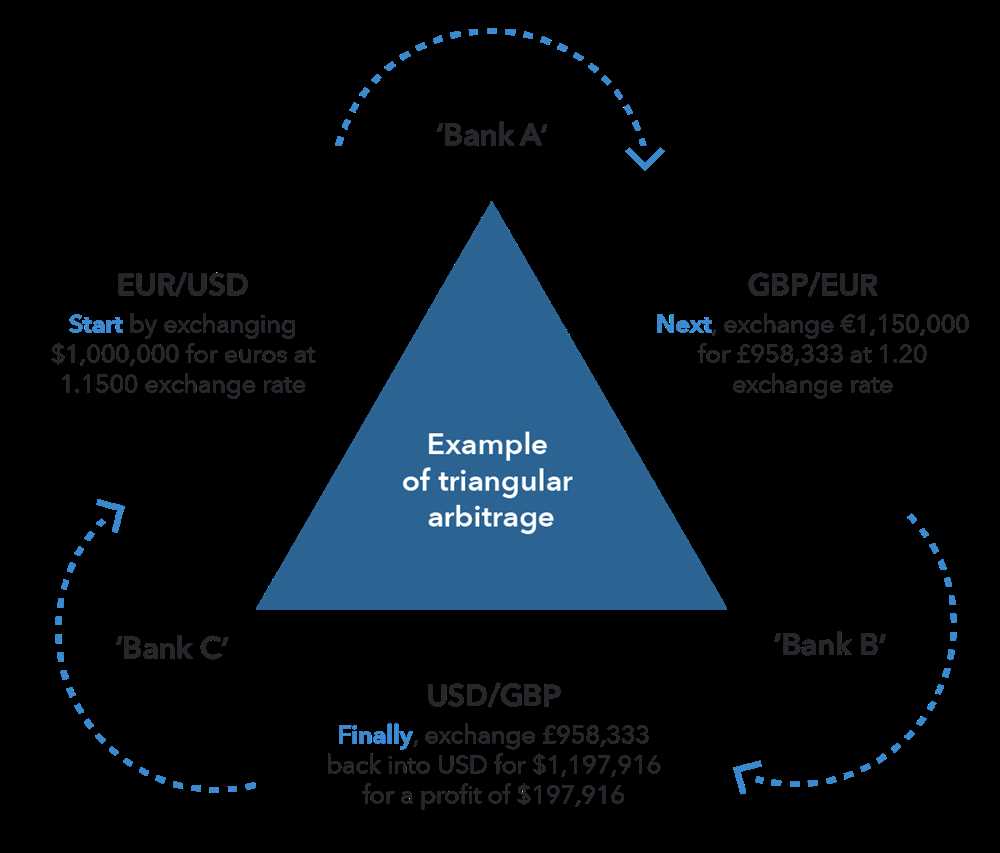

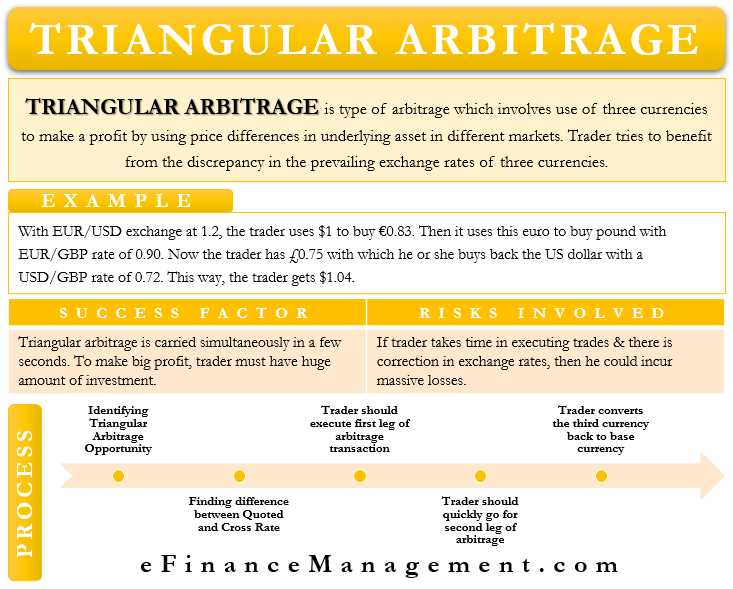

Arbitrage is a fundamental concept in the world of finance and trading. It involves taking advantage of price differences between different markets or exchange platforms to make a profit.

What is Arbitrage?

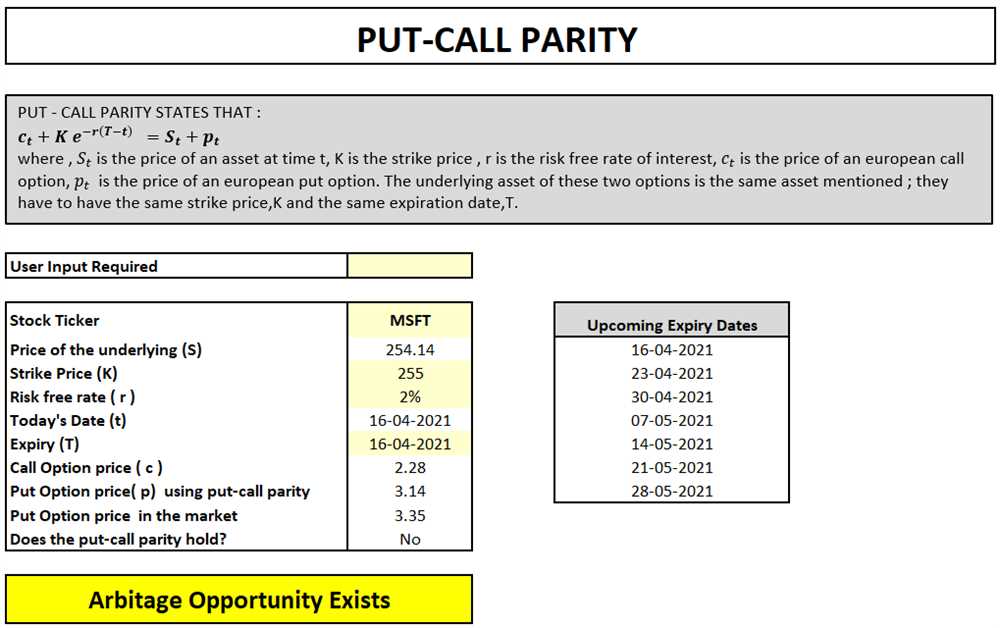

Arbitrage, in simple terms, is the practice of buying a financial instrument or asset at a lower price in one market and simultaneously selling it at a higher price in another market. This price difference allows traders to make a profit without any additional risk.

Arbitrage opportunities arise due to various factors, such as differences in supply and demand, exchange rates, transaction costs, and market inefficiencies. Traders who are knowledgeable and quick to act can exploit these opportunities by executing trades in a timely manner.

The Role of Arbitrage in 1inch.exchange

1inch.exchange is a decentralized exchange aggregator that connects multiple liquidity sources to provide the best possible prices for traders. Arbitrage plays a crucial role in the functioning of 1inch.exchange by taking advantage of price discrepancies across different decentralized exchanges.

By identifying and executing trades on different platforms simultaneously, arbitrageurs help to reduce price differences and increase overall liquidity in the market. This benefits all traders by ensuring fairer prices and better execution of trades.

Moreover, arbitrage also incentivizes liquidity providers to maintain balanced pools on 1inch.exchange. As arbitrageurs exploit price differences, they ensure that prices on different exchanges remain aligned, preventing the emergence of profitable arbitrage opportunities. In return, liquidity providers earn fees for their participation in the platform.

Overall, understanding the basics of arbitrage is essential for traders and participants in the 1inch.exchange ecosystem. It allows them to capitalize on price differences and contribute to the efficiency and liquidity of the decentralized exchange market.

Maximizing Profits through Efficient Trades

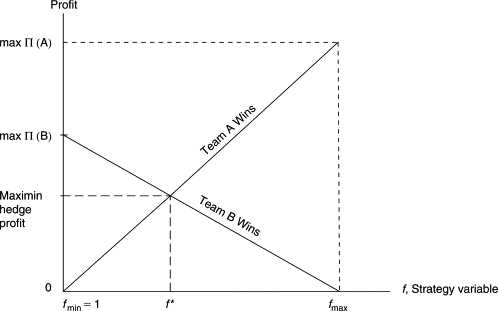

When it comes to arbitrage trading, maximizing profits is the ultimate goal. This can be achieved through efficient trades that capitalize on price differences in the market. By understanding the role of arbitrage in 1inch.exchange and taking advantage of its features, traders can greatly enhance their profitability.

Efficient trades require careful planning and execution. It is essential to closely monitor the market for any price discrepancies across different exchanges. By identifying these differences, traders can quickly move to execute profitable trades.

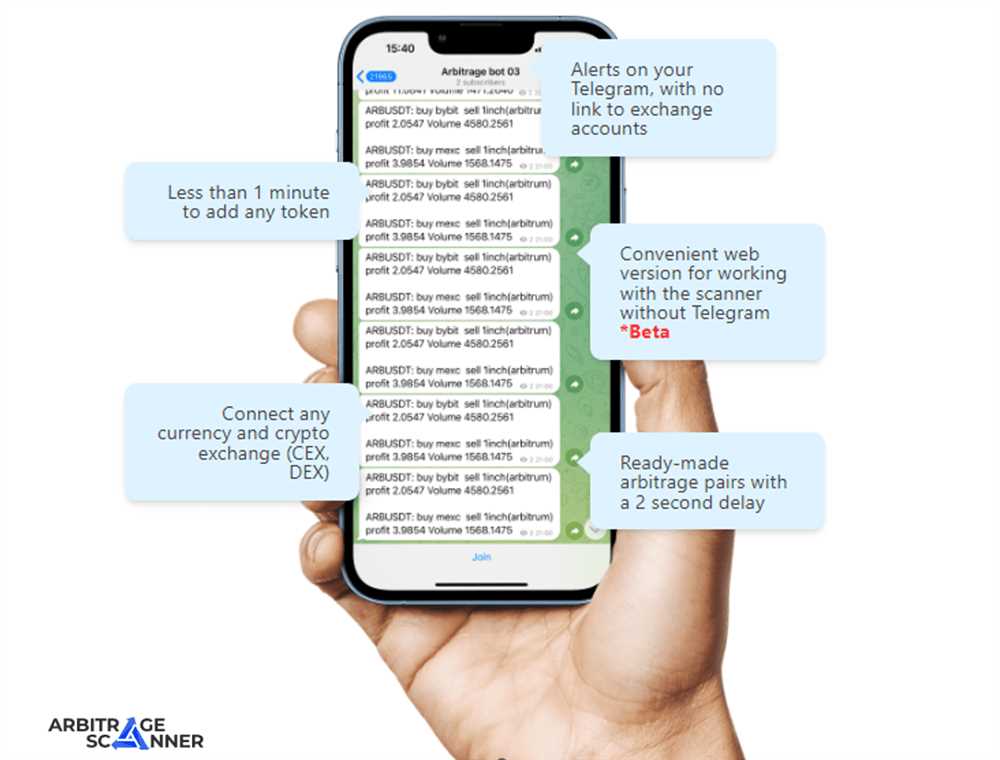

Utilizing Real-Time Data

One of the key factors in executing efficient trades is the availability of real-time data. 1inch.exchange provides users with up-to-date information on various tokens and their prices across multiple exchanges. By utilizing this data, traders can identify and act upon lucrative arbitrage opportunities.

Traders should also consider the transaction costs associated with arbitrage trades. This includes fees for swapping tokens, gas fees, and any other charges imposed by different exchanges. By factoring in these costs, traders can ensure that their trades are profitable and not eroded by excessive fees.

Implementing Automation

To further enhance efficiency, traders can consider implementing automation tools. These tools can help with monitoring and executing trades automatically, based on predefined criteria. By removing the need for manual intervention, traders can execute trades faster and capitalize on price discrepancies in the market.

It is important to note that efficient trades also require risk management. Traders should always assess the potential risks associated with arbitrage trading and implement strategies to mitigate them. This may include setting stop-loss orders or diversifying trading pairs to minimize exposure to volatility.

| Benefits of Efficient Trades |

|---|

| 1. Increased profitability |

| 2. Faster execution of trades |

| 3. Maximized utilization of market opportunities |

| 4. Reduced risk through effective risk management |

In conclusion, maximizing profits through efficient trades is crucial in the world of arbitrage trading. By utilizing real-time data, implementing automation, and practicing effective risk management, traders can significantly enhance their profitability and make the most of price differences in the market.

Utilizing Cryptocurrency Price Differences

When it comes to investing in cryptocurrencies, one strategy that can be highly profitable is utilizing price differences across various exchanges. This strategy is known as arbitrage and it involves buying and selling the same cryptocurrency on different exchanges at the same time in order to take advantage of the price disparities.

With the increasing popularity and widespread adoption of cryptocurrencies, the prices of these digital assets can vary significantly from one exchange to another. This discrepancy occurs due to several factors, including differences in liquidity, trading volume, and market demand.

Arbitrage traders take advantage of these price differences by buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another exchange. The profits are generated from the price spread between the two exchanges, minus any transaction fees and other costs involved.

Utilizing cryptocurrency price differences requires careful monitoring of multiple exchanges and executing trades quickly to capitalize on favorable opportunities. Traders must also consider factors such as withdrawal limits, deposit times, and market volatility to ensure successful arbitrage.

Arbitrage can be a lucrative strategy, especially in highly volatile cryptocurrency markets. However, it is important to note that arbitrage opportunities may be short-lived and can quickly diminish as market participants exploit them. Therefore, it is crucial to have a robust trading platform and efficient execution capabilities to seize these opportunities.

In conclusion, utilizing cryptocurrency price differences through arbitrage can be a profitable strategy for traders. By taking advantage of these disparities, traders can generate profits from the ever-changing cryptocurrency market. However, it is essential to stay informed about market conditions, closely monitor multiple exchanges, and act swiftly to seize arbitrage opportunities.

The Future of Arbitrage in 1inch.exchange

In the world of decentralized finance (DeFi), arbitrage trading has become an essential strategy for savvy investors. One platform that has revolutionized the way arbitrage is performed is 1inch.exchange. With its innovative features and cutting-edge technology, 1inch.exchange has quickly become a go-to destination for traders looking to profit from price differences across various decentralized exchanges (DEXs).

The future of arbitrage in 1inch.exchange looks promising. As the DeFi industry continues to gain traction and evolve, the demand for efficient and reliable arbitrage opportunities is expected to rise. 1inch.exchange is well-positioned to meet this demand with its advanced aggregation algorithm, smart contract infrastructure, and dedication to providing the best user experience.

Enhanced Trading Capabilities

In the future, 1inch.exchange plans to enhance its trading capabilities even further. By incorporating advanced trading strategies and leveraging the power of artificial intelligence, 1inch.exchange will be able to identify and exploit even more profitable arbitrage opportunities. This will give traders an edge in the fast-paced and competitive DeFi market.

Expanding the Number of Supported DEXs

Currently, 1inch.exchange supports a wide range of DEXs, including Uniswap, Balancer, and Kyber Network. However, the team behind 1inch.exchange is constantly striving to expand the number of supported DEXs. With each new integration, the platform will offer traders access to even more liquidity pools and price differences, maximizing the potential for profitable arbitrage trading.

Unleashing the Full Potential of DeFi

Ultimately, the future of arbitrage in 1inch.exchange is not just about profiting from price differences, but also about unleashing the full potential of DeFi. As more users discover the benefits of decentralized finance, the demand for efficient and seamless trading platforms will grow. 1inch.exchange aims to be at the forefront of this revolution by providing a reliable and user-friendly platform for arbitrage trading.

With its commitment to innovation and continuous improvement, 1inch.exchange is set to shape the future of arbitrage in the DeFi landscape. Traders can expect more sophisticated tools, enhanced trading capabilities, and expanded opportunities for profiting from price differences. The future of arbitrage in 1inch.exchange is bright, and investors who embrace this strategy will be well positioned to maximize their returns in the rapidly evolving DeFi market.

Question-answer:

What is 1inch.exchange?

1inch.exchange is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide users with the best possible trading rates. It allows users to access multiple decentralized exchanges through a single platform.

How does arbitrage work on 1inch.exchange?

Arbitrage on 1inch.exchange involves taking advantage of price differences between different decentralized exchanges. Traders can spot opportunities where a token is priced differently on multiple exchanges and buy it at a lower price from one exchange to sell it at a higher price on another exchange, making a profit in the process.

Why is arbitrage important on 1inch.exchange?

Arbitrage is important on 1inch.exchange because it helps in maximizing trading profits. By efficiently utilizing price differences across multiple exchanges, traders can capitalize on market inefficiencies and earn profits by buying and selling tokens at the best possible rates.