In the fast-paced and ever-evolving world of cryptocurrency, the ability to seamlessly transfer assets across different blockchain networks has become increasingly important. Traditional centralized exchanges have long been the go-to solution for trading cryptocurrencies. However, they often come with drawbacks such as high fees, limited liquidity, and the need to trust a third party with your funds. This is where decentralized exchanges (DEXs) like 1inch Crypto step in, offering a decentralized and efficient solution for cross-chain transactions.

1inch Crypto is a decentralized exchange aggregator that leverages multiple liquidity sources to provide users with the best possible rates for their trades. By integrating with various decentralized exchanges and liquidity protocols, such as Uniswap, SushiSwap, and Curve, 1inch Crypto is able to offer users access to a wide range of assets across different blockchain networks, including Ethereum, Binance Smart Chain, and Polygon.

One of the key benefits of using 1inch Crypto for cross-chain transactions is the ability to avoid the hassle and cost of multiple transactions. In traditional cross-chain transactions, users often have to go through several steps, including swapping their assets for an intermediary token, transferring that token to another blockchain, and then swapping it back to their desired asset. These steps not only incur fees but also introduce additional complexity and potential points of failure.

With 1inch Crypto, users can bypass these complexities and perform cross-chain transactions in a single step. The protocol automatically routes the trade through the most efficient path, leveraging its integrated liquidity sources and smart contract technology. This results in lower fees, faster transactions, and a more seamless user experience.

In conclusion, 1inch Crypto plays a crucial role in enabling cross-chain transactions in the world of cryptocurrency. By integrating with various decentralized exchanges and liquidity protocols, 1inch Crypto offers users access to a wide range of assets across different blockchain networks. Its decentralized and efficient approach allows users to bypass the complexities and costs associated with traditional cross-chain transactions. As the cryptocurrency ecosystem continues to evolve, the role of 1inch Crypto and other decentralized exchange aggregators will only become more essential in facilitating seamless and secure cross-chain transactions.

Understanding Cross-Chain Transactions

Cross-chain transactions refer to the process of transferring assets or information between different blockchain networks. In a traditional blockchain network, transactions are typically limited to a single chain, meaning that assets cannot be easily moved from one chain to another. However, with the advent of cross-chain technology, it has become possible to facilitate seamless transactions between different chains.

One of the main challenges in enabling cross-chain transactions is the lack of interoperability between different blockchain networks. Each blockchain has its own unique features, protocols, and consensus mechanisms, which makes it difficult for them to communicate and exchange data. Additionally, the use of different cryptographic algorithms and address formats further complicates the process.

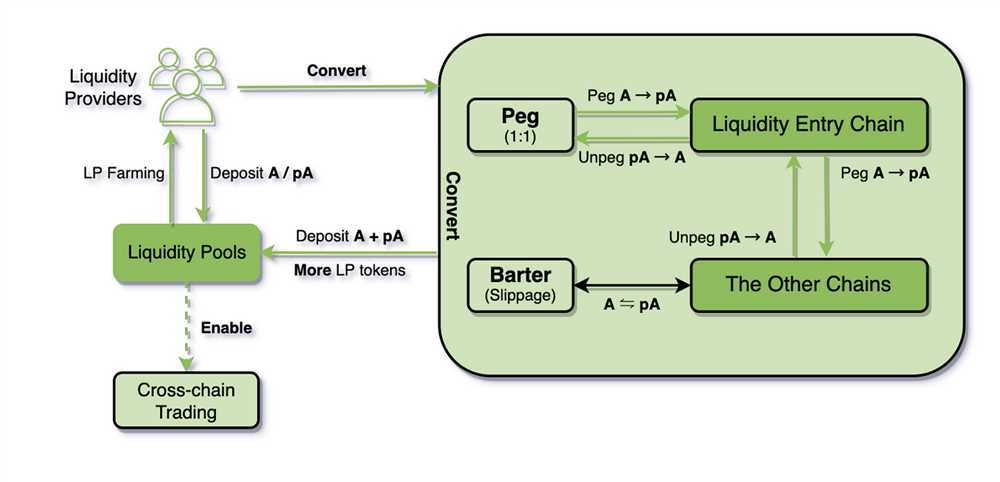

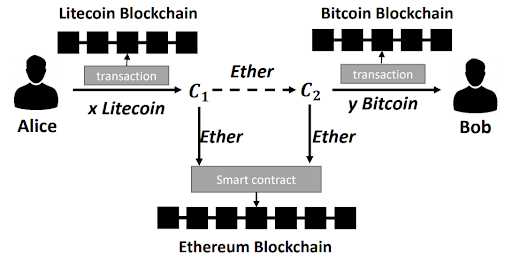

To overcome these challenges, protocols like 1inch Crypto have been developed to act as intermediaries between different chains. These protocols enable users to transfer assets from one chain to another by creating bridges or connectors that facilitate the seamless transfer of data and assets. These bridges can be thought of as virtual tunnels that connect different chains and enable the transfer of information securely and efficiently.

When a cross-chain transaction is initiated, the protocol locks the user’s assets on one chain and mints new assets on the target chain. This ensures that the assets are securely transferred without the risk of double-spending or loss. Once the transaction is complete, the protocol releases the locked assets, ensuring that the user’s assets are safely returned.

Cross-chain transactions offer several advantages, including increased liquidity, enhanced security, and improved scalability. By enabling the transfer of assets between different chains, users have access to a wider range of liquidity pools and can take advantage of arbitrage opportunities. Additionally, cross-chain transactions can enhance security by enabling users to diversify their holdings across multiple chains, reducing the risk of a single point of failure.

In conclusion, cross-chain transactions play a crucial role in enabling the seamless transfer of assets and information between different blockchain networks. Protocols like 1inch Crypto act as intermediaries and facilitate the secure and efficient transfer of assets by creating bridges between different chains. This technology opens up new possibilities for users and enhances the overall functionality and interoperability of blockchain networks.

What are Cross-Chain Transactions?

Cross-chain transactions refer to the process of transferring digital assets between different blockchain networks. Traditional blockchain networks, such as Bitcoin and Ethereum, operate independently, meaning that they cannot directly communicate or interact with each other. This lack of interoperability has been a significant limitation in the blockchain ecosystem, as it restricts the movement of assets and data between different chains.

Cross-chain transactions solve this problem by allowing users to move their assets from one blockchain network to another. This process involves various steps, including locking the assets on the source chain, validating the transaction, and minting corresponding assets on the destination chain. Once the assets have been successfully transferred, they can be used or traded on the receiving chain as if they were native assets.

Cross-chain transactions can take different forms depending on the specific protocols and technologies involved. Some cross-chain solutions use a hub-and-spoke model, where a central hub acts as an intermediary between different chains. Others employ atomic swaps or bridge protocols to facilitate direct transfers between chains. Regardless of the method, cross-chain transactions play a crucial role in enabling interoperability and expanding the functionality of blockchain networks.

The Benefits of Cross-Chain Transactions

Cross-chain transactions offer several key benefits in the blockchain ecosystem. Firstly, they enable users to access a broader range of assets by allowing interoperability between different chains. This opens up new opportunities for investment, trading, and diversification of digital assets.

Secondly, cross-chain transactions improve liquidity by facilitating the movement of assets between different markets. This can help reduce price disparities and improve efficiency in decentralized exchanges, making it easier for users to find counterparties and execute trades.

Lastly, cross-chain transactions contribute to the overall scalability and growth of the blockchain ecosystem. By connecting multiple chains and enabling seamless asset transfers, they foster innovation and collaboration between different projects. This leads to the development of more robust and interconnected blockchain networks.

The Importance of Cross-Chain Transactions

As the world of cryptocurrency continues to grow and evolve, the need for seamless and efficient transactions between different blockchain networks has become increasingly evident. This is where cross-chain transactions play a crucial role.

Enhanced Liquidity

One of the main benefits of cross-chain transactions is the increased liquidity they provide. By enabling the movement of assets across different blockchain networks, users have greater access to a wide range of tokens and currencies, leading to improved market depth and more efficient trading.

With cross-chain transactions, users are no longer limited to a single blockchain network, but are able to tap into the liquidity of multiple networks and take advantage of the opportunities they offer. This enhanced liquidity not only benefits individual users, but also contributes to the overall growth and development of the cryptocurrency ecosystem.

Expanded Use Cases

Another important aspect of cross-chain transactions is the expanded use cases they enable. By facilitating the interoperability of different blockchain networks, cross-chain transactions open up new possibilities for decentralized finance (DeFi), decentralized exchanges (DEXs), and various other applications.

For example, with cross-chain transactions, users can easily move their assets between different DeFi protocols, allowing them to take advantage of the unique features and benefits offered by each platform. This not only enhances the functionality of DeFi applications, but also encourages innovation and fosters greater collaboration among different blockchain projects.

Cross-chain transactions also enable the seamless integration of various blockchain services, making it easier for developers to build and deploy decentralized applications (DApps) that leverage the strengths of multiple blockchain networks. This integration of different networks enhances the overall scalability, security, and efficiency of DApps, ultimately benefiting the end users.

In conclusion, cross-chain transactions play a vital role in the cryptocurrency ecosystem by enhancing liquidity, expanding use cases, and fostering collaboration among different blockchain networks. As the demand for interoperability continues to rise, technologies like 1inch Crypto are becoming increasingly important in facilitating seamless cross-chain transactions.

Introducing 1inch Crypto

1inch Crypto is a cutting-edge technology that plays a crucial role in enabling cross-chain transactions. It is an open-source DEX aggregator built on the Ethereum blockchain and offers a decentralized and secure way for users to swap tokens across different networks.

With the rapid growth of decentralized finance (DeFi) and the increasing number of blockchain networks, interoperability has become a major challenge. 1inch Crypto aims to solve this problem by providing users with a seamless experience of swapping tokens between various chains.

Main Features of 1inch Crypto

1. High Liquidity: 1inch Crypto aggregates liquidity from various decentralized exchanges (DEXs) to provide users with the best possible rates and ensure high liquidity for trading.

2. Low Slippage: 1inch Crypto utilizes advanced algorithms to minimize slippage and deliver optimal trading results, even for large orders.

3. Multi-Chain Compatibility: 1inch Crypto supports multiple blockchains, including Ethereum, Binance Smart Chain, and Polygon. This allows users to seamlessly swap tokens across different networks without the need for multiple wallets or complex processes.

4. Gas Optimization: 1inch Crypto automatically finds the most cost-effective route for transactions by analyzing gas prices on different networks, ensuring efficient and affordable swaps for users.

The Native Token: 1INCH

1INCH is the native token of the 1inch Crypto platform. It serves multiple purposes, including governance, liquidity mining, and fee discounts.

Token holders can participate in the decision-making process of the 1inch network and shape its future development. They also have the opportunity to earn additional tokens by providing liquidity to the platform.

Moreover, holding 1INCH tokens provides users with fee discounts on transactions made through the 1inch Crypto platform, further enhancing the benefits of using the platform.

In conclusion, 1inch Crypto is revolutionizing the way cross-chain transactions are conducted. By offering high liquidity, low slippage, multi-chain compatibility, and gas optimization, it provides users with a seamless and efficient experience of swapping tokens across different networks. The native token 1INCH adds further value by allowing users to participate in governance and earn rewards. With its innovative features and benefits, 1inch Crypto is driving the adoption of decentralized finance and unlocking the full potential of cross-chain transactions.

What is 1inch Crypto?

1inch Crypto is a decentralized exchange aggregator and liquidity protocol that operates on multiple blockchain networks. It aims to provide the best possible trading rates to users by splitting their orders across various decentralized exchanges. This enables users to access deep liquidity and achieve optimal prices for their trades.

1inch Crypto aggregates liquidity from various decentralized exchanges, including popular platforms such as Uniswap, SushiSwap, Balancer, and many others. By connecting to multiple exchanges, 1inch Crypto is able to scan for the best trading rates and split orders between different pools to ensure the most favorable outcome for users.

One of the key features of 1inch Crypto is its ability to facilitate cross-chain transactions. It achieves this by leveraging various protocols and bridges that enable the seamless transfer of assets between different blockchain networks. This allows users to trade or swap tokens across different chains without the need for multiple transactions or complicated setups.

1inch Crypto is powered by its native utility token called 1INCH. The 1INCH token serves multiple purposes within the ecosystem, including governance rights, reward distribution, and fee discounts. Holders of the 1INCH token can participate in the decision-making process of the protocol and also receive a share of the trading fees generated on the platform.

In conclusion, 1inch Crypto is a decentralized exchange aggregator and liquidity protocol that aims to provide users with the best possible trading rates across various blockchain networks. By connecting to multiple decentralized exchanges and leveraging cross-chain protocols, 1inch Crypto ensures optimal liquidity and seamless asset transfers for its users.

How Does 1inch Crypto Enable Cross-Chain Transactions?

The 1inch crypto platform plays a crucial role in enabling cross-chain transactions, allowing users to seamlessly transfer their assets between different blockchain networks. This is made possible through the integration of various key components and protocols.

Decentralized Exchanges (DEXs):

1inch crypto leverages decentralized exchanges (DEXs) to facilitate cross-chain transactions. By aggregating liquidity from multiple DEXs, such as Uniswap, SushiSwap, and Balancer, users can access a larger pool of assets and enjoy better trading rates. This increases the efficiency and cost-effectiveness of cross-chain transactions.

AMMs and Smart Contract Technology:

Automated Market Makers (AMMs) and smart contract technology are at the core of 1inch crypto’s cross-chain functionality. These technologies enable the seamless execution of trades and ensure that users get the best possible rates. Smart contracts automatically search for the most efficient routes and execute transactions accordingly.

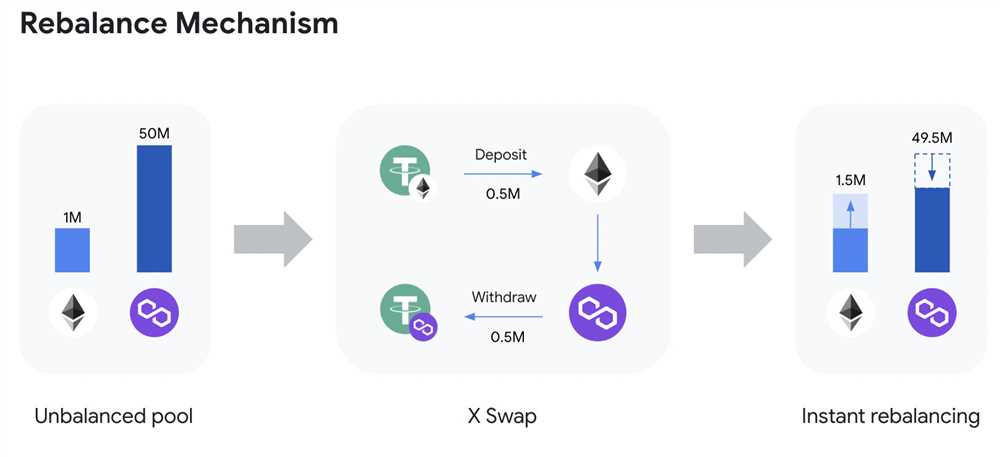

Liquidity Aggregation:

1inch crypto utilizes its proprietary aggregation algorithm to optimize and route transactions across various liquidity sources and DEXs. This algorithm takes into account factors such as slippage, gas fees, and token availability to ensure that users get the best possible outcomes for their cross-chain transactions.

Chain Swaps and Multi-Chain Bridges:

1inch crypto takes advantage of chain swaps and multi-chain bridges to enable the seamless movement of assets between different blockchain networks. Chain swaps involve swapping tokens from one chain to another, while multi-chain bridges act as interoperability solutions, allowing assets to be transferred between different blockchains.

Benefits of Using 1inch Crypto for Cross-Chain Transactions

By leveraging 1inch crypto for cross-chain transactions, users can enjoy several benefits:

Improved Liquidity:

1inch crypto aggregates liquidity from multiple sources, allowing users to access a larger pool of assets and enjoy improved trading rates. This ensures that users can execute cross-chain transactions more efficiently and cost-effectively.

Easy Asset Movement:

With 1inch crypto, users can easily transfer their assets between different blockchain networks without the need for complex and time-consuming processes. The platform’s intuitive interface and seamless integration with various blockchains make asset movement quick and convenient.

Optimized Trading:

Through its advanced aggregation algorithm and smart contract technology, 1inch crypto automatically searches for the best routes and executes cross-chain transactions at the most optimized rates. This ensures that users get the best possible outcomes for their trades.

Enhanced Accessibility:

1inch crypto’s cross-chain functionality enables users to access assets and liquidity from various blockchain networks, boosting overall accessibility. This allows users to explore new investment opportunities and diversify their portfolios more easily.

Increased Security:

1inch crypto prioritizes security in its cross-chain transactions. By utilizing smart contracts and leveraging existing security measures on the underlying blockchains, the platform ensures the safe and secure movement of assets between different chains.

Overall, 1inch crypto’s integration of decentralized exchanges, automated market makers, smart contracts, and liquidity aggregation enables seamless and efficient cross-chain transactions, empowering users to explore new possibilities in the decentralized finance (DeFi) ecosystem.

Question-answer:

What is 1inch Crypto?

1inch Crypto is a decentralized exchange (DEX) aggregator that allows users to trade cryptocurrency across multiple platforms and find the most optimal trading routes.

How does 1inch Crypto enable cross-chain transactions?

1inch Crypto enables cross-chain transactions by leveraging various decentralized protocols and liquidity sources to find the best possible trading routes between different blockchains.

What are the benefits of using 1inch Crypto for cross-chain transactions?

Using 1inch Crypto for cross-chain transactions offers several benefits, including access to a wide range of liquidity sources, lower slippage, and reduced transaction costs.

Can 1inch Crypto be used for both Ethereum and Binance Smart Chain transactions?

Yes, 1inch Crypto supports both Ethereum and Binance Smart Chain transactions, making it possible to trade assets between these two blockchains.

Is 1inch Crypto safe to use for cross-chain transactions?

1inch Crypto is designed with security in mind and implements various measures to ensure the safety of user funds during cross-chain transactions. However, it’s always important to exercise caution and do your own research before engaging in any financial transactions.