1inch is a decentralized exchange aggregator that allows users to access multiple decentralized exchanges in one platform. Besides trading, 1inch also offers a staking feature that allows users to earn rewards by locking their tokens in a liquidity pool. However, staking comes with its own set of risks and rewards that users should be aware of.

One of the main rewards of 1inch staking is the opportunity to earn passive income. By staking your tokens, you contribute to the liquidity pool, which in turn allows other users to trade assets on the platform. As a reward for your contribution, you receive a portion of the trading fees generated by the platform.

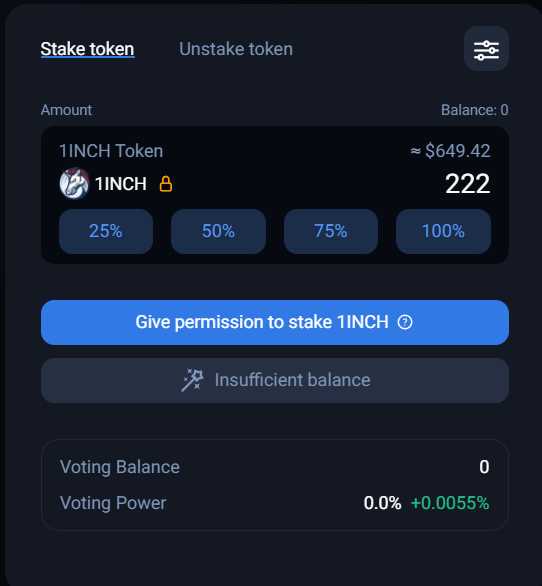

Moreover, 1inch has implemented a governance token called 1INCH, which gives stakers the power to vote on platform proposals and changes. This means that stakers have a say in the future development and direction of the platform. Being a part of the decision-making process can be rewarding and empowering for users.

However, it is important to note the risks associated with 1inch staking. One of the main risks is impermanent loss. When you stake your tokens in a liquidity pool, the value of your tokens might fluctuate compared to holding them in your wallet. If the price of the tokens in the pool changes significantly, you might experience a loss when you withdraw your stake.

Another risk is the potential for smart contract vulnerabilities and hacks. While 1inch has implemented security measures, no platform is entirely immune to security breaches. It is crucial to keep in mind that staking always carries a certain level of risk, and users should only stake an amount that they are willing to lose.

In conclusion, 1inch staking offers the potential for passive income and participation in platform governance. However, it also comes with risks such as impermanent loss and security vulnerabilities. It is essential for users to understand these risks and make informed decisions before staking their tokens on the platform.

Risks Associated with 1inch Staking

While 1inch staking offers the potential for lucrative rewards, it’s important to understand the risks involved. Here are some of the key risks associated with 1inch staking:

1. Smart Contract Risks

One of the primary risks of 1inch staking is smart contract vulnerabilities. As with any decentralized finance (DeFi) project, there is always a risk of bugs or flaws in the smart contract code that could be exploited by malicious actors. These vulnerabilities could result in the loss or theft of staked funds. It’s essential to thoroughly audit the smart contract and stay up-to-date with any security audits or bug bounties before staking your funds.

2. Impermanent Loss

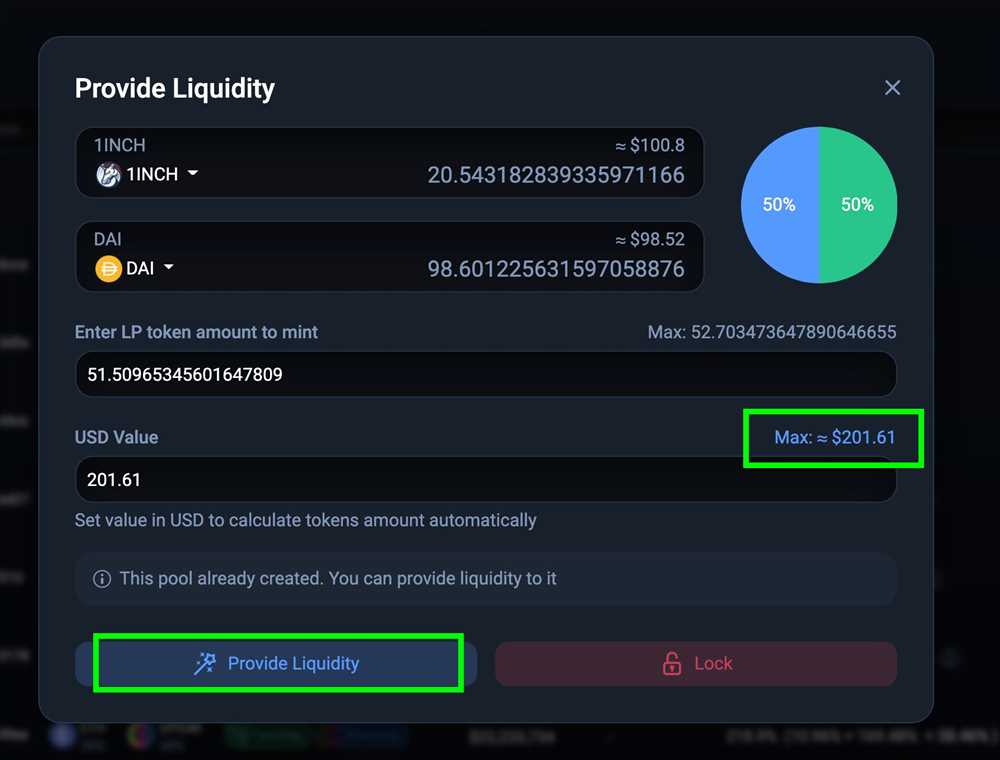

Another risk associated with 1inch staking is impermanent loss. When you provide liquidity to the 1inch platform, you are effectively becoming a market maker. If the price of the assets in the liquidity pool changes significantly, you may experience impermanent loss. This occurs when the value of the assets in the pool is different from the value when you first provided liquidity, resulting in a loss of overall value. It’s important to carefully consider the potential for impermanent loss before staking your assets.

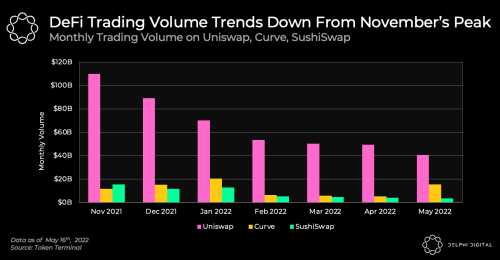

3. Network and Market Risks

1inch staking is inherently linked to the overall health and stability of the underlying network and market. If there are network congestion issues or market volatility, it can impact the performance and profitability of your staked assets. Additionally, if there are sudden changes in the regulatory environment or negative news surrounding the 1inch platform or the cryptocurrency market as a whole, it can result in a decrease in the value of your staked assets. It’s important to assess and monitor these external factors before deciding to stake your funds.

It’s crucial to conduct thorough research and due diligence before participating in 1inch staking. Understanding the risks associated with staking and considering your risk tolerance is essential for making informed investment decisions.

Rewards of 1inch Staking

Staking your 1inch tokens can provide you with a number of attractive rewards. By actively participating in the 1inch staking program, you have the opportunity to earn additional tokens as a reward for providing liquidity to the protocol.

Earn Fees

One of the main rewards of 1inch staking is the ability to earn fees. When you stake your tokens, you become a liquidity provider and contribute to the liquidity pools on the 1inch platform. As a result, you are entitled to a share of the transaction fees generated within these pools. The more liquidity you provide, the larger your share of the fees will be.

Governance Rights

Another reward of staking your 1inch tokens is the ability to participate in the governance of the protocol. By staking your tokens, you gain voting power which allows you to have a say in the decision-making process of the 1inch ecosystem. This gives you the opportunity to influence the future direction of the protocol and ensure that your interests are represented.

In addition to these rewards, staking your 1inch tokens can also offer a sense of security. As a liquidity provider, you play an important role in the stability of the protocol and can contribute to its overall success. By staking your tokens, you are actively supporting the platform and helping to maintain its functionality.

It is important to note that staking also comes with risks. The value of the tokens you stake can fluctuate, and there is always the potential for impermanent loss. However, if you are willing to bear these risks, the rewards of 1inch staking can be quite lucrative.

- Earn transaction fees by providing liquidity to the protocol

- Participate in the governance of the 1inch ecosystem

- Contribute to the stability and success of the platform

Things to Consider Before Staking on 1inch

Staking on 1inch can be a lucrative opportunity, but it’s important to consider a few factors before getting started. Here are some key things to keep in mind:

1. Risks: Staking always comes with risks, and 1inch is no exception. Make sure you understand the potential risks involved, such as smart contract vulnerabilities, market volatility, and liquidity risks.

2. Rewards: While there are risks, staking on 1inch also offers potential rewards. Consider the expected APY (Annual Percentage Yield) and any additional incentives provided by the platform. Compare these rewards with the risks to determine if it’s worth the investment.

3. Lock-up Period: When staking on 1inch, you may need to lock up your funds for a certain period of time. Consider how long you are willing to commit your funds and if you have any immediate liquidity needs.

4. Tokenomics: Understand the tokenomics of the staking platform. This includes the token supply, inflation rate, and any token distribution mechanisms. Ensure that you understand how these factors may impact the value of your staked tokens.

5. Audits and Security: Research the security measures implemented by 1inch and any audits conducted on their smart contracts. It’s crucial to ensure that the platform has undergone thorough security testing to mitigate potential risks.

6. User Experience: Consider the user experience offered by the staking platform. Look for an intuitive interface, responsive customer support, and any additional features that may enhance your staking experience.

7. Diversification: Staking all your funds on a single platform like 1inch may not be the best strategy. Consider diversifying your staking activities across different platforms to spread the risks and maximize potential rewards.

By considering these factors before staking on 1inch, you can make an informed decision and take full advantage of the rewards while managing the risks effectively.

Question-answer:

What is 1inch staking?

1inch staking is a process of locking up your 1inch tokens in a smart contract in order to earn rewards. By staking your tokens, you are contributing to the liquidity of the platform and helping to facilitate decentralized exchanges. In return for your contribution, you can earn a percentage of the trading fees generated on the platform.

What are the risks of 1inch staking?

While 1inch staking can be a lucrative opportunity, it also comes with its own set of risks. One of the main risks is the possibility of losing your staked tokens if there is a smart contract vulnerability or if the platform is hacked. There is also the risk of losing value due to market fluctuations, as the price of 1inch can go up or down. Additionally, there may be risks associated with the governance of the platform, as decisions made by token holders can impact the future of 1inch.