The emergence of blockchain technology has brought about a wave of innovation and disruption across various industries. One of the areas that has seen significant growth and development is decentralized finance (DeFi). Within the DeFi ecosystem, the 1inch token has quickly become a prominent player, revolutionizing the way users interact with decentralized exchanges (DEXs).

1inch is a decentralized exchange aggregator that sources liquidity from various DEXs to provide users with the best rates for their trades. What sets 1inch apart from other DEXs is its ability to split a single trade across multiple DEXs to ensure users get the most optimal rate possible. This feature, known as the Pathfinder algorithm, has made 1inch a go-to platform for traders looking for the best prices.

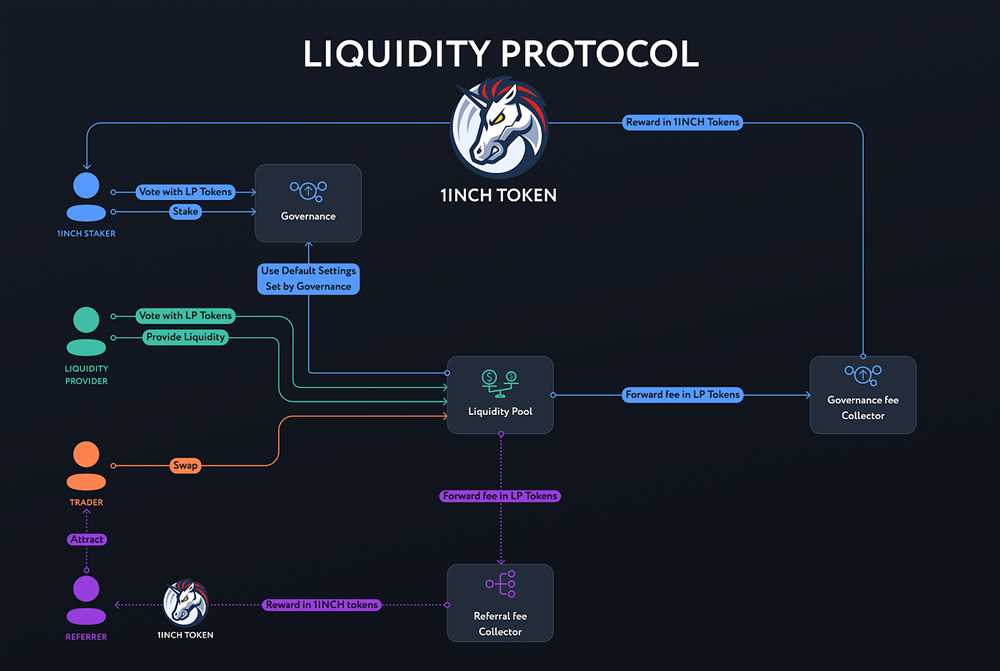

The 1inch token, also known as 1INCH, plays a crucial role within the 1inch ecosystem. Holders of the 1INCH token are rewarded with a portion of the fees generated from trades on the platform, creating a direct incentive for users to hold and stake the token. Additionally, the 1INCH token can be used to vote on protocol upgrades, ensuring that the community has a say in the future direction of the platform.

Since its launch, the 1inch token has experienced tremendous growth and adoption. In just a short period of time, it has become one of the top tokens in terms of market capitalization and trading volume. This success can be attributed to the platform’s innovative features, user-friendly interface, and the strong community that has rallied behind the project.

In conclusion, the rise of the 1inch token represents a decentralized revolution within the DeFi space. By offering users the best rates and incentives to hold the token, 1inch has positioned itself as a leader in the industry. With the continued growth of the DeFi ecosystem, it will be fascinating to see how 1inch evolves and further disrupts the traditional financial landscape.

The Rise of the 1inch Token

With the advent of blockchain technology, decentralized finance (DeFi) has emerged as a revolutionary force in the financial industry. One of the most successful and innovative projects in the DeFi space is the 1inch Exchange.

The 1inch Exchange is a decentralized exchange aggregator that finds the best trading prices across various liquidity pools. It achieves this by splitting up a user’s trade across multiple exchanges, resulting in lower slippage and better prices.

To incentivize users and provide them with additional benefits, the 1inch team introduced their native token, the 1inch token (1INCH). The 1inch token serves as both a governance and utility token within the 1inch ecosystem.

As a governance token, holders of 1INCH have the ability to influence important decisions regarding the development and future of the 1inch protocol. This decentralized governance model ensures that no single entity has control over the platform, making it truly community-driven.

Furthermore, the 1inch token has various utilities within the protocol. Users who hold and stake 1INCH can participate in the platform’s liquidity mining program, earning additional rewards. Additionally, 1INCH can be used to pay for transaction fees on the 1inch Exchange, providing users with reduced fees and enhanced benefits.

Since its launch, the 1inch token has experienced significant growth and adoption. Its price has surged, reaching new all-time highs as more users have recognized the value and potential of the 1inch ecosystem. This rise in popularity has made the 1inch token one of the most traded tokens in the DeFi space.

The success and accelerated rise of the 1inch token can be attributed to the unique features and benefits it offers to users. The decentralized nature of the 1inch Exchange, combined with the opportunities for governance and utility provided by the 1INCH token, have attracted a wide range of users and investors.

Looking ahead, the future of the 1inch token is promising. As the decentralized finance industry continues to grow, the demand for efficient and user-friendly platforms like 1inch will only increase. With its innovative technology and strong community support, the 1inch token has the potential to become a cornerstone of the decentralized finance ecosystem.

A Decentralized Revolution

The rise of the 1inch token represents a significant milestone in the movement towards decentralization. With its innovative protocol and decentralized exchange aggregation, 1inch is disrupting the traditional financial system and empowering individuals to take control of their own finances.

Decentralization is at the core of 1inch’s mission. By eliminating intermediaries and utilizing smart contracts, 1inch provides users with a truly peer-to-peer trading experience. This revolutionary approach not only enhances security and privacy but also reduces costs and eliminates the need for trust in centralized institutions.

One of the key benefits of this decentralized revolution is the ability for individuals to have ownership and control over their assets. With 1inch, users can securely manage their tokens without relying on third parties. This means that users are no longer subject to the restrictions and potential risks associated with centralized exchanges.

Furthermore, 1inch is paving the way for a more inclusive financial system. By democratizing access to financial services and creating a level playing field, 1inch is empowering individuals from all walks of life to participate in the cryptocurrency ecosystem. This has the potential to greatly reduce inequalities and provide economic opportunities for the unbanked and underbanked populations.

In conclusion, the 1inch token is a catalyst for a decentralized revolution. By leveraging blockchain technology and promoting peer-to-peer transactions, 1inch is transforming the financial landscape and giving power back to the people. With its emphasis on transparency, security, and inclusivity, the rise of the 1inch token marks the beginning of a new era in decentralized finance.

The Evolution of Decentralization

Decentralization has been a key concept in the world of technology for years, and it has been evolving rapidly. The rise of blockchain technology has revolutionized the way we think about decentralization and its potential.

From Centralization to Decentralization

In the early days of the internet, centralized systems were the norm. Companies like Google, Facebook, and Amazon centralized vast amounts of data and controlled access to it. This centralization gave these companies unprecedented power and control over the flow of information.

However, as people became more aware of the drawbacks of centralization – including privacy concerns and the risk of a single point of failure – they started looking for alternatives. Decentralization emerged as a solution.

The Birth of Blockchain

The birth of blockchain technology was a major turning point in the evolution of decentralization. With blockchain, power is distributed across a network of computers, known as nodes. Each node has a copy of the blockchain ledger, making it virtually impossible for anyone to manipulate the data without the consensus of the majority.

Blockchain technology has enabled the creation of decentralized applications (dApps) that can function without the need for intermediaries. Transactions can be verified and recorded on the blockchain, eliminating the need for a trusted third party.

This newfound decentralization has far-reaching implications. It allows for increased transparency, as anyone can access and audit the blockchain. It also reduces the risk of censorship and ensures that data remains secure.

Decentralization and the 1inch Token

The 1inch token is a prime example of the power of decentralization. As the native token of the 1inch decentralized exchange (DEX) aggregator, it allows users to trade across multiple DEXs without the need for a middleman.

By leveraging smart contracts and liquidity protocols, the 1inch token enables users to obtain the best possible trade execution across various DEXs. This decentralized approach not only enhances efficiency but also reduces fees and slippage.

In the world of decentralized finance (DeFi), the 1inch token has become an integral part of the ecosystem. Its value is derived from the utility it provides to users, rather than being controlled by a centralized authority.

In conclusion, the evolution of decentralization has been driven by the need for greater transparency, security, and control over our own data. Blockchain technology has paved the way for a decentralized revolution, enabling the development of innovative applications like the 1inch token.

From Centralized Exchanges to DeFi Platforms

The evolution of the cryptocurrency industry has witnessed a significant shift from centralized exchanges to decentralized finance (DeFi) platforms. Centralized exchanges, such as Coinbase and Binance, have long dominated the trading landscape, offering users a convenient and user-friendly interface to buy and sell cryptocurrencies. However, with the emergence of DeFi platforms, the traditional centralized exchange model is being challenged.

What are centralized exchanges?

Centralized exchanges are platforms that act as intermediaries between buyers and sellers of cryptocurrencies. They hold custody of users’ funds and facilitate transactions on behalf of the users. These platforms require users to trust a centralized authority to hold and manage their assets, which goes against the principles of decentralization and self-custody.

The rise of DeFi platforms

DeFi platforms, on the other hand, are built on blockchain technology and utilize smart contracts to automate transactions and remove the need for intermediaries. This allows for a trustless and decentralized system where users have complete control over their assets and can interact with the platform directly. DeFi platforms offer a wide range of financial services, including lending, borrowing, staking, and decentralized exchanges.

The rise of DeFi platforms can be attributed to several factors, including the desire for financial sovereignty, higher returns on investments, and the dissatisfaction with centralized exchanges due to issues such as security breaches and high fees. With DeFi platforms, users can transact directly with each other using peer-to-peer protocols, eliminating the need for intermediaries and reducing costs.

Additionally, DeFi platforms offer users the ability to earn passive income through various mechanisms, such as yield farming and liquidity mining. These incentives have attracted a large number of users to DeFi platforms, resulting in a surge in the popularity and adoption of decentralized finance.

Furthermore, DeFi platforms are characterized by their open and permissionless nature, allowing anyone with an internet connection to participate and utilize the services offered. This inclusivity has opened up financial opportunities to individuals who were previously excluded from traditional financial systems.

In conclusion, the shift from centralized exchanges to DeFi platforms represents a transition towards a more decentralized and inclusive financial system. While centralized exchanges still play a significant role in the cryptocurrency industry, DeFi platforms are disrupting the traditional financial landscape and providing users with increased control, transparency, and financial independence.

The 1inch Token: Empowering the Community

The 1inch Token is not just a digital asset, but the core of a decentralized revolution. It serves as the backbone of the 1inch Network, an innovative DeFi protocol that enables users to access the most efficient swapping routes across various decentralized exchanges.

One of the key benefits of the 1inch Token is its ability to empower the community. Holders of the token have voting power within the 1inch Network, allowing them to participate in the decision-making process. This ensures that the community has a say in the development and governance of the protocol.

Through decentralization and community governance, the 1inch Token creates a level playing field for all participants. It enables individuals to have a voice and influence in the evolution of the protocol, regardless of their background or financial status. This democratic approach helps to foster a sense of ownership and engagement among token holders, leading to a more inclusive and user-friendly ecosystem.

In addition to governance rights, the 1inch Token also offers various utility functions within the ecosystem. Holders can stake their tokens to earn rewards and participate in liquidity mining programs. They can also use the token to pay for transaction fees and access premium features on the 1inch DEX aggregator.

The 1inch Token is designed to align the interests of the community with the success of the protocol. As the value and adoption of the 1inch Network grow, so does the value of the token. This creates a mutually beneficial relationship, where the community is incentivized to actively contribute to the growth and development of the ecosystem.

In conclusion, the 1inch Token plays a vital role in empowering the community within the 1inch Network. With its governance rights, utility functions, and alignment of interests, it provides individuals with the opportunity to actively participate in shaping the future of decentralized finance.

Decentralized Governance and Yield Farming

Decentralized governance is a fundamental concept in the world of blockchain and cryptocurrency. It refers to the ability of users to have a say in the decision-making processes of a protocol or platform. This is achieved through mechanisms such as voting and consensus. One of the key benefits of decentralized governance is that it allows for greater transparency and accountability, as well as reducing the risk of censorship and manipulation.

Yield farming, on the other hand, is a practice where investors provide liquidity to decentralized finance (DeFi) protocols in exchange for rewards. These rewards can come in the form of additional tokens or a percentage of the transaction fees. Yield farming has become popular as it allows individuals to earn passive income on their crypto holdings. However, it also comes with risks, such as impermanent loss and smart contract vulnerabilities.

1inch, a decentralized exchange aggregator and automated market maker (AMM), has integrated decentralized governance and yield farming into its protocol. The 1inch token, known as 1INCH, allows token holders to participate in the decision-making processes of the platform. This includes voting on proposals, such as protocol upgrades and fee changes.

Additionally, 1inch has implemented a yield farming program called 1inch Liquidity Protocol (1LP). Users can stake their tokens in liquidity pools and earn rewards in the form of 1INCH tokens. The amount of rewards earned depends on various factors, such as the amount of liquidity provided and the duration of the stake.

Decentralized governance and yield farming have proven to be powerful tools for community engagement and platform growth. By giving users a stake in the decision-making processes and incentivizing them to provide liquidity, protocols like 1inch can foster a vibrant and active ecosystem. However, it is important for users to understand the risks involved and conduct thorough research before participating in yield farming or voting on proposals.

Question-answer:

What is the 1inch token?

The 1inch token is a cryptocurrency that powers the 1inch decentralized exchange aggregator and liquidity protocol.

How does the 1inch decentralized exchange aggregator work?

The 1inch decentralized exchange aggregator scans multiple cryptocurrency exchanges to find the best prices and routes for users’ trades, allowing them to execute trades at the best possible rates.

What are the benefits of using the 1inch decentralized exchange aggregator?

By using the 1inch decentralized exchange aggregator, users can save on fees and get the best prices for their trades, as the aggregator sources liquidity from multiple exchanges.

What is the liquidity protocol of 1inch?

The liquidity protocol of 1inch is a solution that provides access to the liquidity of multiple decentralized exchanges, allowing users to trade a wide range of cryptocurrency pairs without the need for multiple accounts or manual trading.

Can I earn rewards by holding the 1inch token?

Yes, holders of the 1inch token can earn rewards through various mechanisms such as providing liquidity to the protocol or participating in the governance of the platform.