Staking has become a popular form of earning passive income within the decentralized finance (DeFi) space. One of the leading platforms for staking is 1inch, a decentralized exchange aggregator that provides liquidity to users across various blockchain networks. However, with the increasing prominence of staking and its potential impact on the financial ecosystem, regulatory scrutiny is inevitable.

The current regulatory landscape surrounding 1inch staking

As of now, the regulatory framework for staking in general remains unclear in many jurisdictions. The decentralized nature of platforms like 1inch poses a challenge for regulators, as they strive to strike a balance between fostering innovation and ensuring consumer protection. While some countries have taken proactive steps in providing clarity, others are still grappling with how to classify and regulate staking activities.

In the United States, for instance, the Securities and Exchange Commission (SEC) has yet to release specific guidelines for staking. This has led to uncertainty among participants in the 1inch ecosystem, as they navigate the potential risks and compliance requirements.

The future implications of regulation on 1inch staking

Regulatory frameworks have the power to shape and define the future of staking in general, including the operations conducted on platforms like 1inch. Implementation of clear guidelines can bring much-needed certainty and legitimacy to the industry, attracting institutional investors and fostering broader adoption.

However, excessive or overly restrictive regulations could stifle innovation and hinder the growth of the staking ecosystem. Striking the right balance will be crucial to ensure that platforms like 1inch can continue to thrive and provide value to their users.

In conclusion, the regulation of 1inch staking is a complex and evolving landscape. As regulators grapple with the unique challenges posed by decentralized finance, participants in the industry must stay informed and adapt to changing regulatory requirements. The future of 1inch staking will be shaped by how regulators strike the balance between innovation and protection, ultimately determining the trajectory of the entire staking ecosystem.

The Emerging Trend of Regulation for 1inch Staking

In recent years, the 1inch staking market has seen explosive growth, with more and more investors and users looking to take advantage of the benefits it offers. However, as the popularity of 1inch staking continues to rise, regulators around the world are starting to take notice and consider implementing regulations to ensure the safety and security of participants in the market.

One of the main reasons for the emergence of regulations for 1inch staking is the need to protect investors from potential scams and fraudulent activities. With the decentralized nature of the 1inch ecosystem, it can be challenging to identify and prevent fraudulent actors from taking advantage of unsuspecting investors. Regulations can provide guidelines and requirements that platforms and participants must adhere to, helping to create a more transparent and trustworthy environment.

The Benefits of Regulation

Regulations for 1inch staking can bring several benefits to the market. Firstly, they can help establish a framework for investor protection, ensuring that participants are aware of the risks and potential rewards associated with staking their assets. This can help prevent unsuspecting investors from falling victim to scams or investing in projects with inadequate security measures.

Additionally, regulations can help promote market integrity and transparency. By implementing rules and requirements for reporting, disclosure, and auditing, regulators can ensure that participants have access to accurate and up-to-date information about the projects they are staking in. This can help foster trust between investors and projects, leading to increased participation in the market.

The Challenges of Regulation

While regulations can bring several benefits to the 1inch staking market, there are also challenges that come with implementing them. One of the main challenges is striking the right balance between regulation and innovation. The 1inch ecosystem is built on the principles of decentralization and open participation, and overly burdensome regulations could stifle innovation and limit the growth of the market.

Another challenge is the global nature of the 1inch staking market. As regulations differ from one jurisdiction to another, achieving a harmonized regulatory framework for 1inch staking can be a complex task. However, international collaboration and coordination among regulators can help address this challenge and ensure a consistent approach to regulation across different jurisdictions.

Conclusion

As the 1inch staking market continues to evolve and attract more participants, the emergence of regulation is becoming an inevitable trend. While regulations can bring challenges, they also offer important benefits such as investor protection and market transparency. Finding the right balance between regulation and innovation will be crucial to foster a thriving and secure 1inch staking ecosystem in the future.

The Benefits and Challenges of Regulating 1inch Staking

Regulating 1inch staking can offer several benefits to both investors and the overall ecosystem. However, there are also challenges that need to be addressed to ensure a successful regulatory framework.

Benefits of Regulating 1inch Staking

1. Investor Protection: Regulation can provide investors with a certain level of protection by enforcing transparency, disclosure, and accountability standards. This can help prevent fraudulent activities and ensure that investors have access to accurate and reliable information.

2. Market Stability: By regulating 1inch staking, regulators can establish rules and guidelines that promote stability in the market. This can help prevent excessive volatility and manipulation, making the market more attractive to both retail and institutional investors.

3. Long-Term Sustainability: Regulation can contribute to the long-term sustainability of the 1inch staking ecosystem. It can encourage responsible practices, risk management, and compliance, which are essential for the continued growth and development of the ecosystem.

Challenges of Regulating 1inch Staking

1. Global Jurisdiction: The decentralized nature of 1inch staking poses challenges in terms of jurisdiction. Regulating a cross-border ecosystem requires coordination between different regulatory bodies and jurisdictions, which can be complex and time-consuming.

2. Innovation vs Regulation: Balancing innovation and regulation is a challenge when it comes to 1inch staking. While regulation can provide benefits, it should not stifle innovation or hinder the development of new technologies and business models.

3. Regulatory Compliance: Ensuring compliance with regulatory requirements can be challenging for users, developers, and operators within the 1inch staking ecosystem. It requires educating stakeholders about the regulations and establishing mechanisms for monitoring and enforcement.

In conclusion, regulating 1inch staking has the potential to bring numerous benefits, including investor protection, market stability, and long-term sustainability. However, it also presents challenges related to global jurisdiction, balancing innovation and regulation, and ensuring regulatory compliance. Finding the right balance between regulation and innovation will be crucial for the success of 1inch staking and the broader DeFi ecosystem.

The Potential Impact of Regulation on 1inch Stakers and the DeFi Ecosystem

Regulation has been a topic of ongoing debate in the cryptocurrency space, and its potential impact on 1inch stakers and the wider DeFi ecosystem cannot be overlooked. As governments around the world grapple with how to classify and regulate cryptocurrencies, the future of decentralized finance hangs in the balance.

One potential impact of regulation on 1inch stakers is the increased compliance burden. If regulators decide to treat 1inch staking as a form of investment, stakers may be required to register as investors and comply with a myriad of reporting and disclosure requirements. This could add significant costs and administrative burdens to individuals who simply want to participate in the DeFi ecosystem.

Another potential impact is the restriction of access to certain regions. Regulators may decide to impose geographic limitations on the use of DeFi platforms like 1inch, either by requiring users to undergo identity verification or by outright banning access to these platforms. This would not only limit the ability of individuals in those regions to participate in the DeFi ecosystem but also hinder the growth and adoption of decentralized finance on a global scale.

Furthermore, regulatory measures could impact the security and privacy of 1inch stakers. In an attempt to combat money laundering and other illicit activities, regulators may require platforms like 1inch to implement stricter KYC and AML procedures. While these measures may be necessary from a regulatory standpoint, they could compromise the privacy and anonymity that many individuals value in decentralized finance.

The potential impact of regulation extends beyond just 1inch stakers. The entire DeFi ecosystem could face significant challenges if regulators decide to impose strict rules and limitations. Innovation and experimentation, which have been key drivers of DeFi growth, may be stifled as teams become more risk-averse to avoid regulatory scrutiny. This could result in a slowdown in the development of new protocols and applications, ultimately limiting the potential of decentralized finance.

In conclusion, the potential impact of regulation on 1inch stakers and the DeFi ecosystem is complex and far-reaching. While some level of regulation may be necessary to protect investors and prevent illicit activities, a balanced approach is crucial to ensure that the benefits of decentralized finance can still be realized. As the regulatory landscape continues to evolve, it is imperative for stakeholders in the DeFi space to actively engage with regulators and advocate for sensible and forward-thinking policies that foster innovation and inclusivity.

Exploring the Future of 1inch Staking Regulation

The regulation of 1inch staking is an important aspect to consider as the decentralized finance (DeFi) space continues to evolve. While the current landscape of 1inch staking regulation is relatively nascent, it is likely that regulators will begin to take a closer look at this emerging sector in the future.

One potential area of future regulation is the oversight of 1inch staking platforms. As more users participate in staking their tokens on these platforms, regulators may look to ensure that adequate safeguards are in place to protect the interests of investors. This could include requirements for transparency, security measures, and compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Another aspect that regulators may seek to address is the potential for market manipulation and fraud in 1inch staking. As the value of staked tokens can fluctuate significantly, there is a risk that bad actors could exploit the system for their own gain. Regulators may enact measures to detect and prevent such manipulative practices, including the implementation of strict reporting requirements and penalties for non-compliance.

Additionally, the tax implications of 1inch staking may also come under scrutiny in the future. As staking rewards are typically considered taxable income, authorities may seek to ensure that individuals and platforms are accurately reporting their earnings and paying the appropriate taxes. This could involve the development of specific tax guidelines for staking activities and increased enforcement efforts to ensure compliance.

Overall, as the popularity of 1inch staking continues to grow, it is likely that regulators will focus more attention on this sector. While the exact nature of future regulations remains uncertain, it is important for participants in the 1inch staking ecosystem to stay informed and proactive in order to navigate any potential regulatory changes and ensure the long-term viability of the industry.

Question-answer:

What is 1inch Staking?

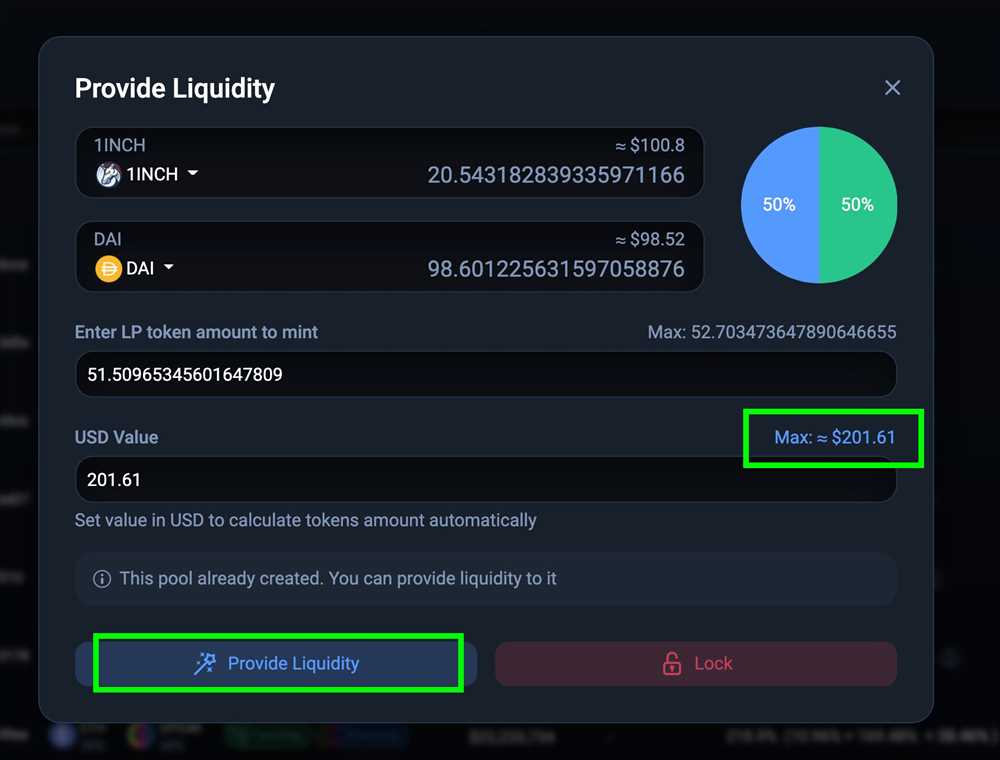

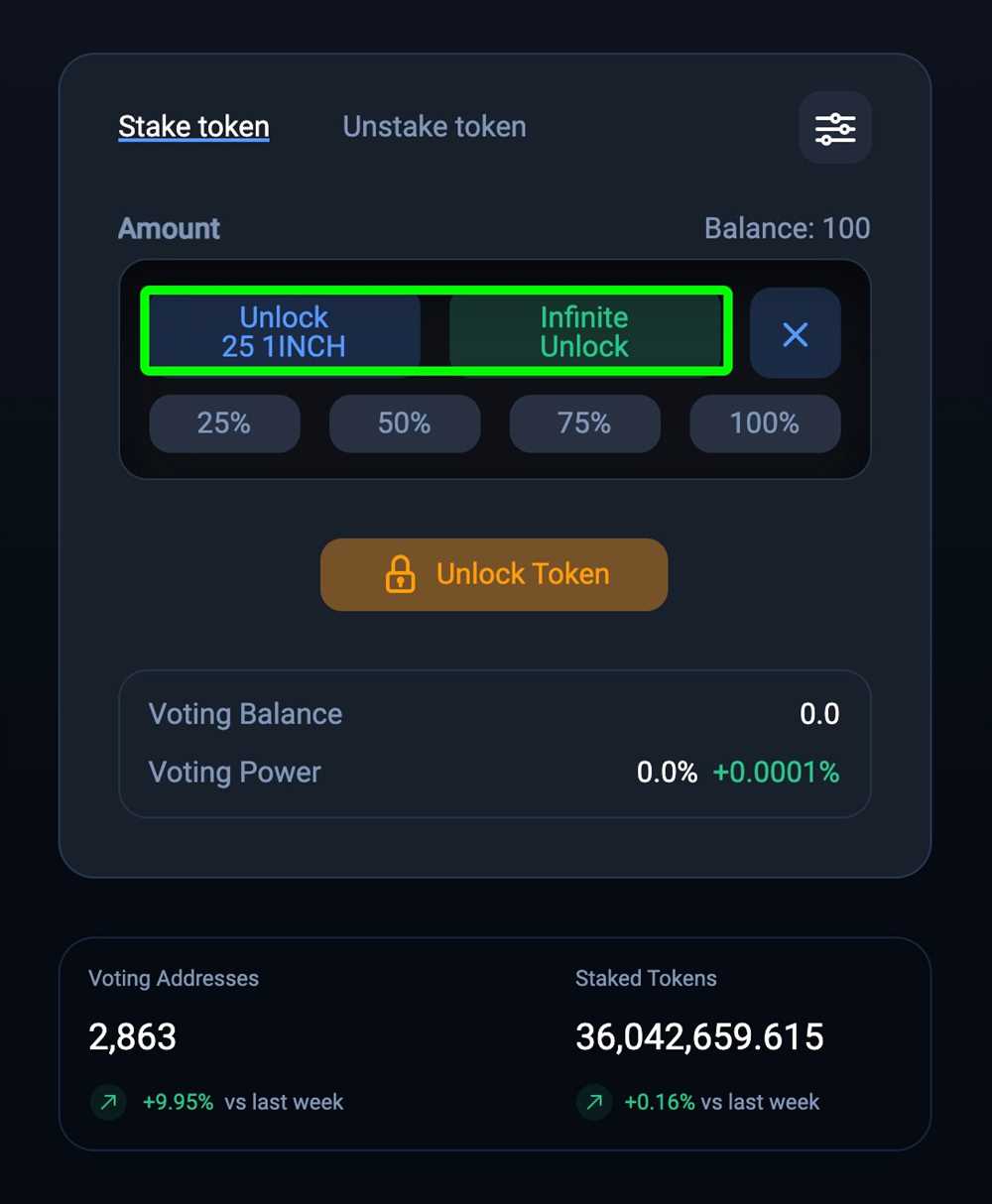

1inch Staking is a way for users to earn passive income by locking up their 1INCH tokens in a smart contract for a specified period of time. In return for staking their tokens, users receive rewards in the form of additional 1INCH tokens.

How does the current regulation landscape affect 1inch Staking?

The current regulation landscape around cryptocurrency staking is still evolving and can vary by country. Some countries may consider staking to be a form of investment or securities, which could subject it to certain regulations. It’s important for users to understand the regulations and comply with them when participating in 1inch Staking.

What are the future implications of 1inch Staking?

The future implications of 1inch Staking are not yet clear. As regulations around cryptocurrency continue to develop, it’s possible that staking could become subject to stricter regulations. Additionally, the success and popularity of 1inch Staking could have an impact on the overall value and adoption of the 1INCH token.