1inch, a decentralized exchange aggregator, has had a significant impact on token prices in the cryptocurrency market. The protocol, powered by an innovative algorithm, seeks to optimize trade routing and minimize slippage by splitting a single trade across multiple liquidity sources. This groundbreaking approach has proven to be a game-changer in the industry, providing users with the best possible prices for their trades.

Since its launch, 1inch has quickly gained popularity among traders and investors. By offering a seamless trading experience and ensuring the best execution, the protocol has attracted a substantial user base. As a result, the increased trading volume on the platform has had a direct influence on the prices of tokens. With more traders using 1inch, the liquidity available for a particular token increases, leading to improved market depth and reduced price volatility.

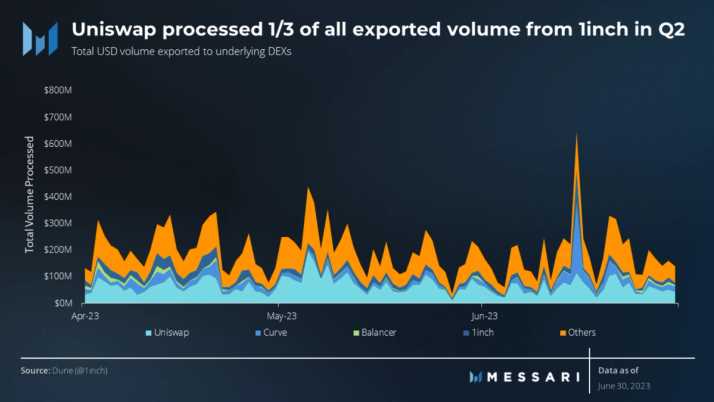

Furthermore, 1inch’s unique approach to liquidity aggregation has enabled it to tap into a wide range of decentralized exchanges, enabling users to access liquidity pools across multiple platforms. This integration with various exchanges has further boosted the protocol’s impact on token prices. By utilizing the liquidity from different DEXs, 1inch ensures that users get the best possible prices, regardless of the trading pair or exchange they choose.

Another factor contributing to 1inch’s impact on token prices is the deployment of its native governance token, 1INCH. Users who hold this token have the opportunity to participate in the platform’s decision-making process, earning governance rewards and influencing the direction of the protocol. This has added an extra layer of demand for the token, driving up its price and creating a positive feedback loop, where increased token value attracts more users to the platform.

In conclusion, 1inch has revolutionized the way in which token prices are influenced in the cryptocurrency market. Through its innovative algorithm, seamless user experience, and integration with various decentralized exchanges, the protocol has significantly impacted liquidity and price stability. Furthermore, the introduction of the 1INCH token has added an additional layer of demand and contributed to the protocol’s continued success. As the cryptocurrency market evolves, it is clear that 1inch will continue to play a crucial role in shaping token prices and the overall market dynamics.

The Impact of 1inch on Token Prices

1inch is a decentralized exchange aggregator that has had a significant impact on token prices in the cryptocurrency market. By integrating with multiple decentralized exchanges, 1inch allows users to find the best prices and liquidity for their trades.

One of the main ways that 1inch impacts token prices is through its smart contract called Pathfinder. This algorithm searches for the most efficient trading routes across multiple decentralized exchanges, optimizing for the best prices and minimizing slippage.

Increased Liquidity and Market Depth

By aggregating liquidity from different exchanges, 1inch has significantly increased the liquidity available for various tokens. This increased liquidity leads to higher market depth, reducing the impact of large buy or sell orders on token prices.

With increased liquidity and market depth, there is also greater price stability in the market. The ability to execute larger trades without significant slippage reduces the risk for traders and attracts more institutional investors to the market.

Efficient Price Discovery

1inch also plays a crucial role in driving efficient price discovery in the cryptocurrency market. By aggregating prices from multiple exchanges, 1inch ensures that users can access the most accurate and up-to-date prices for tokens.

This efficient price discovery helps prevent price discrepancies between different exchanges, reducing the chances of arbitrage opportunities and promoting fair market conditions.

In conclusion, 1inch has had a profound impact on token prices by increasing liquidity, market depth, and driving efficient price discovery. As 1inch continues to grow and integrate with more decentralized exchanges, its influence on token prices is likely to become even more significant.

Analyzing the Protocol’s Market Effects

As an automated market maker (AMM) protocol, 1inch has had a significant impact on token prices in the decentralized finance (DeFi) market. By providing liquidity and enabling efficient token swaps, 1inch has helped shape the market dynamics and contributed to price discovery.

One of the key market effects of 1inch is the reduction of slippage. Slippage refers to the difference between the expected price of a trade and the actual executed price. With 1inch’s aggregation and routing algorithm, traders can find the best possible prices across multiple decentralized exchanges (DEXs), resulting in reduced slippage and improved trading efficiency.

Another market effect of 1inch is the increased liquidity in the DeFi market. By combining liquidity pools from various DEXs, 1inch creates larger pools of tokens, making it easier for traders to execute trades of larger volumes without significantly impacting the token price. This increased liquidity not only benefits traders but also contributes to the overall market stability and efficiency.

Furthermore, the 1inch protocol has introduced the concept of “governance tokens,” which can have a significant impact on token prices. Governance tokens give holders the right to participate in the decision-making process of the protocol, such as voting on upgrades, adding new features, or changing parameters. The introduction of governance tokens can create additional demand for the tokens, leading to price appreciation.

1inch’s impact on token prices can also be seen through its effect on the overall market sentiment. As an established and widely used protocol, 1inch’s performance and reputation can influence market participants’ confidence and perception of the DeFi market as a whole. Positive developments and innovations by 1inch can contribute to positive market sentiment, potentially leading to increased token prices.

Conclusion

- 1inch’s AMM protocol has had a significant impact on token prices in the DeFi market.

- Reduction of slippage and increased liquidity are key market effects of 1inch.

- The introduction of governance tokens by 1inch can impact token prices.

- 1inch’s performance and reputation can influence overall market sentiment.

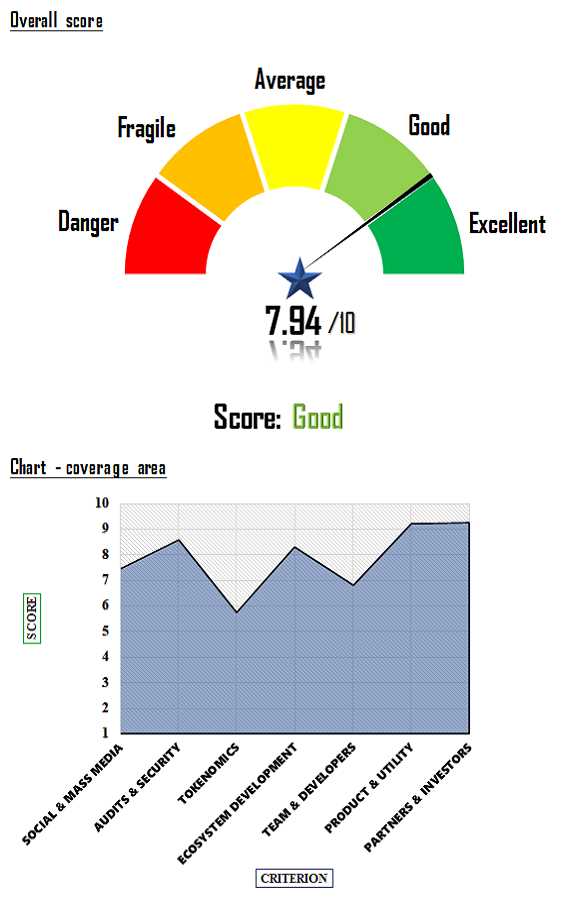

Overall, 1inch has played a vital role in shaping the market dynamics and contributing to the growth and development of the DeFi market. Its innovative features, such as slippage reduction, liquidity aggregation, and governance tokens, have had a positive impact on token prices and the overall market environment.

inch Protocol and Decentralized Exchanges

The inch Protocol is an innovative decentralized exchange (DEX) aggregator that aims to revolutionize the way users interact with decentralized exchanges. With the rapid growth of the DeFi space, decentralized exchanges have become increasingly popular, offering users a way to trade cryptocurrencies directly from their wallets without relying on centralized intermediaries.

However, one of the biggest challenges with decentralized exchanges is liquidity fragmentation. Unlike centralized exchanges, where liquidity is concentrated on a single platform, decentralized exchanges source liquidity from various pools, creating a fragmented market. This fragmentation often leads to higher slippage and lower execution rates for traders.

This is where the inch Protocol comes in. It aggregates liquidity from various decentralized exchanges, allowing users to access the best possible prices and execution rates. By routing trades across different pools, the inch Protocol ensures that users get the most favorable outcomes while minimizing slippage.

The inch Protocol operates on the Ethereum blockchain and achieves its liquidity aggregation through a combination of smart contracts and an automated market maker (AMM) algorithm. The AMM algorithm dynamically optimizes liquidity provision by splitting trades across multiple pools, taking into account factors such as price, volume, and depth.

In addition to liquidity aggregation, the inch Protocol offers a user-friendly interface that simplifies the trading experience. Users can connect their wallets, access multiple exchanges, and make trades with just a few clicks. The protocol also provides comprehensive data and analytics, allowing users to make informed decisions based on real-time market information.

Overall, the inch Protocol plays a crucial role in improving the efficiency and usability of decentralized exchanges. By aggregating liquidity and optimizing trades, it helps users access better prices and execution rates, ultimately contributing to a more seamless and decentralized trading experience.

Evaluating the Relationship between 1inch and Token Prices

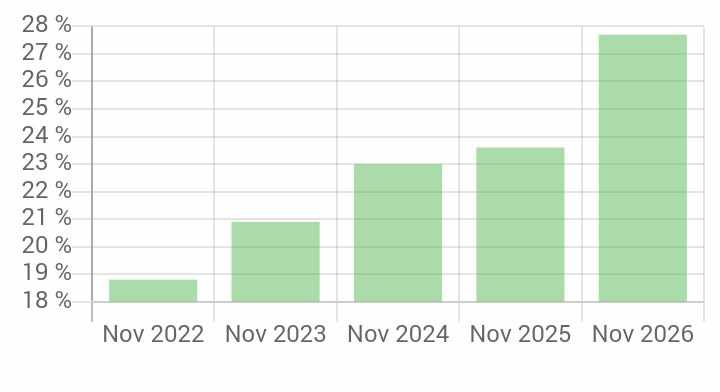

As the decentralized finance (DeFi) landscape continues to expand, the impact of key protocols like 1inch on token prices has become a subject of great interest. In this article, we will analyze the relationship between the 1inch protocol and token prices, shedding light on the factors that influence this relationship.

The Role of 1inch in Token Price Movements

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible rates for their trades. By splitting orders across multiple DEXs, 1inch minimizes slippage and maximizes the value users receive.

This innovative approach to trading has caught the attention of DeFi enthusiasts and investors alike, leading to increased adoption of the 1inch protocol. As more users flock to 1inch to access better trading rates, the demand for the native 1inch token (1INCH) increases, directly impacting its price.

Additionally, the 1inch token has multiple use cases within the protocol’s ecosystem. Holders of 1INCH can participate in governance decisions and earn rewards by staking their tokens. This further amplifies the demand for 1INCH, as users seek to gain voting power and earn passive income.

Factors Influencing the Relationship

Several factors influence the relationship between 1inch and token prices. These factors include:

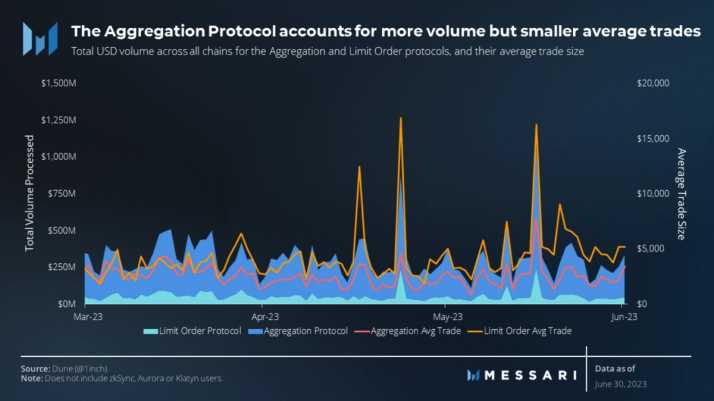

- Trading Volume: The trading volume on 1inch and the overall liquidity provided through the protocol impact token prices. Higher trading volume indicates increased demand for 1inch, leading to a potential price increase.

- Market Sentiment: Sentiment within the DeFi market as a whole can impact the demand for 1inch and subsequently its price. Positive news and developments in the DeFi space may attract more investors to 1INCH.

- Partnerships and Integrations: Collaborations with other DeFi protocols and platforms can significantly impact the demand for 1inch. Integration with popular wallets or DEXs can expose more users to the protocol, resulting in increased demand for the 1INCH token.

- Regulatory Environment: Regulatory changes or announcements related to decentralized finance can have an indirect impact on 1inch and token prices. Any negative regulatory developments may dampen investor sentiment and negatively affect the demand for 1INCH.

It is important to note that while these factors can influence the relationship between 1inch and token prices, they do not guarantee a specific outcome. The cryptocurrency market is highly volatile and subject to various external factors, making it challenging to predict price movements with certainty.

In conclusion, the relationship between 1inch and token prices is complex and influenced by a variety of factors. By understanding these factors and closely monitoring market dynamics, investors can gain insights into the potential impact of 1inch on token prices and make more informed trading decisions.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges to provide the best possible rates to users. It was launched in 2020 and has gained popularity due to its ability to access multiple liquidity sources in one place.

How does 1inch impact token prices?

1inch is a popular platform for trading cryptocurrencies, and its impact on token prices can be significant. When users trade tokens on the 1inch platform, it increases the trading volume and liquidity of those tokens, which can potentially lead to price fluctuations. Additionally, 1inch’s ability to access multiple liquidity sources allows for more efficient price discovery, which can also impact token prices.

Has 1inch had a noticeable impact on token prices?

Yes, 1inch has had a noticeable impact on token prices. The protocol’s ability to provide the best possible rates to users by sourcing liquidity from various exchanges has increased trading volume and liquidity for many tokens. This increased activity can lead to price fluctuations and can potentially drive up or down the prices of certain tokens. However, it is important to note that the impact of 1inch on token prices will vary depending on various factors such as market conditions and the specific tokens being traded.