In recent years, decentralized finance (DeFi) has emerged as a disruptive force within the financial industry. Offering users the ability to access financial services without the need for intermediaries, DeFi has the potential to revolutionize the way we transact, invest, and manage our money. As the DeFi ecosystem continues to evolve, one app has gained significant attention for its innovative approach to decentralized exchanges: the 1inch app.

The 1inch app is a decentralized exchange aggregator that allows users to find and execute the best trades across multiple decentralized exchanges. By leveraging smart contract technology and liquidity pools, the 1inch app is able to provide users with access to the deepest liquidity and the most competitive prices in the DeFi market.

What sets the 1inch app apart from other decentralized exchanges is its unique algorithm, known as Pathfinder. Pathfinder is designed to split orders across multiple decentralized exchanges, optimizing for the best available rates and minimizing slippage. This means that users can trade their assets with minimal price impact, maximizing their returns.

Furthermore, the 1inch app is built on the Ethereum blockchain, ensuring a secure and transparent trading experience. Users have full control over their funds at all times, eliminating the need for trust in centralized intermediaries. With the 1inch app, users can trade directly from their wallets, without the need to deposit funds onto an exchange, reducing the risk of hacks and theft.

The Future of Decentralized Finance

Decentralized finance (DeFi) has emerged as one of the most exciting and transformative sectors within the cryptocurrency industry. With the rise of blockchain technology, DeFi has enabled individuals to access financial services in a decentralized manner, removing the need for intermediaries and traditional financial institutions.

The future of decentralized finance holds immense potential for further disruption and innovation. As more people become aware of the advantages of DeFi, the sector is likely to grow exponentially in the coming years. Here are a few trends and developments that we can expect to see in the future:

1. Increased Accessibility

One of the main barriers to widespread adoption of decentralized finance is its complexity and technical nature. However, as user-friendly platforms and applications like the 1inch app continue to emerge, DeFi will become more accessible to the average user. This will allow individuals from all walks of life to participate in the decentralized economy and take advantage of its benefits.

2. Interoperability

Currently, the DeFi ecosystem is composed of a variety of separate protocols and platforms that do not always work well together. In the future, we can expect to see increased interoperability, allowing different DeFi applications to seamlessly communicate and interact with each other. This will create a more efficient and streamlined user experience, as well as open up new possibilities for innovative financial products and services.

3. Regulatory Clarity

Regulatory uncertainty has been a challenge for the DeFi industry, as governments and regulatory bodies struggle to keep up with the rapid pace of innovation. In the future, we can expect to see more clear and defined regulations surrounding DeFi. This will provide a framework for the industry to operate within, fostering trust and encouraging further growth and adoption.

- 4. Integration with Traditional Finance

As DeFi continues to gain traction, we can expect to see increased integration with traditional finance. This could include partnerships between DeFi platforms and traditional financial institutions, as well as the development of hybrid financial products that combine the best aspects of both centralized and decentralized finance.

The future of decentralized finance is bright, with endless possibilities for innovation and disruption. As the sector continues to mature, it is important for individuals and institutions to stay informed and actively participate in this exciting revolution of the financial industry.

The Rise of 1inch App

Decentralized Finance (DeFi) has gained significant traction in recent years, with various platforms and applications emerging to provide users with the ability to engage in financial services without relying on traditional intermediaries. One such platform that has experienced immense growth and popularity is the 1inch app.

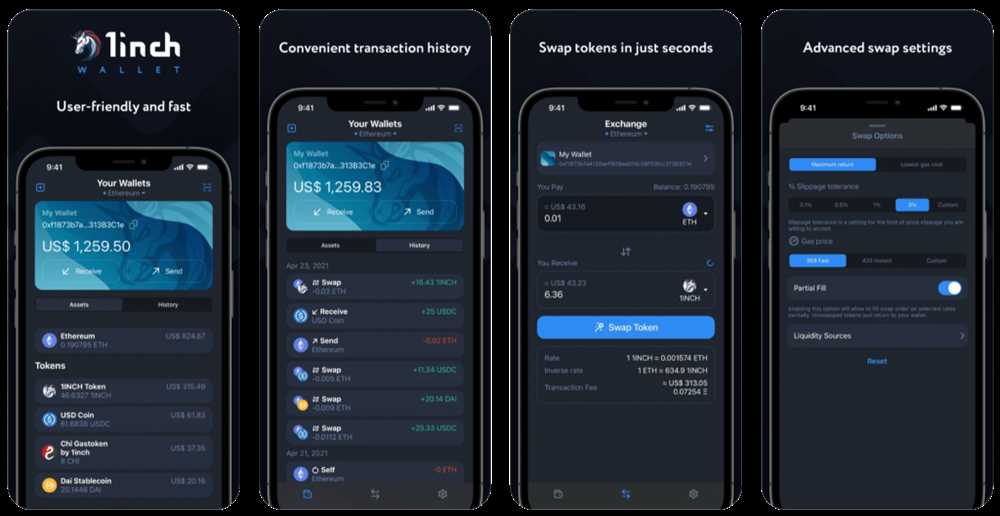

1inch is a decentralized exchange (DEX) aggregator that allows users to find the best prices for their cryptocurrency trades across multiple DEXs. It was launched in 2020 and quickly gained attention in the crypto community due to its innovative approach and user-friendly interface.

The 1inch app operates by splitting a user’s trade across multiple DEXs to ensure that they get the best possible rates. This eliminates the need for users to manually search for the most favorable prices and execute trades on different platforms. 1inch automatically scans various decentralized exchanges, including popular ones like Uniswap, SushiSwap, and PancakeSwap, to provide users with the most competitive rates.

One of the key features that sets 1inch apart from other DEX aggregators is its Pathfinder algorithm. Pathfinder ensures that users’ trades are routed in a way that maximizes their profits while minimizing slippage and fees. It takes into account factors like liquidity, trading volume, and gas prices to determine the most optimal route for a trade.

Another notable aspect of the 1inch app is its governance token, 1INCH. Holders of the 1INCH token can participate in the platform’s governance and decision-making processes, including voting on protocol updates and proposing changes to the platform’s functionality. This gives users a sense of ownership and allows them to actively contribute to the development and growth of the 1inch ecosystem.

Since its launch, the 1inch app has experienced remarkable success and growth. It has attracted millions of users and processed billions of dollars in trading volume. This can be attributed to its efficient and user-centric design, as well as its ability to provide users with better prices and improved trading experiences compared to individual DEX platforms.

In conclusion, the rise of the 1inch app exemplifies the growing popularity and importance of decentralized finance. It showcases how innovative technology and user-focused design can revolutionize traditional financial services and empower individuals to have more control over their assets and investments.

The Benefits of Decentralized Finance

Decentralized finance, or DeFi, offers numerous benefits compared to traditional centralized finance systems. Here are some of the key advantages:

1. Enhanced Financial Inclusion

Decentralized finance opens up opportunities for individuals who lack access to traditional banking services. With DeFi, anyone with an internet connection can participate in financial activities, such as lending, borrowing, and investing, without the need for a middleman. This inclusivity empowers underserved populations and promotes economic growth on a global scale.

2. Increased Transparency

In decentralized finance, all transactions and smart contracts are recorded on a public blockchain, providing complete transparency. This transparency helps to prevent fraud and corruption, as all financial activities can be easily audited and verified by anyone. With improved visibility, users can trust the system more, leading to a more efficient and accountable financial ecosystem.

3. Reduced Counterparty Risk

In traditional finance, there is always a risk of default or bankruptcy by a centralized institution. With decentralized finance, the risk is distributed across the network, making it less vulnerable to single points of failure. Smart contracts and automated processes eliminate the need for intermediaries, reducing counterparty risk and increasing the resilience of the system.

4. Lower Transaction Costs

Decentralized finance enables peer-to-peer transactions without intermediaries, resulting in lower transaction fees. In contrast, traditional financial systems involve multiple intermediaries, each charging fees for their services. With DeFi, users can save on costs and benefit from greater financial efficiency, especially for cross-border transactions.

5. Enhanced Security

Decentralized finance leverages the security of blockchain technology to protect financial assets and data. The use of cryptography and distributed ledger technology ensures that transactions are secure and tamper-proof. Additionally, decentralized finance removes the need for centralized storage and reduces the risk of data breaches or hacking attacks on a single point of failure.

In conclusion, decentralized finance offers numerous benefits that are revolutionizing the financial landscape. From promoting financial inclusion to increasing transparency and reducing costs, DeFi provides a more accessible, secure, and efficient financial infrastructure for individuals and businesses worldwide.

Empowering Financial Freedom

Decentralized finance (DeFi) has emerged as a powerful force in the financial industry, offering individuals unprecedented opportunities to take control of their financial destinies. The 1inch app is at the forefront of this revolution, providing users with a seamless and user-friendly platform to access a wide range of DeFi protocols.

A Transparent and Trustless Ecosystem

One of the key features of the 1inch app is its commitment to transparency and trustlessness. Through the utilization of smart contracts, users can be assured that their transactions are secure and free from the potential for manipulation or fraud. This level of trustlessness is a crucial aspect of empowering financial freedom, as it allows users to confidently interact with the DeFi ecosystem, knowing that their assets are protected.

Access to a World of Opportunities

By using the 1inch app, users gain access to a vast array of DeFi protocols, enabling them to engage in activities such as lending, borrowing, and trading, among others. This opens up a world of opportunities for individuals to grow their wealth and achieve their financial goals. Whether someone is looking to earn passive income through yield farming, or simply wants to trade tokens on a decentralized exchange, the 1inch app provides the tools and resources necessary to make these ambitions a reality.

In addition to its vast selection of DeFi protocols, the 1inch app also offers users access to various liquidity pools. By providing liquidity to these pools, users can earn rewards in the form of fees and additional tokens. This incentivizes participation in the DeFi ecosystem and further empowers individuals to take control of their financial future.

| Benefits of the 1inch app: |

| 1. Seamless and user-friendly interface |

| 2. Trustless and secure transactions |

| 3. Access to a wide range of DeFi protocols |

| 4. Opportunities for earning passive income |

| 5. Incentives for providing liquidity |

In conclusion, the 1inch app is revolutionizing the financial landscape by empowering individuals with the tools and resources they need to take control of their financial destinies. Through its transparent and trustless ecosystem, coupled with its vast selection of DeFi protocols and liquidity pools, the 1inch app is paving the way for a future where financial freedom is accessible to all.

The Challenges and Opportunities

Decentralized finance, also known as DeFi, has opened up a world of opportunities for the financial industry. However, it is not without its challenges. In this section, we will discuss both the challenges and the opportunities that come with the evolving landscape of decentralized finance.

Challenges

- Lack of regulatory framework: One of the biggest challenges in DeFi is the lack of a comprehensive regulatory framework. As the industry continues to grow, regulators are trying to catch up and establish rules to protect investors and prevent fraud.

- Security vulnerabilities: DeFi platforms are often built on blockchain networks, which are not immune to security vulnerabilities. Smart contract bugs and hacks have led to significant financial losses in the past. Improving security measures is crucial for the widespread adoption of DeFi.

- User experience: While DeFi offers financial services without intermediaries, the user experience can be complex and confusing for newcomers. The decentralized nature of DeFi often requires users to manage their private keys and interact with multiple platforms, which can be daunting for those unfamiliar with blockchain technology.

Opportunities

- Financial inclusion: DeFi has the potential to bridge the gap between the banked and the unbanked population. With decentralized platforms, individuals from underserved areas can access financial services such as lending and borrowing without the need for a traditional bank account.

- Reduced costs: DeFi eliminates the need for intermediaries, such as banks, resulting in lower costs for users. Transactions can be conducted directly between parties, reducing fees and improving efficiency.

- Global accessibility: The decentralized nature of DeFi makes it accessible to anyone with an internet connection, regardless of their geographical location. This opens up opportunities for individuals in developing countries who may not have access to traditional financial services.

- Financial innovation: DeFi is a hotbed for financial innovation. Developers are constantly creating new protocols and applications that push the boundaries of what is possible in finance. This continuous innovation has the potential to revolutionize the way we think about and interact with money.

While DeFi faces challenges, the opportunities it presents are vast. As the industry continues to evolve, it is important to address the challenges and work towards creating a more secure, accessible, and user-friendly decentralized financial ecosystem.

Navigating the Complexities of DeFi

Decentralized finance (DeFi) has emerged as one of the most dynamic and rapidly evolving sectors in the blockchain industry. With its promise to revolutionize traditional financial systems by eliminating intermediaries and providing greater accessibility, DeFi has gained significant attention from both institutional investors and individual users.

The Multitude of Options

However, the growing popularity of DeFi has led to an explosion of new projects and platforms, making it increasingly complex for users to navigate the space. From decentralized exchanges (DEXs) and yield farming to lending protocols and liquidity pools, there are a myriad of options available.

Each platform operates differently, has its own unique features, and may involve various risks. As a result, it is essential for users to conduct thorough research and due diligence before engaging with any DeFi application.

Safeguarding Your Assets

One of the key challenges in DeFi is ensuring the security of your assets. As the industry is still relatively young and continuously evolving, it is important to exercise caution and adopt best practices to minimize the risks of hacks and vulnerabilities.

Some of the recommended steps to safeguard your assets in DeFi include:

- Using hardware wallets: Storing your assets offline in a hardware wallet provides an extra layer of security against online threats.

- Diversifying across platforms: Spreading your assets across different platforms can help mitigate the risk of a single point of failure.

- Double-checking smart contracts: Before interacting with any smart contract, it is crucial to review and verify its code to ensure it functions as intended.

By following these practices and staying informed about the latest security measures, users can better protect their assets in the DeFi landscape.

In conclusion, while DeFi offers immense opportunities for financial innovation and inclusion, it also comes with its fair share of complexities and risks. Navigating this rapidly evolving landscape requires a comprehensive understanding of the different platforms and protocols, as well as a commitment to security. With the right knowledge and precautions, users can fully explore the potential of DeFi while safeguarding their assets.

Question-answer:

What is decentralized finance?

Decentralized finance, also known as DeFi, refers to the use of blockchain technology and cryptocurrencies to recreate traditional financial systems in a decentralized manner. It aims to eliminate the need for intermediaries, such as banks, and give individuals more control over their own financial transactions and assets.

What is the 1inch app?

The 1inch app is a decentralized exchange aggregator that aims to provide users with the best possible trading prices by automatically splitting their trades across multiple decentralized exchanges. It scans various exchanges and liquidity pools to find the optimal route for trading, saving users time and money.

How does the 1inch app work?

The 1inch app utilizes smart contracts and algorithms to split trades across multiple decentralized exchanges, aiming to achieve the best possible prices for users. It integrates with various liquidity sources such as Uniswap, SushiSwap, and Balancer, and executes transactions on behalf of users through its own liquidity protocol.

Is the 1inch app safe to use?

The 1inch app utilizes audited smart contracts and has implemented various security measures to ensure the safety of users’ funds. It has undergone multiple security audits and has a bug bounty program in place to encourage the community to identify and report any vulnerabilities. However, as with any decentralized application, users should exercise caution, do their own research, and only invest what they can afford to lose.

What are the benefits of using the 1inch app?

The 1inch app provides users with various benefits, including access to the best possible trading prices by splitting trades across multiple exchanges. It also saves users time by aggregating liquidity from different sources and allowing for quick and convenient trades. Additionally, the 1inch app offers a user-friendly interface and supports a wide range of tokens, making it appealing to both experienced and novice traders in the decentralized finance space.