How the 1inch aggregator integrates multiple exchanges to offer competitive trading rates

With the rise of decentralized finance (DeFi), trading cryptocurrencies has become more popular than ever. However, finding the best trading rates can be a daunting task, as rates can vary significantly between different exchanges. This is where the 1inch aggregator comes in, offering a solution that allows users to access the most competitive trading rates by integrating multiple exchanges into one platform.

The 1inch aggregator is a decentralized exchange (DEX) aggregator that scans multiple DEXs to find the best available rates for a particular trade. By leveraging smart contracts and advanced algorithms, the 1inch aggregator ensures that users always get the most competitive rates without having to manually search through multiple exchanges.

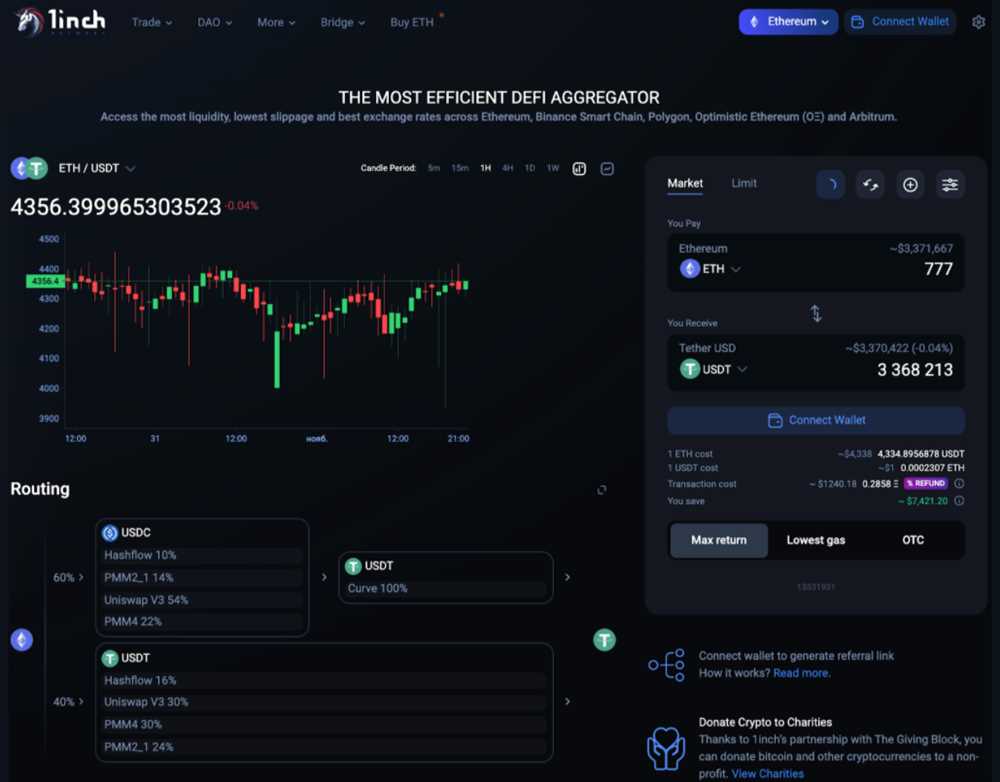

One of the key advantages of using the 1inch aggregator is its ability to split a single trade across multiple DEXs to achieve the most favorable rates. This is achieved through a process known as “splitting,” where the 1inch aggregator divides a trade into smaller parts and executes them on different exchanges. By doing so, the 1inch aggregator minimizes slippage and ensures that users get the best possible outcome for their trades.

Additionally, the 1inch aggregator offers a unique feature called “Chi GasToken,” which allows users to save on transaction fees. By using Chi GasToken, users can pre-purchase gas at a lower price and use it to pay for future transactions, reducing the overall cost of trading on the platform.

In conclusion, the 1inch aggregator is a powerful tool that enables users to access the most competitive trading rates by integrating multiple exchanges into one platform. With its ability to split trades and optimize for the best rates, the 1inch aggregator revolutionizes the way users trade cryptocurrencies, making it easier and more cost-effective than ever before.

1inch Aggregator: Enhancing Trading Rates

1inch Aggregator is a revolutionary platform that aims to enhance trading rates by integrating multiple exchanges. Traditional cryptocurrency exchanges often suffer from liquidity limitations and high slippage, which can significantly impact the trading experience and results.

By integrating various decentralized exchanges (DEXs) such as Uniswap, Kyber Network, and Balancer, 1inch Aggregator allows users to access a wide range of liquidity sources. This eliminates the need to manually search and compare rates across different exchanges, saving time and effort for traders.

Furthermore, 1inch Aggregator utilizes advanced algorithms to split and route orders across multiple exchanges, ensuring optimal execution prices. By leveraging these algorithms, users can achieve better trading rates and reduce slippage compared to using a single exchange.

Benefits of 1inch Aggregator

1. Better trading rates: By aggregating liquidity from multiple exchanges, 1inch Aggregator offers users access to the best available rates in the market. This ensures that traders get the most value out of their trades.

2. Improved execution prices: The advanced algorithms used by 1inch Aggregator analyze and split orders across different exchanges to achieve the most favorable execution prices. This helps users minimize slippage and maximize their profits.

3. Time-saving: Instead of manually searching and comparing rates across various exchanges, users can rely on 1inch Aggregator to provide them with the best rates. This saves time and effort, allowing users to focus on their trading strategies.

4. Enhanced liquidity: By integrating multiple DEXs, 1inch Aggregator ensures that users have access to a wide range of liquidity sources. This improves the overall liquidity of the platform, reducing the impact of large orders on price movements.

In conclusion, 1inch Aggregator is a game-changing platform that enhances trading rates by integrating multiple exchanges and utilizing advanced algorithms. It offers users better trading rates, improved execution prices, time-saving features, and enhanced liquidity. With 1inch Aggregator, traders can optimize their trading strategies and achieve better results in the fast-paced world of cryptocurrency trading.

Combining Exchanges to Maximize Profits

One of the key benefits offered by the 1inch aggregator is the ability to combine multiple exchanges in order to maximize profits. Through advanced algorithms and smart contract technology, 1inch is able to analyze prices across various exchanges and execute trades at the most favorable rates.

By combining multiple exchanges, users can take advantage of different liquidity pools and find the best prices for their trades. This means they can reduce slippage and increase their profits compared to trading on a single exchange.

1inch’s integration with multiple exchanges also offers users access to a wider range of trading pairs. This means they can trade assets that may not be available on a single exchange, giving them greater flexibility and more opportunities to profit.

Advanced Algorithm and Smart Contract Technology

At the heart of 1inch’s aggregator is an advanced algorithm that constantly scans multiple exchanges for the best prices. This algorithm takes into account various factors such as liquidity, trading volume, and fees to ensure that users get the most profitable trades.

1inch also utilizes smart contract technology to execute trades across multiple exchanges. Smart contracts are self-executing contracts with the terms of the agreement directly written into the code. This ensures that trades are executed automatically and without the need for intermediaries, reducing the risk of human error and increasing efficiency.

Reducing Hassle and Maximizing Returns

By combining exchanges, 1inch aims to reduce the hassle of trading on multiple platforms. Instead of manually searching for the best prices and executing trades on different exchanges, users can simply use the 1inch aggregator to access the most competitive rates in one place.

This not only saves users time and effort but also maximizes their returns. By getting the best prices and reducing slippage, users can increase their profits and make the most of their trading activities.

In conclusion, the ability to combine exchanges offered by the 1inch aggregator is a powerful tool for maximizing profits in the cryptocurrency market. By leveraging advanced algorithms, smart contract technology, and access to multiple exchanges, users can optimize their trades and increase their returns.

Understanding the 1inch Aggregator

The 1inch Aggregator is an innovative decentralized exchange (DEX) protocol that offers competitive trading rates to users by integrating multiple exchanges. It was developed to address the problem of fragmented liquidity in the decentralized trading space, where users often face higher prices and slippage due to limited access to liquidity.

The Need for an Aggregator

Decentralized exchanges operate on different protocols and have their own liquidity pools. This fragmentation leads to fragmented liquidity, where each exchange has its own pool of liquidity that is not accessible to other exchanges. As a result, traders often have to manually search across multiple platforms to find the best rates, which is time-consuming and inefficient.

The 1inch Aggregator addresses this problem by connecting to various decentralized exchanges and routing the user’s trades through the exchange that offers the best rates. It continuously scans the market for the best prices and executes trades with minimal slippage, providing users with the most competitive rates available.

How the Aggregator Works

The 1inch Aggregator works by splitting a user’s trade across multiple liquidity sources, such as decentralized exchanges and liquidity protocols, to optimize for the best rates. It uses an algorithm that takes into account factors such as price, gas fees, and slippage to determine the optimal route for each trade.

The aggregator sources liquidity from various exchanges such as Uniswap, SushiSwap, Balancer, and others through smart contract integrations. It combines the liquidity from these different sources to provide users with access to a larger pool of liquidity, resulting in better rates and reduced slippage.

When a user submits a trade on the 1inch Aggregator, the protocol executes the trade by splitting it into smaller trades and routing each part through the exchange with the best rate at that specific moment. This approach ensures that users get the most favorable rates possible for their trades.

The 1inch Aggregator also offers additional features such as limit orders, enabling users to set specific trade parameters and execute trades automatically when certain conditions are met. This gives users more flexibility and control over their trades.

In conclusion, the 1inch Aggregator is a powerful tool that addresses the issue of fragmented liquidity in the decentralized trading space. By integrating multiple exchanges and optimizing trade routes, it provides users with competitive trading rates and reduced slippage. Its ability to source liquidity from various exchanges makes it an attractive option for traders looking for the best rates and improved trading efficiency.

Advantages of Using the 1inch Aggregator

- Increased Liquidity: By integrating multiple decentralized exchanges (DEXs), the 1inch aggregator provides users with access to a larger pool of liquidity. This ensures that users can execute trades at competitive rates without worrying about limited liquidity on a single exchange.

- Best Price Execution: The 1inch aggregator scans multiple DEXs to find the best available prices for a given trade. This ensures that users get the most favorable rates and maximize their returns.

- Lowest Slippage: Slippage occurs when the executed price of a trade deviates from the expected price due to market volatility or limited liquidity. By splitting orders across multiple DEXs, the 1inch aggregator minimizes slippage, resulting in better execution prices for users.

- Reduced Fees: The 1inch aggregator enables users to find the DEX with the lowest fees for their trades. By comparing fees across different exchanges, users can save money on transaction costs and maximize their profits.

- Improved Security: The 1inch aggregator is designed to prioritize user security. By integrating with reputable DEXs and following strict security protocols, the aggregator ensures that users’ funds and personal information are protected.

- User-Friendly Interface: The 1inch aggregator offers a clean and intuitive interface, making it easy for both beginner and experienced traders to navigate the platform. Users can quickly access information about available liquidity, prices, and fees, enabling them to make informed trading decisions.

- Access to a Wide Range of Tokens: Through its integration with multiple DEXs, the 1inch aggregator provides users with access to a wide range of tokens. This allows traders to explore various investment opportunities and diversify their portfolios.

- Time and Cost Efficiency: By aggregating liquidity and prices from multiple exchanges, the 1inch aggregator saves users both time and money. Instead of manually searching for the best rates and available liquidity on different DEXs, users can rely on the aggregator to provide them with the most efficient trading options.

Question-answer:

What is 1inch aggregator?

1inch aggregator is a decentralized exchange (DEX) aggregator that allows users to access multiple decentralized exchanges and find the best trading rates.

How does 1inch aggregator work?

1inch aggregator works by splitting a user’s trade across multiple decentralized exchanges in order to find the best possible trading rates. It takes into account factors such as gas fees and slippage to ensure users get the most value for their trades.

What are the benefits of using 1inch aggregator?

Using 1inch aggregator offers several benefits. It provides users with access to a wide range of decentralized exchanges, allowing them to find the best trading rates. It also helps users save on gas fees by splitting trades across multiple exchanges. Additionally, 1inch aggregator takes into account slippage to ensure users get the best possible price for their trades.

Which decentralized exchanges does 1inch aggregator integrate with?

1inch aggregator integrates with a number of decentralized exchanges, including Uniswap, Kyber Network, Balancer, and more. By integrating with multiple exchanges, 1inch aggregator is able to offer users access to a wider range of markets and better trading rates.