As 1inch, the decentralized exchange aggregator, continues to expand its presence globally, it faces a unique set of challenges in the United States. Navigating the complex regulatory landscape is no easy feat, and 1inch must carefully consider the legal implications of its operations.

One of the main challenges that 1inch encounters in the US is the uncertainty surrounding the classification of cryptocurrencies. With different government agencies providing varying interpretations, it becomes crucial for 1inch to stay up-to-date with any changes in regulations, as well as engage in ongoing discussions with regulators to ensure compliance.

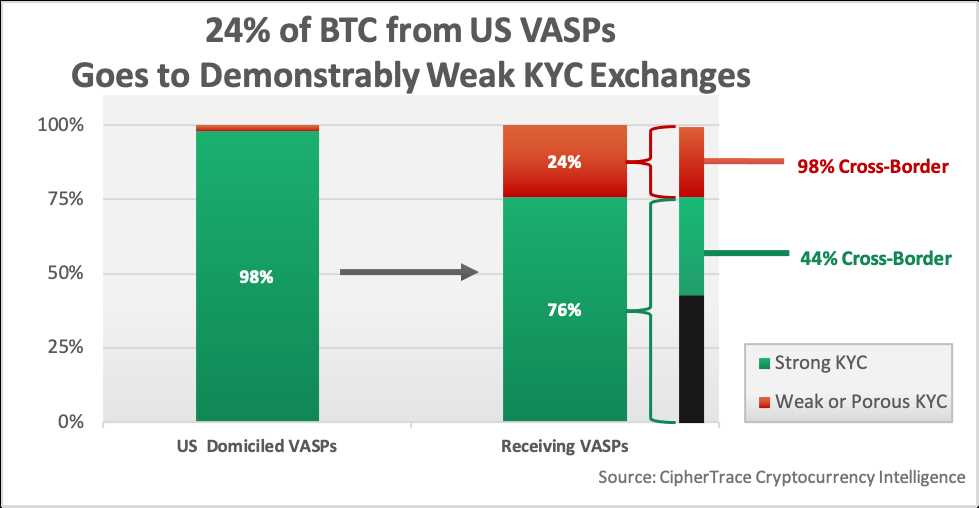

Furthermore, another hurdle for 1inch is the compliance with anti-money laundering (AML) and know your customer (KYC) regulations. These measures are in place in an attempt to prevent illicit activities, but they also create additional burdens for decentralized exchanges like 1inch. Implementing robust identification procedures while still maintaining user privacy is a delicate balance that requires careful consideration.

Another aspect that adds to the challenges faced by 1inch in the US is the fragmented nature of regulatory oversight. Unlike some regions where there is a centralized authority overseeing cryptocurrencies, the US regulatory landscape involves multiple agencies at the federal and state levels. This fragmented approach can lead to inconsistent regulations and requirements, making compliance a complex task.

Despite these challenges, 1inch remains committed to expanding its presence in the US market. By working closely with regulators, staying informed about legal developments, and implementing effective compliance measures, 1inch aims to overcome these hurdles and provide US users with a seamless decentralized exchange experience.

Challenges for 1inch in the US: Navigating Regulatory Hurdles

1inch, a decentralized exchange aggregator and a major player in the decentralized finance (DeFi) space, has been facing significant challenges in the United States when it comes to navigating regulatory hurdles. As the cryptocurrency industry continues to grow and gain mainstream attention, regulators are working to establish a clear framework for crypto-related activities, which has created a complex landscape for companies like 1inch.

One of the main challenges that 1inch faces in the US is the lack of clear regulations surrounding decentralized exchanges and the tokens traded on them. Unlike traditional centralized exchanges, decentralized exchanges operate without a central authority and allow users to trade directly with one another using smart contracts. This decentralized nature raises questions about compliance with existing financial regulations, as well as the potential for money laundering and illicit activities.

Another challenge for 1inch is the state-by-state approach to cryptocurrency regulation in the US. Each state has its own set of rules and requirements, making it difficult for companies like 1inch to operate nationwide. This fragmented regulatory landscape creates a significant compliance burden for companies, requiring them to navigate various licensing and registration processes in each state they operate.

Additionally, 1inch needs to consider the potential enforcement actions by regulatory bodies like the Securities and Exchange Commission (SEC). The SEC has been actively cracking down on initial coin offerings (ICOs) and other crypto-related activities that it deems to be securities offerings. This enforcement approach has created uncertainty for companies in the crypto space, as they need to ensure that their activities do not fall under the category of securities and comply with existing securities laws.

Despite these challenges, 1inch is actively working towards compliance and regulatory clarity in the US market. The company is engaging with regulators, hiring legal experts, and implementing robust compliance measures to ensure they are operating within the bounds of the law. They are also exploring partnerships and collaborations with other industry participants to collectively address regulatory concerns and advocate for a fair and transparent regulatory framework.

Overall, navigating the regulatory hurdles in the US presents significant challenges for 1inch and other crypto companies. However, by actively engaging with regulators and taking proactive measures to comply with existing regulations, 1inch aims to overcome these challenges and continue to provide innovative decentralized finance solutions to users in the US and beyond.

Understanding US Legal Framework

In order to navigate the regulatory hurdles in the US, it is crucial for 1inch to have a comprehensive understanding of the legal framework governing the cryptocurrency space. The US legal framework for cryptocurrencies is still evolving and can be complex, with multiple regulatory agencies having jurisdiction over different aspects of the industry.

One key regulatory agency to be aware of is the Securities and Exchange Commission (SEC), which is responsible for enforcing federal securities laws. The SEC has taken action against numerous cryptocurrency projects and exchanges in the past, asserting that their token sales or trading activities constitute the offering of unregistered securities. As a result, it is important for 1inch to ensure compliance with securities laws to avoid potential legal issues.

Another significant regulatory agency in the US is the Commodity Futures Trading Commission (CFTC), which has oversight over derivatives and futures tied to virtual currencies. The CFTC has been active in regulating the cryptocurrency derivatives market and has taken enforcement actions against entities that have violated commodity trading rules.

Additionally, 1inch must also be aware of anti-money laundering (AML) and know-your-customer (KYC) regulations in the US. These regulations aim to prevent money laundering and terrorist financing and require cryptocurrency exchanges to implement robust AML and KYC procedures to identify and verify their customers’ identities.

Furthermore, 1inch should be cognizant of state-specific regulations, as individual states in the US have implemented their own laws and regulations governing cryptocurrencies. For example, the New York State Department of Financial Services has implemented the BitLicense, which requires companies operating in the state to obtain a license before conducting virtual currency business activities.

Overall, navigating the US legal framework can be challenging for 1inch. It is crucial for the company to stay updated on relevant laws and regulations, work closely with legal counsel, and ensure compliance with all applicable requirements to successfully operate in the US cryptocurrency market.

Complying with Financial Regulations

As 1inch expands its operations in the US, one of the primary challenges it faces is complying with the complex web of financial regulations in the country. Given that the US has a highly regulated financial industry, ensuring compliance is crucial to the long-term success of the platform.

One of the key regulations that 1inch needs to comply with is the Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These regulations are designed to prevent money laundering and terrorist financing by identifying and verifying the identities of individuals using financial services. By implementing robust AML and KYC practices, 1inch can mitigate the risk of being used for illegal activities and protect its users.

Additionally, 1inch needs to navigate the regulatory landscape of securities laws in the US. The Securities and Exchange Commission (SEC) has been increasingly scrutinizing digital assets and decentralized finance platforms, with a particular focus on whether these platforms offer securities. Failure to comply with securities laws can result in significant penalties and legal consequences.

Furthermore, 1inch needs to ensure compliance with tax regulations. In the US, cryptocurrencies are treated as property for tax purposes, and any gains or losses from their sale or exchange are subject to taxation. Therefore, 1inch must stay up to date with the evolving tax regulations and implement appropriate reporting mechanisms to ensure compliance with tax obligations.

To navigate these regulatory hurdles, 1inch will need to engage legal experts who specialize in US financial regulations. These experts can help guide the company through the complexities of compliance and ensure that it meets all the necessary regulatory requirements. By proactively addressing compliance issues, 1inch can build trust with regulators and users, and pave the way for sustainable growth in the US market.

In conclusion, complying with financial regulations is a significant challenge for 1inch as it expands its presence in the US. By prioritizing AML and KYC practices, navigating securities laws, and ensuring compliance with tax regulations, 1inch can establish itself as a trustworthy and compliant platform in the eyes of regulators and users.

Building Trust with US Users

As 1inch expands into the US market, building trust with US users is crucial. The decentralized nature of the platform and the rapidly evolving regulatory landscape present unique challenges.

To navigate these hurdles, 1inch is focused on establishing itself as a trustworthy and compliant platform. This involves proactive engagement with regulators and compliance with relevant laws and regulations.

Transparent and Open Communication

1inch recognizes the importance of transparent and open communication with US users. The platform provides clear and easily understandable information about its operations and compliance efforts.

Regular updates and announcements are made to keep users informed about any changes or developments that may affect their use of the platform. This helps to foster trust and confidence among US users.

Strong Security Measures

Security is a top priority for 1inch when it comes to protecting the funds and personal information of US users. The platform implements industry-leading security measures, including robust encryption protocols and strict authentication processes.

By taking these precautions, 1inch aims to provide US users with a secure and trustworthy environment to trade and interact with decentralized finance (DeFi) protocols.

Community Engagement and Feedback

1inch values the feedback and input of its users, including those in the US market. The platform actively engages with its community through various channels, such as social media platforms, forums, and dedicated communication channels.

User feedback is taken seriously and is used to improve the platform’s features and services. This approach helps to build trust and confidence among US users, as they feel heard and valued by the 1inch team.

- Regular AMA (Ask Me Anything) sessions are conducted, allowing users to ask questions and receive direct responses from the 1inch team.

- Community voting is encouraged for important decisions, ensuring that users have a say in the direction and governance of the platform.

- Bug bounties and security audits are conducted to identify and address any vulnerabilities or weaknesses in the platform’s code.

Through these efforts, 1inch aims to establish a strong foundation of trust and reliability with US users, enabling them to confidently engage with the platform and realize the benefits of decentralized finance.

Question-answer:

What are the regulatory hurdles facing 1inch in the US?

1inch is facing several regulatory hurdles in the US, including compliance with securities regulations, money transmission laws, and anti-money laundering (AML) regulations. These hurdles require 1inch to navigate complex legal frameworks and obtain the necessary licenses and approvals to operate in the US market.

How is 1inch planning to overcome the regulatory challenges in the US?

1inch is planning to overcome the regulatory challenges in the US by working closely with regulatory agencies and legal experts to ensure compliance with all relevant laws and regulations. They are also actively seeking licenses and approvals from regulatory authorities to operate legally in the US market.

What are the potential consequences if 1inch fails to navigate the regulatory hurdles in the US?

If 1inch fails to navigate the regulatory hurdles in the US, they may face legal action, fines, and reputational damage. They may also be prohibited from operating in the US market, which could significantly impact their growth and expansion plans. It is crucial for 1inch to address these regulatory challenges to establish a strong presence in the US.