Exploring the Innovative Algorithm Behind the 1inch Aggregator’s Trading Strategies

If you’ve been following the world of decentralized finance (DeFi), you’ve probably come across the name 1inch. As one of the leading decentralized exchanges (DEX), 1inch has gained popularity for its efficient and innovative trading strategies. But have you ever wondered what powers these strategies? The answer lies in the cutting-edge algorithm behind 1inch Aggregator.

The 1inch Aggregator is not your typical decentralized exchange. Instead of relying on a single exchange, it sources liquidity from multiple exchanges, pools, and even market makers to find the best possible trading routes for users. This approach eliminates the need for users to manually search for the best rates and saves them time and money.

At the heart of the 1inch Aggregator is an advanced algorithm that intelligently splits and routes trades across different liquidity sources. The algorithm takes into account factors like price slippage, gas fees, and transaction speed to ensure the most optimal trading experience for users. It constantly monitors the market and adjusts its strategies in real-time to account for changing conditions.

The algorithm also incorporates a smart contract that ensures the security and transparency of users’ funds. By using smart contract technology, 1inch Aggregator minimizes the risk of frontrunning and other malicious activities that can occur in the DeFi space. This level of security is crucial in building trust and confidence among users.

Overall, the algorithm powering 1inch Aggregator represents a new era in decentralized trading strategies. Its ability to source liquidity from multiple platforms and its intelligent routing capabilities make it a game-changer in the DeFi space. As the decentralized finance ecosystem continues to grow, it’s clear that algorithms like the one behind 1inch Aggregator will play a crucial role in shaping the future of trading.

Unveiling the Revolutionary Algorithm behind 1inch Aggregator’s Trading Tactics

As the cryptocurrency market continues to grow at an astonishing rate, investors are constantly searching for new ways to maximize their profits. The 1inch Aggregator has emerged as a revolutionary platform that offers users the ability to find the best prices and execute trades across multiple decentralized exchanges (DEXs) with just a few clicks.

At the heart of the 1inch Aggregator’s powerful trading strategies lies its cutting-edge algorithm. This algorithm is designed to analyze the liquidity across various DEXs and routing possibilities in real-time, allowing users to take advantage of the best possible trade execution.

The Algorithm’s Functionality

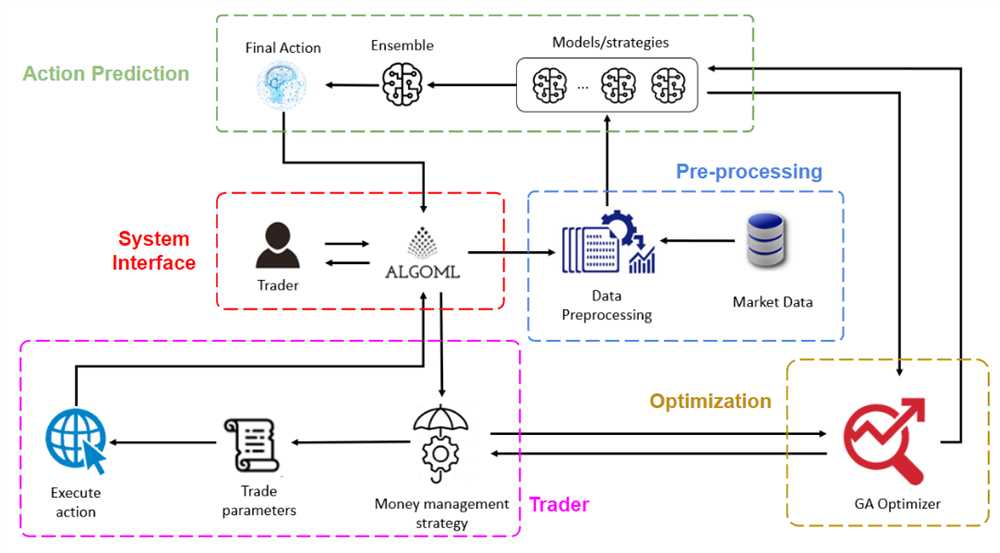

The algorithm powering the 1inch Aggregator consists of several key components that work together to deliver optimal trading tactics:

- Liquidity Analysis: The algorithm constantly monitors the liquidity pools of different DEXs, keeping track of available trading pairs and their respective volumes. This information is crucial for identifying the most liquid markets and ensuring seamless trade execution.

- Routing Optimization: To achieve the best price for a trade, the algorithm searches for the most efficient routing path across various DEXs. By considering factors such as slippage and gas costs, it is able to determine the optimal route that minimizes trading fees and maximizes profits.

- Decentralized Execution: The algorithm executes trades in a decentralized manner, utilizing the power of smart contracts to ensure transparency and security. This eliminates the need for intermediaries and minimizes the risk of front-running or price manipulation.

- Real-time Updates: The algorithm continuously receives and analyzes live data from multiple DEXs, allowing it to adapt to market changes and provide users with up-to-date trading opportunities. This ensures that users can make informed decisions based on the latest price movements and liquidity conditions.

The Advantages of the Algorithm

The algorithm behind the 1inch Aggregator offers several significant advantages:

- Improved Price Execution: By analyzing liquidity across multiple DEXs, the algorithm is able to offer users the best available prices for their trades. This can lead to significant cost savings and increased profits for investors.

- Enhanced Liquidity: The algorithm’s routing optimization feature ensures that users have access to the deepest liquidity pools across various DEXs. This results in improved trade execution and reduced slippage.

- Time Efficiency: Through its real-time data analysis capabilities, the algorithm provides users with instant access to the most lucrative trading opportunities. This enables investors to capitalize on market movements quickly and efficiently.

- Transparency and Security: By utilizing decentralized execution and smart contracts, the algorithm ensures that trades are executed in a trustless and transparent manner. This mitigates the risk of fraud and enhances the overall security of the trading process.

In conclusion, the powerful algorithm behind the 1inch Aggregator is revolutionizing the way investors trade on decentralized exchanges. By providing users with the ability to find the best prices and execute trades seamlessly, the 1inch Aggregator is empowering investors to take control of their cryptocurrency trading strategies like never before.

Understanding the Power of Cutting-Edge Algorithms

1inch Aggregator’s trading strategies are powered by cutting-edge algorithms designed to optimize trading efficiency and deliver the best possible results for users. These algorithms are at the forefront of technological innovation, using advanced mathematical models and real-time data analysis to make informed trading decisions.

One of the primary benefits of these cutting-edge algorithms is their ability to aggregate liquidity from various decentralized exchanges (DEXs) and find the most favorable prices for trades. By connecting to multiple DEXs simultaneously, the algorithms can scan the market and execute trades at the best available prices, minimizing slippage and maximizing gains.

In addition to liquidity aggregation, the algorithms also incorporate sophisticated trading strategies, including smart routing and optimized order splitting. Smart routing allows the algorithms to find the most efficient path for executing a trade, taking into account factors such as liquidity depth, trading fees, and gas costs. This ensures that trades are executed as quickly and cost-effectively as possible.

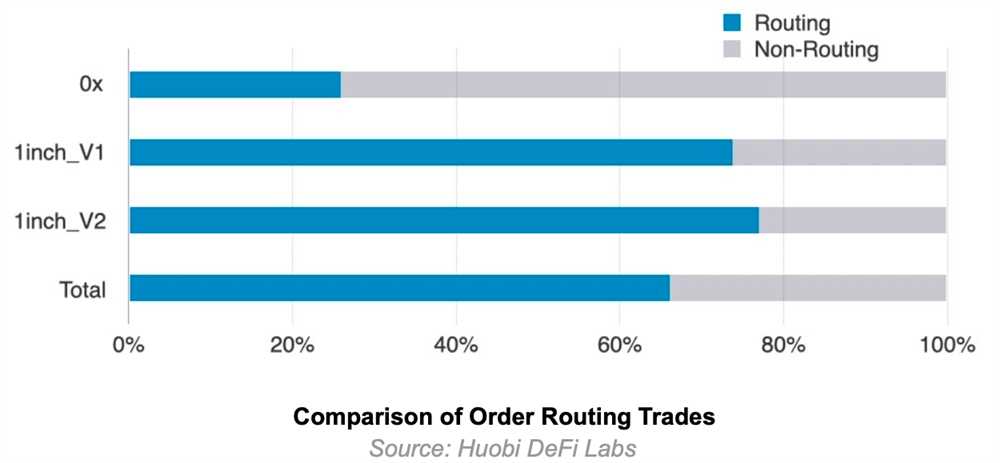

Optimized order splitting is another powerful feature of these algorithms. By dividing a large trading order into smaller orders and executing them across multiple DEXs, the algorithms can minimize the impact on market prices and avoid moving the market. This enables users to trade large volumes without disrupting the market and helps maintain stable prices.

The algorithms used by the 1inch Aggregator are constantly evolving, as the team behind them continues to research and develop new strategies. By staying at the forefront of technological advancements, 1inch Aggregator aims to provide users with the best possible trading experience and maximize their investment returns.

In conclusion, the power of cutting-edge algorithms lies in their ability to aggregate liquidity, find the best prices, and execute trades efficiently. By incorporating advanced mathematical models and real-time data analysis, these algorithms empower users to make the most informed trading decisions and maximize their profits. The continuous development and improvement of these algorithms ensure that 1inch Aggregator remains a leader in the decentralized finance space.

How the Algorithm Works to Optimize Trading Strategies

The algorithm powering the 1inch Aggregator’s trading strategies is a cutting-edge solution designed to optimize the execution of trades across multiple decentralized exchanges. By leveraging a combination of advanced techniques and sophisticated algorithms, the system is able to provide users with the best possible outcomes for their trades.

Data Analysis and Aggregation

The algorithm first collects and analyzes data from various decentralized exchanges to find the most favorable trading opportunities. It takes into account a wide range of factors, including liquidity, fees, and slippage, to determine the optimal path for executing trades.

The algorithm continuously monitors the market conditions and adjusts the trading strategy in real-time. By aggregating liquidity from different exchanges, it ensures that users always get the best possible prices for their trades.

Optimal Routing and Splitting

The algorithm takes advantage of the fragmented nature of the decentralized exchange landscape to optimize trading strategies. It identifies the most efficient route for executing trades by splitting them into smaller orders across multiple exchanges.

This approach minimizes slippage and maximizes the chances of getting the best possible prices. By intelligently routing trades through different liquidity sources, the algorithm minimizes the impact on the market and ensures that users get the most out of their trading activities.

Moreover, the algorithm is designed to adapt to changing market conditions and adjust the routing and splitting strategy accordingly. It considers factors such as order book depth, trading volume, and recent price movements to make informed decisions.

In summary, the algorithm powering the 1inch Aggregator’s trading strategies utilizes advanced data analysis, intelligent routing, and splitting techniques to optimize trades across decentralized exchanges. Its goal is to provide users with the best possible outcomes by taking into account various factors and adapting to changing market conditions.

Question-answer:

What is the algorithm powering 1inch Aggregator’s trading strategies?

The algorithm powering 1inch Aggregator’s trading strategies is called Pathfinder. It is a cutting-edge algorithm that is designed to find the most efficient paths for executing trades across multiple decentralized exchanges.

How does Pathfinder algorithm work?

The Pathfinder algorithm works by analyzing various factors such as liquidity, prices, and fees across multiple decentralized exchanges. It then calculates the optimal path for executing a trade to minimize slippage and maximize the overall trading efficiency.

What are the benefits of using the Pathfinder algorithm for trading on 1inch Aggregator?

The benefits of using the Pathfinder algorithm for trading on 1inch Aggregator are reduced slippage, lower fees, and access to the best possible prices across multiple decentralized exchanges. This allows traders to achieve better trading outcomes and maximize their profits.