In the rapidly evolving world of decentralized finance (DeFi), Ethereum has emerged as the leading platform for creating innovative financial applications. However, as DeFi grows in popularity, the Ethereum network has struggled to keep up with the increasing demand, resulting in high transaction fees and slow confirmation times. To address these scalability issues, developers have been exploring Layer 2 solutions, and two of the most promising ones are Arbitrum and 1inch.

Arbitrum is a Layer 2 scaling solution for Ethereum that aims to significantly increase the network’s capacity by allowing smart contracts to be executed off-chain. By moving transactions off the Ethereum mainnet and onto a sidechain, Arbitrum can provide faster confirmation times and lower transaction fees. This makes it an ideal solution for decentralized applications (dApps) that require high speed and low costs, such as decentralized exchanges.

1inch, on the other hand, is a decentralized exchange aggregator that allows users to find the best prices and execute trades across multiple decentralized exchanges. By integrating with Arbitrum, 1inch can leverage its scalability benefits to provide even faster and cheaper trades for its users. This means that users can access a larger pool of liquidity and benefit from better execution prices, all while minimizing the costs and delays associated with trading on the Ethereum mainnet.

Together, Arbitrum and 1inch are revolutionizing the DeFi landscape by addressing the scalability challenges of the Ethereum network. By enabling faster and cheaper transactions, they are democratizing access to decentralized finance and making it more accessible to a wider audience. As more dApps and users migrate to Layer 2 solutions like Arbitrum and take advantage of the capabilities provided by platforms like 1inch, we can expect to see a new wave of innovation and growth in the DeFi space.

The Rise of DeFi on Ethereum

Decentralized Finance (DeFi) has emerged as one of the hottest trends in the cryptocurrency industry. Built on the Ethereum blockchain, DeFi applications offer users a decentralized alternative to traditional financial services.

Ethereum, with its smart contract capabilities, has become the platform of choice for DeFi projects. The open-source nature of Ethereum allows developers to build and deploy their applications without any central authority. This has led to a surge in innovation and the creation of a wide range of DeFi protocols.

One of the key features of DeFi on Ethereum is the ability to create and trade digital assets. Through smart contracts, users can create and manage their own tokens, which can represent anything from cryptocurrency to real-world assets like stocks or commodities. These tokens can then be traded on decentralized exchanges, allowing users to easily buy, sell, and swap assets without the need for intermediaries.

Another important aspect of DeFi on Ethereum is the concept of lending and borrowing. DeFi protocols like Compound and Aave allow users to lend their assets and earn interest, or borrow assets by providing collateral. This enables users to access liquidity and earn passive income, all in a decentralized and trustless manner.

Furthermore, DeFi applications on Ethereum also offer users the ability to participate in decentralized governance. Through mechanisms like voting and staking, users can have a say in the decision-making process of these protocols. This not only gives them more control over their investments but also promotes community-driven development and decentralization.

The rise of DeFi on Ethereum has not been without its challenges. High gas fees and network congestion have been a concern for users, making transactions expensive and slow. However, innovative solutions like Arbitrum and platforms like 1inch are working towards addressing these issues and improving the scalability and efficiency of DeFi on Ethereum.

In conclusion, DeFi has revolutionized the financial industry by providing a decentralized alternative to traditional financial services. With Ethereum as its foundation, DeFi has unleashed a wave of innovation, allowing users to create, trade, lend, borrow, and govern assets in a trustless and decentralized manner. The rise of DeFi on Ethereum is just the beginning, and with the help of projects like Arbitrum and 1inch, it is expected to continue growing and transforming the financial landscape.

The Need for Scalability Solutions

As the popularity of decentralized finance (DeFi) increases, it becomes clear that scalability is a major concern for the Ethereum network. With more users and transactions, the network can quickly become congested and slow. This is especially evident during times of high demand, such as during market fluctuations or popular token launches.

Scalability refers to the ability of a blockchain network to handle a large number of transactions per second (TPS) without sacrificing speed, security, or decentralization. Unfortunately, Ethereum’s current architecture is not designed to handle the scale necessary to support mainstream adoption of DeFi applications. As a result, users may experience high gas fees and slow transaction confirmations, leading to a poor user experience.

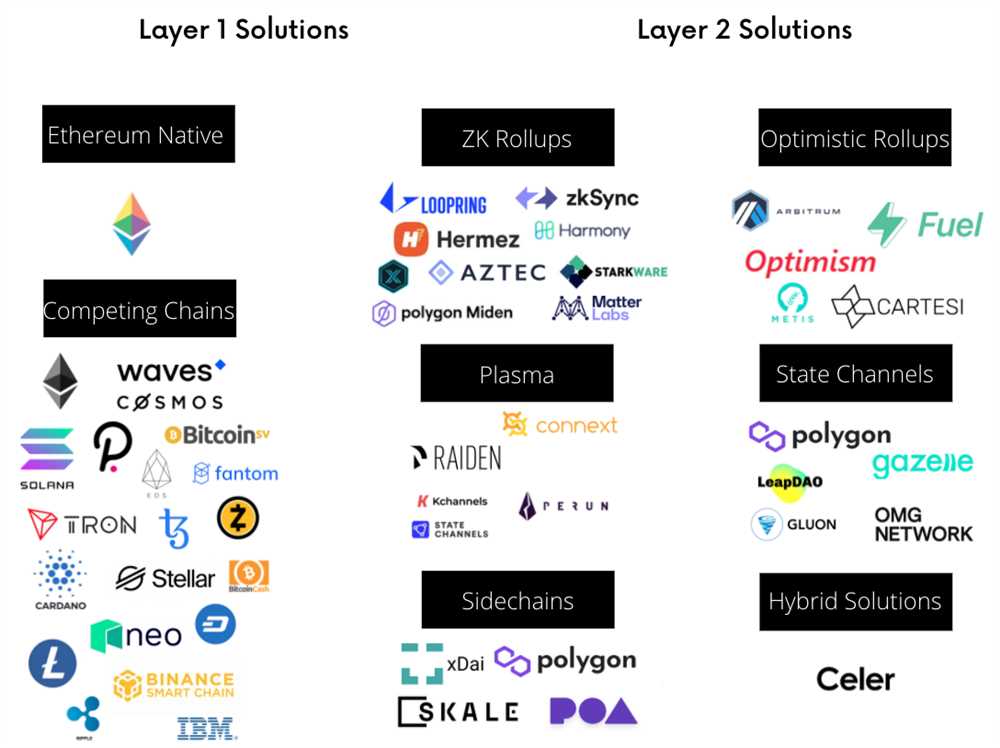

To address these scalability issues, Layer 2 solutions like Arbitrum have emerged. Layer 2 solutions are implemented on top of existing blockchains like Ethereum and aim to increase scalability and reduce congestion by processing transactions off-chain before settling them on the mainnet.

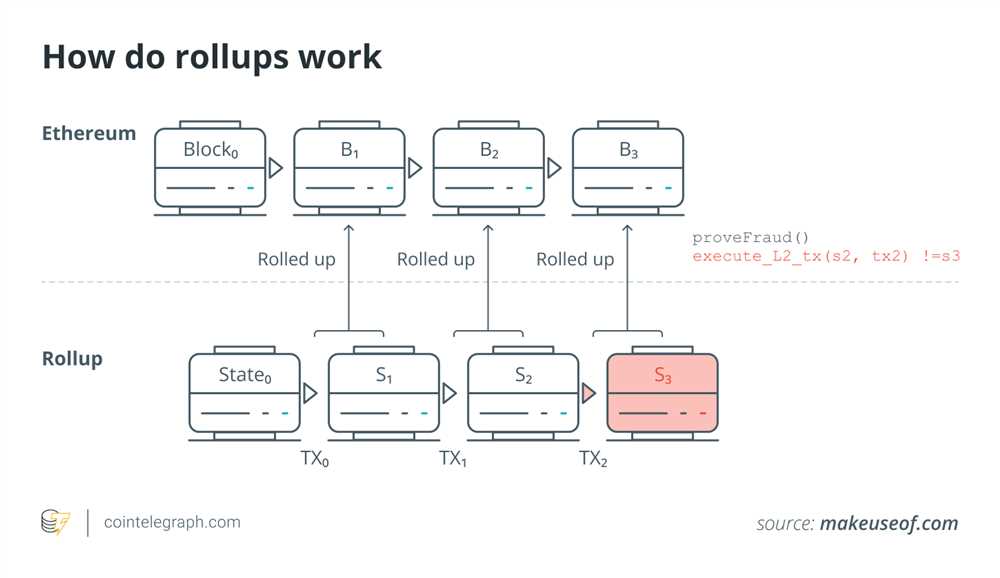

Arbitrum, specifically, utilizes an Optimistic Rollup architecture, which allows for significantly higher throughput compared to the Ethereum mainnet. By bundling multiple transactions together and submitting a single proof to the Ethereum network, Arbitrum can greatly increase the TPS of DeFi applications while still maintaining the security and decentralization of the Ethereum network.

| Scalability Challenges | Layer 2 Solutions |

|---|---|

| Limited TPS on Ethereum mainnet | Optimistic Rollup architecture |

| High gas fees | Batching transactions and submitting proofs |

| Slow transaction confirmations | Off-chain processing and settlement on mainnet |

With the adoption of Layer 2 solutions like Arbitrum, DeFi projects built on Ethereum can offer a significantly improved user experience. Users can enjoy faster transaction speeds, lower fees, and a seamless experience, even during periods of high network demand.

Overall, the need for scalability solutions in the DeFi space is clear. Without these solutions, the Ethereum network may struggle to keep up with increasing user demand and face limitations that hinder its growth. However, with Layer 2 solutions like Arbitrum, the future of DeFi on Ethereum looks promising, offering a scalable and efficient platform for decentralized finance applications.

Introducing Arbitrum: A Game-Changing Layer 2 Solution

Arbitrum, developed by Offchain Labs, is a revolutionary Layer 2 solution for Ethereum that aims to solve the scalability and gas fee issues faced by the network. By leveraging Arbitrum, users can experience faster transaction confirmations and significantly lower fees compared to traditional Ethereum transactions.

How does Arbitrum work?

Arbitrum operates as an Optimistic Rollup, meaning it optimistically assumes that transactions are valid and only reverts them if proven otherwise. This mechanism allows for faster and more efficient processing of transactions. In the unlikely event of a dispute, a dispute resolution process known as “rollup” is initiated to settle the disagreement and ensure the integrity of the network.

Arbitrum achieves these benefits by using a combination of smart contracts and off-chain computation. It allows for the execution of complex computations off-chain, reducing the burden on the Ethereum mainnet. The final outcome of these computations is then settled on the Ethereum mainnet, providing security and transparency.

Advantages of Arbitrum

The introduction of Arbitrum brings several advantages to the Ethereum ecosystem. Firstly, it greatly enhances scalability by increasing the throughput of transactions that can be processed. This is crucial for DeFi applications that often face network congestion and high gas fees. With Arbitrum, users can enjoy a seamless and efficient DeFi experience.

Secondly, Arbitrum significantly reduces transaction fees. By moving complex computations off-chain, users can save on gas fees associated with executing these computations on the Ethereum mainnet. This makes DeFi more accessible to a wider range of users, including those with limited resources.

Furthermore, Arbitrum maintains compatibility with existing Ethereum smart contracts. Users can seamlessly migrate their applications and assets to Arbitrum without any major modifications. This compatibility ensures a smooth transition to the Layer 2 solution without disrupting the existing Ethereum ecosystem.

Conclusion

Arbitrum’s introduction heralds a new era for Ethereum, enabling the network to overcome its scalability and gas fee challenges. With its innovative approach to off-chain computation and dispute resolution, Arbitrum has the potential to revolutionize how DeFi applications are built and used. By embracing this game-changing Layer 2 solution, Ethereum can unlock greater adoption and bring decentralized finance to the masses.

Unlocking DeFi Opportunities with 1inch

DeFi (Decentralized Finance) has emerged as one of the most exciting and rapidly growing sectors in the blockchain industry. It has the potential to disrupt traditional financial systems and provide more accessible and inclusive financial services to individuals around the world. 1inch is a decentralized exchange aggregator that plays a crucial role in unlocking the full potential of DeFi.

What is 1inch?

1inch is a decentralized exchange (DEX) aggregator that sources liquidity from various DEXs to provide users with the best possible prices. It automatically splits trades across multiple DEXs to ensure users get the most favorable rates. By leveraging 1inch, users can access deep liquidity and enjoy reduced slippage while trading on decentralized platforms.

Advantages of 1inch for DeFi Users

1. Enhanced Liquidity: 1inch pools together liquidity from various DEXs, allowing users to access a larger pool of assets and trade a wide range of tokens. This enhanced liquidity ensures that users can execute their trades quickly and efficiently without significant price impact.

2. Best Prices: The smart contract algorithms employed by 1inch constantly monitor and analyze prices on different exchanges to ensure users get the best rates for their trades. By comparing prices across various exchanges, 1inch eliminates the need for users to manually search for the best prices.

3. Reduced Slippage: Slippage occurs when the price of an asset changes between the time a trade is initiated and the time it is executed. 1inch mitigates slippage by splitting trades across different DEXs, finding the optimal route to minimize price impact.

4. Low Fees: 1inch transaction fees are generally lower compared to trading directly on individual DEXs. By aggregating liquidity and routing trades optimally, 1inch minimizes transaction costs, benefiting users with lower fees.

| Key Advantages | Benefits to Users |

| Enhanced Liquidity | Access to a larger pool of assets and reduced slippage |

| Best Prices | Automatic price comparisons across multiple exchanges |

| Reduced Slippage | Optimal trade routing to minimize price impact |

| Low Fees | Lower transaction costs compared to individual DEXs |

1inch has quickly become a trusted and popular platform among DeFi users due to its ability to provide enhanced liquidity, best prices, reduced slippage, and lower fees. Its decentralized nature fits perfectly with the principles of DeFi, allowing users to retain control over their funds while accessing the benefits of the platform. As the DeFi ecosystem continues to expand, 1inch remains at the forefront, unlocking further opportunities and driving innovation in the space.

Question-answer:

What is DeFi and how does it work on Ethereum?

DeFi stands for Decentralized Finance and it refers to a set of financial applications built on blockchain platforms like Ethereum. DeFi enables users to borrow, lend, trade, and earn interest on cryptocurrencies without the need for intermediaries such as banks. On Ethereum, DeFi applications are powered by smart contracts, which are self-executing contracts with the terms of the agreement directly written into the code. These smart contracts enable programmable and automated transactions, allowing for various DeFi protocols to be implemented.

What is Arbitrum and how does it accelerate DeFi on Ethereum?

Arbitrum is a layer 2 scaling solution for Ethereum. It aims to improve the scalability and throughput of the Ethereum network by leveraging off-chain computation. Arbitrum achieves this by moving most of the computational load off-chain while still ensuring the security and trustlessness of transactions. By doing so, it reduces congestion on the Ethereum mainnet and enables faster and cheaper transactions. This acceleration of the Ethereum network benefits DeFi applications by making them more efficient, scalable, and accessible to users.