An introductory guide to purchasing and maintaining 1inch tokens: essential tips and strategies for beginners

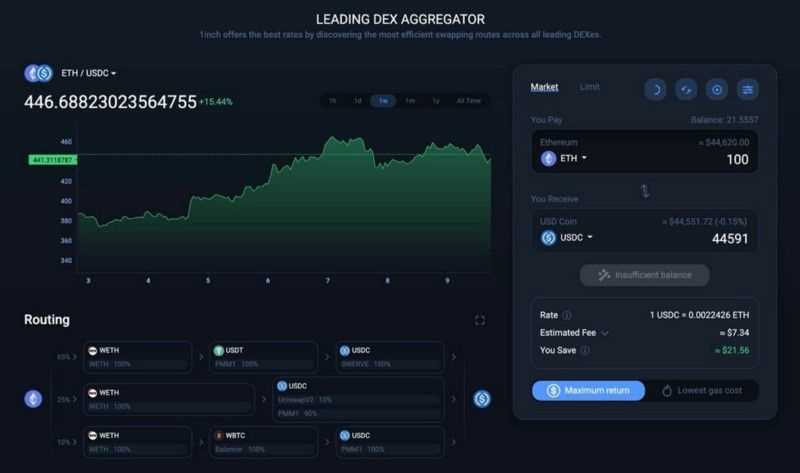

Are you interested in investing in cryptocurrencies and looking to diversify your portfolio? If so, you may want to consider buying and holding 1inch. 1inch is a decentralized exchange aggregator that allows users to find the best prices across multiple exchanges.

1inch has gained popularity due to its ability to provide users with the most cost-effective way to trade cryptocurrencies. By using smart contracts and a network of liquidity sources, 1inch ensures that users get the best possible prices when buying or selling their digital assets.

Buying and holding 1inch can be a smart investment strategy for those who believe in the long-term potential of the cryptocurrency market. As more people start to adopt cryptocurrencies and decentralized finance (DeFi) becomes more mainstream, the demand for 1inch is likely to increase.

When buying and holding 1inch, it’s important to do your research and understand the risks involved. Cryptocurrencies are known for their volatility, and the value of 1inch can fluctuate significantly in a short period of time. However, if you believe in the technology and the team behind 1inch, holding onto your investment for the long-term could be a lucrative opportunity.

In conclusion, buying and holding 1inch can be a smart investment strategy for those looking to diversify their portfolio and take advantage of the growing cryptocurrency market. By doing your research and understanding the risks involved, you can make an informed decision about whether or not to invest in 1inch. Remember to always consult with a financial advisor before making any investment decisions.

A Beginner’s Guide to Buying and Holding 1inch

If you’re new to the world of cryptocurrency, you may have heard about 1inch and are wondering how to buy and hold it. In this beginner’s guide, we’ll walk you through the steps to get started with buying and holding 1inch.

Step 1: Set Up a Wallet

The first thing you’ll need is a cryptocurrency wallet to store your 1inch tokens. There are various types of wallets to choose from, including hardware wallets, software wallets, and online wallets. Research the different options and choose one that suits your needs.

Step 2: Find an Exchange

Once you have a wallet, you’ll need to find a cryptocurrency exchange that supports 1inch. Some popular exchanges that trade 1inch include Binance, Coinbase, and Kraken. Compare the fees, security measures, and user reviews of different exchanges before making a decision.

Step 3: Create an Account

After selecting an exchange, you’ll need to create an account. This typically involves providing your email address, setting a password, and completing any necessary verification steps. Follow the instructions provided by the exchange to complete the registration process.

Step 4: Deposit Funds

Once your account is set up, you’ll need to deposit funds into your exchange account. This can usually be done using a bank transfer, credit card, or another supported payment method. Follow the instructions provided by the exchange to deposit your desired amount.

Step 5: Place an Order

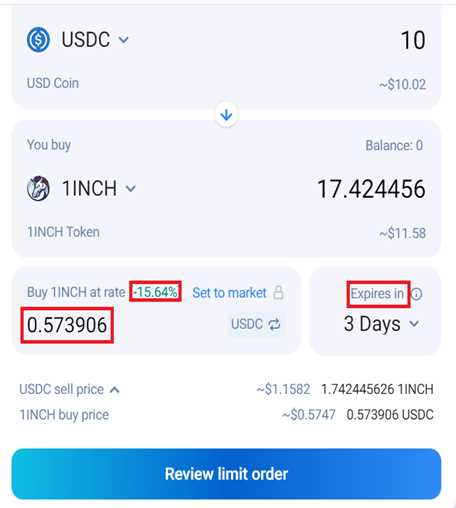

With funds in your exchange account, you’re ready to place an order to buy 1inch. Determine the amount of 1inch you want to buy, set the price, and submit your order. Be aware that the price of 1inch can fluctuate, so consider setting a limit order if you have a specific price in mind.

Step 6: Transfer 1inch to Your Wallet

Once your order is filled and you have acquired 1inch, it’s recommended to transfer your tokens to your personal wallet. This gives you full control over your tokens and provides an extra layer of security. Use your wallet’s receive function to generate a deposit address, and then initiate a withdrawal from the exchange to that address.

Step 7: Hold and Monitor

Now that you have purchased and transferred your 1inch tokens to your wallet, you can choose to hold them for potential future growth. Keep an eye on the crypto market and stay informed about any news or developments related to 1inch. Consider setting up price alerts or using portfolio-tracking tools to monitor your investment.

Remember, investing in cryptocurrencies carries risks, and it’s important to do thorough research and consider your own risk tolerance before making any investment decisions. With this beginner’s guide, you now have a basic understanding of how to buy and hold 1inch.

How to Buy 1inch: A Step-by-Step Guide for Beginners

1inch is a decentralized exchange aggregator that helps users find the best prices across multiple platforms. If you’re new to the world of cryptocurrencies and want to buy 1inch, follow this step-by-step guide:

Step 1: Set up a Wallet

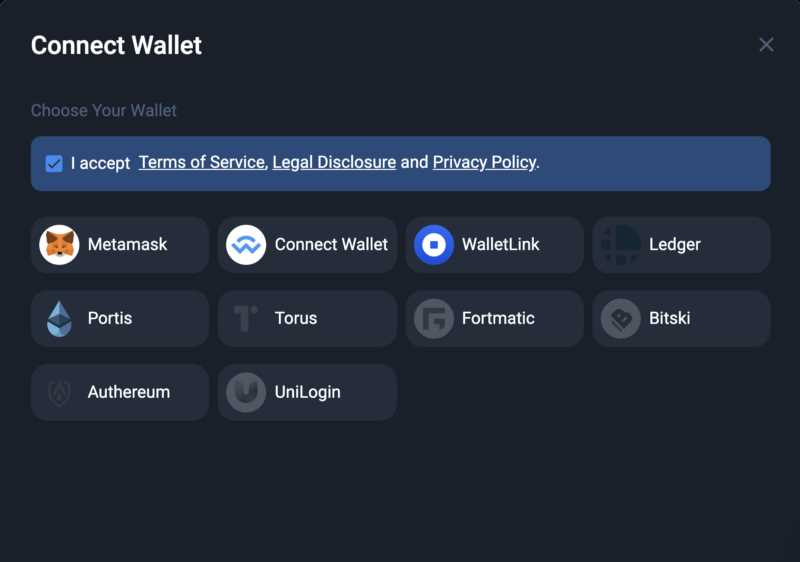

Before you can buy 1inch, you’ll need a cryptocurrency wallet to store your coins. There are several wallet options available, but some popular choices include MetaMask, Trust Wallet, and Ledger.

Choose a wallet that is compatible with the Ethereum blockchain, as 1inch is an ERC-20 token.

Step 2: Choose a Exchange

Once you have set up your wallet, you’ll need to choose a crypto exchange where you can buy 1inch. Some popular exchanges that list 1inch include Binance, Coinbase, and Kraken. Compare the fees, security features, and user experience of different exchanges before making your decision.

Step 3: Create an Account

After choosing an exchange, you’ll need to create an account. This usually involves providing your email address, choosing a strong password, and completing a verification process.

Step 4: Deposit Funds

Once your account is set up, you’ll need to deposit funds into your exchange account. Most exchanges allow you to deposit fiat currency (such as USD or EUR) or cryptocurrencies (such as Bitcoin or Ethereum). Choose the deposit option that suits you and follow the instructions provided by the exchange.

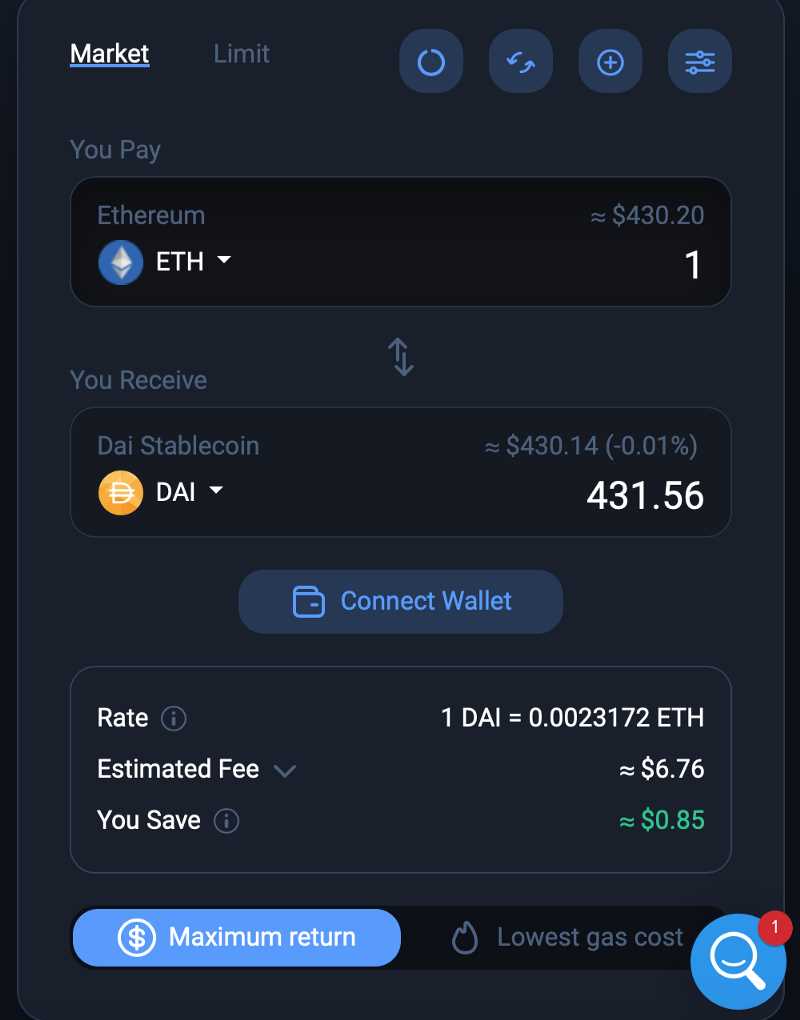

Step 5: Place a Buy Order

With funds in your exchange account, you can now place a buy order for 1inch. Locate the trading pair for 1inch (such as 1INCH/ETH) and input the amount of 1inch you want to buy. Review the order details, including the current price and any fees, before confirming your purchase.

Step 6: Withdraw Your 1inch

After your buy order is complete, you’ll want to withdraw your 1inch from the exchange and into your wallet. Locate the withdrawal option on the exchange platform and enter your wallet address. Double-check that you have entered the correct address to avoid any mistakes.

That’s it! You now know how to buy 1inch. Remember to do your own research and only invest what you can afford to lose. Cryptocurrency investing can be volatile, so it’s important to make informed decisions and stay updated with the latest news and developments in the space.

| Step | Description |

|---|---|

| Step 1 | Set up a Wallet |

| Step 2 | Choose a Exchange |

| Step 3 | Create an Account |

| Step 4 | Deposit Funds |

| Step 5 | Place a Buy Order |

| Step 6 | Withdraw Your 1inch |

The Benefits of Holding 1inch: Why You Should Consider Long-term Investment

Investing in 1inch and holding onto it for the long term can have several benefits for investors. Here are some reasons why you should consider making a long-term investment in 1inch:

- 1. Potential for Growth: As a decentralized exchange aggregator, 1inch has experienced significant growth since its launch. With its innovative features and increasing adoption, there is a high probability that the value of 1inch will continue to appreciate in the long term.

- 2. Earning Passive Income: By holding 1inch in your wallet, you can participate in the governance of the platform and earn passive income through staking and liquidity mining. This allows you to generate additional income while holding onto your investment.

- 3. Diversification: Investing in 1inch can help diversify your investment portfolio. By including cryptocurrencies like 1inch, which operates within the decentralized finance (DeFi) market, you can reduce the risk associated with traditional investments and potentially capitalize on the growth of the DeFi sector.

- 4. Strong Community and Development: 1inch has a vibrant and active community of users and developers who are constantly working on improving the platform. This strong community support and continuous development efforts inspire confidence in the long-term viability and potential of the project.

- 5. Hedge against Inflation: Cryptocurrencies like 1inch can serve as a hedge against inflation. Unlike fiat currencies that are subject to the policies and economic conditions of a central authority, cryptocurrencies are decentralized and not easily influenced by inflationary pressures.

In conclusion, holding 1inch for the long term can provide several advantages, including potential growth, passive income opportunities, portfolio diversification, community support, and inflation protection. However, it’s important to conduct thorough research and consider your own investment goals and risk tolerance before making any investment decisions.

Managing Your 1inch Holdings: Best Practices for Successful Long-term Investment

Investing in 1inch can be an exciting opportunity to grow your wealth over the long term. However, it’s important to have a solid plan in place for managing and growing your holdings. Implementing best practices can help ensure your investment is successful and maximize your returns.

1. Set Clear Investment Goals

Before you start investing in 1inch, it’s crucial to define your investment goals. Are you looking to generate passive income? Do you have a specific time frame in mind for holding your investment? Understanding your goals will help you make informed decisions and adjust your strategy accordingly.

2. Stay Informed

Stay up to date with the latest news and developments in the cryptocurrency market, particularly those related to 1inch. This will help you make informed decisions about when to buy, sell, or hold your investment. Joining relevant online communities and following reputable sources can provide valuable insights.

Additionally, regularly review the 1inch project’s roadmap and updates from the team. This will give you a better understanding of the project’s direction and any upcoming developments that may impact the value of your investment.

3. Diversify Your Portfolio

While investing in 1inch can be lucrative, it’s important not to put all your eggs in one basket. Diversifying your portfolio by investing in other cryptocurrencies and traditional assets can help mitigate risks. Consider investing in a mix of different cryptocurrencies and assets with varying risk profiles to spread out your investments.

4. Evaluate Your Investment Periodically

Regularly evaluate the performance of your 1inch investment to ensure it aligns with your goals. If your investment is performing well and meeting your targets, you may choose to hold onto it. However, if market conditions or your goals have changed, you may need to consider adjusting your investment strategy.

Keep an eye on market trends, evaluate your risk tolerance, and periodically review your investment strategy. Balancing your portfolio and making necessary adjustments can help you stay on track and maximize your returns.

5. Secure Your Investment

As with any investment, it’s crucial to prioritize security. Make sure you store your 1inch holdings in a secure wallet and enable all available security features. Consider using hardware wallets for an extra layer of protection against potential hacks or theft.

Additionally, be cautious of phishing attempts and scams. Stay vigilant and only interact with reputable platforms and sources of information.

By following these best practices, you can enhance your long-term investment strategy for 1inch. Remember to stay informed, diversify your portfolio, evaluate your investments regularly, and prioritize security. With a thoughtful approach, you can increase the likelihood of a successful and profitable investment experience.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various platforms in order to provide users with the best possible trading rates. It also offers a multi-chain and multi-protocol feature, enabling users to access liquidity from different networks.